PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846170

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846170

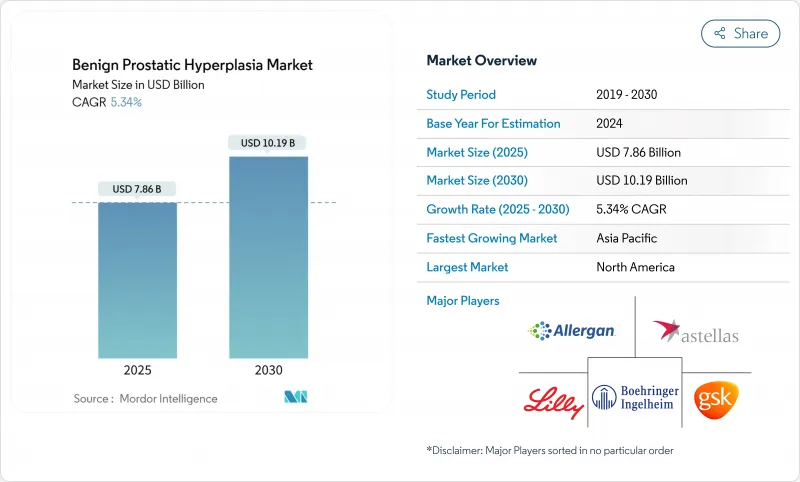

Benign Prostatic Hyperplasia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Benign Prostatic Hyperplasia Market size is estimated at USD 7.86 billion in 2025, and is expected to reach USD 10.19 billion by 2030, at a CAGR of 5.34% during the forecast period (2025-2030).

Growth stems from the rising global population of men aged >= 50, rapid uptake of tele-urology services, and the steady migration toward fixed-dose combination (FDC) products that promise faster symptom relief with fewer sexual side effects. North America remains the largest regional opportunity, supported by integrated electronic health records that streamline renewal prescriptions, while Asia-Pacific is advancing the fastest as China's national screening campaigns accelerate early diagnosis. Competition is intensifying as minimally invasive surgical therapies (MISTs) such as Aquablation and UroLift win payer backing, prompting drug makers to emphasize real-world evidence around quality-of-life improvement. In parallel, e-commerce pharmacies are widening patient access and nudging adherence rates upward by enabling discreet home delivery and automated refill reminders.

Global Benign Prostatic Hyperplasia Market Trends and Insights

Surge of Tele-urology Platforms Expanding Prescription Volumes in North America

Telehealth now manages up to 30% of outpatient urology visits with patient-satisfaction levels above 85% Scientific Reports. Rural areas benefit most; earlier care access has narrowed the historical 20% urban-rural mortality gap tied to prostate conditions. Integrated data feeds let clinicians track International Prostate Symptom Score (IPSS) trends remotely, facilitating timely shifts to combination therapy once monotherapies plateau. Automated refill alerts on these platforms curtail the 30% discontinuation rate historically linked to adverse sexual effects, thereby elevating lifetime prescription volume.

National Prostate Health Screening Campaigns Elevating Diagnosis Rates in China

Under Healthy China 2030, municipal clinics conduct routine prostate checks, markedly increasing early-stage BPH detection bayer.com. Acceptance of foreign clinical dossiers has shortened launch timelines for innovative therapies, giving global manufacturers faster on-ramp to the world's largest patient pool. Enhanced reimbursement from the National Medical Security Bureau further supports medicine uptake, extending therapy duration before surgical referral and inflating cumulative drug spending.

Restraint Impact Analysis

Other drivers and restraints analyzed in the detailed report include:

- Government Price Caps on Generic Drugs

- Reimbursement Expansion for Dutasteride/Tamsulosin FDC

- Finasteride Sexual-Side-Effect Concerns Dampening Adherence

- Rising Preference for Minimally Invasive Procedures Cannibalizing Drug Revenues

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Alpha-blockers generated the largest revenue base in 2024, holding 45.54% of benign prostatic hyperplasia drugs market share. Tamsulosin 0.4 mg remains the anchor therapy given its rapid onset and favorable cardiovascular profile. Yet, PDE-5 inhibitors are pacing the highest 6.98% CAGR, benefiting from dual urological and sexual-health indications that enhance compliance. FDCs such as dutasteride/tamsulosin (Jalyn) and finasteride/tadalafil (ENTADFI) integrate prostate-volume reduction with erectile-function support, expanding their addressable audience among sexually active patients. Network meta-analyses confirm that alpha-blocker + PDE-5 inhibitor regimens significantly outscore monotherapies on IPSS and quality-of-life scales.

The Benign Prostatic Hyperplasia Market Report Segments Into by Drug Type (Alpha-Blockers, 5- Alpha-Reductase Inhibitors (5-Aris) and More), by Dosage Form (Oral Immediate-Release Tablets/Capsules, Oral Extended-Release Tablets and More) by Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 39.87% of 2024 revenue, underpinned by broad insurance coverage and high diagnostic penetration. The U.S. Inflation Rebate Program tempers list-price inflation yet sustains access to combination products viewed as reducing downstream surgical costs. Formularies remain fluid; the 2025 Blue Cross Blue Shield of Massachusetts exclusion of Jalyn and Entadfi underscores the need for sophisticated market-access strategies bluecrossma.org. Canada benefits from pan-provincial prostate-health campaigns, while Mexico's Seguro Popular expansion propels generic uptake.

Asia-Pacific is the fastest-growing geography at 7.01% CAGR. China's Healthy China 2030 initiative has normalized annual prostate screening in community clinics, tripling early-stage diagnosis rates and filling the therapy funnel. Japan's prescription volume for alpha-1 blockers climbed reflecting increasing physician comfort with pharmacologic management Cleveland Clinic Journal of Medicine. India and South Korea show momentum as public-sector hospitals integrate tele-urology pilots that shorten specialist waitlists.

Europe maintains a solid installed base, but rigorous health-technology assessments compress price-volume corridors. Germany and France favor FDCs with documented reduction in acute urinary retention, while the UK's National Institute for Health and Care Excellence (NICE) is reassessing cost utility of MISTs versus lifelong medication. In the Middle East & Africa, Gulf Cooperation Council states are investing in urology centers that import branded alpha-blockers, whereas most sub-Saharan systems rely on low-cost generics, leaving pockets of unmet need. South America, led by Brazil, is widening insurance formularies for dutasteride after domestic real-world studies linked therapy persistence to lower hospitalization.

- Abbvie

- Astellas Pharma

- GlaxoSmithKline

- Pfizer

- Eli Lilly and Company

- Viatris

- Merck

- Teva Pharmaceutical Industries

- Sun Pharmaceuticals Industries

- Dr. Reddy's Laboratories Ltd.

- Lupin

- Cipla

- Torrent Pharmaceuticals

- Recordati S.p.A.

- Eisai

- Ferring Pharmaceuticals

- Sandoz (Novartis Division)

- Sanofi

- Alkem Laboratories Ltd.

- Zydus Lifesciences Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge of Tele-urology Platforms Expanding Prescription Volumes in North America

- 4.2.2 National Prostate Health Screening Campaigns Elevating Diagnosis Rates in China

- 4.2.3 Government Price Caps on Generic Drugs

- 4.2.4 Reimbursement Expansion for Dutasteride/Tamsulosin FDC

- 4.2.5 Rising Preference for Combination a-Blocker/5-ARI Fixed-Dose Pills in Europe

- 4.2.6 Accelerated Private Urology Clinic Build-outs Across GCC Nations

- 4.3 Market Restraints

- 4.3.1 Finasteride Sexual-Side-Effect Concerns Dampening Adherence

- 4.3.2 Rising Preference for Minimally Invasive Procedures Cannibalizing Drug Revenues

- 4.3.3 Shortage of Fellowship-Trained Endourologists in Sub-Saharan Africa

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Drug Class

- 5.1.1 Alpha-Blockers

- 5.1.2 5-Alpha Reductase Inhibitors (5-ARIs)

- 5.1.3 Phosphodiesterase-5 (PDE-5) Inhibitors

- 5.1.4 Combination Therapies (a-Blocker + 5-ARI / PDE-5)

- 5.1.5 Others

- 5.2 By Dosage Form

- 5.2.1 Oral Immediate-Release Tablets / Capsules

- 5.2.2 Oral Extended-Release Tablets

- 5.2.3 Softgel Capsules

- 5.2.4 Orally Disintegrating Tablets (ODT)

- 5.3 By Distribution Channel

- 5.3.1 Hospital Pharmacies

- 5.3.2 Retail & Community Pharmacies

- 5.3.3 E-commerce & Mail-Order Pharmacies

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 AbbVie Inc.

- 6.3.2 Astellas Pharma Inc.

- 6.3.3 GlaxoSmithKline plc

- 6.3.4 Pfizer Inc.

- 6.3.5 Eli Lilly and Company

- 6.3.6 Viatris Inc.

- 6.3.7 Merck & Co., Inc.

- 6.3.8 Teva Pharmaceutical Industries Ltd.

- 6.3.9 Sun Pharmaceutical Industries Ltd.

- 6.3.10 Dr. Reddy's Laboratories Ltd.

- 6.3.11 Lupin Limited

- 6.3.12 Cipla Ltd.

- 6.3.13 Torrent Pharmaceuticals Ltd.

- 6.3.14 Recordati S.p.A.

- 6.3.15 Eisai Co., Ltd.

- 6.3.16 Ferring Pharmaceuticals

- 6.3.17 Sandoz (Novartis Division)

- 6.3.18 Sanofi

- 6.3.19 Alkem Laboratories Ltd.

- 6.3.20 Zydus Lifesciences Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment