PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846147

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846147

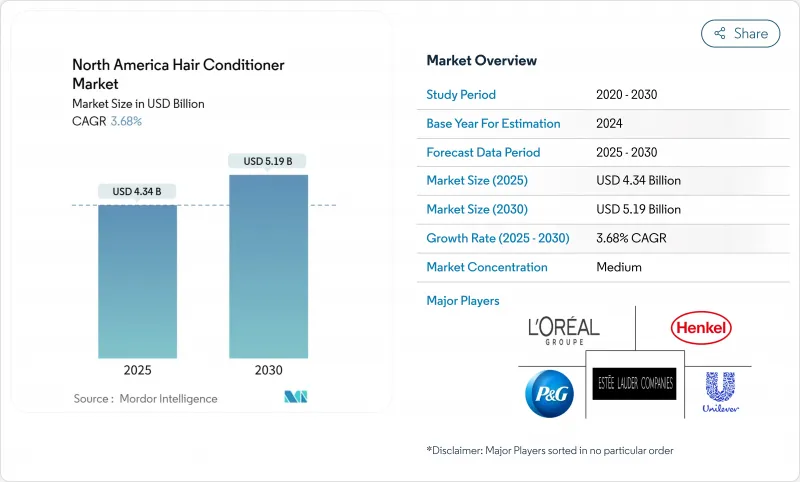

North America Hair Conditioner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The North America hair conditioner market is estimated to be USD 4.34 billion in 2025 and is forecast to reach USD 5.19 billion by 2030, reflecting a 3.68% CAGR over the forecast period (2025-2030).

The hair conditioner market in North America is witnessing consistent growth, driven by increasing consumer preference for natural, sulfate-free formulations and semi-solid, leave-in conditioning products designed to address diverse hair types and styling requirements. Also, premium products, clean-label claims, and algorithm-driven personalization are capturing an increasing share of discretionary spending. Meanwhile, mass-market offerings reliant on volume are depending heavily on promotions to maintain shelf presence. Consumer purchasing decisions are increasingly influenced by ingredient transparency and proven product efficacy. This shift has allowed smaller, science-driven brands to gain market share in the North American hair conditioner market, even with limited advertising budgets. While the United States remains the primary driver of demand, Mexico's rapid adoption of salon culture and Canada's strong preference for eco-certified products are prompting suppliers to reassess regional production and inventory strategies.

North America Hair Conditioner Market Trends and Insights

Strong Demand For Products Formulated With Clean Label Ingredients

Consumers are increasingly prioritizing health, sustainability, and transparency, driving a significant shift in purchasing behavior. They now demand products that are not only safe and effective but also environmentally responsible and ethically sourced. This evolution has elevated "clean label" from a marketing term to a baseline expectation, compelling formulators to replace controversial surfactants and preservatives with plant-based alternatives. Heightened regulatory focus has driven the advancement of innovative natural alternatives. For instance, in April 2025, BASF introduced two new personal care ingredients: Verdessence Maize, a biodegradable styling polymer, and Dehyton PK45 GA/RA, a betaine derived from Rainforest Alliance Certified coconut oil. Additionally, products formulated without sulfates, silicones, and parabens, and enhanced with natural oils such as argan and coconut, are rapidly gaining market share. A prominent example is Pantene's "Hair Volume Multiplier" conditioner, which utilizes plant-derived actives to comply with clean-beauty standards. Also, formulated without sulfates, silicones, parabens, dyes, phthalates, or mineral oil, this hair conditioner provides targeted nourishment and strengthens hair to minimize damage.

Influence Of Social Media And Celebrity Endorsement

Social media platforms such as TikTok and Instagram have transformed from simple promotional tools into highly interactive ecosystems where consumers engage with influencers to co-create products. The rise of viral product-testing videos has not only driven substantial growth in online sales but has also provided research and development teams with valuable, real-time feedback on critical product attributes, including scent, texture, and packaging. Influencer promotions have a measurable impact on consumer behavior, with consumers purchasing beauty products after encountering such endorsements. Moreover, in North America, data-driven consumer insights are increasingly influencing celebrity-led product launches in the hair conditioner market. This approach enables faster formulation adjustments based on real-time feedback. For instance, Pattern Beauty, led by Tracee Ellis Ross, leverages consumer input to refine products designed for textured hair. This democratization of product development gives digitally native, influencer-driven brands a competitive edge over traditional players. Consequently, major corporations like P&G Company and Unilever are adopting more agile, consumer-centric innovation strategies within their hair care portfolios.

Consumer Concerns Over Product Safety And Ingredients

In North America, the intensification of regulatory scrutiny surrounding hair care product safety is significantly transforming the operational and strategic approaches of manufacturers. The California Toxic-Free Cosmetics Act, which prohibits the use of several harmful chemicals, has necessitated comprehensive product reformulations. Simultaneously, the FDA's ongoing investigation into adverse events associated with hair cleansing products has heightened consumer awareness and concern regarding potential health risks, further influencing purchasing decisions. These evolving safety concerns have far-reaching implications across the entire supply chain. Manufacturers are now tasked with the critical responsibility of balancing product efficacy with stringent safety standards. Additionally, there is a growing demand for enhanced transparency in ingredient sourcing and testing protocols, as consumers and regulatory bodies alike seek greater accountability. The Board of Barbering and Cosmetology has identified specific chemicals in hair conditioners that pose risks such as skin irritation, respiratory complications, and potential long-term health effects, reinforcing the urgency for the development of safer alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Consumers' Inclination Towards Natural And Organic Products

- Consumer Demand For Multicultural Hair Conditioners

- Counterfeit Products Affecting Brand Reputation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, the adult segment dominates the North American hair conditioner market, accounting for 94.24% of the market share. This leadership reflects its well-established consumer base and extensive product portfolio, catering to various price ranges and formulations. The segment's dominance is further bolstered by the increasing demand for specialized treatments targeting specific hair concerns. On the other hand, the kids/children segment, though currently smaller, is anticipated to grow at a faster CAGR of 4.25% during the forecast period of 2025-2030. This growth is driven by rising parental demand for gentle, tailored formulations, fueled by heightened awareness of early hair care practices. Additionally, the introduction of child-specific products addressing needs such as detangling and scalp sensitivity is contributing to this upward trend.

The rising focus on preventative hair care, mirroring trends in the hair conditioner industry, presents a significant growth opportunity for both segments. For instance, Croda Beauty's launch of FibraShield C in March 2025 highlights this shift. This innovative protective multi-peptide, derived from chickpea extract, reduces reactive oxygen species by 95% and reverses UV-induced cuticle damage, emphasizing a proactive approach to hair protection over reactive treatments.

Mass products account for 72.23% of the North American hair conditioner market in 2024, maintaining their dominant position through wide distribution networks and accessible price points. Mass-market conditioners continue to hold the largest share of the North American hair conditioner market in volume terms, driven by extensive distribution across supermarkets and value chains. Promotional pricing strategies and family-sized packaging appeal to cost-conscious consumers, while impulse purchases increase when mass brands introduce naturally-derived fragrances or limited-edition variants. Retail data indicates that multi-packs achieve the highest sales velocity when supported by social media tutorials, highlighting the growing impact of digital storytelling on value-tier products.

Premium and prestige conditioners are anticipated to achieve 4.62% CAGR (2025-2030) growth, supported by salon-quality positioning, sulfate-free formulations, and premium sensorial experiences. Consumers who previously prioritized professional salon services are reallocating portions of their budgets toward high-end at-home treatments, a behavioral shift further accelerated by inflationary pressures on service costs. The premium segment frequently combines conditioners with complementary scalp serums, driving higher average order values in online channels. Consequently, mid-tier brands must strategically decide whether to expand upward with premium sub-lines or focus on defending core price points through packaging innovation.

The North America Hair Conditioner Market is Segmented by End User (Adults and Kids/Children), Category (Premium Products and Mass Products), Ingredients (Natural/Organic and Conventional/Synthetic), Distribution Channel (Supermarkets/Hypermarkets, Specialist Stores, Online Retail Stores, and Others), and Geography (United States, Canada, Mexico, and Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Procter & Gamble Company

- L'Oreal S.A.

- Unilever PLC

- Henkel AG and Co. KGaA

- Kao Corporation

- Kenvue Inc.

- The Estee Lauder Companies Inc.

- Church and Dwight Co., Inc.

- Olaplex Holdings, Inc.

- Moroccanoil, Inc.

- Davines Group SpA

- John Paul Mitchell Systems

- Coty Inc.

- Akita Brands, Inc (Fable & Mane)

- L'Occitane Groupe S.A.

- Luxury Brand Partners, LLC

- LolaVie

- BondiBoost

- Cecred

- Zuru Edge Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Strong demand for products formulated with clean label ingredients

- 4.2.2 Influence of social media and celebrity endorsement

- 4.2.3 Consumers' inclination towards natural and organic products

- 4.2.4 Consumer demand for multicultural hair conditioners

- 4.2.5 Increasing popularity of customized hair care solutions

- 4.2.6 Advancements in hair care product formulations

- 4.3 Market Restraints

- 4.3.1 Consumer concerns over product safety and ingredients

- 4.3.2 Counterfeit products affecting brand reputation

- 4.3.3 High competition among established players

- 4.3.4 Fluctuations in raw material prices impacting profit margins

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By End User

- 5.1.1 Adults

- 5.1.2 Kids/Children

- 5.2 By Category

- 5.2.1 Premium Products

- 5.2.2 Mass Products

- 5.3 By Ingredients

- 5.3.1 Natural/Organic

- 5.3.2 Conventional/Synthetic

- 5.4 By Distribution Channel

- 5.4.1 Specialist Stores

- 5.4.2 Supermarkets/Hypermarkets

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Procter & Gamble Company

- 6.4.2 L'Oreal S.A.

- 6.4.3 Unilever PLC

- 6.4.4 Henkel AG and Co. KGaA

- 6.4.5 Kao Corporation

- 6.4.6 Kenvue Inc.

- 6.4.7 The Estee Lauder Companies Inc.

- 6.4.8 Church and Dwight Co., Inc.

- 6.4.9 Olaplex Holdings, Inc.

- 6.4.10 Moroccanoil, Inc.

- 6.4.11 Davines Group SpA

- 6.4.12 John Paul Mitchell Systems

- 6.4.13 Coty Inc.

- 6.4.14 Akita Brands, Inc (Fable & Mane)

- 6.4.15 L'Occitane Groupe S.A.

- 6.4.16 Luxury Brand Partners, LLC

- 6.4.17 LolaVie

- 6.4.18 BondiBoost

- 6.4.19 Cecred

- 6.4.20 Zuru Edge Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK