PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846192

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846192

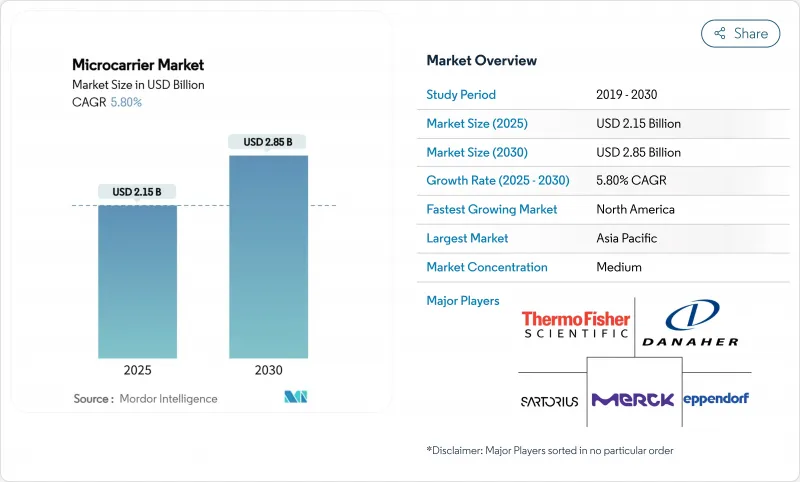

Microcarrier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The microcarrier market size stood at USD 2.15 billion in 2025 and is projected to reach USD 2.85 billion by 2030, advancing at a 5.80% CAGR.

Demand is propelled by cell-based vaccines, the wider biologics pipeline, and the shift toward continuous manufacturing platforms that enable higher cell densities, smaller facility footprints, and lower utility consumption. Growing investment in cultivated-meat R&D is accelerating interest in edible, biodegradable substrates, while single-use bioreactors and integrated process-analytical technologies are improving batch-to-batch consistency and shortening changeover times . Automation, magnetic separation, and thermo-responsive materials are reducing labor requirements by up to 40%, supporting cost-containment strategies in commercial operations. Collectively, these factors keep the microcarrier market on a steady growth trajectory despite headwinds linked to biologics price pressure and scale-up complexities.

Global Microcarrier Market Trends and Insights

Demand for Cell-Based Vaccines & Therapeutics

Accelerated mRNA and viral-vector programs need adherent cell culture systems capable of exceeding 20 million cells/mL, well above the 5-8 million cells/mL typical of suspension cultures. Regulatory streamlining now shortens development timelines to 7-10 years for select modalities, stimulating sustained orders for scalable microcarrier platforms. Pandemic-era investment in domestic vaccine capacity cemented the role of optimized microcarriers that shrink reactor footprints by as much as 70%, easing capital constraints for smaller firms. Personalized-medicine pipelines demand flexible, small-batch bioreactors, further reinforcing microcarrier adoption. Collectively, these factors add 1.2 percentage points to the forecast CAGR of the microcarrier market.

Expansion of Biologics & Biosimilar Manufacturing

Biologics revenue surpassed USD 300 billion in 2025, while governments in China and India injected over USD 15 billion into green-field biopharma capacity over the past two years. Continuous perfusion systems achieve 10-fold volumetric productivity and 50% media savings, but their high cell-density operation depends on rugged microcarriers that tolerate sustained shear. Biosimilar developers seek carrier chemistries that faithfully replicate originator culture conditions, raising the bar for surface-modification precision. The BIOSECURE Act is redirecting Western outsourcing toward India's CDMOs, where inquiry volumes jumped more than 40% in 2024, expanding the global footprint of the microcarrier market.

High Cost of Biologics & Cell-Based Therapies

Manufacturing accounts for 40-60% of end-user prices in cell therapies, far above the 10-15% typical for small-molecule drugs. Emerging-market payers therefore restrict reimbursement, curbing facility builds and muting demand for new microcarrier installations. While scale-up promises economies of scale, it also introduces validation costs that smaller firms struggle to absorb, delaying commercialization timelines. Extensive carrier characterization can add USD 2-5 million to regulatory filings, deterring novel-material entrants and tempering growth in the microcarrier market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Global Funding for Cell & Gene Therapy R&D

- Shift Toward Single-Use Bioprocessing Platforms

- Shear-Stress & Aggregation Issues in Carrier Cultures

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polystyrene carriers retained a 43.31% share of the microcarrier market size in 2024 as the long-standing workhorse for viral vaccine and monoclonal-antibody lines. Their surface chemistry is well understood, lot-to-lot consistency is high, and regulatory files are mature, lowering qualification hurdles. However, the growing environmental focus of biopharma and the ascent of cultivated-meat producers are redirecting R&D budgets toward biodegradable alginate, chitosan, and cellulose variants. The alginate cohort is charting a 6.64% CAGR, the fastest across material classes, benefiting from its edible profile and ability to gel under Ca2+ gradients, a prized attribute for muscle-fiber scaffolding in cultured meat.

Hybridformulations now merge rigid synthetic cores with bio-active outer layers, delivering mechanical resilience during high-shear perfusion runs while presenting natural ligands for delicate stem cells. Magnetic polystyrene cores coated in collagen fragments enable auto-separation and gentle detachment, trimming harvest times by 30-40% in commercial plants . Thermo-responsive poly-N-isopropyl-acrylamide shells release cells upon a 5 °C temperature drop without enzymatic insult, preserving membrane-bound proteins vital to cell-therapy potency. The regulatory push toward chemically defined, animal-component-free processes further stimulates demand for synthetic-plant hybrids, upholding growth momentum in the microcarrier market.

Vaccine production absorbed 38.99% of the microcarrier market size in 2024 as influenza, polio, and more recently mRNA-based platforms rely on adherent lines for antigen or virus propagation. Decades of process optimization keep barrier-to-entry high for challengers, ensuring stable demand. Yet cell-therapy pipelines-spanning CAR-T, mesenchymal stromal cells, induced pluripotent stem cells, and NK cells-are driving a 6.45% CAGR, outpacing every other use case. Regulatory approvals for allogeneic "off-the-shelf" immunotherapies demand reactors that can bank billions of cells per lot with lot-release timelines under two weeks, a benchmark achievable only with intensified microcarrier cultures.

Automation suites integrating sensor-rich harvest skids now support inline washing, concentration, and fill-finish activities, slashing vein-to-vein time for CAR-T candidates from 20 days to under 12 days. Downstream, edibility is becoming a critical design parameter for cultured-meat carriers that must degrade or remain consumable without altering texture or taste. R&D segments, including tissue engineering and organ-on-chip, continue to adopt microcarriers for scalable proof-of-concept studies, gradually widening the microcarrier market application base.

The Microcarrier Market Report is Segmented by Material Type (Polystyrene-Based, Dextran-Based, Alginate-Based, and More), Application (Vaccine Manufacturing, Cell Therapy, Others), End User (Biopharma and Biotechnology Firms, and More), Scale of Operation (Laboratory Scale, Pilot Scale, Commercial Scale), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 42.78% of 2024 revenue, supported by mature GMP infrastructure, robust venture funding, and proximity to regulators that often set global validation benchmarks. Skilled-labor shortages and premium operating costs are nudging firms toward dual-shore models, yet the region retains leadership in high-value cell-and-gene therapies and maintains one of the densest clusters of microcarrier innovation pipelines.

Asia-Pacific is the fastest-growing territory at a 6.78% CAGR, underpinned by government subsidies, lower labor overhead, and expanding biosimilar exports. China allocated more than USD 8 billion to biopharma industrial parks in 2024, featuring purpose-built single-use suites that standardize microcarrier processes from seed train to harvest. India's CDMO complex saw inbound project inquiries soar by over 40% following U.S. supply-chain legislation, prompting capacity expansions in Hyderabad and Bangalore. Japan and South Korea focus on regenerative medicine and cell-therapy commercialization, demanding advanced carriers with traceable supply chains to satisfy strict pharmacopoeial standards.

Europe shows steady, environmentally focused growth, with circular-economy directives incentivizing biodegradable carriers and closed-loop water systems. Industrial policy supports continuous manufacturing pilot plants in Germany, the Netherlands, and Ireland, ensuring that the microcarrier market maintains momentum amid rising energy costs. Emerging regions in the Middle East, Africa, and South America are building foundational capability, often through technology-transfer agreements and modular GMP suites, gradually enlarging the microcarrier market footprint.

- Thermo Fisher Scientific

- Merck

- Sartorius

- Danaher (Cytiva & Pall)

- Corning

- Lonza Group Ltd.

- Eppendorf

- VWR International

- Becton Dickinson & Co.

- Getinge

- Greiner Bio-One GmbH

- Matrix F.T.

- Gelatex Technologies

- CelVivo ApS

- CELLTREAT Scientific

- HiMedia Laboratories

- Microcarriers Labs (China)

- Esco Aster

- Nanofiber Solutions

- PBS Biotech

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for cell-based vaccines & therapeutics

- 4.2.2 Expansion of biologics & biosimilar manufacturing

- 4.2.3 Surge in global funding for cell & gene therapy R&D

- 4.2.4 Shift toward single-use bioprocessing platforms

- 4.2.5 Growth of cultivated-meat industry demanding edible carriers

- 4.2.6 Process-intensification via magnetic & thermo-responsive carriers

- 4.3 Market Restraints

- 4.3.1 High cost of biologics & cell-based therapies

- 4.3.2 Shear-stress & aggregation issues in carrier cultures

- 4.3.3 Lack of regulatory-cleared biodegradable microcarriers

- 4.3.4 Supply-chain volatility for specialty polymers & coatings

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Material Type

- 5.1.1 Polystyrene-based

- 5.1.2 Dextran-based

- 5.1.3 Alginate-based

- 5.1.4 Collagen-/Gelatin-based

- 5.1.5 Others

- 5.2 By Application

- 5.2.1 Vaccine Manufacturing

- 5.2.2 Cell Therapy

- 5.2.3 Others

- 5.3 By End User

- 5.3.1 Biopharma and Biotechnology Firms

- 5.3.2 CROs and CDMOs

- 5.3.3 Academic & Research Institutes

- 5.3.4 Others

- 5.4 By Scale of Operation

- 5.4.1 Laboratory Scale

- 5.4.2 Pilot Scale

- 5.4.3 Commercial Scale

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Merck KGaA

- 6.3.3 Sartorius AG

- 6.3.4 Danaher (Cytiva & Pall)

- 6.3.5 Corning Inc.

- 6.3.6 Lonza Group Ltd.

- 6.3.7 Eppendorf SE

- 6.3.8 VWR International LLC

- 6.3.9 Becton Dickinson & Co.

- 6.3.10 Getinge AB

- 6.3.11 Greiner Bio-One GmbH

- 6.3.12 Matrix F.T.

- 6.3.13 Gelatex Technologies

- 6.3.14 CelVivo ApS

- 6.3.15 CELLTREAT Scientific

- 6.3.16 HiMedia Laboratories

- 6.3.17 Microcarriers Labs (China)

- 6.3.18 Esco Aster

- 6.3.19 Nanofiber Solutions

- 6.3.20 PBS Biotech

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment