PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846200

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846200

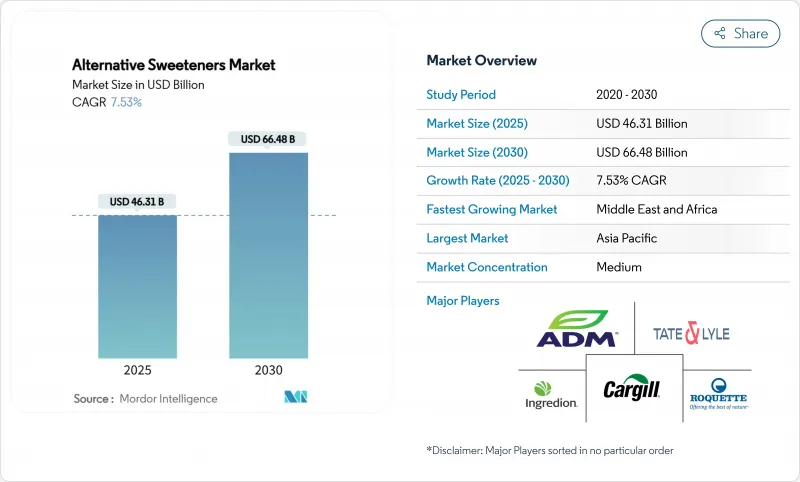

Alternative Sweeteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The alternative sweeteners market size reached USD 46.31 billion in 2025 and is forecast to advance to USD 66.48 billion by 2030, registering a 7.53% CAGR.

The expansion is propelled by fiscal policies that penalize sugar, rapid breakthroughs in precision-fermentation, and a pronounced consumer tilt toward low-calorie foods. Asia-Pacific remains the leading regional market, supported by rapid urbanization and rising health concerns like diabetes, while the Middle East and Africa is emerging as a key growth frontier. High-intensity sweeteners, particularly those using improved steviol glycosides and innovative sweet proteins, are steadily gaining ground, gradually challenging the dominance of high-fructose corn syrup. Meanwhile, natural sweeteners are carving out a premium niche, appealing to health-conscious consumers who value clean-label products. Despite these positive trends, challenges such as high production costs, fluctuations in raw material availability, and concerns over product shelf life continue to limit broader adoption, especially in markets where price sensitivity shapes purchasing decisions.

Global Alternative Sweeteners Market Trends and Insights

Rising Health Consciousness and Increasing Prevalence of Lifestyle Diseases

The global food and beverage industry is experiencing a significant transformation due to increasing health-conscious consumption patterns. According to the Supply Side Food and Beverage Journal (2025), 36% of consumers are actively reducing their sugar intake, while 56% avoid products with artificial sweeteners. This consumer behavior creates formulation challenges for manufacturers who must balance sweetness, taste, and functionality while meeting clean-label requirements. Consumers are focusing beyond calorie reduction to consider the metabolic and digestive effects of sweeteners, particularly their glycemic response and gut health impact. Natural low-calorie sweeteners, including allulose, monk fruit, and tagatose, are gaining market acceptance. Tagatose stands out for its low glycemic index and prebiotic properties that support gut microbiota. The U.S. Food and Drug Administration (FDA) has reinforced the potential of these alternative sweeteners by granting classifications such as generally recognized as safe (GRAS) status to tagatose and similar ingredients. Research and development teams are now focusing on multifunctional sweeteners that reduce sugar content while providing additional health benefits. These sweeteners are becoming essential components in functional foods, beverages, and nutraceutical formulations.

Government Regulations Supporting Sugar Reduction and the Implementation of Sugar Taxes across Regions

Sugar taxes and other regulatory measures aimed at reducing sugar consumption are creating new market opportunities for alternative sweeteners. The sugar tax in the UK demonstrated a significant impact on consumption patterns, as children's daily sugar intake from soft drinks decreased from 70g to 45g within one year of implementation, according to the Journal of Epidemiology and Community Health. The World Health Organization's recommendation to limit free sugar intake to below 5% of total calorie consumption has influenced global regulatory trends. These regulations are driving manufacturers to reformulate their products to avoid tax thresholds, increasing the demand for alternative sweetening ingredients. Several countries, including Mexico, France, and Norway, have implemented similar sugar taxes, while others, like India and Australia, are considering such measures. Additionally, major beverage manufacturers have pledged to reduce sugar content across their product portfolios by 2025, further driving innovation in alternative sweeteners.

Stringent Regulatory Requirements and Lengthy Approval Processes for New Alternative Sweeteners

Regulatory requirements remain a critical challenge in the alternative sweeteners market, significantly impacting product development timelines and market accessibility. The European Food Safety Authority (EFSA) has announced updated guidance for novel food applications, set to take effect in February 2025. This guidance imposes rigorous submission criteria, requiring detailed documentation of production processes, toxicological safety data, nutritional value, and estimated consumption levels. These stringent requirements disproportionately affect small and medium-sized enterprises (SMEs), which often lack the necessary regulatory infrastructure and financial capacity to navigate multi-jurisdictional compliance. Furthermore, the fragmented global regulatory landscape intensifies these challenges, creating additional barriers to market entry. For instance, in 2024, the UK High Court brought attention to the complexities of regulatory inconsistencies when it ruled that the Food Standards Agency (FSA) had misclassified monk fruit extract as a novel food. This misclassification temporarily restricted the product's market access, highlighting the uncertainty and delays caused by varying regulatory frameworks. Such inconsistencies not only impede the introduction of innovative natural sweeteners but also disrupt the market's growth trajectory. Addressing these regulatory disparities and fostering alignment across jurisdictions will be crucial for unlocking the full potential of the alternative sweeteners market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Taste Profiles and Solubility Enhance Product Adoption

- Growing Consumer Preference for Low-calorie and Sugar-free Products

- High Production Costs Compared to Traditional Sugar

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, High-Fructose Corn Syrup (HFCS) maintains its dominant position with a 35.87% market share, driven by its cost-effectiveness and functional versatility in large-scale food and beverage processing. The Corn Refiners Association highlights that the industry is prioritizing sustainability and technological advancements, with members adopting practices to reduce carbon emissions, enhance resource efficiency, and maintain competitive pricing. HFCS remains a cornerstone in beverage applications due to its liquid form, which simplifies processing and ensures consistent sweetness profiles, critical for product standardization. The segment also benefits from robust supply chains and regulatory approvals across major markets, providing resilience and stability in an increasingly competitive and evolving sweetener market.

High-Intensity Sweeteners are the fastest-growing product segment, with a projected CAGR of 9.84% from 2025-2030. This growth is fueled by continuous innovations in taste profiles and their expanding applications across various food categories. Regulatory advancements, such as the FDA's GRAS designation for neohesperidin dihydrochalcone in July 2024, have further accelerated adoption. This approval expanded permissible usage levels from 10-1000 ppm, enabling its incorporation into products like sweet crackers, fruit juices, and energy drinks. Additionally, the segment is witnessing significant progress in sweet protein technologies, with companies developing fermentation-derived solutions that deliver superior taste while aligning with clean-label trends. These innovations cater to the growing demand from health-conscious consumers seeking natural, transparent, and sustainable ingredient options.

In 2024, artificial sweeteners hold a dominant 55.33% market share, driven by their long-standing regulatory approvals, robust manufacturing infrastructure, and cost-effectiveness, which make them highly suitable for mass-market applications. Ongoing advancements in taste enhancement and application optimization further reinforce this segment's leadership. Companies are actively addressing historical challenges, such as aftertaste and temperature stability, through innovative formulations. Clear regulatory frameworks in key markets provide manufacturers with the confidence to develop products that meet compliance and safety standards. Additionally, technological advancements continue to improve the functionality of artificial sweeteners while preserving the economic advantages that have been pivotal to their widespread adoption.

Natural sweeteners are emerging as the fastest-growing segment, with a projected CAGR of 8.97% from 2025 to 2030. This growth is fueled by increasing consumer demand for clean-label products and rising concerns about the potential long-term health effects of artificial alternatives. Recent regulatory developments have significantly contributed to this upward trajectory. For instance, monk fruit recently gained approval in the UK and EU markets after overcoming its novel food classification through a successful legal challenge. This regulatory shift has unlocked substantial opportunities in European markets, which were previously inaccessible. Furthermore, advancements in extraction and processing technologies are enhancing taste profiles and reducing production costs, making natural sweeteners more competitive. These improvements position natural sweeteners as strong contenders in premium product categories, where consumers are willing to pay a premium for natural and authentic ingredients.

The Alternative Sweeteners Market Report Segments the Industry by Product Type (High-Fructose Corn Syrup, High-Intensity Sweeteners, and More); by Source (Natural, Artificial, and Fermentation-Derived); by Form (Liquid and Solid); by Application (Food and Beverages, and More); and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, Asia-Pacific leads the global alternative sweeteners market with a 34.75% share, driven by rapid urbanization, rising middle-class populations, and growing health consciousness across China, India, and Japan. The regional food processing industry aligns with consumer demand and regulatory requirements for reduced sugar content in processed foods. China dominates regional consumption, particularly of high-fructose corn syrup, while expanding its domestic stevia production to reduce import dependence. China also strengthens its monk fruit cultivation and processing infrastructure, leveraging the fruit's native origins in southern China to meet increasing global demand for natural sweeteners. The beverage sector drives market expansion, with zero-sugar formulations gaining popularity among urban consumers seeking healthier alternatives.

North America ranks as the second-largest market, supported by increased awareness of sugar-related health risks and a robust regulatory framework that promotes reduced-sugar initiatives. The region leads sweetener innovation, especially in fermentation-based solutions. Cargill's EverSweet(R), a stevia sweetener produced through specialized yeast fermentation, exemplifies this innovation by providing enhanced sweetness with a clean, natural flavor profile, addressing traditional sensory limitations of plant-based sweeteners.

The Middle East and Africa emerges as the fastest-growing region with a projected CAGR of 7.66% from 2025-2030, driven by increasing health consciousness, government initiatives to combat rising diabetes rates, and growing demand for premium food and beverage products. According to the U.S. Department of Agriculture (2024), the UAE's food processing industry, comprising over 2,000 companies and generating more than USD 7.6 billion annually, incorporates alternative sweeteners in healthier product formulations. The region's grocery market expansion reflects this trend through increased wellness-focused product offerings. The UAE's National Food Security Strategy 2051, focused on enhancing local production and reducing import dependence, creates opportunities for domestic alternative sweetener production, supporting broader food security and health objectives.

- Cargill, Incorporated.

- Tate & Lyle PLC

- Archer Daniels Midland Company

- Ingredion Incorporated

- Roquette Freres

- NutraSweet Company

- Heartland Food Products Group

- Ajinomoto Co. Inc.

- Tereos S.A.

- JK Sucralose Inc.

- Celanese Corporation

- Wilmar International Ltd.

- Apura Ingredients Inc.

- Nantong Changhai Food Additive Co., Ltd.

- Evolva Holding SA

- GLG Life Tech Corporation

- Sweegen Inc.

- Morita Kagaku Kogyo Co. Ltd

- Hyet Sweet B.V.

- Zhucheng Dongxiao Biotechnology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising health consciousness and increasing prevalence of lifestyle diseases

- 4.2.2 Government regulations supporting sugar reduction and the implementation of sugar taxes across regions

- 4.2.3 Technological advancements in sweetener development, particularly in taste profiles and solubility, enhance product adoption.

- 4.2.4 Growing consumer preference for low-calorie and sugar-free products

- 4.2.5 Increased research and development in the sweeteners domain.

- 4.2.6 Expanding applications of alternative sweeteners in food and beverages.

- 4.3 Market Restraints

- 4.3.1 Stringent regulatory requirements and lengthy approval processes for new alternative sweeteners

- 4.3.2 High production costs compared to traditional sugar

- 4.3.3 Raw material price fluctuations impact costs.

- 4.3.4 Shorter shelf life leads to wastage.

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 High-Fructose Corn Syrup (HFCS)

- 5.1.2 High-Intensity Sweeteners

- 5.1.2.1 Sucralose

- 5.1.2.2 Stevia

- 5.1.2.3 Acesulfame K

- 5.1.2.4 Aspartame

- 5.1.2.5 Cyclamate

- 5.1.2.6 Other High Intensity Sweeteners

- 5.1.3 Low-Intensity Sweeteners

- 5.1.3.1 Xylitol

- 5.1.3.2 Erythritol

- 5.1.3.3 Sorbitol

- 5.1.3.4 Maltitol

- 5.1.3.5 Others

- 5.1.4 Others

- 5.2 By Source

- 5.2.1 Natural

- 5.2.2 Artificial

- 5.2.3 Fermentation-Derived

- 5.3 By Form

- 5.3.1 Liquid

- 5.3.2 Solid

- 5.4 By Application

- 5.4.1 Food and Beverages

- 5.4.1.1 Food

- 5.4.1.1.1 Bakery and Confectionery

- 5.4.1.1.2 Dairy and Desserts

- 5.4.1.1.3 Meat and Savory Products

- 5.4.1.1.4 Sauces, Dressings and Spreads

- 5.4.1.1.5 Other Processed Foods

- 5.4.1.2 Beverages

- 5.4.1.2.1 Soft Drinks

- 5.4.1.2.2 Sport Drinks

- 5.4.1.2.3 Other Beverages

- 5.4.2 Pharmaceuticals and Nutraceuticals

- 5.4.3 Personal and Oral Care

- 5.4.4 Animal Feed

- 5.4.1 Food and Beverages

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Chile

- 5.5.2.5 Peru

- 5.5.2.6 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Netherlands

- 5.5.3.6 Poland

- 5.5.3.7 Belgium

- 5.5.3.8 Sweden

- 5.5.3.9 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 Indonesia

- 5.5.4.6 South Korea

- 5.5.4.7 Thailand

- 5.5.4.8 Singapore

- 5.5.4.9 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, Product Launches)

- 6.3 Market Positioning Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)}

- 6.4.1 Cargill, Incorporated.

- 6.4.2 Tate & Lyle PLC

- 6.4.3 Archer Daniels Midland Company

- 6.4.4 Ingredion Incorporated

- 6.4.5 Roquette Freres

- 6.4.6 NutraSweet Company

- 6.4.7 Heartland Food Products Group

- 6.4.8 Ajinomoto Co. Inc.

- 6.4.9 Tereos S.A.

- 6.4.10 JK Sucralose Inc.

- 6.4.11 Celanese Corporation

- 6.4.12 Wilmar International Ltd.

- 6.4.13 Apura Ingredients Inc.

- 6.4.14 Nantong Changhai Food Additive Co., Ltd.

- 6.4.15 Evolva Holding SA

- 6.4.16 GLG Life Tech Corporation

- 6.4.17 Sweegen Inc.

- 6.4.18 Morita Kagaku Kogyo Co. Ltd

- 6.4.19 Hyet Sweet B.V.

- 6.4.20 Zhucheng Dongxiao Biotechnology

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK