PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846236

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846236

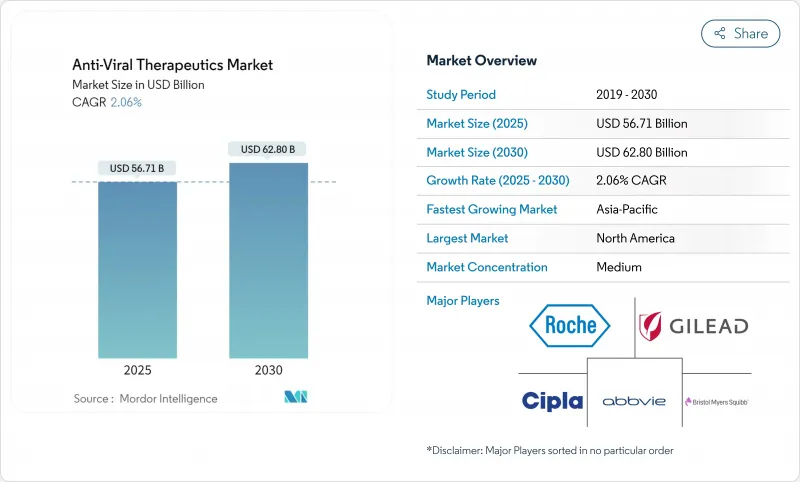

Anti-Viral Therapeutics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Anti-Viral Therapeutics market size is USD 56.71 billion in 2025 and is forecast to reach USD 62.80 billion by 2030 at a 2.06% CAGR, highlighting a stable but opportunity-rich arena where legacy small molecules meet high-value delivery innovations.

Long-acting formulations, AI-guided lead discovery, and government-backed broad-spectrum programs headline the current investment focus, while patent expiries on first-generation antivirals temper headline growth. Therapeutic developers are prioritizing real-world evidence packages to secure favorable reimbursement as price-control rules tighten in major economies. Competitive intensity remains moderate because scale players still dominate global distribution, yet differentiated biotech pipelines are attracting premium partnerships. The Anti-Viral Therapeutics market is also navigating supply-chain hardening, with cold-chain capacity expansions enabling wider access to biologics and long-acting injectables.

Global Anti-Viral Therapeutics Market Trends and Insights

Expanding Long-Acting Injectable Pipelines

Twice-yearly lenacapavir entered the Anti-Viral Therapeutics market in 2025 and immediately reframed adherence expectations by reducing clinic visits, a key barrier in low-resource settings. Proprietary nanocrystal carriers maintain drug levels for up to six months, improving viral suppression persistence and cutting monitoring costs. Building on this proof point, Merck's once-monthly oral MK-8527 flags a next wave where modified-release capsules rival injectables for convenience. Health-system capacity gains matter most in regions where over-burdened clinics hinder daily pill programs. Payers increasingly favor these regimens because fewer missed doses translate to lower progression-of-care costs. As manufacturing matures, pricing parity with daily orals is anticipated, accelerating global uptake beyond the early adopter markets that currently anchor volumes.

Surge in HIV Combination-Therapy Adoption

Clinical practice is pivoting from three-drug backbones toward dual or long-acting pairings that limit cumulative toxicity while sustaining undetectable viral loads . Co-formulations such as lenacapavir plus islatravir seek to lock in multi-mechanism coverage against resistance, and GSK-ViiV's VH499/VH184 program echoes the same strategy in a novel target space. Regulators are rewarding these fixed-dose combinations with priority reviews because the adherence upside generates downstream public-health benefits. For pharmaceutical incumbents that face generic erosion on older protease inhibitors, next-generation combos deliver a defendable margin and extend brand lifecycles. The Anti-Viral Therapeutics market benefits from higher per-patient values, while patients see fewer pills and reduced drug-drug interaction risk as they age with comorbidities.

AI-Enabled Nucleos(t)ide Analog Design

Machine-learning models trained on viral polymerase structures are cutting years from analog optimization by predicting binding affinity and metabolic liabilities in silico. Exscientia's pipeline showcases how AI-directed iterations can identify compounds that retain potency across coronavirus, influenza, and paramyxovirus families, supporting the push for broad-spectrum coverage. Algorithmic resistance forecasting guides combination-therapy design, reducing the likelihood of early cross-resistance. The result is a data-rich dossier that impresses regulators and payers alike. Although upfront computational investment is high, cycle-time savings and lower clinical attrition more than offset costs, boosting return on R&D across the Anti-Viral Therapeutics industry.

Other drivers and restraints analyzed in the detailed report include:

- COVID-19-Driven Antiviral R&D Spill-Over

- Rising Antiviral-Resistance Mutations

- Price-Control & Reimbursement Headwinds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Influenza antivirals delivered USD 26.2 billion in 2024, equal to 46.29% of the Anti-Viral Therapeutics market size, underscoring entrenched seasonal demand and clinical familiarity. Steady pipeline progress toward polymerase acidic (PA) and polymerase basic (PB2) inhibitors broadens therapeutic options and may counter neuraminidase resistance. Meanwhile, COVID-19/SARS-CoV-2 treatments, though originating from pandemic urgency, now post a 3.78% CAGR through 2030 as post-exposure prophylaxis gains favor, especially among immunocompromised cohorts. Mature hepatitis B and C segments plateau because cure or functional-cure regimens shorten treatment durations, yet remain sizeable given disease burden in Asia and Africa. Herpes therapies are benefiting from micro-needle patches and in-situ gel formulations that promise superior lesion control. RSV and CMV programs leverage monoclonal antibodies and small-molecule fusion inhibitors, with pediatric indications offering growth headroom.

The Anti-Viral Therapeutics market shifts from single-pathogen strategies to host-targeted or broad-spectrum agents poised for pandemic readiness. Such programs attract non-dilutive public funding and can bypass narrow epidemiological peaks. CMV assets still address niche transplant populations, leading to premium pricing but limited volumes. Future competitive landscapes will hinge on rapid outbreak response capacity and cross-family efficacy, redrawing the virus-type hierarchy over the forecast horizon.

Reverse transcriptase inhibitors retained a 33.94% Anti-Viral Therapeutics market share in 2024, propelled by backbone status in HIV and hepatitis B therapy. Incremental chemical tweaks improve resistance barriers and renal profiles, sustaining relevance against generic incursion. Capsid inhibitors, fronted by lenacapavir, show a category-leading 3.91% CAGR and are reshaping dose-frequency expectations through twice-yearly administration. Protease inhibitors remain vital in acute COVID-19 management, while polymerase/nucleoside analogs hold cross-viral credibility but seek differentiation via inhalable and pediatric formulations.

RNAi and antisense modalities press into late-phase trials, yet face delivery challenges that temper near-term commercial impact. Broad-spectrum small molecules court government stockpile contracts, providing a hedge against unpredictable outbreaks. Companies with balanced portfolios across these mechanistic classes are best placed to ride out resistance cycles and pricing volatility. Over the next five years, the Anti-Viral Therapeutics market size attached to capsid-based and host-factor inhibitors could double as clinical validation and manufacturing scale converge.

The Anti-Viral Therapeutics Market Report is Segmented by Virus Type (HIV & AIDS, Hepatitis B, Hepatitis C, and More), Drug Class (Reverse Transcriptase Inhibitors, Protease Inhibitors, Polymerase/Nucleoside Analog Inhibitors, and More), Route of Administration (Oral, Injectable, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America represented 34.91% of 2024 sales, buoyed by the FDA's streamlined designations and deep payer wallets that reimburse premium antivirals. US-centric R&D hubs fast-track first-in-class assets, and integrated specialty-pharmacy logistics ensure prompt nationwide distribution. However, Medicare's drug-price negotiations are set to pressure free-on-board prices, nudging firms toward value-based contracts that hinge on real-world virologic outcomes.

Asia-Pacific posts the fastest 4.19% CAGR as China, India, and Southeast Asia invest heavily in domestic pharmaceutical capacity and universal insurance schemes. China's 2024 tally of 228 novel drug approvals signals regulator intent to match Western review speeds, drawing multinationals into local co-development partnerships. India leverages cost-optimized production to supply regional demand, and Japanese aging demographics support sustained antivirals usage for reactivated herpes zoster and RSV. Simultaneously, improving cold-chain frameworks unlock broader biologics access, further expanding the regional Anti-Viral Therapeutics market.

Europe maintains steady value but negotiates harder on price, using health technology assessments to enforce cost-effectiveness thresholds. EMA's centralized procedure remains attractive for simultaneous bloc entry, yet post-Brexit dual filings add complexity. Southern and Eastern European nations, supported by EU healthcare restructuring funds, offer incremental volume upside as vaccine and antiviral awareness climbs. Collectively, geographic diversification spreads revenue risk but raises compliance costs, making global regulatory mastery a core competence for sector leaders.

- Gilead Sciences

- GlaxoSmithKline

- Merck

- Roche

- Abbvie

- Johnson & Johnson

- Bristol-Myers Squibb

- Pfizer

- Novartis

- AstraZeneca

- Cipla

- Dr. Reddy's Laboratories

- Aurobindo Pharma Ltd.

- Lupin

- Sun Pharmaceutical Inds.

- Shionogi & Co., Ltd.

- Takeda Pharmaceutical Co.

- Vir Biotechnology, Inc.

- Regeneron Pharmaceuticals

- Eli Lilly and Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding long-acting injectable pipelines

- 4.2.2 Surge in HIV combination-therapy adoption

- 4.2.3 COVID-19-driven antiviral R&D spill-over

- 4.2.4 AI-enabled nucleos(t)ide analog design

- 4.2.5 Public-sector funding for broad-spectrum agents

- 4.2.6 mRNA platforms pivoting to antivirals

- 4.3 Market Restraints

- 4.3.1 Rising antiviral-resistance mutations

- 4.3.2 Price-control & reimbursement headwinds

- 4.3.3 Biosafety-grade manufacturing bottlenecks

- 4.3.4 Cold-chain gaps in low-income regions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Virus Type

- 5.1.1 HIV & AIDS

- 5.1.2 Hepatitis B

- 5.1.3 Hepatitis C

- 5.1.4 Influenza

- 5.1.5 Herpes (HSV)

- 5.1.6 Respiratory Syncytial Virus (RSV)

- 5.1.7 Cytomegalovirus (CMV)

- 5.1.8 Other & Emerging Viruses

- 5.2 By Drug Class / Mechanism

- 5.2.1 Reverse Transcriptase Inhibitors (NRTI/NNRTI)

- 5.2.2 Protease Inhibitors

- 5.2.3 Polymerase / Nucleoside Analog Inhibitors

- 5.2.4 RNAi & Antisense Therapeutics

- 5.2.5 Broad-spectrum Small-molecule Antivirals

- 5.2.6 Capsid Inhibitors

- 5.2.7 Others

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Injectable (incl. Long-Acting)

- 5.3.3 Topical

- 5.3.4 Others

- 5.4 By Region

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Gilead Sciences Inc.

- 6.3.2 GlaxoSmithKline plc (ViiV Healthcare)

- 6.3.3 Merck & Co., Inc.

- 6.3.4 F. Hoffmann-La Roche AG

- 6.3.5 AbbVie Inc.

- 6.3.6 Johnson & Johnson (Janssen)

- 6.3.7 Bristol Myers Squibb Co.

- 6.3.8 Pfizer Inc.

- 6.3.9 Novartis AG

- 6.3.10 AstraZeneca plc

- 6.3.11 Cipla Ltd.

- 6.3.12 Dr. Reddy's Laboratories

- 6.3.13 Aurobindo Pharma Ltd.

- 6.3.14 Lupin Ltd.

- 6.3.15 Sun Pharmaceutical Inds.

- 6.3.16 Shionogi & Co., Ltd.

- 6.3.17 Takeda Pharmaceutical Co.

- 6.3.18 Vir Biotechnology, Inc.

- 6.3.19 Regeneron Pharmaceuticals

- 6.3.20 Eli Lilly and Company

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment