PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846201

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846201

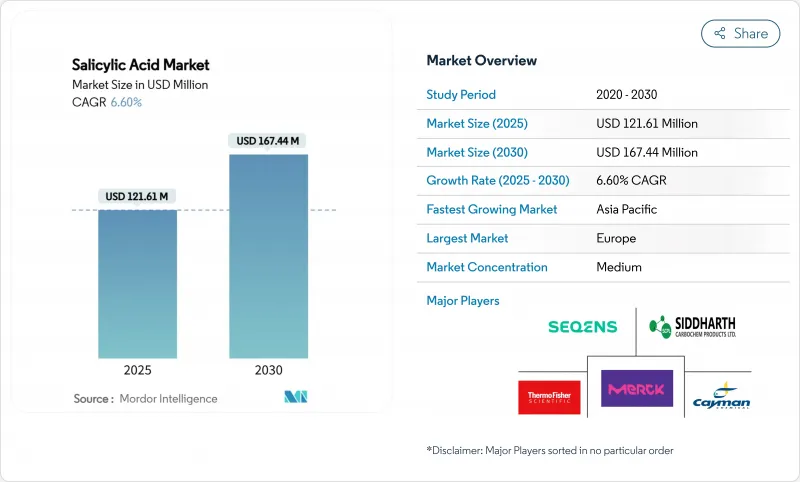

Salicylic Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The salicylic acid market is estimated to be USD 121.61 million in 2025 and is expected to grow to USD 167.44 million by 2030, at a CAGR of 6.60%.

This market growth stems from therapeutic approvals, clean-label preservative demand, and agricultural applications. The pharmaceutical industry requires salicylic acid for its keratolytic and anti-inflammatory properties, while personal care manufacturers use it in acne treatment and exfoliation products. Besides, the United States and European regulators have increased safety requirements for children's products but expanded allowances in food and beverage applications. CO2-based synthesis, achieving 92.68% yield, has improved production efficiency and reduced emissions. Moreover, the powder/crystal form leads the market due to its stability and applications in pharmaceutical and personal care products. This crystalline form is essential in topical treatments, including acne creams, anti-dandruff shampoos, and medicated patches. The pharmaceutical segment maintains growth through salicylic acid's use in over-the-counter and prescription products, supported by established regulatory frameworks in developed markets.

Global Salicylic Acid Market Trends and Insights

Increasing Demand for Salicylic Acid in the Pharmaceutical Industry

Pharmaceutical applications drive market expansion through expanding therapeutic indications and enhanced formulation technologies. Advanced delivery systems, particularly supramolecular formulations, demonstrate superior collagen density improvement and reduced skin irritation compared to conventional preparations, addressing historical limitations that constrained broader therapeutic adoption. Patent activity in pharmaceutical applications remains robust, with recent filings focusing on combination therapies and novel delivery mechanisms that enhance bioavailability while minimizing gastrointestinal side effects. The pharmaceutical segment benefits from established regulatory pathways and growing recognition of salicylic acid's anti-inflammatory properties beyond traditional dermatological applications. Moreover, the compound's established safety profile and regulatory approvals encourage manufacturers to incorporate it into various formulations. Key suppliers such as Hebei Jingye Group, Shandong Xinhua Company, and others play a significant role in producing pharmaceutical-grade salicylic acid for global markets. Finally, the surge in over-the-counter pharmaceutical products containing salicylic acid, driven by consumer preference for self-care solutions, also contributes significantly to the market's growth.

Rising Demand in Skincare and Personal Care Products

Consumer preference for scientifically validated active ingredients continues to drive the adoption of salicylic acid in cosmetic formulations. However, increasing regulatory scrutiny around safety is shaping how the ingredient is used. For instance, the European Commission's Scientific Committee on Consumer Safety recently limited the concentration of salicylic acid in children's cosmetic products to 0.1% for dermal applications, reflecting growing safety concerns while still allowing higher concentrations in adult products . In the United States, regulatory enforcement is also tightening, as evidenced by the United States Food and Drug Administration (FDA)'s warning letter to Skin Beauty Solutions regarding unapproved chemical peel products containing high concentrations of salicylic acid. This has prompted manufacturers to focus on developing compliant, safe formulations. Additionally, the Modernization of Cosmetics Regulation Act implements new registration requirements, increasing compliance standards and market entry protocols. Cosmetic and personal care manufacturers are integrating salicylic acid into formulations to address market demand for scientifically validated skincare products. Allergan Aesthetics, an AbbVie subsidiary, launched two SkinMedica products in April 2024 for acne treatment. The Acne Clarifying Treatment and Pore Purifying Gel Cleanser utilize 2% encapsulated salicylic acid for controlled release and reduced irritation.

Availability of Substitutes

Alternative active ingredients in pharmaceutical and cosmetic applications create competitive pressure, particularly in cost-sensitive market segments where efficacy differences may not justify premium pricing. Beta-hydroxy acids like betaine salicylate and alpha-hydroxy acids such as glycolic acid offer similar exfoliation benefits with potentially reduced irritation profiles, appealing to sensitive-skin consumers who experience adverse reactions to salicylic acid. In agricultural applications, synthetic plant growth regulators and alternative natural compounds compete for market share, though salicylic acid's dual role as both growth promoter and a disease resistance enhancer provides differentiation advantages. The availability of combination products that blend multiple active ingredients can reduce reliance on salicylic acid as a standalone component, particularly in cosmetic formulations where multi-functional ingredients command premium positioning. Patent expiration on key formulation technologies may accelerate generic competition and substitute adoption. Market dynamics favor products that demonstrate superior efficacy-to-irritation ratios, driving innovation in both salicylic acid formulations and competitive alternatives.

Other drivers and restraints analyzed in the detailed report include:

- Rise in Clean-Label Beverage Preservation Approvals

- Increasing Demand for Salicylic Acid in the Packaged Food Sector as a Food Preservative

- Price Volatility of Raw Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powder/crystal forms maintain market leadership with a 71.78% share in 2024, supported by established manufacturing processes and cost-effective production economics. Liquid formulations exhibit accelerated growth at 7.44% CAGR as manufacturers develop enhanced bioavailability and application convenience. Traditional powder forms benefit from stability advantages and established supply chain infrastructure, particularly in pharmaceutical applications where precise dosing and extended shelf life remain critical requirements.

The salicylic acid market demonstrates increased adoption of liquid formulations, attributed to their superior solubility, efficient skin absorption, and application convenience. These characteristics address market demand for ready-to-use cosmetic products, specifically in acne treatments, exfoliators, and clarifying toners. The efficacy of salicylic acid increases when formulated in stable liquid bases. Furthermore, emerging delivery systems, including transdermal patches and controlled-release gels, integrate the advantages of solid formulations' stability with liquid forms' rapid effectiveness. These advancements drive market demand for salicylic acid products that deliver optimal performance, minimize skin sensitivity, and provide efficient application methods.

The Global Salicylic Acid Market Analysis is Segmented by Application (Pharmaceuticals, Cosmetics and Personal Care, Food and Beverages, and Others), Form (Powder/Crystal and Liquid), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe maintains market leadership with a 31.17% share in 2024, supported by established pharmaceutical manufacturing infrastructure and stringent regulatory frameworks that validate product quality and safety standards. The region benefits from comprehensive regulatory oversight through the European Medicines Agency and national authorities, creating consumer confidence in salicylic acid-containing products while establishing clear compliance pathways for manufacturers. European manufacturers leverage advanced production technologies and established distribution networks to serve both domestic and export markets, with particular strength in high-value pharmaceutical and cosmetic applications.

The Asia-Pacific region emerges as the fastest-growing region, with a 9.83% CAGR through 2030, driven by expanding pharmaceutical manufacturing capacity, increasing agricultural applications, and rising consumer awareness of the benefits of active ingredients in personal care products. China leads regional growth through significant investments in manufacturing, including the establishment of new production facilities that incorporate environmental compliance measures and advanced process technologies. Moreover, North America represents a mature market with stable demand patterns across pharmaceutical, cosmetic, and emerging food preservation applications, supported by comprehensive regulatory frameworks and established consumer acceptance of active ingredient benefits. The United States Food and Drug Administration (FDA)'s clear guidance on salicylic acid use in various applications provides regulatory certainty that supports product development and market entry strategies.

South America, and Middle East and Africa (MEA) markets present growth opportunities for salicylic acid, driven by urbanization, higher disposable incomes, and increased demand for pharmaceutical and personal care products. Brazil and Mexico are experiencing growth in their domestic pharmaceutical manufacturing and over-the-counter skincare segments, leading to increased adoption of salicylic acid formulations. The Middle East and Africa (MEA) region shows increased consumer awareness of personal hygiene and skin health, resulting in higher demand for salicylic acid in acne treatments and exfoliating products. However, market growth faces constraints from limited manufacturing capabilities, varying regulations across regions, and dependence on imports. Global manufacturers are focusing on strategic partnerships and local presence to expand their market reach and establish stronger supply chains in these regions.

- Seqens Group

- Merck KGaA

- Thermo Fisher Scientific

- Cayman Chemical Company

- Siddharth Carbochem Products

- Lona Industries (Alta Laboratories)

- SimSon Pharma Limited

- Hebei Jingye Group

- Zhenjiang Gaopeng Pharmaceutical

- Spectrum Chemical Mfg

- Avantor Inc.

- Emco Group (Emco Dyestuff Pvt Ltd)

- Alpha Chemika

- Flychem Private Limited

- Central Drug House

- MedChemExpress

- The Andhra Sugars Limited.

- GFS Chemicals

- Plater Group

- Honeywell Research Chemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Salicylic Acid in the Pharmaceutical Industry

- 4.2.2 Rising Demand in Skincare and Personal Care Products

- 4.2.3 Rise in Clean-Label Beverage Preservation Approvals

- 4.2.4 Increasing Demand for Salicylic Acid in the Packaged Food Sector as a Food Preservative

- 4.2.5 Growing Need for Plant Growth Regulators

- 4.2.6 Increasing Consumer Preference for Dermatologically Tested and Natural Ingredients

- 4.3 Market Restraints

- 4.3.1 Availability of Substitutes

- 4.3.2 Price Volatality of Raw materials

- 4.3.3 Stringent Regulatory Approvals and Compliance Requirements

- 4.3.4 Potential Health Risks and Skin Sensitivities

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE, USD MN)

- 5.1 By Application

- 5.1.1 Pharmaceuticals

- 5.1.2 Cosmetics and Personal Care

- 5.1.3 Food and Beverages

- 5.1.4 Others

- 5.2 By Form

- 5.2.1 Powder/Crystal

- 5.2.2 Liquid

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Seqens Group

- 6.4.2 Merck KGaA

- 6.4.3 Thermo Fisher Scientific

- 6.4.4 Cayman Chemical Company

- 6.4.5 Siddharth Carbochem Products

- 6.4.6 Lona Industries (Alta Laboratories)

- 6.4.7 SimSon Pharma Limited

- 6.4.8 Hebei Jingye Group

- 6.4.9 Zhenjiang Gaopeng Pharmaceutical

- 6.4.10 Spectrum Chemical Mfg

- 6.4.11 Avantor Inc.

- 6.4.12 Emco Group (Emco Dyestuff Pvt Ltd)

- 6.4.13 Alpha Chemika

- 6.4.14 Flychem Private Limited

- 6.4.15 Central Drug House

- 6.4.16 MedChemExpress

- 6.4.17 The Andhra Sugars Limited.

- 6.4.18 GFS Chemicals

- 6.4.19 Plater Group

- 6.4.20 Honeywell Research Chemical

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK