PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846226

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846226

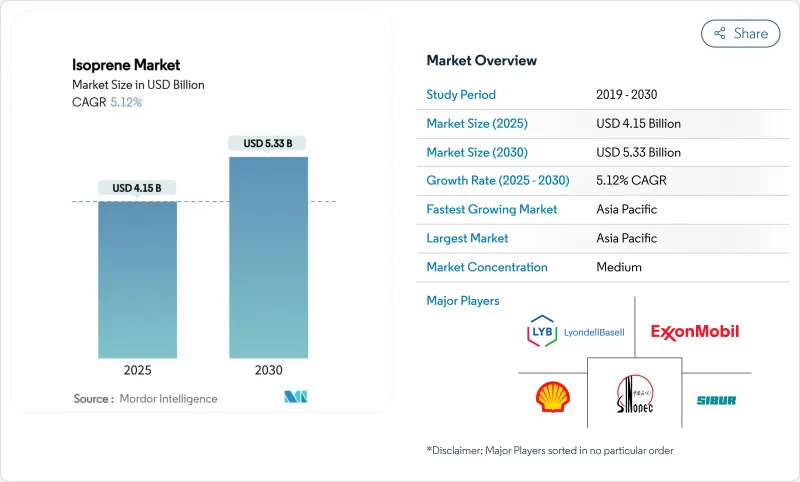

Isoprene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The isoprene market is valued at USD 4.15 billion in 2025 and is forecast to reach USD 5.33 billion in 2030, reflecting a 5.12% CAGR over the period.

Growth is propelled by automakers' shift toward high-performance synthetic elastomers for electric-vehicle (EV) tires, expanding bio-based feedstock trials, and Asia-Pacific's dominance in manufacturing that supplies over half of global volumes. Polymer-grade materials retain a premium as tire manufacturers prioritize consistent cure rates, while healthcare demand for ultra-pure polyisoprene accelerates on the back of medical-device innovation. Bio-fermentation routes gain strategic importance as petrochemical producers hedge crude-oil volatility through renewable integration, supported by recent capital flows into fermentation start-ups. Competitive intensity rises as fermentation specialists and alternative-rubber innovators challenge conventional C5-cracking economics, nudging incumbents toward joint ventures and feedstock diversification.

Global Isoprene Market Trends and Insights

EV-Led Surge in Synthetic-Rubber Demand for High-Performance Tires

Higher torque loads in EVs mandate polymers with superior tensile strength and reduced rolling resistance, directing tire makers toward consistent isoprene formulations that natural rubber cannot guarantee. The US EPA notes over 3 billion tires produced annually, with EV-specific compounds requiring enhanced durability for battery-range preservation. Michelin's exploration of bio-based synthetic rubber underscores the redesign imperative facing tire compounds. Asia-Pacific's EV manufacturing concentration magnifies regional pull for isoprene, thereby sustaining a structural uplift in demand beyond the typical replacement cycle.

Investments in Bio-Based Isoprene Routes to Cut Petro-Feedstock Risk

Fermentation technologies such as IFPEN's Atol and the BioButterfly project confirm the technical feasibility of converting renewable ethanol into polymer-grade isoprene. Global Bioenergies' industrial isobutene output and Insempra's USD 20 million funding round highlight the growing investor appetite for renewable C5 chemistry. Cost-parity forecasts indicate fermentation will approach petro-routes within the forecast window, particularly in regions with surplus bio-ethanol.

Crude-Oil Feedstock Price Volatility Widening Producer Margins

Refinery utilization swings alter C5 fraction availability, pushing input costs higher for non-integrated processors and squeezing margins during crude-price spikes. Although bio-based routes offer price stability, current sugarcane-derived options command premiums between 280% and 752% over fossil routes, challenging near-term competitiveness.

Other drivers and restraints analyzed in the detailed report include:

- Rising Healthcare Demand for Ultra-Pure Polyisoprene Medical Devices

- Asia-Pacific Automotive Capacity Expansion Boosting C5 Extraction

- Stricter Workplace Exposure Limits for Isoprene Monomer (Carcinogen)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polymer grade commanded 62.95% of 2024 revenue and is forecast to advance at 6.19% CAGR to 2030, mirroring demand for uniform cure rates in EV tires. Producers deploy advanced polymerization to achieve lower branching and higher molecular weights that curb heat build-up, benefiting tire longevity. Chemical grade continues serving niche intermediates but faces gradual share erosion as automotive and healthcare sectors value polymer consistency. Elevated purity requirements for surgical devices sustain premium pricing and insulate supply contracts from cyclical auto demand.

The Isoprene Market Report is Segmented by Grade (Polymer Grade and Chemical Grade), Production Route (Petrochemical C5 Cracking, Bio-Based Fermentation, and Catalytic Conversion of Bio-Ethanol), Application (Tyres, Healthcare, Apparels and Footwear, and Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's isoprene market size hit USD 2.15 billion in 2025, and proximity to automotive OEMs offers freight savings that strengthen regional supply stability. China invests in elastomer self-sufficiency through processing advancements that bridge natural and synthetic rubber capability gaps. India's chemical-industrial growth broadens downstream demand, while Thailand's bio-ethylene hub creates a springboard for renewable C5 integration.

North American producers expand bio-polymer capacity to 260 kt per year, reflecting corporate attention to consumer pressure for sustainable tires and medical devices. The European Union's decarbonization policies steer investment toward fermentation and catalytic conversion platforms. Health Canada's carcinogen classification influences procurement, prompting OEMs to favor suppliers with robust safety protocols. South America's sugarcane value chain presents a strategic opportunity once cost premiums shrink. Middle Eastern complexes bundle inexpensive Naphtha feed with export logistics that reach Africa's emerging automotive hubs, while African demand growth hinges on vehicle assembly expansion and infrastructure improvement.

- Braskem

- Chevron Phillips Chemical Company LLC.

- China Petrochemical Corporation

- ENEOS Corporation

- Exxon Mobil Corporation

- JSR Corporation

- Kraton Corporation

- KURARAY CO., LTD.

- LLC Tolyattikauchuk

- LOTTE Chemical CORPORATION

- LyondellBasell Industries Holdings B.V.

- PJSC SIBUR Holding

- Shell plc

- The Goodyear Tire & Rubber Company

- Zeon Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-led surge in synthetic-rubber demand for high-performance tyres

- 4.2.2 Investments in bio-based isoprene routes to cut petro-feedstock risk

- 4.2.3 Rising healthcare demand for ultra-pure polyisoprene medical devices

- 4.2.4 Asia-Pacific automotive capacity expansion boosting C5 extraction

- 4.2.5 3-D-printed footwear adopting isoprene-based thermoplastic elastomers

- 4.2.6 Low-VOC interior adhesives shifting towards low-odor polyisoprene

- 4.3 Market Restraints

- 4.3.1 Crude-oil feedstock price volatility widening producer margins

- 4.3.2 Stricter workplace exposure limits for isoprene monomer (carcinogen)

- 4.3.3 Fermentation scale-up bottlenecks delaying commercial BioIsoprene

- 4.3.4 Competition from guayule & dandelion natural-rubber alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Grade

- 5.1.1 Polymer Grade

- 5.1.2 Chemical Grade

- 5.2 By Production Route

- 5.2.1 Petrochemical C5 Cracking

- 5.2.2 Bio-based Fermentation

- 5.2.3 Catalytic Conversion of Bio-Ethanol

- 5.3 By Application

- 5.3.1 Tyres

- 5.3.2 Heathcare

- 5.3.3 Apparels and Footwear

- 5.3.4 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Braskem

- 6.4.2 Chevron Phillips Chemical Company LLC.

- 6.4.3 China Petrochemical Corporation

- 6.4.4 ENEOS Corporation

- 6.4.5 Exxon Mobil Corporation

- 6.4.6 JSR Corporation

- 6.4.7 Kraton Corporation

- 6.4.8 KURARAY CO., LTD.

- 6.4.9 LLC Tolyattikauchuk

- 6.4.10 LOTTE Chemical CORPORATION

- 6.4.11 LyondellBasell Industries Holdings B.V.

- 6.4.12 PJSC SIBUR Holding

- 6.4.13 Shell plc

- 6.4.14 The Goodyear Tire & Rubber Company

- 6.4.15 Zeon Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-needs assessment

- 7.2 Introducing New Manufacturing Techniques to Reduce Hazardous Waste