PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846140

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846140

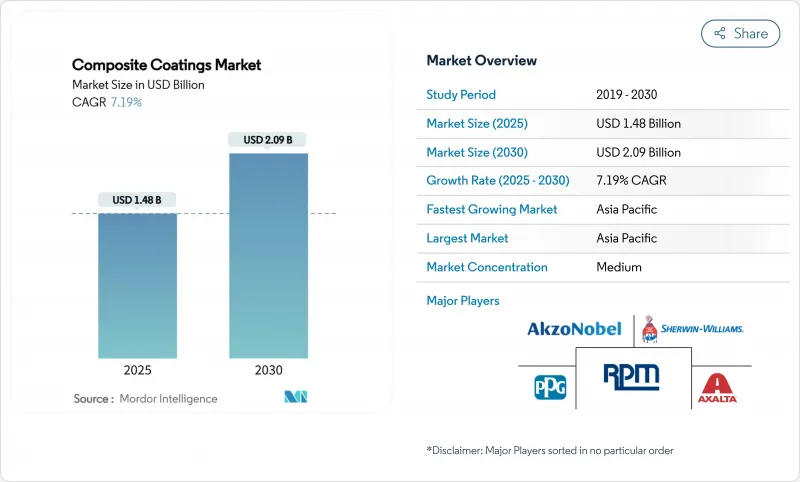

Composite Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Composite Coatings Market size is estimated at USD 1.48 billion in 2025, and is expected to reach USD 2.09 billion by 2030, at a CAGR of 7.19% during the forecast period (2025-2030).

Continuous adoption of multilayer technologies that marry corrosion resistance, wear tolerance, and functional surface attributes positions the composite coatings market for sustained expansion. Accelerating offshore oil and gas developments, widening uptake of lightweight transportation parts, and stricter OEM lifetime specifications are collectively lifting demand. Innovation momentum in fluoropolymer, nano-structured, and bio-based chemistries is unlocking fresh, higher-margin use cases. Meanwhile, regional manufacturing shifts and large-scale renewable-energy projects are intensifying competition among established formulators and specialized newcomers.

Global Composite Coatings Market Trends and Insights

Growth in Oil and Gas Exploration Activities

Deep-water and ultra-deep-water projects are elevating specifications for high-build, glass-flake-reinforced epoxy systems that tolerate temperature swings, hydrostatic pressure, and saline attack. Major offshore operators in Saudi Arabia, the North Sea, and the Gulf of Mexico are extending maintenance cycles toward 10 to 15 years by switching to composite barriers that inhibit cathodic disbondment and under-film corrosion. Uniform coating integrity on risers, wellheads, and topside equipment lowers the total cost of ownership despite higher upfront spend. Rising rig counts and asset-life extension programs, therefore, inject consistent volume growth into the composite coatings market.

Rising Demand for Lightweight, Corrosion-Resistant Structures in Transportation

Automakers pursuing range gains for electric vehicles are replacing steel battery enclosures with aluminum and composite housings that need thin yet resilient protection. Laser-textured primers combined with nanoparticle-filled topcoats elevate wear resistance and paint adhesion on carbon-fiber substrates, supporting weight reductions without compromising durability. In aerospace, self-healing epoxy chemistries incorporating micro-encapsulated agents flag early corrosion onset and autonomously repair micro-scratches, enabling predictive maintenance and shorter aircraft turnaround times.

High Processing and Capital Costs

Sophisticated spray booths, inert-gas curing zones, and laser-injection units raise capital outlays, delaying payback for smaller converters. In January, the prices of epoxy resins rose in Europe amid tight supply, whereas surplus inventory pushed Asian prices lower, illustrating volatility that squeezes margins. Until supply chains stabilize and equipment costs decline, some purchasers will default to lower-performing legacy coatings.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward High-Performance Functional Surfaces for Renewable-Energy Hardware

- OEM Mandates for Extended Coating Life and Reduced Maintenance Cycles

- Limited Repairability and Recyclability Versus Conventional Paints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy maintained a 45.27% composite coatings market share in 2024, underscoring unmatched adhesion and chemical resistance for drilling platforms, aerospace structures, and transportation components. Fast-curing formulations with glass flake or ceramic microsphere fillers reinforce barrier paths, extending maintenance cycles. The composite coatings market size for epoxy systems is projected to grow steadily alongside offshore investments and fleet electrification requirements.

Parallel momentum is building around fluoropolymers and emerging bio-epoxies, whose 8.61% CAGR highlights an industry pivot toward sustainability mandates and extreme weatherability. Manufacturers like Sicomin are moving the market toward GreenPoxy lines incorporating waste glycerol and plant oils without diluting mechanical performance.

The Composite Coatings Report is Segmented by Resin (Epoxy, Polyester, Polyamide, and Others), Technique (Electroless Plating, Laser-Melt Injection, Brazing, and Other Techniques), End-User Industry (Oil and Gas, Marine, Automotive and Transportation, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained a dominant 44.88% share of the composite coatings market in 2024 and is projected to compound at 7.72% through 2030. Massive Chinese port expansions, Indian highway corridors, and Southeast Asian petrochemical complexes collectively fuel the consumption of high-build protective formulations. Offshore wind farms off Guangdong and Tamil Nadu further call for anti-biofouling and erosion-resistant systems.

North America commands substantial adoption driven by rigorous OSHA and EPA statutes that reward low-VOC, high-solids chemistries. The Gulf of Mexico's deep-water rigs, Canada's oil-sands upgraders, and the United States Navy's fleet refurbishment pipeline together underpin steady requisition of ceramic-filled epoxies and zinc-rich primers.

Europe's Green Deal blueprint is steering demand toward bio-derived and recyclable formulations. German automotive producers and UK aerospace plants are early adopters of self-healing clear coats that broadcast integrity status via fluorescence or embedded RFID. Offshore wind foundations across the North Sea rely on nano-structured foul-release films aligned with IMO environmental conventions.

- Akzo Nobel N.V.

- Axalta Coating Systems, LLC

- BEECK Mineral Paints

- Bodycote

- FUSION Mineral Paint

- Hempel A/S

- Henkel AG and Co. KGaA

- Jotun

- KC Jones Plating Company

- KEIM Mineral Coatings of America, Inc.

- Mader Group

- Nippon Paint Holdings Co., Ltd.

- Plasma Coatings Ltd.

- PPG Industries, Inc.

- RPM International Inc.

- Socomore

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Oil and Gas Exploration Activities

- 4.2.2 Rising Demand for Lightweight, Corrosion-Resistant Structures in Transportation

- 4.2.3 Shift Toward High-Performance Functional Surfaces for Renewable-Energy Hardware

- 4.2.4 OEM Mandates for Extended Coating Life and Reduced Maintenance Cycles

- 4.2.5 Nano-Structured Composite Topcoats Enabling Anti-Biofouling for Offshore Wind

- 4.3 Market Restraints

- 4.3.1 High Processing and Capital Costs

- 4.3.2 Limited Repairability and Recyclability Versus Conventional Paints

- 4.3.3 Inconsistent Global Standards for Multilayer Composite Coatings

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts(Value)

- 5.1 By Resin

- 5.1.1 Epoxy

- 5.1.2 Polyester

- 5.1.3 Polyamide

- 5.1.4 Others (Fluoropolymer, Acrylic, etc.)

- 5.2 By Technique

- 5.2.1 Electroless Plating

- 5.2.2 Laser-Melt Injection

- 5.2.3 Brazing

- 5.2.4 Other Techniques (Sol-Gel and Dip-Coating, etc.)

- 5.3 By End-User Industry

- 5.3.1 Oil and Gas

- 5.3.2 Marine

- 5.3.3 Automotive and Transportation

- 5.3.4 Infrastructure

- 5.3.5 Other End-user Industries (Aerospace and Defense, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems, LLC

- 6.4.3 BEECK Mineral Paints

- 6.4.4 Bodycote

- 6.4.5 FUSION Mineral Paint

- 6.4.6 Hempel A/S

- 6.4.7 Henkel AG and Co. KGaA

- 6.4.8 Jotun

- 6.4.9 KC Jones Plating Company

- 6.4.10 KEIM Mineral Coatings of America, Inc.

- 6.4.11 Mader Group

- 6.4.12 Nippon Paint Holdings Co., Ltd.

- 6.4.13 Plasma Coatings Ltd.

- 6.4.14 PPG Industries, Inc.

- 6.4.15 RPM International Inc.

- 6.4.16 Socomore

- 6.4.17 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment