PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846232

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846232

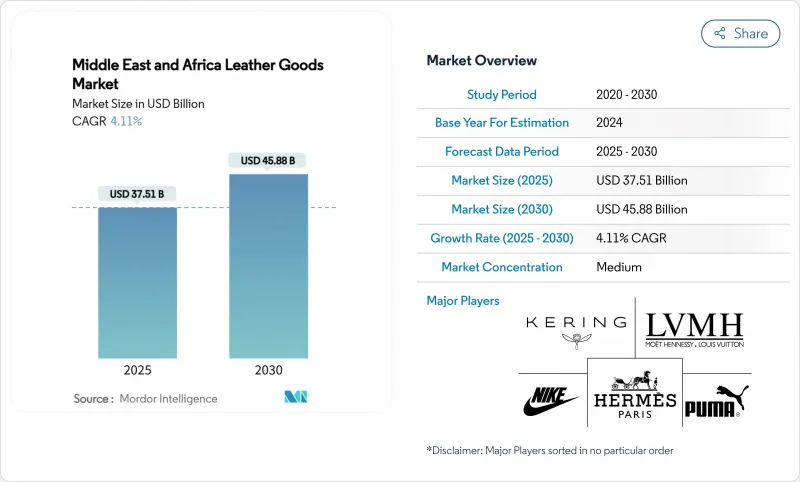

Middle East And Africa Leather Goods - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Middle East and Africa leather goods market size is estimated to be USD 37.51 billion in 2025, and is expected to reach USD 45.88 billion by 2030, at a CAGR of 4.11% during the forecast period (2025-2030).

The market's expansion is primarily attributed to the region's strategic economic diversification initiatives and increasing consumer purchasing power, particularly evident in Gulf Cooperation Council nations, where evolving luxury consumption behaviors are fundamentally restructuring traditional retail frameworks. Furthermore, the implementation of progressive regulatory reforms has facilitated enhanced foreign investment opportunities, establishing a robust foundation for sustained premium goods consumption across both mature and emerging consumer demographics. This market evolution reflects the region's broader economic transformation and increasing integration into global luxury retail networks, positioning it as a significant participant in the international leather goods trade.

Middle East And Africa Leather Goods Market Trends and Insights

Rising Demand for Luxury Goods

The Middle East and Africa (MEA) leather goods market is experiencing significant growth, driven by increasing demand for luxury products. Economic prosperity, particularly in Gulf Cooperation Council (GCC) countries, has increased consumer disposable income, enabling purchases of premium leather products. The average monthly household disposable income in Saudi Arabia amounted to SAR 11,839, based on the 2023 Household Income and Consumption Expenditure Statistics published by the General Authority for Statistics (GASTAT) . The region's young, fashion-conscious population actively seeks global luxury brands. The cultural significance of luxury goods in the Middle East and Africa (MEA) region, where leather products are viewed as symbols of status and achievement, further strengthens market demand. Consumers are drawn to leather goods for their durability, craftsmanship, and ability to convey social status.

Increasing Popularity of Synthetic (Vegan) Leather

The Middle East and Africa (MEA) leather goods market is experiencing significant growth driven by the rising demand for synthetic or vegan leather. This trend stems from increased environmental awareness, animal welfare concerns, and consumer preference for sustainable alternatives to traditional leather. Synthetic leather, including polyurethane (PU), bio-based, and plant-derived materials, offers reduced environmental impact compared to conventional leather production methods. Technological advancements have improved synthetic leather's quality, making it comparable to genuine leather in appearance, texture, and durability. This material serves in various applications across the fashion, footwear, and other industries. The region's ongoing urbanization and expanding middle-class population have increased the demand for affordable and durable goods, positioning synthetic leather as a practical choice that meets both economic and ethical considerations.

Environmental Concerns and Pollution

Environmental regulations increasingly restrict traditional leather production methods, requiring manufacturers to adopt cleaner technologies or risk losing market access. The Chouara tannery industry in Morocco exemplifies the challenge of balancing traditional methods with regulatory compliance. Water scarcity in the Middle East and North Africa region emphasizes the need for effluent reduction technologies, as conventional tanning processes require substantial water resources and generate ecosystem-impacting pollutants. The European Union's Ecodesign Regulation (ESPR), Regulation 2024/1781, imposes additional compliance requirements on manufacturers from the Middle East and African countries exporting to European markets, potentially constraining growth for companies that do not implement sustainable production practices. While these environmental requirements stimulate innovation in synthetic leather alternatives and cleaner production methods, they also increase operational costs, affecting price competitiveness in cost-sensitive market segments.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Manufacturing

- Fashion Trends and Consumer Preferences

- Counterfeit Products and Brand Dilution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Footwear holds a 33.83% market share in 2024, dominating the leather goods market due to its fundamental role in consumer wardrobes. The segment's strength comes from widespread demand for athletic footwear in mass markets and luxury leather shoes, particularly in Gulf countries where Italian and European premium brands maintain a significant presence. Additionally, accessories are projected to grow at 4.38% CAGR during 2025-2030, making it the fastest-growing segment. This growth reflects consumer preference for versatile luxury items that enhance multiple outfits without substantial wardrobe investments. Handbags contribute significantly to this expansion, notably in Nigeria, where domestic luxury brands gain international recognition through celebrity endorsements and cultural authenticity.

Luggage and clothing segments exhibit distinct growth patterns. The luggage segment benefits from increased business travel and tourism recovery across the region. According to UN Tourism, the Middle East recorded 95 million arrivals, performing 32% above pre-pandemic levels in 2024, with a 1% increase from 2023. Africa received 74 million arrivals, 7% higher than 2019 and 12% more than 2023 . The clothing segment faces competition from fast fashion alternatives that impact traditional leather garment categories.

Men account for 55.72% of the luxury leather goods market in 2024, primarily due to their established purchasing patterns in business and formal wear categories. This market share reflects the cultural emphasis on men's fashion and accessories across Middle Eastern and African markets. The women's segment is projected to grow at a 4.51% CAGR during 2025-2030, outpacing the men's category as female workforce participation and disposable income levels increase across the region.

The growth in women's consumption stems from fundamental socioeconomic changes, including higher education levels, career advancement, and evolving social norms. The United Arab Emirates (UAE) has implemented legal reforms permitting 100% foreign ownership in retail, enabling luxury brands to establish direct market operations and develop women-focused collections independently. This regulatory framework supports increased investment in female-oriented retail experiences and product development. The distinct growth rates between gender segments present opportunities for manufacturers to adjust their product portfolios while maintaining their existing customer base across both demographics.

The Middle East and Africa Leather Goods Market is Segmented by Product Type (Footwear, Handbags, Luggage, Accessories, and More), End User (Men, and Women), Category (Mass, and Premium), Distribution Channel (Offline Stores, and Online Stores), and Geography (South Africa, Saudi Arabia, United Arab Emirates, Nigeria, Egypt, Morocco, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Adidas AG

- Nike Inc.

- Puma SE

- LVMH Moet Hennessy Louis Vuitton SE

- Kering SA

- Tapestry Inc.

- Capri Holdings Limited

- Prada SpA

- Hermes International S.A.

- Salvatore Ferragamo SpA

- Fossil Group Inc.

- Chalhoub Group

- ECCO Sko A/S

- Charles & Keith Group

- C. & J. Clark International Limited

- Bata Corporation

- Azadea Group

- Derimod

- Nappa Dori Private Ltd

- Saudi Leather Industries Company

- Italian Shoe Factory

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand for Luxury Goods

- 4.2.2 Increasing Popularity of Synthetic (Vegan) Leather

- 4.2.3 Technological Advancements in Manufacturing

- 4.2.4 Fashion Trends and Consumer Preferences

- 4.2.5 Influence of Brand Awareness and Celebrity Endorsements

- 4.2.6 Focus on Craftsmanship and Premium Quality

- 4.3 Market Restraints

- 4.3.1 Environmental Concerns and Pollution

- 4.3.2 Counterfeit Products and Brand Dilution

- 4.3.3 Animal Welfare Issues

- 4.3.4 Supply Chain Disruptions

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Footwear

- 5.1.2 Handbags

- 5.1.3 Luggage

- 5.1.4 Accessories

- 5.1.5 Clothing

- 5.1.6 Other Product Types

- 5.2 By End User

- 5.2.1 Men

- 5.2.2 Women

- 5.3 By Category

- 5.3.1 Mass

- 5.3.2 Premium

- 5.4 By Distribution Channel

- 5.4.1 Offline Stores

- 5.4.2 Online Stores

- 5.5 By Geography

- 5.5.1 South Africa

- 5.5.2 Saudi Arabia

- 5.5.3 United Arab Emirates

- 5.5.4 Nigeria

- 5.5.5 Egypt

- 5.5.6 Morocco

- 5.5.7 Turkey

- 5.5.8 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Adidas AG

- 6.4.2 Nike Inc.

- 6.4.3 Puma SE

- 6.4.4 LVMH Moet Hennessy Louis Vuitton SE

- 6.4.5 Kering SA

- 6.4.6 Tapestry Inc.

- 6.4.7 Capri Holdings Limited

- 6.4.8 Prada SpA

- 6.4.9 Hermes International S.A.

- 6.4.10 Salvatore Ferragamo SpA

- 6.4.11 Fossil Group Inc.

- 6.4.12 Chalhoub Group

- 6.4.13 ECCO Sko A/S

- 6.4.14 Charles & Keith Group

- 6.4.15 C. & J. Clark International Limited

- 6.4.16 Bata Corporation

- 6.4.17 Azadea Group

- 6.4.18 Derimod

- 6.4.19 Nappa Dori Private Ltd

- 6.4.20 Saudi Leather Industries Company

- 6.4.21 Italian Shoe Factory

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK