PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846176

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846176

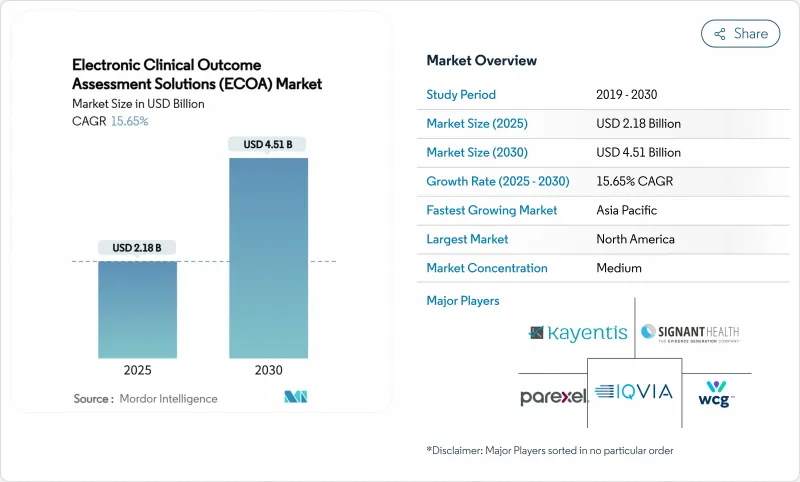

Electronic Clinical Outcome Assessment Solutions (ECOA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The electronic clinical outcome assessment solutions market size stands at USD 2.18 billion in 2025 and is projected to reach USD 4.51 billion by 2030, advancing at a 15.65% CAGR.

Intensifying regulatory focus on patient-centric evidence, rapid migration to cloud-native eClinical stacks, and the widespread adoption of decentralized trial models are accelerating platform demand . Pharmaceutical sponsors view these systems as the primary mechanism for collecting high-integrity patient-reported, clinician-reported, observer-reported, and performance outcomes data that inform labeling and reimbursement. Mature vendors keep broadening their suites through acquisitions, while niche players differentiate with artificial-intelligence decision support and integrated payment capabilities. Emerging economies add further tailwinds by offering cost advantages that encourage multi-regional trial execution.

Global Electronic Clinical Outcome Assessment Solutions (ECOA) Market Trends and Insights

Growing Outsourcing of Clinical Trials by Pharma & Biotech Sponsors

Contract research organizations handle an expanding share of trial execution because sponsors prioritize core discovery activities. In the United States, the biopharmaceutical CRO market is projected to reach USD 19.75 billion by 2033, a signal of enduring outsourcing appetite. CROs now adopt turnkey electronic clinical outcome assessment solutions platforms, offering sponsors unified data capture, randomization, and patient engagement services at scale. Consolidation, exemplified by the Suvoda-Greenphire merger, creates integrated ecosystems spanning eCOA, payments, and supply chain functions . Post-pandemic staffing shortages-Clinical Research Associate turnover rates exceed 25%-reinforce the preference for external partners capable of supplying trained digital-trial personnel .

Expansion of Cloud/SaaS-Based eClinical Stacks

Cloud deployments outpace legacy web-hosted models as sponsors seek elasticity, automated validation, and lower total cost of ownership. FDA's Computer Software Assurance guidance supports risk-based verification, reducing barriers to cloud adoption while preserving 21 CFR Part 11 requirements. Major providers such as Microsoft Azure meet SOC 1, SOC 2, and ISO/IEC 27001 standards, giving life-science teams out-of-the-box security frameworks. Specialized firms like USDM automate patch management and maintain continuous audit readiness, enabling multi-regional compliance for sponsors running concurrent studies.

Data-Security and Privacy-Breach Concerns

The FDA now requires a software bill of materials for connected medical technologies, compelling eCOA vendors to maintain robust vulnerability monitoring programs. Europe's GDPR adds strict data-transfer constraints, forcing sponsors to deploy regional data-residency controls and layered encryption. Enforcement actions-such as the FDA's 2024 warning letter to Exer Labs-underscore the financial and reputational hazards of inadequate cybersecurity. Rising scrutiny of algorithmic transparency leads 72% of healthcare organizations to favor government oversight of AI-driven predictive models, putting pressure on vendors to explain machine-learning logic in plain language.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Patient-Focused Drug Development

- Shift Toward Decentralized & BYOD Trial Models

- High Upfront Implementation and Validation Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Web-hosted deployments held 74.23% of electronic clinical outcome assessment solutions market share in 2024 because many sponsors rely on established data-center contracts. The model's familiarity and proven audit readiness sustain near-term preference, particularly for late-phase portfolios where continuity outweighs innovation. However, cloud-native platforms are expanding at a 16.23% CAGR to 2030, reflecting sponsors' drive for elastic capacity, real-time analytics, and automated regulatory updates. Microsoft Azure's security certifications and FDA-endorsed risk-based validation create confidence that cloud infrastructure can satisfy data-integrity mandates.

Sponsors shift workloads incrementally, often starting with early-phase or observational studies before migrating pivotal trials once internal policies mature. Hybrid architectures that tether legacy web-hosted databases to cloud analytics services help firms manage transition risk. As a result, cloud solutions are projected to capture a growing slice of electronic clinical outcome assessment solutions market size, while on-premise instances retreat to niche scenarios demanding maximal data control, such as defense-funded infectious-disease projects.

The Electronic Clinical Outcome Assessment Solutions Market Report is Segmented by Delivery Mode (Web-Hosted, Cloud-Based, On-Premise), Approach (Patient-Reported Outcome (PRO), and More), End User (Pharmaceutical and Biopharmaceutical Companies, Contract Research Organisations (CROs), Others), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America dominates the electronic clinical outcome assessment solutions market with 42.21% share, driven by stringent yet well-defined FDA regulations, sophisticated clinical research infrastructure, and early deployment of patient-centric metrics. Continuous FDA guidance, including the Computer Software Assurance framework, underpins sponsor confidence by clarifying validation expectations. The United States accounts for most regional revenue, with Canada contributing specialized day-1 access programs for rare diseases and Mexico offering cost-effective Phase I units.

Asia-Pacific records the fastest regional expansion at 16.57% CAGR, reflecting harmonized trial policies, rising domestic R&D investment, and the promise of lower per-patient costs. China's streamlining of clinical-trial approval timelines, India's digital-health mission, and South Korea's telemedicine pilots collectively foster a receptive environment for decentralized study designs that require robust eCOA backbones. Nevertheless, divergent data-localization policies and language complexity demand that vendors deliver multi-tenant architectures with configurable sovereignty controls.

Europe, supported by EMA alignment and national eHealth agendas, remains a stable adopter. Germany's hospital digitalization budget and the UK's Medicines and Healthcare products Regulatory Agency sandbox stimulate uptake of sensor-driven outcomes in oncology and neurology. Meanwhile, GDPR compliance costs push smaller biotech to partner with established vendors holding pre-certified hosting zones, ensuring uninterrupted flow of electronic clinical outcome assessment solutions market transactions across the continent.

- Dassault Systemes

- Signant Health

- Clario (ERT Clinical)

- Oracle

- IQVIA

- Veeva Systems

- Parexel Intl. Corp.

- Kayentis

- Castor EDC

- WCG Clinical

- Mednet Solutions

- Aris Global

- Medable

- Suvoda

- TrialSpark

- eClinical Solutions

- OpenClinica

- Anju Software

- CRF Health (Parexel)

- OmniComm Systems

- Castor (Cloud Solutions)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing outsourcing of clinical trials by pharma & biotech sponsors

- 4.2.2 Expansion of cloud / SaaS-based eClinical stacks

- 4.2.3 Regulatory push for patient-focused drug development

- 4.2.4 Accelerating shift to decentralized & BYOD trial models

- 4.2.5 BYOD-enabled wearables lower device costs & boost compliance

- 4.2.6 AI-driven adherence coaching lifts PRO data quality

- 4.3 Market Restraints

- 4.3.1 Data-security & privacy-breach concerns

- 4.3.2 High upfront implementation & validation costs

- 4.3.3 Shortage of eCOA-skilled clinical-ops workforce

- 4.3.4 Device heterogeneity risks measurement equivalence

- 4.4 Regulatory Landscape

- 4.5 Porters Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Delivery Mode

- 5.1.1 Web-hosted

- 5.1.2 Cloud-based

- 5.1.3 On-premise

- 5.2 By Approach

- 5.2.1 Patient-Reported Outcome (PRO)

- 5.2.2 Clinician-Reported Outcome (ClinRO)

- 5.2.3 Observer-Reported Outcome (ObsRO)

- 5.2.4 Performance Outcome (PerfO)

- 5.3 By End User

- 5.3.1 Pharmaceutical and Biopharmaceutical Companies

- 5.3.2 Contract Research Organisations (CROs)

- 5.3.3 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Dassault Systemes (Medidata)

- 6.3.2 Signant Health

- 6.3.3 Clario (ERT Clinical)

- 6.3.4 Oracle Corporation

- 6.3.5 IQVIA Inc.

- 6.3.6 Veeva Systems

- 6.3.7 Parexel Intl. Corp.

- 6.3.8 Kayentis

- 6.3.9 Castor EDC

- 6.3.10 WCG Clinical

- 6.3.11 Mednet Solutions

- 6.3.12 ArisGlobal

- 6.3.13 Medable Inc.

- 6.3.14 Suvoda

- 6.3.15 TrialSpark

- 6.3.16 eClinical Solutions LLC

- 6.3.17 OpenClinica

- 6.3.18 Anju Software

- 6.3.19 CRF Health (Parexel)

- 6.3.20 OmniComm Systems

- 6.3.21 Castor (Cloud Solutions)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment