PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846167

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846167

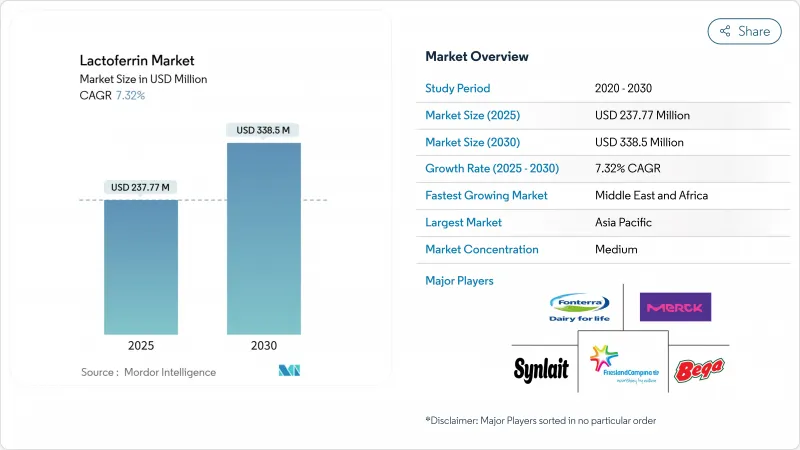

Lactoferrin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The lactoferrin market size of USD 237.77 million in 2025 is expected to reach USD 338.50 million by 2030, growing at a CAGR of 7.32%.

Regulatory approvals for new applications drive the market expansion, increased parental focus on immune-supporting ingredients following the pandemic, and pharmaceutical research validating lactoferrin's antimicrobial and neuroprotective properties. In infant nutrition, lactoferrin has emerged as an essential bioactive component that enhances immune system development and promotes optimal gut health in infants. Formula manufacturers are incorporating lactoferrin into their products to better replicate human breast milk composition, fostering product innovation and differentiation in the competitive infant nutrition market. Increasing parent awareness of lactoferrin's long-term health benefits is driving demand, particularly in emerging markets where infant nutrition standards continue to improve significantly. Ongoing clinical research demonstrating lactoferrin's effectiveness in infection prevention and cognitive development support reinforces its premium market position, contributing to sustained growth prospects through 2030.

Global Lactoferrin Market Trends and Insights

Increasing Use of Lactoferrin in Infant Nutrition for Immune Support

The integration of lactoferrin in infant nutrition products is driving growth in the lactoferrin market. Global regulatory requirements are influencing infant formula compositions, with India's Food Safety and Standards Authority (FSSAI) mandating 27 mg lactoferrin per 100 ml of formula, while China's GB 25596-2025 standards provide broader formulation options . These regulations ensure product standards and emphasize lactoferrin's importance in infant health. The ingredient's iron-binding capabilities improve mineral absorption, and its antimicrobial properties protect infants from harmful bacteria, making it essential for premium formula products. The United States government represents the largest baby formula purchaser, with 40% of American infants receiving formula through the Supplemental Nutrition Program for Women, Infants, and Children (WIC) . This institutional demand establishes a consistent market for infant nutrition products. The increasing adoption of lactoferrin-enriched formulas, particularly those with regulatory approval, could expand further through federal assistance programs.

Antimicrobial and Antiviral Properties Driving Pharmaceutical Applications

Lactoferrin's broad-spectrum antimicrobial and antiviral properties drive its adoption in pharmaceutical applications. As antibiotic resistance becomes a global health threat, lactoferrin offers a natural alternative that inhibits bacteria, viruses, and fungi without causing resistance. Its iron-binding mechanism restricts nutrients to harmful microbes, preventing their growth while enhancing the body's immune response. Pharmaceutical companies integrate lactoferrin into oral supplements, topical agents, and adjunctive treatments for infectious diseases. Clinical studies and regulatory approvals demonstrate the protein's effectiveness in reducing microbial infections, strengthening its position in the pharmaceutical industry. This evidence establishes lactoferrin as an effective antimicrobial agent, particularly as conventional antibiotics become less effective. The increasing need for natural and safe antimicrobial agents, along with lactoferrin's proven benefits, drives its incorporation into pharmaceutical products worldwide.

Lack of Standardization in Product Quality across Manufacturers

The absence of harmonized standards for lactoferrin quality, purity, and analytical assessment restricts market growth. The variations in extraction techniques, source materials (bovine versus fermentation-derived), and processing protocols result in inconsistent bioactivity and concentration levels across manufacturers. These inconsistencies affect product formulation and raise concerns in infant nutrition, dietary supplements, and clinical nutrition applications where specific functional outcomes are essential. The diversity in detection methods, including ELISA assays, HPLC, and sensor-based technologies, compounds these challenges. Different analytical approaches produce varying results, making it difficult to verify and compare product specifications among suppliers. Precision fermentation technologies provide potential solutions for controlled lactoferrin production but require new regulatory frameworks to establish quality and safety standards between synthetic and bovine-derived lactoferrin.

Other drivers and restraints analyzed in the detailed report include:

- Growing Preference for Natural and Bioactive Ingredients

- Consumer Shift Toward Personalized Nutrition with Targeted Benefits

- High Costs Associated with Lactoferrin Production

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium purity lactoferrin held a dominant 57.46% market share in 2024, driven by its optimal cost-performance ratio in infant nutrition and dietary supplement applications. Medium-purity lactoferrin remains the standard choice for dietary supplements and fortified foods, offering a balance between cost and functionality. The high-purity segment is projected to grow at 8.46% CAGR during 2025-2030, supported by increasing pharmaceutical and clinical applications. High-purity lactoferrin, with protein content exceeding 95%, commands premium prices due to complex purification processes required for therapeutic applications where biological activity must remain uncompromised by contaminants.

Companies like All G utilize precision fermentation technologies to achieve purity levels above 99% for pharmaceutical and cosmetic uses. The market demonstrates clear segmentation, with therapeutic applications supporting premium pricing while mass-market segments focus on cost efficiency. Manufacturing advancements in chromatographic separation and biotechnology platforms, combined with stringent regulatory requirements, continue to drive convergence toward higher purity standards across all applications. The lactoferrin market's distinct purity levels influence procurement decisions among formulators and brand owners.

The Global Lactoferrin Market is Segmented by Purity (High, Medium, and Low), by Application (Food and Beverage, Infant Nutrition, Dietary Supplement, Pharmaceutical, Animal Feed, Personal Care and Cosmetics, and Others), and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 36.47% market share in 2024, anchored by China's infant formula regulations and India's expanding nutraceutical sector, while the Middle East and Africa exhibit the fastest growth at 8.63% CAGR through 2025-2030, driven by increasing healthcare investments and regulatory modernization. China's updated GB standards create formulation opportunities for lactoferrin incorporation in infant nutrition and foods for special medical purposes, while India's Food Safety and Standards Authority (FSSAI) mandates establish minimum lactoferrin requirements in infant formulas.

North America and Europe maintain significant market presence through established regulatory frameworks and consumer health awareness, though growth rates moderate as markets mature. The lactoferrin market benefits from a well-established regulatory landscape that supports the inclusion of bioactive proteins in both infant formula and functional foods, underpinned by stringent European Food Safety Authority (EFSA) guidelines ensuring safety and efficacy. Consumer preference for scientifically validated, natural health ingredients continues to drive demand, particularly in premium segments like specialized infant formulas, dietary supplements targeting immunity and iron metabolism, and cosmeceuticals leveraging lactoferrin's skin health benefits.

South America shows steady development through Brazil and Argentina's dairy processing capabilities, though market penetration remains constrained by economic volatility and regulatory complexity. Geographic expansion patterns reflect the intersection of regulatory support, economic development, and cultural acceptance of functional nutrition concepts across different regional markets. The global landscape for lactoferrin is increasingly characterized by a balance between established markets where consumer familiarity and regulatory maturity sustain demand, and emerging markets where improving healthcare infrastructure, evolving food regulations, and growing middle-class populations are unlocking new opportunities.

- Royal FrieslandCampina N.V.

- Merck KGaA

- Fonterra Co-operative Group Ltd

- Bega Cheese Ltd

- Synlait Milk Ltd

- Maypro

- The Tatua Co-operative Dairy Company Ltd

- Purolite

- Ingredia SA

- Farbest Brands

- Morinaga Milk Industry (Milei GmbH)

- Shaanxi Hongda Phytochemistry Co.,Ltd.

- Arrovest Pty Limited (Noumi Limited)

- Bionatin B.V.

- Allg

- Valfoo Asia Pacific Ltd.

- Actus Nutrition (Milk Specialties Global)

- Helaina Inc.

- Hilmar Cheese Company (Hilmar Ingredients)

- Savencia Fromage & Dairy (Armor Proteines)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increaing Use of Lactoferrin in Infant Nutrition for Immune Support

- 4.2.2 Antimicrobial and Antiviral Properties Driving Pharmaceutical Applications

- 4.2.3 Growing Preference for Natural and Bioactive Ingredients

- 4.2.4 Consumer Shift Toward Personalized Nutrition with Targeted Benefits

- 4.2.5 Use of Lactoferrin in Animal Feed to Enhance Immunity and Growth

- 4.2.6 Surge in Research Supporting Lactoferrin's Role in Gut Health

- 4.3 Market Restraints

- 4.3.1 Lack of Standarization in Product Quality Across Manufacturer

- 4.3.2 Fluctuation in Raw Milk Prices Impacting Profit Margins

- 4.3.3 Allergen Concern Related to Dairy-Derived Ingredients

- 4.3.4 High Cost Associated with Lactoferrin

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Purity

- 5.1.1 High

- 5.1.2 Medium

- 5.1.3 Low

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.2 Infant Nutrition

- 5.2.3 Dietary Supplement

- 5.2.4 Pharmaceutical

- 5.2.5 Animal Feed

- 5.2.6 Personal Care and Cosmetics

- 5.2.7 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Netherlands

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Saudi Arabia

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Royal FrieslandCampina N.V.

- 6.4.2 Merck KGaA

- 6.4.3 Fonterra Co-operative Group Ltd

- 6.4.4 Bega Cheese Ltd

- 6.4.5 Synlait Milk Ltd

- 6.4.6 Maypro

- 6.4.7 The Tatua Co-operative Dairy Company Ltd

- 6.4.8 Purolite

- 6.4.9 Ingredia SA

- 6.4.10 Farbest Brands

- 6.4.11 Morinaga Milk Industry (Milei GmbH)

- 6.4.12 Shaanxi Hongda Phytochemistry Co.,Ltd.

- 6.4.13 Arrovest Pty Limited (Noumi Limited)

- 6.4.14 Bionatin B.V.

- 6.4.15 Allg

- 6.4.16 Valfoo Asia Pacific Ltd.

- 6.4.17 Actus Nutrition (Milk Specialties Global)

- 6.4.18 Helaina Inc.

- 6.4.19 Hilmar Cheese Company (Hilmar Ingredients)

- 6.4.20 Savencia Fromage & Dairy (Armor Proteines)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK