PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846141

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846141

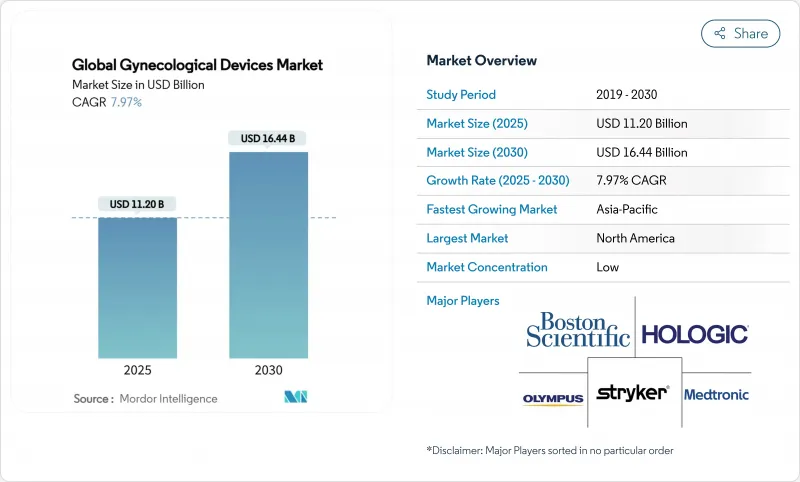

Global Gynecological Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global gynecological devices market size reached USD 11.20 billion in 2025 and is projected to climb to USD 16.44 billion by 2030, reflecting a 7.97% CAGR across the forecast period.

Rising demand for minimally invasive therapies, rapid technology convergence in endoscopy and imaging, and supportive reimbursement for outpatient procedures are combining to accelerate replacement cycles and spur fresh capital spending by providers. Adoption of artificial-intelligence-enabled diagnostics, next-generation robotic systems with force feedback, and smart contraceptive platforms is reshaping competitive dynamics and intensifying the focus on integrated care pathways. Heightened patient awareness, a growing elderly female population, and value-based payment structures that reward shorter hospital stays are expanding addressable volumes for office-based therapies while simultaneously raising the bar for usability and safety validation. Established brands are leveraging acquisitions to access niche intellectual property, whereas younger entrants are racing to commercialize connected devices that deliver data-driven insights to clinicians.

Global Gynecological Devices Market Trends and Insights

Rising Prevalence of Gynecological Disorders

Chronic and malignant gynecological conditions are climbing in incidence, raising the need for frequent screenings and intervention devices. Cervical and uterine cancers continue to post high mortality in parts of Asia, while incidence in North America remains stable but still drives significant demand for early detection tools. Providers are upgrading colposcopes and biopsy systems that integrate optical enhancements to detect premalignant lesions during first-line exams. Growth momentum is strongest in urban settings where organized screening programs and public awareness campaigns capture patients earlier in disease progression. Parallel investments in home-based diagnostics aim to improve participation rates and relieve hospital capacity constraints. Collectively, these trends increase the installed base of precision instruments and consumables, reinforcing recurring revenue streams for manufacturers.

Aging Female Population and Higher Healthcare Spend

Women older than 50 constitute a steadily rising share of global populations, bringing elevated risk for prolapse, incontinence, and malignant gynecological diseases. In the United States, annual pelvic organ prolapse surgery cost hit USD 1.523 billion in 2018, with 82.5% of cases managed outpatient. Similar trajectories appear in Western Europe, pushing hospitals to adopt cost-efficient minimally invasive approaches. Higher disposable incomes in developed nations further support elective treatments such as uterine fibroid ablation and long-acting contraception, expanding demand for premium devices with patient-friendly features. On the payer side, improved health coverage in emerging markets unlocks new volumes, though at lower average selling prices.

Device Recalls and Litigation

High-profile transvaginal mesh lawsuits and subsequent product withdrawals continue to exert a chilling effect on innovation and procurement. Johnson & Johnson's Ethicon division faces USD 302 million in fines for deceptive marketing, while a separate USD 830 million settlement covered 20,000 mesh cases. Hospitals scrutinize vendor track records more closely, lengthening evaluation cycles and increasing demand for exhaustive post-market surveillance data. Manufacturers redirect R&D budgets toward regulatory compliance, slowing the cadence of new product introductions. At the same time, insurers impose stricter coverage criteria, particularly for implantable devices, dampening near-term procedure growth.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Minimally-Invasive Surgeries

- Technological Advances in OB-GYN Endoscopy & Imaging

- Heightened FDA / EU MDR Re-classification Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, gynecological endoscopy platforms commanded 46.29% of the gynecological devices market size thanks to their versatility in diagnosing and treating diverse conditions. Continuous improvements in chip-on-tip optics and disposable sheath options simplify office workflows and reduce cross-contamination risks. However, endometrial ablation devices are projected to post an 8.67% CAGR through 2030, outpacing every other product class. Second-generation balloon and radiofrequency systems deliver higher amenorrhea rates and fit within reimbursement bundles that reward same-day discharge. Their rapid uptake is steering capital budgets away from legacy resectoscopes. Contraceptive devices remain a resilient revenue base, highlighted by the 2025 approval of Miudella, which uses half the copper of earlier IUDs yet maintains 99% efficacy.

Miniaturized hysteroscopes, such as the 3.1 mm Olympus HYF-XP, facilitate dilation-free access, opening hysteroscopy to smaller clinics with limited anesthesia capabilities. Diagnostic imaging systems are converging toward unified towers that integrate fluorescence, ultrasound, and AI analysis to streamline operating-room footprints. Fluid management remains mission-critical as new pumps with real-time pressure monitoring aim to curb fluid overload complications. Overall, product choice is tilting toward multi-modality platforms that compress procedure times and minimize inventory while embedding software hooks for future analytics upgrades.

The Gynecological Devices Market Report is Segmented by Product Type (Gynecological Endoscopy Devices, Endometrial Ablation Devices, Contraceptive Devices, Diagnostic Imaging Systems, Fluid Management Systems, and More), Application (Laparoscopy, Hysteroscopy, and More), End User (Hospitals, Gynecology Clinics, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 42.23% share of the gynecological devices market in 2024, supported by robust reimbursement, widespread robotic surgery adoption, and continuous refresh of imaging infrastructure. Providers prioritize capital projects that shorten procedure times and enable outpatient migration, creating steady pull for AI-enabled visualization and ergonomically optimized instrumentation. Strategic acquisitions, such as Boston Scientific's USD 3.7 billion purchase of Axonics, underscore the region's appetite for neuromodulation and other high-growth adjacencies that complement core surgical franchises.

Europe remains a key market, though growth is tempered by the resource demands of MDR compliance. Health systems encourage reuse and sustainability initiatives, steering procurement toward devices with validated reprocessing protocols or recyclable components. Investment in office-based hysteroscopy has accelerated, aided by bundled payments that incentivize day-case care. European research hubs foster collaborations between hospitals and technology firms, driving pilot programs for AI-guided colposcopy and smart tampon diagnostics.

Asia-Pacific is projected to deliver the fastest 2025-2030 expansion at a 10.93% CAGR as governments pour resources into maternal health and cancer screening programs. Rising disposable incomes and urbanization improve access to private care, where demand skews toward minimally invasive and fertility services. Local manufacturers are scaling up to compete globally, aided by harmonized regulatory pathways and export-oriented policies. Telemedicine is extending specialist reach into rural settings, lifting adoption of portable ultrasound and at-home monitoring kits.

- Hologic

- Boston Scientific

- Johnson & Johnson

- Medtronic

- The Cooper Companies

- Karl Storz

- Olympus

- Stryker

- Cook Group

- Richard Wolf

- Intuitive Surgical

- B. Braun

- Coloplast

- Beckton Dickinson

- Conmed

- Teleflex

- Minerva Surgical

- Lumenis

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of gynecological disorders

- 4.2.2 Growing adoption of minimally-invasive surgeries

- 4.2.3 Technological advances in OB-GYN endoscopy & imaging

- 4.2.4 Aging female population plus higher healthcare spend

- 4.2.5 Outpatient hysteroscopy reimbursement bundling surge

- 4.2.6 FemTech-enabled smart OB-GYN instruments

- 4.3 Market Restraints

- 4.3.1 Device recalls & litigation (e.g., vaginal mesh)

- 4.3.2 Heightened FDA/EU MDR re-classification hurdles

- 4.3.3 Shortage of trained gynecologic surgeons

- 4.3.4 Price erosion from generic laparoscopic instruments

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Gynecological Endoscopy Devices

- 5.1.1.1 Hysteroscope

- 5.1.1.2 Resectoscope

- 5.1.1.3 Colposcope

- 5.1.1.4 Laparoscope

- 5.1.1.5 Endoscopic Imaging Systems

- 5.1.2 Endometrial Ablation Devices

- 5.1.2.1 Balloon Ablation Devices

- 5.1.2.2 Hydrothermal Ablation Devices

- 5.1.2.3 Radiofrequency Ablation Devices

- 5.1.2.4 Other Endometrial Ablation Devices

- 5.1.3 Contraceptive Devices

- 5.1.3.1 Temporary Birth Control

- 5.1.3.2 Permanent Birth Control

- 5.1.4 Diagnostic Imaging Systems

- 5.1.5 Fluid Management Systems

- 5.1.6 Other Product Types

- 5.1.1 Gynecological Endoscopy Devices

- 5.2 By Application (Value)

- 5.2.1 Laparoscopy

- 5.2.2 Hysteroscopy

- 5.2.3 Dilation & Curettage

- 5.2.4 Colposcopy

- 5.2.5 Endometrial Ablation

- 5.2.6 Female Sterilization

- 5.2.7 Others

- 5.3 By End User (Value)

- 5.3.1 Hospitals

- 5.3.2 Gynecology Clinics

- 5.3.3 Ambulatory Surgery Centers

- 5.3.4 Fertility Centers

- 5.3.5 Research & Academic Institutes

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Hologic Inc.

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Johnson & Johnson (Ethicon)

- 6.3.4 Medtronic plc

- 6.3.5 CooperSurgical Inc.

- 6.3.6 Karl Storz SE & Co. KG

- 6.3.7 Olympus Corporation

- 6.3.8 Stryker Corporation

- 6.3.9 Cook Medical

- 6.3.10 Richard Wolf GmbH

- 6.3.11 Intuitive Surgical

- 6.3.12 B. Braun Melsungen AG

- 6.3.13 Coloplast A/S

- 6.3.14 Becton, Dickinson and Company

- 6.3.15 CONMED Corporation

- 6.3.16 Teleflex Incorporated

- 6.3.17 Minerva Surgical Inc.

- 6.3.18 Lumenis Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment