PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846182

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846182

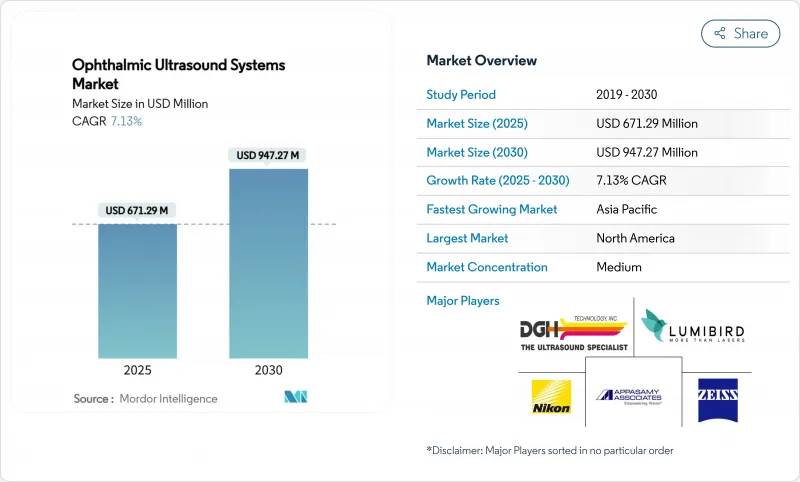

Ophthalmic Ultrasound Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ophthalmic Ultrasound Systems Market size is estimated at USD 671.29 million in 2025, and is expected to reach USD 947.27 million by 2030, at a CAGR of 7.13% during the forecast period (2025-2030).

Robust demand stems from the growing integration of artificial intelligence with ultrasound platforms, the strategic pivot toward portable formats, and rising procedural volumes linked to cataract and glaucoma care. AI-enhanced systems now achieve diagnostic precision on par with expert clinicians, shortening workflows and improving triage in high-volume eye clinics. Demand is further stimulated by demographic aging that is expanding the pool of patients with cataracts, diabetic retinopathy, and angle-closure glaucoma. Vendors are responding with compact probes, multi-modal displays, and cloud connectivity that support point-of-care diagnostics across hospitals, ambulatory centers, and outreach programs. The competitive environment is moderately fragmented; platform differentiation increasingly depends on algorithm performance rather than purely on hardware specifications.

Global Ophthalmic Ultrasound Systems Market Trends and Insights

Increasing Prevalence of Eye Diseases

Population aging is accelerating demand across the Ophthalmic Ultrasound Devices market as larger cohorts enter the 65-plus age group that carries the highest cataract and glaucoma risk. Procedures using ultrasound are growing at 3.4% CAGR through 2030 because dense media opacities often preclude optical imaging. Cataract already affects half of adults by 75 years, and ultrasound remains indispensable for axial length measurement when corneal clarity is compromised. The prevalence of diabetic retinopathy is adding further workload because B-Scan can visualize the retina behind vitreous hemorrhage. Overall, the escalation of chronic ocular disorders is translating into sustained capital investment in ultrasound workstations across both tertiary centers and high-street clinics.

Advent of Novel Ophthalmic Technologies

Deep-learning algorithms embedded in new consoles interpret echo patterns faster and with higher repeatability than manual review, reaching diagnostic accuracy comparable to seasoned ophthalmologists. Automated caliper placement and real-time angle-closure risk alerts shorten acquisition time and support less-experienced sonographers. The DeepUniUSTransformer architecture exemplifies a platform-agnostic model capable of segmenting ocular structures and recommending follow-up protocols. These innovations allow manufacturers to sell value-added software subscriptions that complement equipment revenue, encouraging faster replacement cycles.

Increasing Adoption of Alternate Imaging Modalities

Optical coherence tomography provides superior axial resolution for retinal layers and dominates diabetic macular edema management, reducing ultrasound utilization in well-equipped centers. In vivo confocal microscopy is also preferred for corneal nerve-fiber assessment because of its non-contact design. Nonetheless, ultrasound retains advantages when the ocular media are opaque or when extraocular extension must be ruled out, highlighting a complementary rather than purely competitive relationship.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Point-of-Care Portable Ultrasound

- Integration of AI-Enhanced Image Analysis with Ultrasound Data

- High Capital Outlay for High-Frequency Ultrasound Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ultrasound Biomicroscopy posted the fastest 7.83% CAGR during 2025-2030 as ophthalmologists seek micro-level visualization of the ciliary body and iridocorneal angle. UBM contributes to early detection of plateau iris and zonular weakness, issues that are invisible on routine slit-lamp examination. B-Scan retained leadership with 35.21% of the Ophthalmic Ultrasound Devices market share in 2024 thanks to its versatility in vitreous hemorrhage and retinal detachment cases. Combined A/B platforms appeal to mid-sized hospitals that require a single cart for both biometry and posterior-segment imaging, supporting efficient capital deployment. Pachymeters maintain relevance for glaucoma risk stratification and refractive-surgery planning, while compact A-Scan modules remain the biometric cornerstone of the high-volume cataract service line.

The Ophthalmic Ultrasound Devices market size attached to UBM is reflecting sustained adoption in glaucoma specialty clinics. Conversely, B-Scan revenue growth will moderate yet remain significant as new software layers extend lifespan and reduce replacement urgency. Niche players focus on dedicated tumor-assessment probes that integrate elastography to broaden the clinical envelope.

Stand-alone accounted for 60.36% of the ophthalmic ultrasound systems market in 2024. Portable scanners are growing at 9.03% CAGR, triple the pace of console replacements. Portables integrate lithium-ion power packs and wi-fi modules that synchronize studies to electronic medical records before patients leave the examination room. High-resolution touchscreens enable pinch-to-zoom review that mimics smartphone use. Stand-alone systems continue to dominate surgical theaters where foot-pedal control, pedal-mapped presets, and dual-monitor output support complex cases. These units are also favored for teaching because large displays aid trainee supervision.

Manufacturers leverage interchangeable pods that allow a single handle to accept linear, convex, and annular probes. Subscription models bundle cloud analytics, firmware updates, and damage insurance, lowering the entry threshold for solo practitioners and optical retail chains expanding into diagnostic services. The flexibility of portables also supports novel care models such as drive-through cataract camps, where pre-operative biometry is performed in mobile vans.

The Ophthalmic Ultrasound Systems Market is Segmented by Product (A- Scan, B- Scan, and More), Modality (Portable and Standalone), Technology (Conventional Ultrasound, and More), Application (Cataract Assessment, and More), End User (Hospitals, Ophthalmology, Clinics, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 34.89% share in 2024 driven by early uptake of AI-enabled platforms, ample reimbursement, and a dense network of glaucoma and retina specialists. The FDA streamlined quality-management-system rules in February 2024, reducing documentation overlap and accelerating product launches. Portable scanners see brisk adoption in US ambulatory surgery centers because they eliminate the need for separate biometry suites.

Asia-Pacific is the fastest-growing region at 9.92% CAGR. Investments under India's Ayushman Bharat program and China's Healthy China 2030 blueprint expand cataract and diabetic-retinopathy screening. Domestic firms supply cost-optimized consoles, while global brands partner with provincial hospitals to install tele-expertise hubs. Portable ultrasound units facilitate eye camps in rural county fairs, boosting awareness and creating latent replacement demand.

Europe maintains steady performance, supported by well-funded national health services and stringent device-safety regulations that favor established brands. Carl Zeiss Meditec reported ophthalmology revenue of EUR 1,589.2 million (USD 1,776.4 million) in fiscal 2023/24, underscoring resilient capital investment despite macro headwinds. Integrated suites that link ultrasound, OCT, and fundus photography into a common software shell resonate with European workflow preferences.

- AMETEK (Reichert)

- Appasamy Associates

- Carl Zeiss

- Clarion Medical Technologies

- DGH Technology

- Lumibird Medical

- MEDA Co. Ltd.

- Micro Medical Devices

- NIDEK Co. Ltd.

- Sonomed Escalon

- Sonostar Technologies

- Nikon

- Tomey

- Lumibird Medical

- HiUltrasound.com

- Mecanmedical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Eye Diseases

- 4.2.2 Advent of Novel Ophthalmic Technologies

- 4.2.3 Growing Adoption of Point-of-Care Portable Ultrasound

- 4.2.4 Rising Cataract Surgical Volumes

- 4.2.5 Integration of AI-enhanced Image Analysis with Ultrasound Data

- 4.2.6 Expansion of Ambulatory Surgical Centers & Ophthalmic Clinics

- 4.3 Market Restraints

- 4.3.1 Increasing Adoption of Alternate Imaging Modalities

- 4.3.2 High Capital Outlay for High-Frequency Ultrasound Platforms

- 4.3.3 Shortage of Trained Ophthalmic Sonographers in Low-income Regions

- 4.3.4 Limited Awareness & Adoption in Underserved Regions

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 A-Scan

- 5.1.2 B-Scan

- 5.1.3 Combined Scan

- 5.1.4 Pachymeter

- 5.1.5 Ultrasound Biomicroscopy (UBM)

- 5.2 By Modality

- 5.2.1 Portable

- 5.2.2 Standalone

- 5.3 By Technology

- 5.3.1 Conventional Ultrasound

- 5.3.2 Doppler / Colour-Flow Ultrasound

- 5.4 By Application

- 5.4.1 Cataract Assessment

- 5.4.2 Glaucoma & Ocular Hypertension

- 5.4.3 Retinal Disorders

- 5.4.4 Ocular Trauma & Tumours

- 5.4.5 Others

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Ophthalmology Clinics

- 5.5.3 Ambulatory Surgical Centres

- 5.5.4 Academic & Research Institutes

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 AMETEK (Reichert)

- 6.3.2 Appasamy Associates

- 6.3.3 Carl Zeiss Meditec AG

- 6.3.4 Clarion Medical Technologies

- 6.3.5 DGH Technology Inc.

- 6.3.6 Lumibird Medical

- 6.3.7 MEDA Co. Ltd.

- 6.3.8 Micro Medical Devices

- 6.3.9 NIDEK Co. Ltd.

- 6.3.10 Sonomed Escalon

- 6.3.11 Sonostar Technologies

- 6.3.12 Nikon Corporation (Optos Plc)

- 6.3.13 Tomey Corporation

- 6.3.14 Lumibird Medical

- 6.3.15 HiUltrasound.com

- 6.3.16 Mecanmedical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment