PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846152

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846152

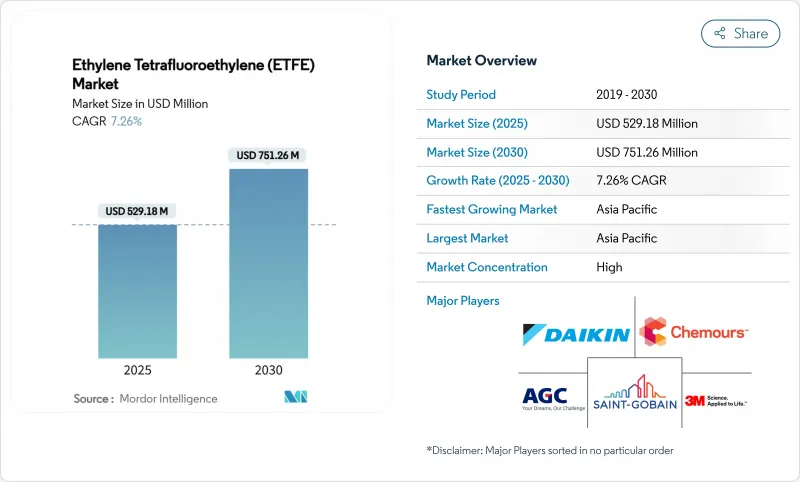

Ethylene Tetrafluoroethylene (ETFE) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ethylene Tetrafluoroethylene Market size is estimated at USD 529.18 Million in 2025, and is expected to reach USD 751.26 Million by 2030, at a CAGR of 7.26% during the forecast period (2025-2030).

Architectural membranes, aerospace wiring, and transparent photovoltaic laminates are the principal growth engines, as the material's clarity, chemical inertness, and tensile strength outperform conventional glass and polymer alternatives. Stadium roofing projects across North America and Europe continue to showcase ETFE's weight savings and daylighting advantages, while airlines and Electric Vertical Take-off and Landing (eVTOL) manufacturers specify ETFE-insulated cables to withstand thermal cycling and hydraulic-fluid exposure. Solar module producers are deploying transparent ETFE laminates that preserve facade aesthetics and convert sunlight into power, expanding the ETFE market into building-integrated photovoltaics. Regional production capacity additions in Asia-Pacific underpin supply security, although Per- and polyfluoroalkyl substances (PFAS) regulations in Europe and North America could redirect investment toward greener chemistries and localized value chains.

Global Ethylene Tetrafluoroethylene (ETFE) Market Trends and Insights

Gaining Popularity as Roof-cover Material for Stadium-type Structures

Stadium architects are increasingly specifying ETFE roofing systems because they deliver natural lighting while eliminating the structural weight penalties of traditional glass canopies. The Intuit Dome's 277,000 square foot diagrid roof structure incorporates clear ETFE membranes that allow natural airflow, eliminating air conditioning requirements in certain areas while achieving Leadership in Energy and Environmental Design (LEED) Platinum certification. The material's self-extinguishing properties address fire safety concerns that have historically limited membrane adoption in high-occupancy venues. Beyond functionality, ETFE's ability to scatter sunlight prevents greenhouse effects while maintaining 95% daylight transmission, creating optimal playing conditions that traditional roofing cannot match. This trend is accelerating as venue operators recognize ETFE's long-term cost advantages, with maintenance requirements limited to cleaning every 2-3 years compared to frequent glass panel replacements.

Rising Demand for Ethylene Tetrafluoroethylene (ETFE) Cables in Aerospace Wiring

Aerospace manufacturers are expanding ETFE cable adoption because the material withstands extreme temperature cycles and chemical exposure that would degrade conventional insulation materials. The 2025 Aerospace and Defense Industry Outlook projects 11.6% growth in global air passenger traffic, with defense spending surpassing USD 2.4 Trillion, creating sustained demand for high-performance wiring solutions. ETFE's resistance to hydraulic fluids and thermal stability make it essential for next-generation aircraft systems, particularly in electric vertical takeoff and landing (eVTOL) aircraft where weight reduction is critical. Military applications drive premium pricing, as ETFE cables meet stringent specifications for combat aircraft and spacecraft thermal control surfaces. The shift toward more electric aircraft architectures is expanding ETFE's role beyond traditional wiring to power management systems, where its thermal stability enables higher current densities without insulation failure.

Environmental Concerns and Stricter Per- and Polyfluoroalkyl Substances (PFAS)/Fluoropolymer Regulations

The European Union's proposed Per- and Polyfluoroalkyl Substances (PFAS) restrictions could ban over 10,000 substances, including ETFE, in concentrations exceeding specified limits, with implementation timelines extending to 2029. This regulatory pressure is forcing manufacturers to develop PFAS management strategies, including supply chain audits and sourcing alternatives, though suitable replacements often underperform or carry higher costs. Daikin has responded by investing over USD 300 Million to capture PFAS emissions, targeting a 99.9% capture rate in process water discharges while transitioning to sustainable manufacturing technologies by 2030. The European Environment Agency emphasizes that PFAS polymers constitute 24-40% of total PFAS volume in European Union (EU) markets, with their persistence and potential toxicity creating pollution throughout their lifecycle from production to disposal. The regulatory fragmentation between Europe's centralized approach and the United States' (US) state-by-state restrictions creates compliance complexities that increase operational costs and limit market access for ETFE products.

Other drivers and restraints analyzed in the detailed report include:

- Light-weight, Durable Facades Replacing Conventional Glass

- Emergence of Transparent Ethylene Tetrafluoroethylene (ETFE) Photovoltaic Laminates

- Fire-safety Scrutiny on Single-skin Ethylene Tetrafluoroethylene (ETFE) Cushions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Extrusion molding generated 61.76% of 2024 revenue, highlighting its efficiency for continuous films, sheets, and wire coatings. The ETFE market size for extrusion-grade products is set to grow steadily alongside stadium and greenhouse projects. Injection molding's 8.09% CAGR reflects rising demand for precision parts such as complex cable connectors and semiconductor chamber components. Hybrid machines capable of both extrusion and injection are gaining traction as converters aim to serve niche aerospace and electronics orders without multiple capital assets.

Optimized resin grades like NEOFLON ETFE-TX strengthen tensile performance for both processes, enabling thinner walls and lower part weight without sacrificing durability. Processing-equipment makers are introducing screw geometries and hot-runner systems tailored to ETFE's high melt temperature, helping processors avoid degradation and surface defects.

Granules accounted for 56.14% of the 2024 market value share because pelletized form assures consistent flow during extrusion and injection. Wire & cable producers favor granules for precise metering that minimizes dielectric defects. Powder grades, expanding at 8.57% CAGR, cater to spray-coating and additive-manufacturing uses where thin, uniform layers are mandatory. The ETFE market share for powders will rise as aerospace primes qualify powder-bed fusion and cold-spray repairs.

Manufacturers are blending nano-fillers into powder grades to raise surface hardness for process piping and fuel plants. Hybrid formats, micro-granules and high-bulk-density powders bridge the gap between conventional pellets and ultrafine particles, giving converters flexibility to switch between extrusion and coating lines with minimal changeovers.

The Ethylene Tetrafluoroethylene (ETFE) Market Report is Segmented by Technology (Extrusion Molding and Injection Molding), Product Type (Powder, Granule, and More), Application (Coatings, Tubes, and More), End-Use Industry (Aerospace and Defense, Solar Photovoltaics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 47.24% of global market revenue in 2024 and is advancing at an 8.66% CAGR through 2030, benefiting from China's expanding ethylene capacity and Japan's expertise in high-purity fluoropolymers. Government-backed stadium and high-speed-rail stations frequently adopt ETFE roofs, reinforcing regional construction pull. Local converters scale powder-coating lines to serve semiconductor fabs and lithium-battery plants, deepening domestic value capture.

North America remains a prime consumer as National Football League (NFL) and Major League Soccer venues adopt ETFE membranes that deliver clear sightlines and year-round turf protection Axios. The aerospace cluster from Washington State to Quebec drives wire-insulation demand, while renewable-fuel refineries along the Gulf Coast integrate ETFE tubing for corrosion control. Regional clean-energy incentives funnel capital toward Building-Integrated Photovoltaics (BIPV) facades that capitalize on ETFE's optical properties.

Europe grapples with PFAS regulation but still embraces ETFE for iconic structures and offshore wind farm cables. German carmakers deploy ETFE wire harnesses in 800-V drivetrains, whereas Nordic countries integrate ETFE-laminated agrivoltaic roofs across greenhouses to stretch production seasons under limited sunlight. Ethylene rationalization tightens supply, yet specialty ETFE grades retain pricing power.

South America and the Middle East & Africa remain nascent, yet stadium upgrades for upcoming tournaments and airport expansions are beginning to spec ETFE facades. Local resin shortages prompt imports, but regional engineering firms partner with established suppliers to accelerate technology transfer and installation expertise.

- 3M

- AGC Inc.

- Arkema

- DAIKIN INDUSTRIES, Ltd.

- Denise Chemical Co., Limited

- Everflon Fluoropolymers

- Ganzhou Lichang New Materials Co., Ltd.

- Guarniflon S.p.A

- HaloPolymer, OJSC

- NOWOFOL Kunststoffprodukte GmbH & Co. KG

- SABIC

- Saint-Gobain

- The Chemours Company

- Vector Foiltec

- Zeus Company LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Gaining Popularity as Roof-cover Material for Stadium-type Structures

- 4.2.2 Rising Demand for Ethylene Tetrafluoroethylene (ETFE) Cables in Aerospace Wiring

- 4.2.3 Light-weight, Durable Facades Replacing Conventional Glass

- 4.2.4 Emergence of Transparent Ethylene Tetrafluoroethylene (ETFE) Photovoltaic Laminates

- 4.2.5 Chemical-resistant Tubing Demand in Renewable Aviation-fuel Plants

- 4.3 Market Restraints

- 4.3.1 Environmental Concerns and Stricter Per- and polyfluoroalkyl substances (PFAS)/fluoropolymer Regulations

- 4.3.2 Fire-safety Scrutiny on Single-skin Ethylene Tetrafluoroethylene (ETFE) Cushions

- 4.3.3 Limited Global Ethylene Tetrafluoroethylene (ETFE)-resin Capacity

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Extrusion Molding

- 5.1.2 Injection Molding

- 5.2 By Product Type

- 5.2.1 Powder

- 5.2.2 Granule

- 5.2.3 Other Product Types (Pellet, etc.)

- 5.3 By Application

- 5.3.1 Film and Sheet

- 5.3.2 Wire and Cable

- 5.3.3 Tubes

- 5.3.4 Coatings

- 5.3.5 Other Applications (3D-Printed Components, etc.)

- 5.4 By End-use Industry

- 5.4.1 Building and Construction

- 5.4.2 Aerospace and Defense

- 5.4.3 Automotive and E-Mobility

- 5.4.4 Electrical and Electronics

- 5.4.5 Solar Photovoltaics

- 5.4.6 Industrial and Chemical Processing

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 India

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 NORDIC Countries

- 5.5.3.8 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 AGC Inc.

- 6.4.3 Arkema

- 6.4.4 DAIKIN INDUSTRIES, Ltd.

- 6.4.5 Denise Chemical Co., Limited

- 6.4.6 Everflon Fluoropolymers

- 6.4.7 Ganzhou Lichang New Materials Co., Ltd.

- 6.4.8 Guarniflon S.p.A

- 6.4.9 HaloPolymer, OJSC

- 6.4.10 NOWOFOL Kunststoffprodukte GmbH & Co. KG

- 6.4.11 SABIC

- 6.4.12 Saint-Gobain

- 6.4.13 The Chemours Company

- 6.4.14 Vector Foiltec

- 6.4.15 Zeus Company LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Investment in Ethylene Tetrafluoroethylene (ETFE) Recycling Technologies