PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846149

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846149

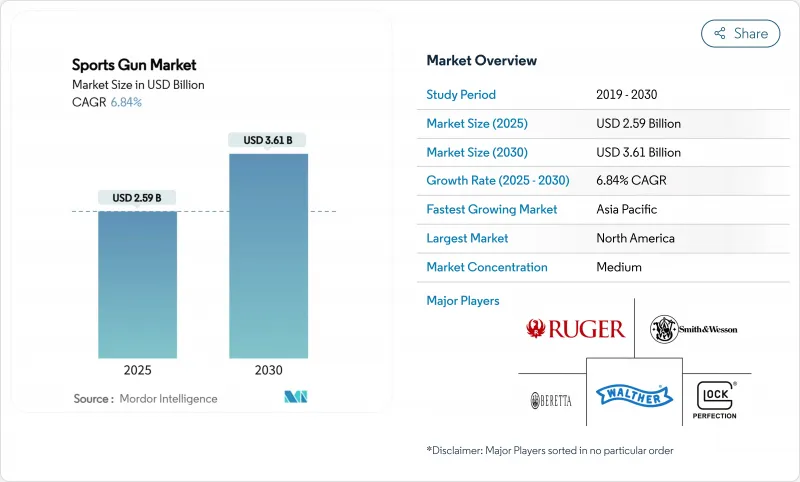

Sports Gun - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The sports gun market is valued at USD 2.59 billion in 2025 and is forecasted to reach USD 3.61 billion by 2030, advancing at a 6.84% CAGR.

This momentum comes despite tightening regulations because product designers keep raising performance through lighter composites, modular components, and smart-gun electronics that command premium prices. Demand also benefits from the digital shift toward direct-to-consumer channels, which gives small brands cost-effective reach and better compliance tools. Competitive pressure is visible in how lever-action rifle sales jumped 57% in 2024, even as handgun volumes fell 17%, indicating that enthusiasts are willing to switch categories for new experiences. Rising participation among younger shooters, fresh club memberships, and cross-border tourism packages reinforce the sports gun market's resilience.

Global Sports Gun Market Trends and Insights

Increasing Engagement in Recreational Shooting and Hunting Activities

Participation in shooting sports keeps climbing as new clubs open and existing ones add members, fueling equipment replacement cycles that lift the sports gun market. Japan's decision to allow councils to license hunters for emergency bear control underscores official acceptance of hunting as a wildlife-management tool and signals additional demand for specialty rifles. Once considered niche, Lever-action platforms recorded the fastest 57% sales rise among long guns in 2024. This shows how younger buyers blend nostalgia with modern ergonomics to expand the sports gun market. In Australia, mandatory annual participation hours for club members keep firearm owners active and willing to upgrade optics and barrels, strengthening aftermarket revenue. Outdoor travel firms now bundle shooting sessions with adventure tourism, adding incremental gear purchases to each trip. These patterns help cushion the sports gun market from broader volatility in general-purpose firearm sales.

Advancements in Lightweight Materials and Optical Enhancements for Sporting Firearms

Carbon-fiber hand-guards, polymer lowers, and slimline rails cut rifle weight by double-digit percentages, making them more accurate over long competition days and bolstering the sports gun market. Japan's Type 20 adoption demonstrates how military R&D migrates quickly into civilian modular rifles that feature full-length Picatinny rails for quick optic swaps. Smart optics that adjust aim-points dynamically are becoming key selling points in premium price tiers, although vendors keep specifications proprietary to protect intellectual property. Ammunition innovation parallels SIG Sauer's new NATO round, which targets flatter trajectories that match lightweight rifle characteristics, lifting the sports gun market's margin profile. The cost of exotic materials remains high, so only brands with scale or strong price positioning can capture full value. Nevertheless, performance gains create a persuasive upgrade path for competitive shooters who value every tenth of a second.

Tightening and Evolving Firearm Regulatory Frameworks

Canada outlawed 503 specific firearm models between December 2024 and March 2025, causing immediate product withdrawals that shrink the sports gun market. The UK moved to full cost recovery on licensing in early 2025, adding application fees that raise ownership costs for casual participants. Western Australia now requires health assessments for every license renewal, creating another administrative layer that strains small retailers. Even firearm-friendly Czechia overhauled its code, mandating digital tracking of every weapon by 2026. Each new rule increases uncertainty, discouraging capital investment and nudging consumers toward rental or club-owned guns.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of E-Commerce Channels for Firearm Sales

- Emergence of Smart-Gun Pilot Programs Fueling Demand for High-End Models

- Significant Initial Investment Required for High-Performance Sporting Guns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rifles generated 40.45% of 2024 revenue, and their 7.98% CAGR keeps the segment at the core of the sports gun market. Bolt-action platforms retain hunting loyalty, while semi-automatic AR-style and the modular Type 20 pattern accelerate demand for quick-change uppers and lighter hand-guards. Lever-action designs enjoy a renaissance with younger hobbyists who value heritage styling, helping the sports gun market diversify its rifle mix. Manufacturers concentrate R&D on integrated suppressor barrels and tunable gas blocks that simplify competition prep.

Shotguns show volume erosion as tactical rifles absorb clay-sport enthusiasts, yet field guns see modest gains alongside rising waterfowl license numbers. Pistols remain a dependable revenue pillar for indoor ranges; Smith & Wesson's Bodyguard 380 became an instant digital bestseller, validating compact formats in the sports gun market. Revolvers keep niche pricing power due to craftsmanship appeal. Altogether, rifle innovation sets performance benchmarks that spill over into other categories.

Small-caliber options have a 37.28% share of the sports gun market, thanks to low recoil and inexpensive ammunition. Ranges use .22 LR platforms for safety courses, ensuring steady base-level demand. Regulatory leniency in many jurisdictions also lifts small-caliber popularity as entry pathways for youth programs.

Medium-caliber firearms expand at 8.12% CAGR as competitors transition to cartridges that balance flat trajectory and manageable recoil. New match-grade loads support precision disciplines and keep the margin per round higher than bulk rimfire. Large-caliber rifles remain niche but profitable for international safari bookings and extreme-distance matches. Ammunition makers coordinate forward contracts on copper and powder to hedge cost swings and protect sports gun market profitability.

The Sports Gun Market Report is Segmented by Product Type (Rifles, Pistols, and Shotguns), Caliber (Small, Medium, and Large), Technology (Traditional Firearms, and Modular-Platform Firearms), End User (Competitive Shooting Clubs, Hunting Enthusiasts, Recreational Shooters, and More), and Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 36.80% revenue share in 2024, underpinned by established dealer networks and favorable regulations in many US states. Smith & Wesson recorded 46.8% sequential sales growth on the back of new launches, showing how innovative SKUs can still unlock volume within a mature sports gun market. Canada's ban on 503 models forces OEMs to redesign or abandon certain SKUs, temporarily depressing shipments but encouraging compliance-oriented product lines. Mexico's climbing IPSC enrollment hints at incremental demand once distribution hurdles ease.

Asia-Pacific posts the leading 8.35% CAGR through 2030. Japan procures 8,577 Type 20 rifles for USD 23.3 million, signaling rising technical standards that spill into civilian products. Australia's state-by-state regimes complicate logistics and create service niches that digital platforms exploit. South Korea and India cultivate small yet fast-growing shooting communities, while the Chinese state-owned Norinco leverages scale for selective export under tight licensing.

Europe combines deep sporting traditions with stiff rules. The UK's full cost recovery model and component quotas raise total ownership cost, slowing casual uptake but reinforcing premium positioning for heritage brands. Germany's engineering pedigree keeps match-rifle innovation alive even under strict storage codes. Czechia's digital weapons agenda will become a regional test case for paperless licensing when it goes live in 2026. The Middle East builds luxury ranges that import high-end US and European firearms, while South Africa leverages hunting tourism to sustain riflescope and large-caliber sales.

- Sturm, Ruger & Co. Inc.

- SMITH & WESSON BRANDS, INC.

- SIG SAUER, Inc.

- GLOCK, Inc.

- Fabbrica d'Armi Pietro Beretta SpA

- RemArms LLC

- Carl Walther GmbH

- FN America, LLC

- Heckler & Koch GmbH

- SPRINGFIELD, INC.

- Taurus Holdings, Inc.

- Savage Arms Inc.

- O.F. Mossberg & Sons, Inc.

- Crosman Corporation

- FX Airguns AB

- Daisy Outdoor Products

- J.G. ANSCHUTZ GmbH & Co. KG

- Chiappa Firearms Srl

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising participation in recreational shooting and hunting

- 4.2.2 Advancements in lightweight materials and optical enhancements for sporting firearms

- 4.2.3 Rising adoption of e-commerce channels for firearm sales

- 4.2.4 Emergence of smart-gun pilot programs fueling demand for high-end models

- 4.2.5 Expanding participation from women and youth in shooting sports

- 4.2.6 Growth in cross-border shooting tourism and experience-based packages

- 4.3 Market Restraints

- 4.3.1 Tightening and evolving firearm regulatory frameworks

- 4.3.2 Significant initial investment required for high-performance sporting guns

- 4.3.3 ESG-related financial barriers limiting funding for firearms manufacturers

- 4.3.4 Market diversion due to increasing use of realistic airsoft and laser-based simulators

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Rifles

- 5.1.1.1 Bolt-Action Rifles

- 5.1.1.2 Semi-Automatic Rifles

- 5.1.1.3 Lever-Action Rifles

- 5.1.1.4 Air Rifles

- 5.1.2 Pistols

- 5.1.2.1 Semi-Automatic Pistols

- 5.1.2.2 Revolvers

- 5.1.2.3 Air Pistols

- 5.1.3 Shotguns

- 5.1.3.1 Pump-Action Shotguns

- 5.1.3.2 Semi-Automatic Shotguns

- 5.1.3.3 Break-Action Shotguns

- 5.1.1 Rifles

- 5.2 By Caliber

- 5.2.1 Small

- 5.2.2 Medium

- 5.2.3 Large

- 5.3 By Technology

- 5.3.1 Traditional Firearms

- 5.3.2 Modular-Platform Firearms

- 5.4 By End User

- 5.4.1 Competitive Shooting Clubs

- 5.4.2 Hunting Enthusiasts

- 5.4.3 Recreational Shooters

- 5.4.4 Law-Enforcement Training Academies

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sturm, Ruger & Co. Inc.

- 6.4.2 SMITH & WESSON BRANDS, INC.

- 6.4.3 SIG SAUER, Inc.

- 6.4.4 GLOCK, Inc.

- 6.4.5 Fabbrica d'Armi Pietro Beretta SpA

- 6.4.6 RemArms LLC

- 6.4.7 Carl Walther GmbH

- 6.4.8 FN America, LLC

- 6.4.9 Heckler & Koch GmbH

- 6.4.10 SPRINGFIELD, INC.

- 6.4.11 Taurus Holdings, Inc.

- 6.4.12 Savage Arms Inc.

- 6.4.13 O.F. Mossberg & Sons, Inc.

- 6.4.14 Crosman Corporation

- 6.4.15 FX Airguns AB

- 6.4.16 Daisy Outdoor Products

- 6.4.17 J.G. ANSCHUTZ GmbH & Co. KG

- 6.4.18 Chiappa Firearms Srl

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment