PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846191

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846191

Veterinary Ultrasound Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

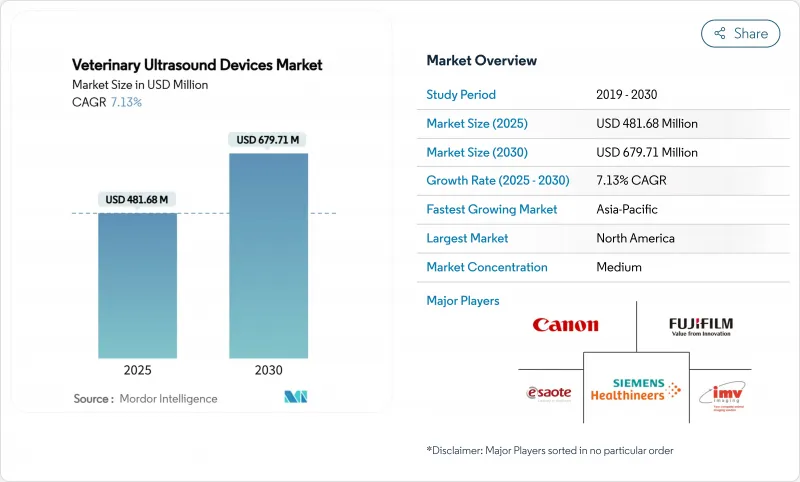

The Veterinary Ultrasound Devices Market size is estimated at USD 481.68 million in 2025, and is expected to reach USD 679.71 million by 2030, at a CAGR of 7.13% during the forecast period (2025-2030).

Growing pet ownership, the humanization of companion animals, and rising demand for reproductive and cardiology imaging in livestock and companion species are broadening the addressable base for vendors. Handheld wireless scanners, 3D/4D modalities, and AI-enabled interpretation are reshaping competitive positioning, while cloud-based archiving relieves capacity constraints in rural settings. Manufacturers are targeting workflow automation to offset the shortage of ultrasound-trained veterinarians and to deliver consistent diagnoses across species. Capital-light subscription models and telemedicine integrations are opening new revenue streams for practices that previously lacked imaging capabilities. However, small clinics still face up-front equipment costs and inconsistent reimbursement for large-animal scans, which curb near-term penetration in developing economies.

Global Veterinary Ultrasound Devices Market Trends and Insights

Surge in Companion-Animal Wellness Screening Programs Accelerating Ultrasound-Device Procurement

Preventive care packages now embed abdominal and cardiac scans as routine components, reflecting owners' desire for human-grade diagnostics. Automated algorithms flag hypoechoic liver lesions or valvular anomalies that clinicians might miss at the point of care, boosting confidence in early treatment protocols. Studies in August 2024 showed AI-assisted canine screenings identifying subclinical issues in 86% of apparently healthy dogs. Hospitals with more than three veterinarians report 67% adoption of senior-pet ultrasound protocols, and uptake is rising in urban Asia-Pacific clinics as awareness spreads through social channels. Subscription-based imaging bundles help smaller practices recover equipment costs while offering standardized annual check-ups. The driver adds momentum to the veterinary ultrasound devices market by embedding imaging into membership wellness plans that lock in repeat revenue.

Rapid Diffusion of Handheld Wireless Scanners Among Mobile Mixed-Animal Veterinarians

Lightweight probes tethered to smartphones let practitioners acquire images in barns, equine stables, and wildlife rehabilitation centers. Comparative testing in 2024 confirmed that the Vscan Air yielded abdominal-view clarity on par with mid-range cart systems, winning highest ease-of-use scores. Rural clinicians can transmit scans to referral specialists via cloud PACS, shortening decision time for emergency foaling or bovine dystocia cases. Device makers price wireless scanners between USD 2,800 and USD 4,500, widening access for solo veterinarians with tight budgets. The rapid uptake elevates the veterinary ultrasound devices market by replacing auscultation-only visits with data-rich imaging consults that justify higher service fees.

Limited Ultrasound-Trained Veterinarians in Rural Regions

Practitioners servicing wide geographic areas often rotate across species and cannot devote time to advanced imaging training. A July 2024 workforce study highlighted cases where rural clinicians recommended euthanasia or referrals due to limited diagnostic resources, underscoring the access gap. Tele-mentoring programs and AI overlays alleviate knowledge deficits but still rely on baseline probe skills. The enduring competence shortfall weighs on the veterinary ultrasound devices market by slowing hardware uptake where patient densities would otherwise justify investment.

Other drivers and restraints analyzed in the detailed report include:

- Increase in Animal Adoption and Health Expenditure

- Rise in Demand for Diagnosis of Animal Health Conditions and Technological Advancements

- Up-front Capital Burden of Premium Doppler & 4D Platforms for Small Practices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cart/trolley systems retained the largest slice of the veterinary ultrasound devices market share at 49.13% in 2024, reflecting entrenched use in referral hospitals. Yet handheld scanners are forecast to outpace overall growth at 9.21% CAGR, propelled by farm-call efficiency and reduced maintenance overhead. The veterinary ultrasound devices market size attributable to handhelds is expected to double by 2030 as subscription-priced probes lower entry barriers.

Advances in battery life, probe cooling, and AI-driven presets now deliver cart-like performance in devices weighing under 300 g. Wireless probes operating on Wi-Fi or Bluetooth stream DICOM-compatible images to tablets, enabling instant uploads to PACS. Practices report that mobile imaging increases client compliance because diagnoses occur on-site, minimizing patient transport stress. As connectivity improves, handheld adoption forms a cornerstone of the veterinary ultrasound devices market expansion strategy for both incumbent and challenger brands.

Two-dimensional ultrasound dominated revenue with a 57.46% stake in 2024 owing to versatility and favorable price-performance. Doppler modalities, crucial for cardiovascular assessments, are slated for a 9.65% CAGR, widening their contribution to the overall veterinary ultrasound devices market size by 2030. AI overlays now quantify flow velocities and auto-classify regurgitant jets, streamlining cardiology workflows.

3D/4D imaging, once limited to academic centers, finds new traction in equine musculoskeletal evaluations and canine skull mapping for brachycephalic breeds. Super-resolution research demonstrates ten-fold gain in microvascular depiction, elevating oncologic staging accuracy. The veterinary ultrasound devices market benefits as clinics upgrade firmware to unlock such features without swapping base hardware, extending lifecycle value.

The Veterinary Ultrasound Devices Market is Segmented by Product (Handheld Ultrasound, and More), Technology (2-Dimensional Ultrasound, and More), Application (Obstetrics & Gynecology, and More), Animal Type (Companion Animals, and More), End User (Veterinary Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38.51% of 2024 revenue owing to sophisticated veterinary infrastructure and rapid AI adoption. The United States remains the primary revenue engine within the regional veterinary ultrasound devices market, supported by pet-insurance penetration and widespread specialty referral networks. Canada's growth is driven by telemedicine extensions into remote provinces, while Mexico experiences upticks in handheld sales linked to expanding mixed-animal practices.

Asia-Pacific is forecast to record the fastest 10.32% CAGR through 2030 as urbanization lifts companion-animal ownership and livestock intensification accelerates reproductive monitoring. China's investment in large-scale dairy operations and India's government push for improved animal health services bolster scanner demand. Japan and South Korea exhibit high per-capita pet spending, whereas Australia benefits from dual livestock and companion-animal revenue streams. Cross-border e-commerce platforms simplify procurement of mid-tier devices, enlarging the regional veterinary ultrasound devices market size.

Europe maintains a mature yet still expanding base. Germany, the United Kingdom, and France anchor demand, accompanied by steady adoption in Southern Europe and emerging interest in Eastern markets. Variability in veterinary service pricing across the continent affects scan uptake, yet harmonized EU animal-welfare statutes sustain equipment renewal cycles. South America, led by Brazil's significant cattle industry, and the Middle East & Africa, where GCC investments in premium clinics rise, round out global contribution. Together they add incremental volumes to the worldwide veterinary ultrasound devices market despite infrastructural challenges.

- Esaote

- Mindray

- Canon

- FUJIFILM Sonosite Inc.

- Samsung Group

- DRAMINSKI SA

- IMV Imaging

- Siemens Healthineers

- Sonostar Technologies Co. Ltd

- SonoScape Medical Corp.

- Chison Medical Technologies Co. Ltd

- Clarius Mobile Health Corp.

- E.I. Medical Imaging

- Butterfly Network Inc.

- Edan Instruments Inc.

- Kaixin Electronic Instrument Co. Ltd

- Healcerion Co. Ltd

- Telemed Medical Systems

- Xuzhou Palmary Electronics Co. Ltd

- Heska

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in Companion-Animal Wellness Screening Programs Accelerating Ultrasound-Device Procurement

- 4.2.2 Rapid Diffusion of Handheld Wireless Scanners Among Mobile Mixed-Animal Veterinarians

- 4.2.3 Increase in Animal Adoption and Animal Health Expenditure

- 4.2.4 Rise in Demand for Diagnosis of Animal Health Conditions and Technological Advancements

- 4.2.5 Expansion of Livestock Farming & Reproductive Monitoring Needs

- 4.2.6 Integration of AI & Telemedicine in Veterinary Imaging

- 4.3 Market Restraints

- 4.3.1 Limited Ultrasound-Trained Veterinarians in Rural Regions

- 4.3.2 Up-front Capital Burden of Premium Doppler & 4D Platforms for Small Practices

- 4.3.3 Inconsistent Reimbursement for Large-Animal Diagnostic Imaging in Emerging Economies

- 4.3.4 High Cost of Advanced Ultrasound Equipment

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Portability

- 5.1.1 Handheld Ultrasound

- 5.1.2 Table-top Ultrasound

- 5.1.3 Cart/Trolley-based Ultrasound

- 5.2 By Technology

- 5.2.1 2-Dimensional Ultrasound

- 5.2.2 Doppler Ultrasound

- 5.2.3 3D/4D Ultrasound

- 5.2.4 Contrast-Enhanced Ultrasound

- 5.3 By Application

- 5.3.1 Obstetrics & Gynecology

- 5.3.2 Cardiology

- 5.3.3 Musculoskeletal

- 5.3.4 Abdominal & Internal Medicine

- 5.3.5 Emergency & Critical Care

- 5.4 By Animal Type

- 5.4.1 Companion Animals

- 5.4.1.1 Dogs

- 5.4.1.2 Cats

- 5.4.1.3 Other Small Companion Animals

- 5.4.2 Livestock Animals

- 5.4.2.1 Horse

- 5.4.2.2 Cattle

- 5.4.2.3 Other Livestock Animals

- 5.4.3 Other Animals

- 5.4.1 Companion Animals

- 5.5 By End User

- 5.5.1 Veterinary Hospitals

- 5.5.2 Veterinary Clinics

- 5.5.3 Other End Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Esaote SpA

- 6.3.2 Shenzhen Mindray Bio-Medical Electronics Co. Ltd

- 6.3.3 Canon Inc.

- 6.3.4 FUJIFILM Sonosite Inc.

- 6.3.5 Samsung Medison Co. Ltd

- 6.3.6 DRAMINSKI SA

- 6.3.7 IMV Imaging

- 6.3.8 Siemens Healthineers GmbH

- 6.3.9 Sonostar Technologies Co. Ltd

- 6.3.10 SonoScape Medical Corp.

- 6.3.11 Chison Medical Technologies Co. Ltd

- 6.3.12 Clarius Mobile Health Corp.

- 6.3.13 E.I. Medical Imaging

- 6.3.14 Butterfly Network Inc.

- 6.3.15 Edan Instruments Inc.

- 6.3.16 Kaixin Electronic Instrument Co. Ltd

- 6.3.17 Healcerion Co. Ltd

- 6.3.18 Telemed Medical Systems

- 6.3.19 Xuzhou Palmary Electronics Co. Ltd

- 6.3.20 Heska Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment