PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846162

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846162

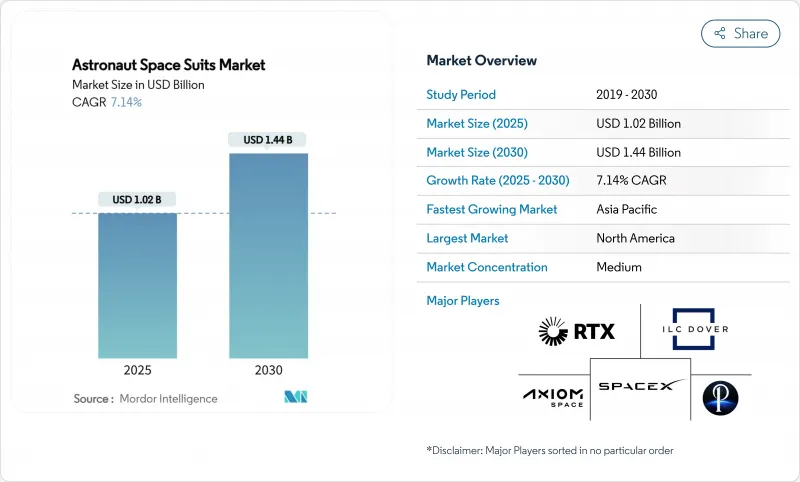

Astronaut Space Suits - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The astronaut space suits market is valued at USD 1.02 billion in 2025 and is projected to reach USD 1.44 billion by 2030, advancing at a 7.14% CAGR.

This expansion reflects widening demand beyond the historical government-only customer base as commercial space tourism, private lunar programs, and national exploration initiatives adopt next-generation life-support systems. The transition toward privately funded spacewalks-underscored by SpaceX's first commercial EVA during the Polaris Dawn mission in September 2024-confirms that agile commercial developers now match performance standards once defined by NASA. North America preserves its lead through Artemis procurement, yet Asia-Pacific delivers the quickest growth as China, India, and the UAE elevate human-spaceflight budgets. Supply-chain resilience has emerged as a structural driver, prompting consolidation such as Ingersoll Rand's USD 2.325 billion purchase of ILC Dover to secure pressure-garment capacity.

Global Astronaut Space Suits Market Trends and Insights

Artemis and Artemis II Lunar Missions Boost EVA Suit Demand

NASA's Artemis schedule has moved planetary-surface suit development to the top of R&D agendas. Axiom Space's AxEMU prototype passed thermal-vacuum trials at Johnson Space Center, validating performance in -370°F environments that dominate the lunar south pole. Delays that may push Artemis III to 2027 have not slowed technical advances in dust-mitigation layers and miniaturized power-and-cooling subsystems. Prada's contribution of high-tensile yarns plus ergonomic patterning illustrates cross-sector design infusion that blends luxury with mission safety. Eight-hour EVA capability, wider joint articulation, and lighter portable life-support systems set new performance floors that influence every tier of the astronaut space suits market.

Commercial Space-Tourism Flight Frequency Surges

Virgin Galactic's 12th suborbital flight in June 2024 proved repeatable operations and previewed Delta-class vehicles arriving in 2026. Blue Origin's April 2025 New Shepard flight-featuring an all-female manifest-underscored the shift toward personalized IVA garments that trade some durability for passenger comfort. The sector anticipates more than 500 private astronauts by 2030, pushing manufacturers toward higher-volume, modular production lines. SpaceX's EVA work on Polaris bridges tourism and professional mission standards, narrowing the capability gap and enlarging the market's addressable portion of the astronaut space suits.

Ultra-High R&D Plus Qualification Cost Per Design Iteration

Collins Aerospace's exit from xEVAS highlights how re-certification of each life-critical modification multiplies expenditure and risk beyond commercial ROI thresholds. Dual compliance with NASA human-rating and FAA commercial-spaceflight rules lengthens development cycles, favoring firms with legacy certification infrastructures. Capital intensity, not intellectual property, has become the principal barrier to new entrants in the astronaut space suits market.

Other drivers and restraints analyzed in the detailed report include:

- Extended ISS and Gateway Operations Create Refurbishment Backlog

- Rising National Budgets for New Space Powers Drive Demand

- Fragile Supply Chain for Aerospace-Grade Fabrics and Electromechanical Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

IVA suits captured 53.12% of the astronaut space suits market share in 2024, buoyed by their near-universal role aboard Crew Dragon, Starliner, and Soyuz vehicles. Enhanced Starliner IVA garments delivered improved torso flexibility during a 2024 ISS tour, reinforcing the segment's incumbency. The astronaut space suits market size for Planetary Surface Suits is projected to grow at an 8.91% CAGR as Artemis, the Wangyu program, and commercial lunar tourism schedules converge. Axiom Space's AxEMU dust-mitigation skirts and China's parallel MPC-hybrid prototypes exemplify mobility-first design, embedding haptic guidance and 4G voice telemetry. Across the forecast, EVA replacement cycles accelerate as aging EMUs approach end-of-life and fail to meet current safety guidelines.

Planetary surface suits represent the technology frontier. Mechanical counter-pressure panels cut bulk without sacrificing cabin pressure, while graphene-infused fabrics deflect thermal spikes from sun-shadow transitions. Modular thigh ports accept sensor pods for geology tools, expanding scientific throughput per sortie. Apollo-era ankle restrictions limited traverse distance; new lower-torso bearings enlarge step stride by 32%, raising productivity metrics attractive to lunar-mining investors. Consequently, innovation in this sub-segment sheds R&D spillovers into IVA refresh programs, reinforcing the broader astronaut space suits market.

Government agencies maintained 62.35% of the astronaut space suits market share in 2024, thanks to NASA's multi-year commitments and China's state-funded programs. Artemis procurement alone covers surface-suit deliveries through 2032, anchoring volumes for primary contractors. Yet, the astronaut space suits market size is attributable to commercial operators, and it is forecasted to expand at an 8.24% CAGR as Virgin Galactic, Blue Origin, and SpaceX scale flight cadence. Following the Polaris Dawn EVA, private EVA capability now rivals ISS operations in complexity, shrinking the performance gap.

Commercial growth alters production economics. Standardized sizing, simplified closure systems, and quick-swap glove modules cut per-unit costs by up to 25%. Merchandising rights around celebrity passenger flights create secondary revenue streams for manufacturers offering co-branded garments. Regulatory clarity under the US Commercial Space Launch Competitiveness Act allows operators to self-certify IVA equipment if passenger risk disclosures meet FAA thresholds, speeding time-to-market for new designs.

The Astronaut Space Suits Market Report is Segmented by Suit Type (IVA Suits, EVA Suits, Planetary Surface Suits), End User (Government Space Agencies, and More), Material Technology (Soft Suit, Hard Shell, Hybrid//Mechanical Counter-Pressure), Life Support Architecture (Backpack PLSS, Distributed-System PLSS, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 40.21% of 2024 revenue, anchored by NASA's sustained Artemis funding and SpaceX's vertically integrated manufacturing. The region's astronaut space suits market benefits from established pressure-garment supply lines in Delaware, Texas, and Florida. US export-control frameworks favor domestic sourcing, though Canada's contribution of life-support avionics to Gateway keeps cooperation intact. A renewed congressional budget top-up in 2025 extends EVA refurbishment spending to 2032, providing volume predictability for prime contractors.

Asia-Pacific posts the fastest 8.83% CAGR, powered by China's dual ISS-class station and lunar ambitions. The Wangyu program's emphasis on sovereign components-from bearing seals to PLSS processors-creates parallel ecosystems that bypass Western ITAR constraints. India's Gaganyaan module partners with private firms in Bengaluru to mature IVA ventilation packs by 2026, aiming for regional export potential. South Korea and Japan leverage extant spacesuit testbeds at JAXA's Tsukuba complex, collaborating on radiation-shielded textiles suitable for cislunar orbits.

Europe remains steady, mobilizing ESA's Pextex initiative to engineer basalt-fiber fabrics that repel lunar dust. The astronaut space suits market size attributable to ESA could rise once the Gateway assembly ramps, as Airbus and Thales Alenia Space provide suitport docking hardware. National space agencies in France and Germany co-finance Spartan Space's IVA prototype, enhancing the continent's autonomy. Eastern European suppliers in Poland and the Czech Republic incubate micro-pump technologies, securing a foothold in the value chain as bigger primes consolidate.

The Middle East pivots from satellite focus to human spaceflight. The UAE's Mohammed bin Rashid Space Centre pilots extravehicular training with refurbished Russian Orlan units before ordering indigenous designs trained on desert dust trials replicating lunar regolith. Saudi Arabia earmarked funding to co-locate a pressure-garment plant inside the NEOM industrial zone, courting Western partners with tax incentives. These moves diversify the astronaut space suits market and hedge against single-region shocks.

- RTX Corporation

- ILC Dover, LP

- The Boeing Company

- David Clark Company

- Oceaneering International, Inc.

- Axiom Space, Inc.

- Space Exploration Technologies Corp.

- Blue Origin Enterprises, L.P.

- Virgin Galactic Holdings, Inc.

- Paragon Space Development Corporation

- SURE SAFETY (INDIA) LIMITED

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Artemis and Artemis II lunar missions boost EVA suit demand

- 4.2.2 Commercial space-tourism flight frequency surges

- 4.2.3 Extended ISS and Gateway operations create refurbishment backlog

- 4.2.4 Rising national budgets for new space powers

- 4.2.5 Closed-loop water-recycling suit tech for greater than 8-hr EVAs

- 4.2.6 Modular exoskeleton add-ons lower astronaut fatigue

- 4.3 Market Restraints

- 4.3.1 Ultra-high R&D and qualification cost per design iteration

- 4.3.2 Fragile supply chain for aerospace-grade fabrics and electromech

- 4.3.3 Glove dexterity limits complex on-orbit tasks

- 4.3.4 Liability ambiguity for privately owned EVA suits

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Suit Type

- 5.1.1 IVA Suits

- 5.1.2 EVA Suits

- 5.1.3 Planetary Surface Suits (xEMU / AxEMU)

- 5.2 By End User

- 5.2.1 Government Space Agencies

- 5.2.2 Commercial Launch and Space-Tourism Operators

- 5.2.3 Defense and Research Institutions

- 5.3 By Material Technology

- 5.3.1 Soft Suit

- 5.3.2 Hard Shell

- 5.3.3 Hybrid/Mechanical Counter-Pressure (MCP)

- 5.4 By Life Support Architecture

- 5.4.1 Backpack PLSS

- 5.4.2 Distributed-system PLSS

- 5.4.3 Suitport-Integrated Systems

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)

- 6.4.1 RTX Corporation

- 6.4.2 ILC Dover, LP

- 6.4.3 The Boeing Company

- 6.4.4 David Clark Company

- 6.4.5 Oceaneering International, Inc.

- 6.4.6 Axiom Space, Inc.

- 6.4.7 Space Exploration Technologies Corp.

- 6.4.8 Blue Origin Enterprises, L.P.

- 6.4.9 Virgin Galactic Holdings, Inc.

- 6.4.10 Paragon Space Development Corporation

- 6.4.11 SURE SAFETY (INDIA) LIMITED

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment