PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846146

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846146

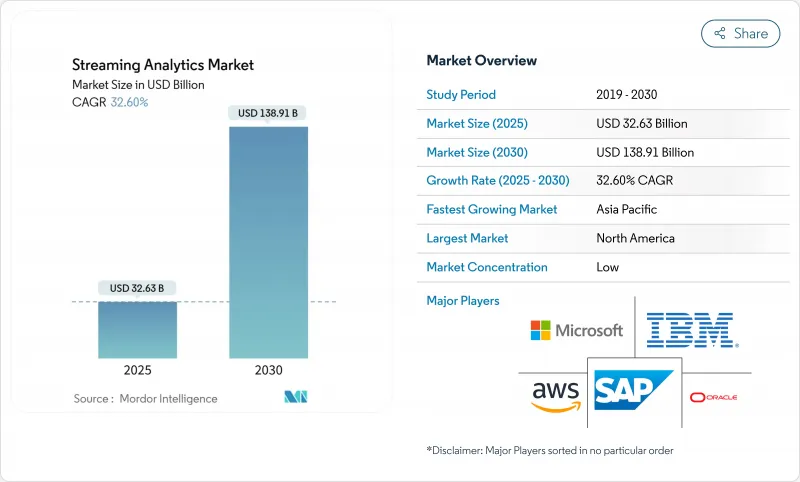

Streaming Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The streaming analytics market is valued at USD 32.63 billion in 2025 and is forecast to reach USD 138.91 billion by 2030, advancing at a 33.6% CAGR.

Near-instant insights generated from continuously flowing data are becoming a board-room priority as enterprises pivot away from batch practices toward responsive, AI-enhanced decision loops. Generative models embedded directly inside data pipelines, wide availability of edge inference chips, and a growing set of managed cloud services collectively compress the time between data capture and action. Vendors are refining pay-as-you-go pricing and simplifying orchestration so that firms can scale real-time workloads without provisioning burdens. While early adopters focused on fraud detection and recommendation engines, 2025 sees an uptick in industrial reliability use cases, telehealth monitoring, and 5G-enabled network optimization. Heightened sensitivity to data-transfer charges and talent scarcity temper otherwise robust demand, yet the fundamental shift toward event-driven architectures keeps the streaming analytics market on a steep growth path.

Global Streaming Analytics Market Trends and Insights

Generative-AI Infused Data Pipelines

Context-aware models integrated with high-throughput brokers turn raw events into prescriptive actions in milliseconds. Financial institutions combining language models with streaming telemetry report 40% gains in fraud-detection accuracy while slashing false positives. Bidirectional connectors between Confluent Tableflow and Databricks Delta Lake keep models supplied with fresh, lineage-rich data, eliminating manual refresh cycles. Retailers now auto-tune promotion parameters in real time, lifting conversion rates during flash sales. As libraries for vector search and semantic enrichment join core stream engines, predictive maintenance and anomaly triage are shifting from dashboards to closed-loop autonomy. The result is a broader enterprise appetite to operationalize AI without the latency penalties of traditional ETL.

Edge AI Chips Enabling On-Device Processing

NVIDIA's Jetson AGX Thor supplies up to 8 times the prior-generation compute, with 128 GB memory supporting hefty transformer inference at source. Manufacturers deploy the module next to vibration sensors so that models flag bearing wear before costly downtime. Hospitals rely on edge inference to trigger nurse alerts when patient vitals deviate, meeting privacy rules that restrict continuous cloud upload . Emerging accelerators like Groq's LPU push token generation to 300 tokens per second, letting conversational assistants run inside teller kiosks. By sidestepping back-haul latency and bandwidth charges, firms unlock real-time use cases in ships, mines, and rural cell towers where connectivity remains inconsistent. The technology thus widens geographic reach for the streaming analytics market while reinforcing compliance with data-sovereignty codes.

Rising Kafka Skill-Set Shortage and Wage Inflation

Eighty-plus percent of Fortune 100 enterprises rely on Kafka, yet job boards list far more openings than qualified engineers. United States salaries top USD 100,000, squeezing budgets for mid-tier firms. The steep learning curve around brokers, replication factors, and exactly-once semantics deters newcomers, while retaining talent proves challenging as cloud vendors poach senior staff. Managed platforms help but trade flexibility for subscription outlays. Consulting partners expand training bootcamps, though ramp-up times still lag project deadlines. Until educational pipelines catch up, talent scarcity will curb some rollouts, particularly in regulated sectors where outsourcing is constrained.

Other drivers and restraints analyzed in the detailed report include:

- Low-Code/No-Code Streaming Workbenches for Citizen Developers

- Mainstream Adoption of Event-Driven Micro-Services

- Escalating Egress Fees on Hyperscaler Clouds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions provided the structural backbone of the streaming analytics market in 2024 with 65.4% revenue, reflecting wide adoption of brokers, processors, and interactive query engines. Yet services are accelerating at 33.8% CAGR through 2030 as enterprises seek design blueprints, migration aid, and 24/7 SRE support. Architecture assessments, data-quality remediation, and schema governance dominate new statements of work. Confluent and EY formed a strategic alliance in 2025 to bundle implementation accelerators, underscoring demand for outside expertise. As observability and cost-optimization mandates rise, managed services extend from simple hosting to auto-tuning capacity based on event velocity.

Skills shortages push even risk-averse sectors to outsource runtime operations, shifting budgets from capital expenditure to recurring services. Vendor roadmaps show pre-packaged compliance modules for PCI-DSS and HIPAA emerging inside subscription tiers, which lowers the barrier for regulated adopters. Consequently, the streaming analytics market size for professional and managed services is projected to outpace core software revenues, reinforcing a virtuous cycle where know-how, not tool count, differentiates providers.

Cloud claimed 59.5% of 2024 revenue, and its 34.2% CAGR signals continued preference for elastic capacity. Hyperscalers pair auto-scaling stream engines with lakehouses and vector databases, letting teams ingest, enrich, and serve ML features without hardware procurement. Google Cloud stitches Pub/Sub, Dataflow, BigQuery, and Vertex AI into a managed continuum, easing burden for firms lacking distributed-systems talent. The streaming analytics market size for on-premise workloads remains meaningful in defense, fintech, and public health, but growth trails cloud due to refresh cycles and capex hurdles.

Hybrid blueprints mitigate egress costs by processing sensitive telemetry in factories with Azure SQL Edge before forwarding aggregates to cloud ML endpoints. Providers now enable policy-based topic placement so that individual partitions stay inside national borders, satisfying emerging sovereignty rules. Over the forecast, multicloud federation tools that span IAM, lineage, and governance will influence vendor selection as buyers seek exit-cost protection.

Streaming Analytics Market Report is Segmented by Component (Software, Services), Deployment (On-Premise, Cloud-Based), End-User Industry (Media and Entertainment, Retail and ECommerce, Manufacturing, BFSI, and More), Organization Size (Large Enterprises, Small and Medium Enterprises), and by Geography. The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

North America captured 29.7% revenue in 2024 owing to early hyperscaler ecosystems and a mature cadre of Kafka specialists. Financial services, ride-hailing, and retail pioneers validated ROI, creating reference designs that spread across sectors. Yet saturation tempers incremental growth, and skilled-labor bottlenecks spark wage premiums that influence deployment budgets. Government push for real-time public-sector dashboards-covering weather, wildfire, and mobility-adds steady demand, albeit at rigorous compliance levels.

Asia-Pacific posts the swiftest 34.1% CAGR as 5G rollouts, smart-factory programs, and sovereign cloud initiatives converge. China's AI revenue projections near USD 300 billion by 2030, with edge streaming deemed vital to autonomous manufacturing cells. India's public-digital-infrastructure drive embeds event streams into tax, identity, and payments rails, while Southeast Asian e-commerce platforms rely on real-time personalization to compete for mobile users. Local chipmakers and telcos co-innovate, reducing hardware costs and boosting regional vendor ecosystems, which keeps adoption momentum high.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Amazon Web Services

- Google (Alphabet)

- Confluent Inc.

- TIBCO Software Inc.

- Software AG

- SAS Institute Inc.

- Striim Inc.

- Impetus Technologies

- Databricks

- Snowflake Inc.

- Apache Software Foundation (Kafka/Flink)

- Cloudera Inc.

- Ververica

- Aiven Ltd.

- Timeplus

- Hazelcast Inc.

- StreamSets Inc.

- Redpanda Data

- Cisco Systems (ThousandEyes)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Generative-AI infused data pipelines

- 4.2.2 Edge AI chips enabling on-device stream processing

- 4.2.3 Low-code/no-code streaming workbenches for citizen developers

- 4.2.4 Mainstream adoption of event-driven micro-services

- 4.2.5 Growing SME demand for cloud stream analytics (consensus driver)

- 4.2.6 Expansion of IoT and industrial automation (consensus driver)

- 4.3 Market Restraints

- 4.3.1 Rising Kafka skill-set shortage and wage inflation

- 4.3.2 Escalating egress fees on hyperscaler clouds

- 4.3.3 Data-sovereignty regulations limiting cross-border stream flows

- 4.3.4 Legacy batch-centric architectures delaying migration (consensus)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud-Based

- 5.3 By End-user Industry

- 5.3.1 Media and Entertainment

- 5.3.2 Retail and eCommerce

- 5.3.3 Manufacturing

- 5.3.4 BFSI

- 5.3.5 Healthcare and Life Sciences

- 5.3.6 Transportation and Logistics

- 5.3.7 Telecommunications

- 5.3.8 Others

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Microsoft Corporation

- 6.4.3 Oracle Corporation

- 6.4.4 SAP SE

- 6.4.5 Amazon Web Services

- 6.4.6 Google (Alphabet)

- 6.4.7 Confluent Inc.

- 6.4.8 TIBCO Software Inc.

- 6.4.9 Software AG

- 6.4.10 SAS Institute Inc.

- 6.4.11 Striim Inc.

- 6.4.12 Impetus Technologies

- 6.4.13 Databricks

- 6.4.14 Snowflake Inc.

- 6.4.15 Apache Software Foundation (Kafka/Flink)

- 6.4.16 Cloudera Inc.

- 6.4.17 Ververica

- 6.4.18 Aiven Ltd.

- 6.4.19 Timeplus

- 6.4.20 Hazelcast Inc.

- 6.4.21 StreamSets Inc.

- 6.4.22 Redpanda Data

- 6.4.23 Cisco Systems (ThousandEyes)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment