PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846227

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846227

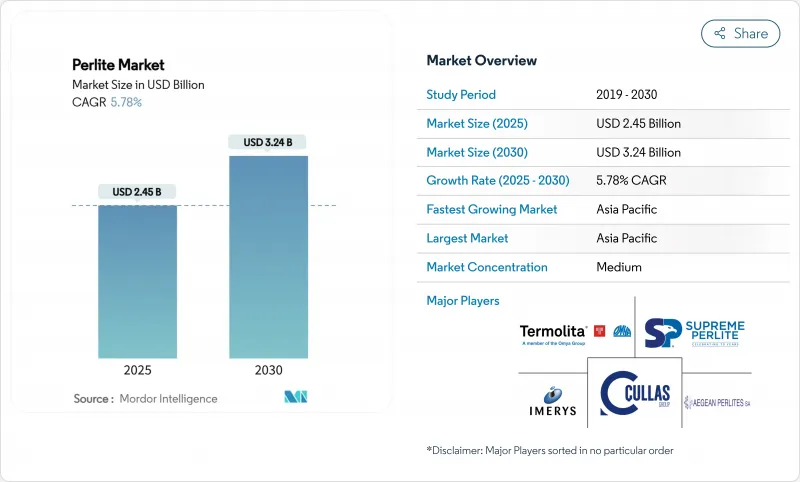

Perlite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Perlite Market size is estimated at USD 2.45 Billion in 2025, and is expected to reach USD 3.24 Billion by 2030, at a CAGR of 5.78% during the forecast period (2025-2030).

The outlook reflects strong demand for lightweight aggregates in energy-efficient construction, horticulture, precision filtration and cryogenic insulation. Construction codes that tighten thermal-performance benchmarks, especially in Europe and North America, reinforce volume growth, while rapid urbanization in the Asia Pacific creates large-scale infrastructure demand. Specialty grades for cryogenic storage, craft-beverage filtration and cosmetics deliver higher margins and anchor product innovation. Supply remains adequate because of abundant volcanic ore in Turkey and the United States, yet logistics costs influence regional pricing differentials.

Global Perlite Market Trends and Insights

Growth in Lightweight Construction Demand

Perlite concrete and plasters lower structural load without sacrificing thermal performance, enabling taller buildings on smaller foundations . Transportation savings arise because expanded particles weigh up to 80% less than sand and gravel. Modular building factories increasingly specify Perlite-enhanced panels to shorten on-site assembly time and meet stringent thermal-bridge limits. Prefabrication lines benefit from the mineral's consistency, which improves batching accuracy and reduces rejects. Long-term urbanization in China, India and the ASEAN bloc positions the Perlite market as a preferred source of lightweight aggregates for sustainable, high-rise construction.

Horticulture & Hydroponics Adoption Boom

Controlled-environment farms value Perlite for sterile, pH-neutral, reusable substrates that retain moisture while preventing root rot. Commercial greenhouses in the United States and the Netherlands report yield gains when Perlite replaces peat-heavy mixes. Vertical-farm operators choose coarse grades that allow automated fertigation systems to maintain precise oxygen levels. Specialty growers of medical cannabis pay premium prices for ultra-clean grades certified for pharmaceutical cultivation. Expanding urban agriculture in Southeast Asia positions local processors to supply fresh media without high freight costs, underpinning regional Perlite market demand.

Readily Available Substitutes

Vermiculite, rock wool, and expanded clay compete directly on weight and R-value, while glass wool often offers a lower installed cost in large-scale commercial projects. Recycled expanded polystyrene (EPS) beads gain share in light screeds that do not require high service temperatures. In filtration, engineered synthetic media achieve narrower cut-off thresholds, threatening Perlite's position in sterile pharmaceutical lines. Horticulture faces bio-based rivals such as coconut coir that claim superior sustainability credentials. Product innovation and application support remain crucial for Perlite suppliers to defend their share in price-sensitive niches.

Other drivers and restraints analyzed in the detailed report include:

- Rising Metallurgical Insulation Requirements

- Energy-efficient Building Codes Tightening

- Volatile Bulk-shipping Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Expanded Perlite secured a 67.56% share of the Perlite market in 2024, reflecting broad acceptance in construction plasters, horticultural mixes, and industrial loose-fill insulation. Mature adoption keeps prices competitive, and suppliers emphasize logistics efficiency and ore purification to safeguard margins. Specialty producers now promote higher-density Vapex and coated grades that resist dusting inside cryogenic tanks, while cosmetic manufacturers demand finely classified powders for facial scrubs. The emerging specialty tier is projected to expand at a 6.45% CAGR to 2030, absorbing research and development (R&D) spend focused on surface functionalization.

Vapex & Specialty Grades add disproportionate value because technical thresholds govern approval in pharmaceutical filtration and space-constrained LNG modules. Processors apply silane or polymeric treatments that raise unit pricing several-fold relative to commodity expanded Perlite. Agro-Perlite maintains steady volumes in greenhouses that appreciate its balanced water-holding capacity and neutral pH. Other product types, including lump ore for foundry slag removal, occupy smaller niches yet benefit from captive customer relationships. The portfolio mix indicates a Perlite market trend toward bifurcation, high-volume commoditized insulation on one flank and low-volume, high-value engineered grades on the other.

The Perlite Market Report is Segmented by Product Type (Expanded Perlite, Agro-Perlite, and More), Application (Insulation, Fire-Proofing & Refractory, and More), End-Use Industry (Construction & Infrastructure, Horticulture & Agriculture, Industrial Manufacturing, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific accounted for 48.75% consumption in 2024 and is set to expand at a 6.88% CAGR through 2030. China's 14th Five-Year Plan emphasizes prefabricated housing and green buildings, both heavy consumers of lightweight aggregates. India's Smart Cities Mission funds mixed-use developments that use Perlite panels to reduce dead load and renovation timelines. Japan, South Korea, and Taiwan demand ultra-clean grades for electronics fabs and high-tech greenhouses. Domestic processors in Indonesia and the Philippines back-integrate into ore mining to reduce import reliance.

North America remains a technology and specialty-grade stronghold. United States LNG-export terminals in Texas and Louisiana consume loose-fill Perlite for 100-million-gal storage tanks, while Canadian cannabis producers buy horticultural grades in bulk. Energy codes such as American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) 90.1-2025 trigger deeper insulation retrofits, including Perlite cavity fills. Europe benefits from the EU zero-emission-building directive, with retrofit programs in Germany, France, and Italy accelerating mineral-based insulation uptake. Mediterranean ore supply from Greece and Turkey keeps landed cost competitive despite higher labor expenses.

South America and the Middle East & Africa together deliver a smaller yet strategic share. Brazil's protected Amazon region prompts urban centers to expand vertically, favoring lightweight, low-transport-energy aggregates. Chilean lithium brine operations adopt Perlite filter aids to remove fine particulates before evaporation. Gulf Cooperation Council countries insulate LNG transshipment hubs to mitigate desert heat, and South Africa's emerging greenhouse cluster sources horticultural Perlite to offset water scarcity. Although logistics and scale challenges persist, these regions present long-term upside for market participants that invest early.

- Aegean Perlites SA

- Ausperl Pty Ltd

- Azer Perlite Corporation

- Blue Pacific Minerals

- Carolina Perlite Co., Inc.

- Cullas Construction Materials Industry and Foreign Trade Inc.

- Dupre Minerals Ltd.

- Genper Group

- Imerys

- Keltech Energies Ltd.

- Omya AG

- Perlite Canada Inc.

- Profilytra BV

- Resonac

- Silbrico Corporation

- Supreme Perlite

- Omya International AG

- The Schundler Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Lightweight Construction Demand

- 4.2.2 Horticulture & Hydroponics Adoption Boom

- 4.2.3 Rising Metallurgical Insulation Requirements

- 4.2.4 Energy-efficient Building Codes Tightening

- 4.2.5 Expansion of Craft-beverage Filtration

- 4.3 Market Restraints

- 4.3.1 Readily Available Substitutes

- 4.3.2 Volatile Bulk-shipping Costs

- 4.3.3 Regional Depletion of High-grade Ore

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Expanded Perlite

- 5.1.2 Agro-Perlite

- 5.1.3 Vapex & Specialty Grades

- 5.1.4 Other Product Types

- 5.2 By Application

- 5.2.1 Insulation

- 5.2.2 Fillers

- 5.2.3 Fire-Proofing & Refractory

- 5.2.4 Filtration & Filter-Aid

- 5.2.5 Abrasives & Polishing

- 5.2.6 Soil Amendment/Horticulture

- 5.3 By End-Use Industry

- 5.3.1 Construction & Infrastructure

- 5.3.2 Horticulture & Agriculture

- 5.3.3 Industrial Manufacturing

- 5.3.4 Food & Beverage Processing

- 5.3.5 Oil & Gas/Cryogenic Storage

- 5.3.6 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 NORDIAC

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/ Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Aegean Perlites SA

- 6.4.2 Ausperl Pty Ltd

- 6.4.3 Azer Perlite Corporation

- 6.4.4 Blue Pacific Minerals

- 6.4.5 Carolina Perlite Co., Inc.

- 6.4.6 Cullas Construction Materials Industry and Foreign Trade Inc.

- 6.4.7 Dupre Minerals Ltd.

- 6.4.8 Genper Group

- 6.4.9 Imerys

- 6.4.10 Keltech Energies Ltd.

- 6.4.11 Omya AG

- 6.4.12 Perlite Canada Inc.

- 6.4.13 Profilytra BV

- 6.4.14 Resonac

- 6.4.15 Silbrico Corporation

- 6.4.16 Supreme Perlite

- 6.4.17 Omya International AG

- 6.4.18 The Schundler Company

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

- 7.2 Government Certification for its Consumption