PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846196

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846196

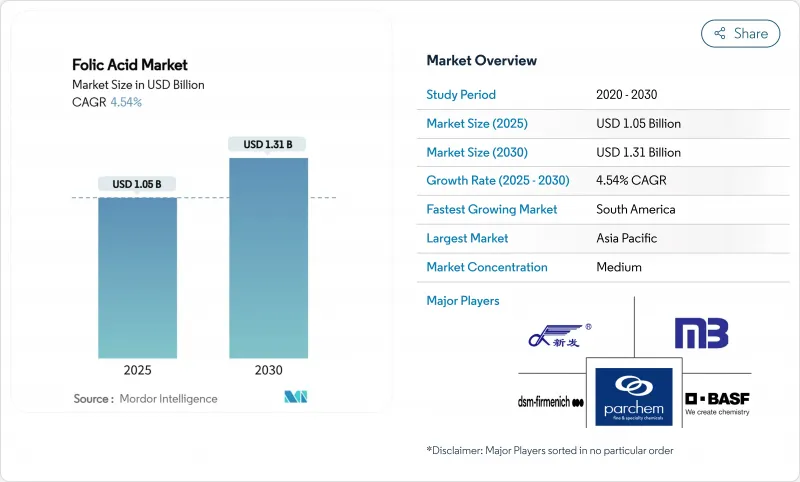

Folic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The folic acid market is estimated to reach USD 1.05 billion in 2025 and is forecast to reach USD 1.31 billion by 2030, advancing at a 4.54% CAGR.

This steady expansion is built on mandatory fortification policies, higher anemia prevalence, and the pharmaceutical sector's widening use of high-purity folic acid in biopharmaceutical manufacturing . Regulatory momentum is reshaping demand: the United Kingdom's decision to enrich non-wholemeal wheat flour by December 2026 anchors a multiyear uptick in raw material offtake that buffers the folic acid market against economic cycles. At the same time, functional foods and fermentation-derived folate ingredients are gaining traction as consumers shift toward clean-label nutrition and seek bioavailable options tailored to MTHFR genetic variants. South America illustrates a different yet complementary growth engine; Brazil's long-standing flour mandate and expanding neural-tube-defect prevention programs underpin regional gains that outpace the global average. Cost volatility in para-aminobenzoic acid inputs, coupled with tighter oversight of unmetabolized folic acid exposure, adds operating complexity that favors manufacturers able to secure raw material supply, execute fermentation scale-ups, and navigate evolving label rules.

Global Folic Acid Market Trends and Insights

Mandatory folate fortification policies fueling demand for folic acid

Government mandates for flour fortification maintain consistent market demand, independent of economic cycles and consumer trends. These regulations require manufacturers to add specific nutrients to flour products to address public health concerns and nutritional deficiencies in the population. The United Kingdom's mandate for folic acid fortification in non-wholemeal wheat flour, effective December 2026, aims to prevent 200 neural tube defects annually and generate USD 25 million in NHS cost savings over a decade. This initiative aligns with global public health objectives and demonstrates the increasing focus on preventive healthcare measures through food fortification. The expansion of fortification regulations across 142 countries as of 2024 enables manufacturers to confidently invest in production capacity and technology upgrades. This widespread adoption creates a stable regulatory environment that supports long-term planning and development in the flour fortification industry.

Increase in prenatal supplement uptake

The growing awareness of maternal health has driven increased adoption of folic acid supplementation across all income segments, particularly among health-conscious consumers and expectant mothers. According to the Centers for Disease Control and Prevention's 2024 data, anemia affects approximately 13.0% of females in the United States compared to 5.5% of males, emphasizing the importance of gender-specific nutritional interventions and preventive healthcare measures . This demographic trend has generated robust demand in market segments with reduced price sensitivity and high brand loyalty, especially in premium supplement categories and physician-recommended products. Scientific evidence demonstrating that adequate folate intake during pregnancy reduces neural tube defects, cardiovascular complications, and other pregnancy-related health issues has reinforced medical guidelines for supplementation throughout pregnancy and preconception periods. The demand for folic acid supplements has expanded beyond developed countries, with emerging economies experiencing urbanization and better healthcare access, creating new consumer bases focused on prenatal nutrition and preventive healthcare practices. This expansion has been particularly notable in regions with improving healthcare infrastructure and rising disposable incomes.

Stability issues of folates in high-temperature food processing limiting its application in fortified snacks

Thermal degradation of folic acid during food processing limits fortification applications in products manufactured at high temperatures. Studies show that folic acid maintains stability under anaerobic conditions but undergoes significant degradation when exposed to oxygen, with 5-methyl-5,6,7,8-tetrahydrofolate being particularly susceptible to heat. Folic acid losses occur through diffusion and thermal degradation, with diffusivity constants varying across different food matrices. This technical challenge limits folic acid addition in popular snack categories such as extruded cereals, baked goods, and fried products that require high-temperature processing for texture development and shelf stability. Manufacturers must balance processing requirements with nutrient retention, often needing to over-fortify to offset processing losses, which raises costs and regulatory complexities. This limitation especially affects emerging markets where processed snacks are growing in popularity but lack the technical capabilities for controlled-atmosphere processing or post-processing fortification methods.

Other drivers and restraints analyzed in the detailed report include:

- Increased prevalence of anemia and deficiency disorders

- Expansion of functional foods and beverages

- Risk of overconsumption and unmetabolized folic acid

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pharmaceutical grade folic acid continues to lead the market with a 63.78% share in 2024, as companies focus on meeting rigorous quality standards for medical treatments and high-end supplements. The segment's higher pricing reflects the investment in advanced manufacturing processes, thorough quality testing, and compliance with regulatory requirements to deliver consistent product quality. Companies in this segment serve both medical applications and premium supplement manufacturers who emphasize product quality to stand out in competitive markets.

The food grade market is set to expand at 6.56% CAGR through 2030, as more countries implement food fortification programs and companies develop new functional food products. This growth comes as regulators increasingly support food-grade folic acid in national nutrition programs that prioritize cost-effective solutions. Companies benefit from reduced production costs in large-scale fortification projects while meeting necessary quality benchmarks. The segment's expansion reflects a shift in public health strategies toward broader nutrition improvements, allowing manufacturers to streamline production while meeting regulatory standards.

The Folic Acid Market Report is Segmented by Grade (Food Grade, and Pharmaceutical Grade), Source (Chemical Synthesis, and Fermentation-Derived), Application (Dietary Supplements, Pharmaceuticals, Functional Foods, Animal Feed, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region demonstrates its market dominance by capturing 38.42% of the global share in 2024, underpinned by well-structured fortification programs implemented across 10 countries under the Food Fortification Initiative guidance. The region's strength lies in China's robust manufacturing ecosystem, which provides significant cost benefits and streamlined supply chains. India's expanding healthcare accessibility has opened new avenues for both therapeutic and preventive applications. The pharmaceutical manufacturing infrastructure in the region has proven instrumental in meeting domestic requirements while serving global export markets, particularly in supplying high-purity grades essential for biopharmaceutical applications.

South America's market demonstrates robust performance, achieving a CAGR of 7.01% through 2030. The region's healthcare systems are implementing neural tube defect prevention programs while strengthening medical infrastructure. This growth aligns with South America's economic development, as governments increase investments in public health initiatives, particularly maternal and child nutrition programs across urban centers. The implementation of these programs has resulted in improved healthcare outcomes and increased market penetration across various regions. The combination of government support, healthcare infrastructure development, and rising awareness among healthcare providers has created favorable conditions for sustained market growth.

North America and Europe maintain stable market positions through established regulatory frameworks and high per-capita consumption. While these markets have matured, growth opportunities exist in premium segments and specialized applications. The United Kingdom's mandate for flour fortification by December 2026 indicates renewed potential in developed markets where voluntary programs have reached maximum effectiveness. This regulatory shift is expected to influence other European nations to review and potentially strengthen their fortification policies. The market in these regions continues to evolve through innovation in product formulations and expanding applications across different food categories.

- BASF SE

- DSM-Firmenich

- Parchem

- Xinfa Pharmaceutical Co., Ltd.

- Medicamen Biotech Ltd.

- Nantong Changhai Food Additive Co., Ltd.

- Hema Pharma

- Makers Nutrition

- Gnosis by Lesaffre

- Emcure Pharmaceuticals Ltd.

- Hebei Jiheng (Group) Pharmaceutical Co., Ltd.

- Shengda Pharmaceutical Co., Ltd.

- Zydus Pharmaceuticals Ltd.

- Kirkman Group, Inc.

- Superior Supplement Manufacturing

- Prinova Group LLC

- Foodchem International Corporation

- Jiangxi Tianxin Pharmaceutical

- Jarrow Formulas Inc.

- Merck KGaA / MilliporeSigma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory Folate Fortification Policies Fueling Demand for Folic Acid

- 4.2.2 Increase in Prenatal Supplement Uptake

- 4.2.3 Increased Prevalence of Anemia and Deficiency Disorders

- 4.2.4 Expansion of Functional Foods and Beverages

- 4.2.5 Growth of Clean-Label Vegan Vitamins Driving Plant-Derived Folate Ingredients

- 4.2.6 Rise in the Adoption of High-Purity Folic Acid for Biopharmaceutical Applications

- 4.3 Market Restraints

- 4.3.1 Stability Issues of Folates in High-Temperature Food Processing Limiting its application in Fortified Snacks

- 4.3.2 Stringent Regulatory Approvals and Labeling Requirements

- 4.3.3 Risk of Overconsumption and Unmetabolized Folic Acid

- 4.3.4 Price Volatality of Raw materials

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Grade

- 5.1.1 Food Grade

- 5.1.2 Pharmaceutical Grade

- 5.2 By Source

- 5.2.1 Chemical Synthesis

- 5.2.2 Fermentation-Derived

- 5.3 By Application

- 5.3.1 Dietary Supplements

- 5.3.2 Pharmaceuticals

- 5.3.3 Functional Foods

- 5.3.4 Animal Feed

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Italy

- 5.4.2.6 Spain

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 DSM-Firmenich

- 6.4.3 Parchem

- 6.4.4 Xinfa Pharmaceutical Co., Ltd.

- 6.4.5 Medicamen Biotech Ltd.

- 6.4.6 Nantong Changhai Food Additive Co., Ltd.

- 6.4.7 Hema Pharma

- 6.4.8 Makers Nutrition

- 6.4.9 Gnosis by Lesaffre

- 6.4.10 Emcure Pharmaceuticals Ltd.

- 6.4.11 Hebei Jiheng (Group) Pharmaceutical Co., Ltd.

- 6.4.12 Shengda Pharmaceutical Co., Ltd.

- 6.4.13 Zydus Pharmaceuticals Ltd.

- 6.4.14 Kirkman Group, Inc.

- 6.4.15 Superior Supplement Manufacturing

- 6.4.16 Prinova Group LLC

- 6.4.17 Foodchem International Corporation

- 6.4.18 Jiangxi Tianxin Pharmaceutical

- 6.4.19 Jarrow Formulas Inc.

- 6.4.20 Merck KGaA / MilliporeSigma

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK