PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846223

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846223

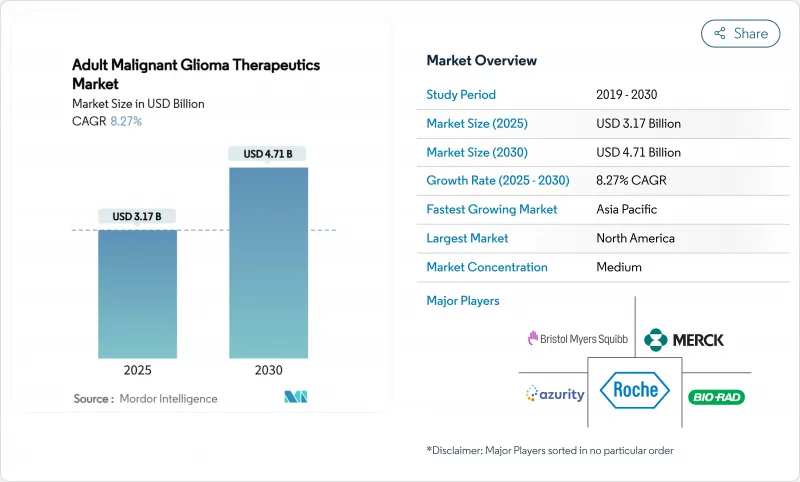

Adult Malignant Glioma Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Adult Malignant Glioma Therapeutics Market size is estimated at USD 3.17 billion in 2025, and is expected to reach USD 4.71 billion by 2030, at a CAGR of 8.27% during the forecast period (2025-2030).

Pipeline momentum stems from the FDA's fast-track and breakthrough programs, which shorten review timelines for first-in-class assets such as LP-184, and from AI-driven diagnostic tools that improve tumor characterization and treatment matching. Venture capital continues to flow into precision platforms, while large pharmaceutical firms consolidate targeted portfolios to offset temozolomide resistance and the blood-brain-barrier delivery challenge. Regionally, North America anchors commercial uptake through reimbursement support, yet hospital network expansion and regulatory harmonization in Asia Pacific are catalyzing the next demand wave. Parallel growth opportunities arise in device-based modalities like Tumor Treating Fields (TTFields), biosimilar bevacizumab launches, and cell-based therapies that register favorable stable-disease rates in early studies.

Global Adult Malignant Glioma Therapeutics Market Trends and Insights

Rising Incidence of Malignant Gliomas

Epidemiological projections indicate that Asian glioma cases will jump 39.3% by 2040, fundamentally shifting the Adult malignant glioma therapeutics market toward emerging economies. Improved imaging infrastructure now detects tumors earlier, adding previously undocumented patients to national registries. Younger Asian cohorts also present higher treatment tolerance, encouraging localized clinical trials and region-specific protocol adjustments. Survival rates from leading Chinese centers already surpass many Western benchmarks, implying potential biological or care-pathway differences. Drug developers therefore increase trial footprints in China, India, and South Korea to validate molecularly targeted regimens in genetically diverse populations.

Sustained Public-Sector R&D Funding

The adult malignant glioma therapeutics market benefits from government spending that offsets early-stage risk. The California Institute for Regenerative Medicine has allocated USD 11 million to UCSF's CAR-T glioblastoma program, complementing NIH and DoD line items aimed at brain cancer. Europe mirrors this trajectory through Horizon Europe grants that underpin the LEGATO study, which enrolls 411 patients at 43 sites across 11 countries. Public co-funding stretches beyond direct grants to include tax incentives and academic-industry incubators, thereby lowering capital barriers for first-in-class concepts such as synNotch cell therapies and nanoparticle delivery vehicles.

Low Late-Stage Trial Success Rates

Success rates in phase 3 glioblastoma programs remain below 5%, eroding investor confidence and inflating capital requirements. The Adult malignant glioma therapeutics market therefore witnesses portfolio diversification as companies balance high-risk CNS assets with solid-tumor franchises. Failures often stem from off-target toxicity, insufficient blood-brain-barrier penetration, or control-arm outperformance. Each setback can wipe USD 500 million in sunk costs, driving partnerships that share financial exposure. Venture syndicates react by inserting stringent milestone-based tranched financing, prolonging timelines for smaller entrants.

Other drivers and restraints analyzed in the detailed report include:

- Fast-Track & Breakthrough Designations for Novel Devices

- AI-Enabled Early Diagnosis & Treatment Planning

- Rapid Emergence of Temozolomide Resistance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Glioblastoma multiforme led with 58.38% of the adult malignant glioma therapeutics market share in 2024, a level that steered sponsor focus toward blood-brain-barrier penetration chemistry and adaptive trial designs. Anaplastic oligodendroglioma, aided by IDH-targeted breakthroughs such as vorasidenib, is registering a 9.41% CAGR to 2030 and is on course to raise its contribution to the Adult malignant glioma therapeutics market size in absolute terms. Anaplastic astrocytoma garners steady funding for combination regimens, while anaplastic oligoastrocytoma benefits from refined WHO re-classification that funnels patients into mutation-specific protocols.

The success of vorasidenib, which delivered 27.7-month median progression-free survival against 11.1 months for placebo, illustrates how genotype-guided design outperforms histology-centric approaches. As panel sequencing becomes routine, developers can match small-molecule libraries to well-defined subpopulations, improving statistical power in trials and facilitating conditional approvals. The Adult malignant glioma therapeutics market therefore shifts toward smaller, faster studies that direct capital efficiency toward high-response cohorts.

The Adult Malignant Glioma Therapeutics Market Report is Segmented by Disease Type (Glioblastoma Multiforme, Anaplastic Astrocytoma, Anaplastic Oligodendroglioma, and More), Therapy (Chemotherapy, Targeted Therapy, Immunotherapy, Device-Based Therapy, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 41.84% of the Adult malignant glioma therapeutics market size in 2024, supported by robust reimbursement schemes, NCI-designated trial networks, and high diagnosis rates. The United States leads in fast-track designations, enabling products like vorasidenib to move from pivotal data to approval within a year. Canada integrates provincial health technology assessments that expedite reimbursement once Health Canada decisions align with FDA precedents.

Asia Pacific is the fastest-growing theatre at an 11.92% CAGR, adding modern radiotherapy suites and accelerating inclusion of Chinese, Japanese, and South Korean centers in global protocols. Superior survival metrics reported by large tertiary hospitals in Beijing and Shanghai have triggered comparative-effectiveness collaborations to decode protocol differences. Harmonized rules under the ASEAN Mutual Recognition Arrangement further reduce barriers for device-based therapies, positioning the region as a volume and innovation hub.

Europe posts stable momentum as EMA's Project Orbis shortens market entry gaps. Germany, France, and the United Kingdom dominate trial starts, while Southern and Eastern European countries benefit from pan-regional ethical-review alignment. Horizon Europe grants finance multi-national datasets such as LEGATO, reinforcing investigator-initiated evidence generation that feeds directly into NICE and G-BA decisions. The Adult malignant glioma therapeutics market thus enjoys continent-wide platform harmonization, improving sponsor ROI on pivotal enrollment.

- Roche

- Merck

- Pfizer

- Novocure

- Bristol-Myers Squibb

- Amgen

- Abbvie

- AstraZeneca

- Chimerix

- DelMar Pharma

- Sumitomo Heavy Industries

- TAE Life Sciences

- Bluebird Bio

- Immunomic Therapeutics

- Ono Pharma

- GlaxoSmithKline

- Novartis

- Boehringer Ingelheim

- Servier

- Sun Pharmaceuticals Industries

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Incidence of Malignant Gliomas

- 4.2.2 Sustained Public-Sector R&D Funding

- 4.2.3 Fast-Track & Breakthrough Designations for Novel Devices

- 4.2.4 Ai-Enabled Early Diagnosis & Treatment Planning

- 4.2.5 Venture Capital Surge into BNCT Platforms

- 4.2.6 Availability of Bevacizumab Biosimilars

- 4.3 Market Restraints

- 4.3.1 Low Late-Stage Trial Success Rates

- 4.3.2 Rapid Emergence of Temozolomide Resistance

- 4.3.3 Boron-10 Isotope Supply-Chain Bottlenecks

- 4.3.4 Oncology R&D Capital Diverted to Higher-Incidence Tumors

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Disease Type

- 5.1.1 Glioblastoma Multiforme

- 5.1.2 Anaplastic Astrocytoma

- 5.1.3 Anaplastic Oligodendroglioma

- 5.1.4 Anaplastic Oligoastrocytoma

- 5.1.5 Other High-Grade Gliomas

- 5.2 By Therapy

- 5.2.1 Chemotherapy

- 5.2.1.1 Temozolomide

- 5.2.1.2 Lomustine

- 5.2.1.3 Carmustine

- 5.2.1.4 Bevacizumab

- 5.2.1.5 Other Alkylating Agents

- 5.2.2 Targeted Therapy

- 5.2.2.1 EGFR Inhibitors

- 5.2.2.2 VEGF/VEGFR Inhibitors

- 5.2.2.3 IDH Inhibitors

- 5.2.3 Immunotherapy

- 5.2.3.1 Checkpoint Inhibitors

- 5.2.3.2 CAR-T/NK Cell Therapy

- 5.2.3.3 Oncolytic Viruses

- 5.2.4 Device-Based Therapy

- 5.2.5 Radiation Therapy

- 5.2.6 Gene & Cell Therapy

- 5.2.1 Chemotherapy

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 F. Hoffmann-La Roche

- 6.3.2 Merck & Co.

- 6.3.3 Pfizer

- 6.3.4 Novocure

- 6.3.5 Bristol-Myers Squibb

- 6.3.6 Amgen

- 6.3.7 AbbVie

- 6.3.8 AstraZeneca

- 6.3.9 Chimerix

- 6.3.10 DelMar Pharma

- 6.3.11 Sumitomo Heavy Industries

- 6.3.12 TAE Life Sciences

- 6.3.13 Bluebird Bio

- 6.3.14 Immunomic Therapeutics

- 6.3.15 Ono Pharma

- 6.3.16 GlaxoSmithKline

- 6.3.17 Novartis

- 6.3.18 Boehringer Ingelheim

- 6.3.19 Servier

- 6.3.20 Sun Pharma

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment