PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846173

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846173

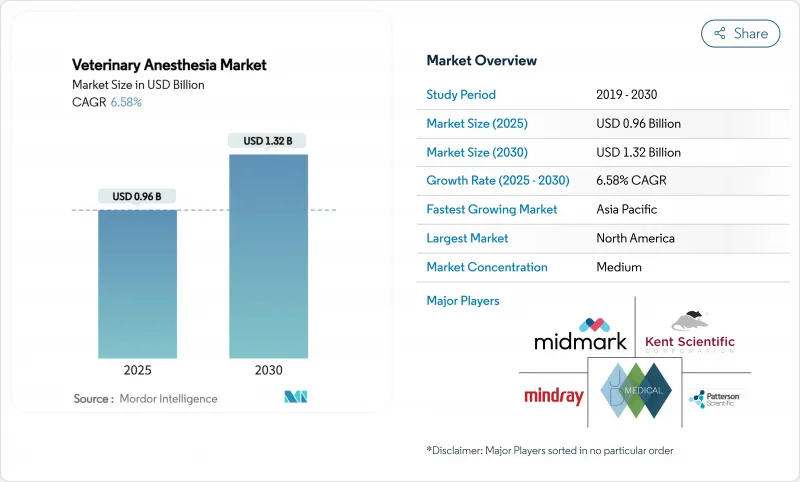

Veterinary Anesthesia - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The veterinary anesthesia market size stands at USD 0.96 billion in 2025 and is forecast to reach USD 1.32 billion by 2030, translating into a 6.58% CAGR over the period.

Rising global pet ownership, stricter surgical safety protocols, and rapid upgrades in vaporizer and ventilator designs are the three strongest demand catalysts. Integrated AI dosing modules, now available even on portable consoles, allow practices to treat senior pets with chronic conditions more safely, while remote diagnostics reduce downtime for rural clinics. Environmental rules that limit desflurane and reward low-flow techniques are reshaping purchase criteria. Finally, supply-side digitalization-especially predictive maintenance via cloud connectivity-helps clinics stretch capital budgets, sustaining refresh cycles even when operator shortages persist.

Global Veterinary Anesthesia Market Trends and Insights

Rising Chronic Diseases & Associated Surgical Procedures

Two-thirds of U.S. households owned pets in 2024, and annual veterinary spend rose to USD 580 per dog and USD 433 per cat. The older pet cohort now presents multiple comorbidities that demand delicate anesthetic plans. Integrated multi-parameter monitors track capnography, temperature, and neuromuscular blockade simultaneously, supporting clinicians through longer orthopedic and oncology surgeries. Because geriatric cases carry higher cardiovascular risk, clinics increasingly specify dual-vaporizer workstations to switch rapidly between isoflurane and sevoflurane. Incremental revenue from such complex surgeries directly lifts the veterinary anesthesia market, while AI-based drug calculators reduce dosing errors and help newer graduates manage chronic-disease caseloads confidently.

Growth in Pet Ownership & Expenditure on Companion Animals

Global pet care spending climbed 7.5% in 2023 to USD 147 billion, with Gen Z households posting a 43.5% jump in ownership. Younger owners view advanced surgery as an expected service, propelling clinics to upgrade vaporizers and ventilators capable of neonatal tidal volumes. Pet insurance premiums topped USD 3.9 billion in 2023, covering 5.7 million animals and effectively underwriting high-ticket procedures that rely on modern anesthesia consoles. This financial cushioning accelerates the replacement cycle for aging machines, especially in suburban start-up practices that want plug-and-play portability.

Shortage of Certified Veterinary Anaesthetists & Technicians

Only 7,500 candidates clear the U.S. Veterinary Technician National Exam each year, nowhere near the 33% demand surge expected by 2030. Average pay of USD 53,759 fails to stem attrition; 39% cite compensation as their primary grievance. Colorado State University's VPA program will add mid-level providers, but its first graduates will not enter the workforce until 2027. Under-staffed clinics often delay adopting complex workstations, dampening near-term gains for the veterinary anesthesia market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Leap in Integrated Ventilator-Anesthesia Platforms

- Sustainability Push Toward Low-Flow, Climate-Friendly Systems

- High Upfront Cost of Advanced Machines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile and table-top units generated 38.51% of the global revenue in 2024, underscoring how portability aligns with mixed-animal practice workflows. Clinics value quick set-ups, and ambulatory equine services can run these units from vehicle inverters. The veterinary anesthesia market size for table-top units is projected to reach USD 0.51 billion by 2030 as new graduates open suburban clinics and prefer entry-level capital outlays. AI-ready circuit boards are now pre-installed even on compact boxes, letting owners subscribe to software upgrades without swapping hardware. Conversely, integrated ventilator workstations, although only 21% of shipments today, will post a 12.25% CAGR, as specialty centers require synchronized ventilation and hemodynamic monitoring.

Integrated platforms add animal-friendly touches: heated breathing hoses curb the hypothermia that raises mortality, and color-coded touch panels guide technicians through pre-use checks. American College of Veterinary Anesthesia and Analgesia guidelines now list capnography as mandatory in general anesthesia, propelling demand for machines with built-in side-stream analyzers. Fragmentation persists among lower-end devices, but mid-tier vendors are consolidating software ecosystems, raising switching costs and driving long-term stickiness in the veterinary anesthesia market.

The Veterinary Anesthesia Market Report is Segmented by Product (On Trolley, Wall Mounted, Tabletop, and Integrated Ventilator Systems), Animal (Companion, Livestock, Equine, and Zoo & Wildlife), End User (Veterinary Clinics, Veterinary Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America leads revenues with 43.32% share owing to high pet spending, insurance penetration, and early adoption of AI modules. Mandatory state inspection regimes shorten retirement cycles, boosting replacement demand. Europe follows, guided by stringent GHG and welfare directives that favor low-flow machines, though unit volumes plateau in mature economies. Latin America's cattle sector supports steady sales of rugged, large-animal units; Brazilian rules for drug residue testing push ranchers toward precise vaporizer calibration.

Asia-Pacific records the fastest 9.71% CAGR as urbanization lifts disposable income in China, India, and Indonesia. Veterinary schools in Thailand and Vietnam have doubled anesthesia lab hours since 2023, stimulating institutional purchases. Regulatory harmonization under VICH eases cross-border device approvals. The veterinary anesthesia market size for Asia-Pacific is projected to exceed USD 0.32 billion by 2030. Middle East and Africa benefit from NGO-funded rabies programs that require mobile inhalation units. Population density of production animals in Egypt and South Africa opens future pathways for hybrid small-ruminant ventilators, sustaining global momentum.

- Midmark

- Mindray Medical Intl. Ltd

- Patterson Scientific

- JD Medical Distribution Co.

- Kent Scientific Corp.

- ICU Medical

- Supera Anesthesia Innovations

- Avante Health Solutions

- Vetland Medical Sales & Service

- Dispomed

- Prunus Medical

- Burtons Medical Equipment

- Hallowell Engineering

- RWD Life Science

- Smiths Group

- Eickemeyer Veterinary Equipment

- DRE Veterinary

- KeeboVet

- Yuesen Medical

- TechVet Industria Veterinaria

- Patterson Companies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Chronic Diseases & Associated Surgical Procedures

- 4.2.2 Growth In Pet Ownership & Expenditure On Companion Animals

- 4.2.3 Technological Leap In Integrated Ventilator-Anesthesia Platforms

- 4.2.4 Sustainability Push Toward Low-Flow, Climate-Friendly Systems

- 4.2.5 AI-Guided Dosing For Exotic & Small Mammals

- 4.2.6 Remote Tele-Anaesthesia Maintenance Services In Rural Clinics

- 4.3 Market Restraints

- 4.3.1 High Upfront Cost Of Advanced Machines

- 4.3.2 Shortage Of Certified Veterinary Anaesthetists & Technicians

- 4.3.3 Supply-Chain Bottlenecks In Vaporizer Sensors & Rare-Earth Valves

- 4.3.4 Emerging GHG Regulations On Volatile Agents Raise OPEX

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 On-Trolley (Mobile)

- 5.1.2 Wall-Mounted

- 5.1.3 Table-Top / Portable

- 5.1.4 Integrated Ventilator Systems

- 5.2 By Animal Type

- 5.2.1 Companion

- 5.2.2 Livestock

- 5.2.3 Equine

- 5.2.4 Zoo & Wildlife

- 5.3 By End User

- 5.3.1 Veterinary Clinics

- 5.3.2 Veterinary Hospitals & Teaching Institutions

- 5.3.3 Emergency Service & Referral Centers

- 5.3.4 Research & Academic Labs

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Midmark Corporation

- 6.3.2 Mindray Medical Intl. Ltd

- 6.3.3 Patterson Scientific

- 6.3.4 JD Medical Distribution Co.

- 6.3.5 Kent Scientific Corp.

- 6.3.6 ICU Medical Inc.

- 6.3.7 Supera Anesthesia Innovations

- 6.3.8 Avante Health Solutions

- 6.3.9 Vetland Medical Sales & Service

- 6.3.10 Dispomed Ltd.

- 6.3.11 Prunus Medical

- 6.3.12 Burtons Medical Equipment

- 6.3.13 Hallowell Engineering

- 6.3.14 RWD Life Science

- 6.3.15 Smiths Medical

- 6.3.16 Eickemeyer Veterinary Equipment

- 6.3.17 DRE Veterinary

- 6.3.18 KeeboVet

- 6.3.19 Yuesen Medical

- 6.3.20 TechVet Industria Veterinaria

- 6.3.21 Patterson Companies

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment