PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846229

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846229

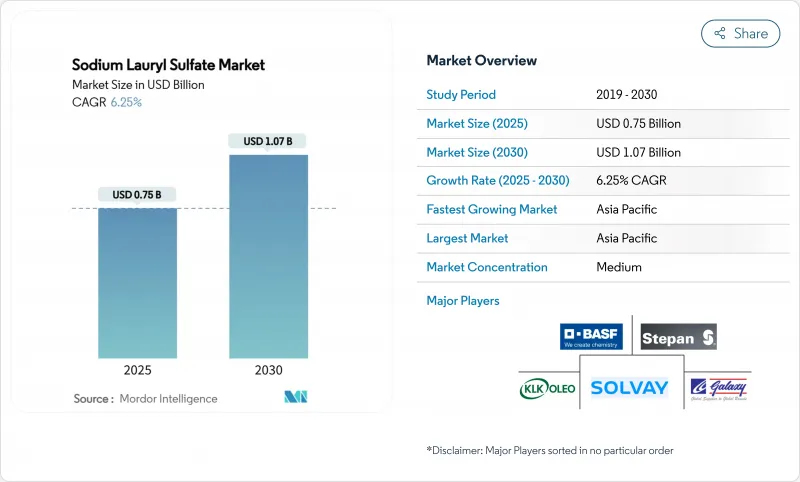

Sodium Lauryl Sulfate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Sodium Lauryl Sulfate Market size is estimated at USD 0.75 billion in 2025, and is expected to reach USD 1.07 billion by 2030, at a CAGR of 6.25% during the forecast period (2025-2030).

This momentum stems from the compound's entrenched role in detergents, personal-care products, oilfield chemicals, and crop-protection adjuvants, even as "sulfate-free" labeling pushes formulators toward milder alternatives. Feedstock volatility, especially in palm-derived fatty alcohols, is compressing producer margins and simultaneously highlighting cost advantages over fully bio-based surfactants. Capacity expansions in China, Malaysia, and Indonesia keep Asia-Pacific in a structural cost-lead position, while aggressive decarbonization programs by multinational majors safeguard the compound's regulatory acceptance in North America and Europe.

Global Sodium Lauryl Sulfate Market Trends and Insights

Demand Surge from Household Detergents and Cleaners

Surging appliance ownership and rising laundry frequency underpin the most resilient outlet for the sodium lauryl sulfate market demand. Formulators value the anionic surfactant's stability under hard-water conditions, enabling lower builder loading while preserving wash performance. Its foaming profile also allows concentrated liquids to deliver the sensory cues consumers expect, a critical success factor in emerging economies where visual foam is equated with efficacy. Reformulated high-efficiency laundry liquids rely on sodium lauryl sulfate's compatibility with protease, lipase, and cellulase enzymes, facilitating lower-temperature washes that trim energy bills. EPA Safer Choice recertification in 2024 further elevates the compound's status as a mainstream, regulatory-endorsed ingredient for mass-market cleaners.

Expansion of Personal-Care Manufacturing Bases in APAC

Massive capital projects, most notably BASF's USD 10 billion Zhanjiang Verbund complex, illustrate how brand owners are localizing ingredient supply to match explosive demand for hair-care and bath-care products in China, India, and Southeast Asia. Access to competitively priced palm lipid feedstocks and renewable electricity keeps unit costs low while trimming embedded carbon. The clustering effect attracts contract manufacturers and packaging suppliers, shortening lead times for global FMCG leaders. These dynamics strengthen the sodium lauryl sulfate market's resilience in APAC even as premium sulfate-free lines proliferate.

Human and Aquatic-Toxicity Concerns Driving "Sulfate-Free" Labeling

Although wash-off toxicology reviews from the FDA and the Cosmetic Ingredient Review reaffirm safety, social-media discussions amplify anecdotal scalp-irritation claims, pushing mid- to high-end hair-care brands toward sulfate-free positioning. These products achieve price premiums of 20-30% in North America. Retail shelf resets allocate dedicated "clean beauty" space, visibly fragmenting the sodium lauryl sulfate market in prestige segments. European eco-label schemes tighten discharge-toxicity thresholds, nudging institutional buyers of dish-wash liquids to pilot milder blends.

Other drivers and restraints analyzed in the detailed report include:

- Heightened Post-COVID Hygiene Focus in Emerging Economies

- Cost-Competitiveness Versus Bio-Based Surfactants

- Rapid Commercialization of Bio-Based and Mild Surfactant Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SLS Liquid captured 61.35% of 2024 revenue and is forecast to outpace the overall sodium lauryl sulfate market at a 6.85% CAGR. Inline dosing, fully automated batching, and instant solubility make liquids the default choice for megatonne detergent plants in China and the United States. Liquid format also minimizes dust exposure, a growing occupational-safety compliance priority. Dry SLS retains a foothold in export-driven textile auxiliaries and SDS-PAGE reagents, where lower freight mass drives logistics savings, but clocks sub-5% growth.

Formulators targeting concentrated pods or bar detergents add powder SLS for viscosity control and reduced water carry. Process improvements in spray-drying cut energy use by 15%, modestly improving powder economics. Even so, liquid capacity expansions announced for 2026 in Malaysia and Texas point to a continued tilt toward flowable formats in the sodium lauryl sulfate market.

The Sodium Lauryl Sulfate Report is Segmented by Product Form (Sodium Lauryl Sulfate (SLS) Liquid and Sodium Lauryl Sulfate (SLS) Dry), Grade (Industrial Grade, Cosmetic and Personal Care Grade, Pharmaceutical Grade, and Food Grade), End-User Industry (Detergents and Cleaners, Personal Care Products, Industrial Cleaners, and Other Applications), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific anchors 45.16% of global sales and will accelerate at 8.03% CAGR to 2030. Low-cost feedstock, robust consumer-goods output, and new oleochemical complexes in Malaysia, Thailand, and coastal China preserve the region's structural advantage. Zhanjiang Verbund alone supplies enough anionic surfactant base to serve one-third of the incremental APAC demand through 2030.

North America holds a mature yet steady position, bolstered by long-lived laundry-detergent brands and a vibrant oilfield-chemicals sector. Stepan's PerformanX acquisition expands value-added agriculture surfactant capacity, mitigating import reliance.

Europe grapples with stiffer regulatory overhead, but sodium lauryl sulfate remains entrenched in industrial dish-washers and fabric-care tablets, where biodegradability hurdles for newcomers are equally onerous. Digital labeling pilots under the revised Detergent Regulation funnel granular ingredient data to smartphones, nudging formulators toward traceable, certified-sustainable palm derivatives. Mid-tier manufacturers counter margin erosion by adopting biomass-balance models similar to BASF's EcoBalanced grades.

List of Companies Covered in this Report:

- Aarti Surfactants

- Alpha Chemicals Pvt Ltd

- BASF

- Croda International Plc

- Dongming Jujin Chemical Co., Ltd

- Dow

- Galaxy

- Indorama Ventures Public Company Limited.

- Kao Chemicals Europe, S.L.U.

- KLK OLEO

- Sasol Limited

- Solvay

- Spectrum Chemical

- Stepan Company

- Taiwan NJC Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand Surge from Household Detergents and Cleaners

- 4.2.2 Expansion of Personal-Care Manufacturing Bases in Asia-Pacific

- 4.2.3 Heightened Hygiene Focus in Emerging Economies

- 4.2.4 Cost-Competitiveness Versus Bio-Based Surfactants

- 4.2.5 Adoption in Adjuvant Systems for High-Value Herbicide Blends

- 4.3 Market Restraints

- 4.3.1 Human and Aquatic-Toxicity Concerns Driving "Sulfate-Free" Labeling

- 4.3.2 Rapid Commercialisation of Bio-Based and Mild Surfactant Substitutes

- 4.3.3 Palm-Kernel Oil Price Volatility Inflating Feedstock Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Form

- 5.1.1 Sodium Lauryl Sulfate (SLS) Liquid

- 5.1.2 Sodium Lauryl Sulfate (SLS) Dry

- 5.2 By Grade

- 5.2.1 Industrial Grade (Greater than or equal to 93% active)

- 5.2.2 Cosmetic and Personal Care Grade

- 5.2.3 Pharmaceutical Grade

- 5.2.4 Food Grade

- 5.3 By End-User Industry

- 5.3.1 Detergents and Cleaners

- 5.3.2 Personal Care Products

- 5.3.3 Industrial Cleaners

- 5.3.4 Other Applications (Oilfield Chemicals and Enhanced Oil Recovery, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Australia and New Zealand

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Aarti Surfactants

- 6.4.2 Alpha Chemicals Pvt Ltd

- 6.4.3 BASF

- 6.4.4 Croda International Plc

- 6.4.5 Dongming Jujin Chemical Co., Ltd

- 6.4.6 Dow

- 6.4.7 Galaxy

- 6.4.8 Indorama Ventures Public Company Limited.

- 6.4.9 Kao Chemicals Europe, S.L.U.

- 6.4.10 KLK OLEO

- 6.4.11 Sasol Limited

- 6.4.12 Solvay

- 6.4.13 Spectrum Chemical

- 6.4.14 Stepan Company

- 6.4.15 Taiwan NJC Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Growing Application Footprint Across Various Industries