PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846217

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846217

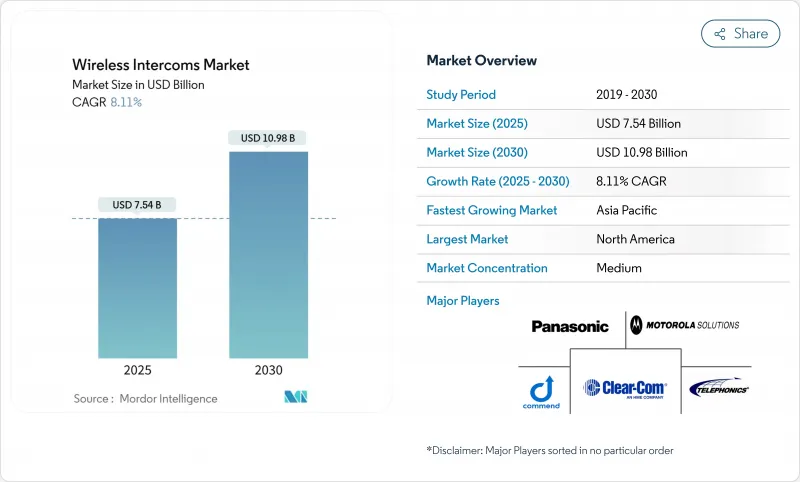

Wireless Intercoms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Wireless Intercoms Market size is estimated at USD 7.54 billion in 2025, and is expected to reach USD 10.98 billion by 2030, at a CAGR of 8.11% during the forecast period (2025-2030).

Demand follows the steady shift from hard-wired voice panels to IP-enabled, multi-modal systems that blend audio, video, and data across the same network backbone. Widespread digitization of building infrastructure, improved affordability of Wi-Fi 6E and private 5G radios, and occupational-safety rules that formalize hands-free communication are the primary growth levers. Competitive intensity is rising as cloud-native entrants bundle device management and analytics with hardware, creating lifetime value propositions that appeal to facility owners who lack in-house IT resources. Procurement patterns also favor scalable architectures that limit tooling downtime, trimming installation labor in an environment where RF-certified technicians remain scarce.

Global Wireless Intercoms Market Trends and Insights

Expanding demand for security and surveillance solutions

Integrated intercom platforms now feed audio streams directly into video analytics consoles so control-room operators can correlate spoken commands with visual alerts. Hospitals illustrate this convergence as Zenitel systems automatically escalate a distress call to security staff and lock designated access doors when embedded speech engines detect specific keywords. At major airports, Ericsson's private LTE backbone supports mission-critical push-to-talk between tarmac crews and tower staff, reducing taxi-time deviations and improving incident traceability. High-purity quartz shortages during 2024 highlighted supply-chain fragility, prompting facility owners to favor modular devices that can be swapped without re-certifying the entire array. Tight pairing of voice, video, and analytics shortens forensic investigation cycles, a decisive benefit for operators facing budget scrutiny. The result is a firm linkage between security-centric capital expenditure and wireless intercom adoption.

Proliferation of Wi-Fi/IP-based smart-home intercoms

Residential builders increasingly bundle voice panels with door cameras on the same Wi-Fi 6E network, simplifying low-voltage wiring plans and cutting commissioning time. CableLabs research confirms that the 6 GHz band alleviates earlier congestion that degraded voice quality in dense apartment blocks. AiphoneCloud lets installers troubleshoot devices remotely, lowering truck-roll costs and making subscription models more attractive to property managers. Hotels echo this IP trend; Stryker's Vocera badge integrates with property-management back-ends, allowing staff to receive housekeeping tasks as secure voice prompts rather than mobile app notifications that require screen interaction. The cumulative effect is faster refresh cycles for legacy analog door stations, reinforcing demand nodes for the wireless intercoms market.

RF interference and spectrum congestion

Six-gigahertz Wi-Fi channels are nearing saturation in high-rise dwellings, a problem visualized in CableLabs multi-floor simulations that reveal head-of-line blocking for low-latency traffic such as intercom voice. Shared-spectrum policies offer partial relief but add coordination overhead. Japan's Technical Regulations Conformity Certification requires each wireless appliance to pass separate band tests at 315 MHz, 400 MHz, 920 MHz, and 2.4 GHz, lengthening approval cycles. The US National Spectrum R&D Plan stresses dynamic sensing as a remedy, but large-scale deployment remains years away. In the interim, vendors integrate interference-rejection antennas that raise the bill of materials.

Other drivers and restraints analyzed in the detailed report include:

- Smart-building and infrastructure modernization wave

- Shift to full-duplex mesh intercoms in live events

- Cyber-security vulnerabilities in IP devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Security and surveillance accounted for 38% of the wireless intercoms market in 2024, underscoring the modality's central role in layered defense architectures. The segment benefits from mandatory access-control upgrades in airports, hospitals, and data centers, where voice verification now complements biometric scans. Suppliers differentiate by embedding noise cancellation and AI keyword spotting that escalate alerts without operator input. Event management, while smaller in absolute revenue, is forecast to post a 9.5% CAGR, propelled by full-duplex mesh radios that let show directors coordinate light cues, pyrotechnics, and broadcast links in real time. Healthcare keeps adopting intercom-driven workflow automation; Zenitel's turbine units integrate with nurse-call middleware so staff can triage before entering isolation wards, cutting personal-protective gear use. Logistics firms deploy truck-scale intercoms that pair with weigh-bridge software, slashing idle time and minimizing driver-dock interactions, a feature validated in Zenitel-B-TEK pilots.

Event production's embrace of wireless comms is visible in multi-venue contracts that specify roaming capability across auditoriums, stadiums, and temporary marquees. Hospitality chains gravitate toward discreet badge-style devices that mesh with property-management software, ensuring housekeeping can signal engineering without two-way radios that may disturb guests. Heavy-industry sites demand intrinsically safe housings and wide-area horns linked to the same talk paths, an offering INDUSTRONIC couches as a "one network, all alarms" proposition. Education campuses opt for mass-notification integration, enabling simultaneous lockdown announcements and intercom overrides from a single GUI. Collectively, application diversity cements multiprotocol compatibility as a must-have feature across the wireless intercoms market.

The Wireless Intercoms Market Report is Segmented by Application (Security and Surveillance, Event Management, Hospitality, Transportation and Logistics, Healthcare, and More), Technology (Wi-Fi/IP, DECT 6. 0, Digital UHF/VHF [MURS, FRS, Etc. ], LTE/5G Cellular, and Zigbee/Bluetooth), End-Use Sector (Residential, Commercial, Enterprise/Corporate Campuses, Government and Public Safety, and Others), and Geography.

Geography Analysis

North America generated 36.2% of 2024 revenue, buoyed by stringent OSHA mandates and mature indoor-coverage infrastructure that favors early adoption of private 5G intercoms. Large system integrators lock in long-term maintenance contracts, enabling sustained upgrade cycles. Fiscal 2025 procurement sees airports prioritizing redundant talk paths after FAA ground-stop incidents underscored voice resiliency gaps. The National Spectrum R&D Plan's backing for dynamic sharing experiments adds policy certainty that encourages vendor R&D spend.

Asia Pacific posts the fastest 10.9% CAGR. China's "Signal Upgrade" mission funnels state and private capital into indoor mobile coverage across 120,000 venues, creating a platform for wireless intercom rollouts. India's telecom sector, worth INR 2.4 trillion (USD 29.0 billion) in FY24, benefits from a regulatory quality-rating tool that prods landlords to install high-availability connectivity, lifting intercom attach rates. Japanese compliance testing ensures low emissions gear, spurring domestic suppliers to embed interference-mitigation filters that later become export advantages.

Europe registers steady growth on the back of energy-efficient smart-building retrofits. Directive-led targets for carbon neutrality by 2030 require converged networks that reduce cabling duplication. EU Worker Safety regulations classify full-duplex voice as a critical control measure in high-noise zones, energizing demand for ATEX-rated intercoms. South America and the Middle East & Africa see intercom adoption ride on transportation upgrades, metros in Sao Paulo and Riyadh specify IP voice along platform edges, and hospitality expansions linked to tourism corridors.

- Aiphone Co. Ltd

- Panasonic Corp.

- Clear-Com (HME)

- Motorola Solutions

- Zenitel NV

- Commend International GmbH

- RTS Intercom Systems (Bosch)

- Riedel Communications

- Sena Technologies

- Telephonics Corp.

- Axis Communications

- Dahua Technology

- Godrej Security Solutions

- Honeywell International

- Hytera Communications

- JVCKenwood Corp.

- 2N Telekomunikace (Axis)

- ButterflyMX

- DoorBird (Bird Home Automation)

- Alpha Communications

- Siedle and Sohne

- Akuvox

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding demand for security and surveillance solutions

- 4.2.2 Proliferation of Wi-Fi/IP-based smart-home intercoms

- 4.2.3 Smart-building and infrastructure modernization wave

- 4.2.4 Shift to full-duplex mesh intercoms in live events

- 4.2.5 Occupational-safety rules mandating hands-free comms

- 4.2.6 LTE/5G site-based systems for temporary job sites

- 4.3 Market Restraints

- 4.3.1 RF interference and spectrum congestion

- 4.3.2 Cyber-security vulnerabilities in IP devices

- 4.3.3 Shortage of RF-IT skilled installers

- 4.3.4 Global spectrum-licence fragmentation

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Security and Surveillance

- 5.1.2 Event Management

- 5.1.3 Hospitality

- 5.1.4 Transportation and Logistics

- 5.1.5 Healthcare

- 5.1.6 Industrial and Manufacturing

- 5.1.7 Education

- 5.1.8 Others

- 5.2 By Technology (Connectivity)

- 5.2.1 Wi-Fi/IP

- 5.2.2 DECT 6.0

- 5.2.3 Digital UHF/VHF (MURS, FRS, etc.)

- 5.2.4 LTE/5G Cellular

- 5.2.5 Zigbee/Bluetooth

- 5.3 By End-use Sector

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Enterprise/Corporate Campuses

- 5.3.4 Government and Public Safety

- 5.3.5 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Argentina

- 5.4.2.2 Brazil

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Aiphone Co. Ltd

- 6.4.2 Panasonic Corp.

- 6.4.3 Clear-Com (HME)

- 6.4.4 Motorola Solutions

- 6.4.5 Zenitel NV

- 6.4.6 Commend International GmbH

- 6.4.7 RTS Intercom Systems (Bosch)

- 6.4.8 Riedel Communications

- 6.4.9 Sena Technologies

- 6.4.10 Telephonics Corp.

- 6.4.11 Axis Communications

- 6.4.12 Dahua Technology

- 6.4.13 Godrej Security Solutions

- 6.4.14 Honeywell International

- 6.4.15 Hytera Communications

- 6.4.16 JVCKenwood Corp.

- 6.4.17 2N Telekomunikace (Axis)

- 6.4.18 ButterflyMX

- 6.4.19 DoorBird (Bird Home Automation)

- 6.4.20 Alpha Communications

- 6.4.21 Siedle and Sohne

- 6.4.22 Akuvox

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment