PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846242

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846242

Volumetric Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

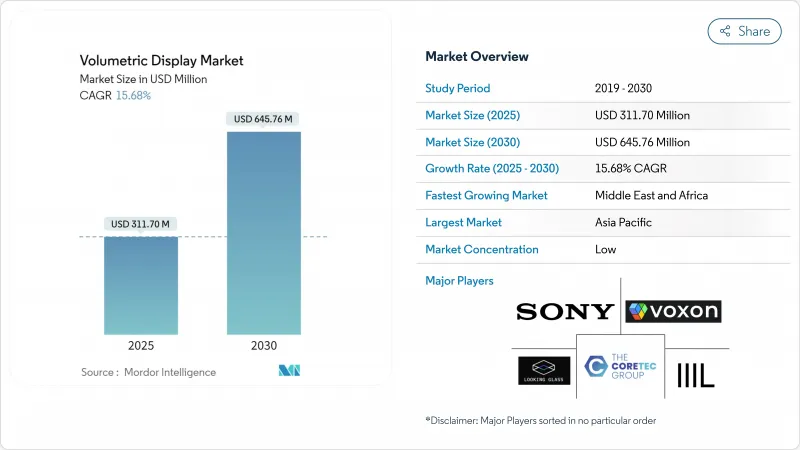

The volumetric display market size is valued at USD 311.7 million in 2025 and is on course to expand to USD 645.76 million by 2030, reflecting a sturdy 15.68% CAGR.

Over the forecast period the technology shifts from experimental novelty toward a core visualization platform across operating rooms, command centers, and advanced cockpits. Strong demand for 3D anatomical imaging, growing defense procurement of glass-free situational-awareness consoles, and automotive moves toward full-windshield 3D clusters underpin this climb. In parallel, projector costs per lumen keep falling while real-time hologram processors shorten latency, making premium user experiences available at lower total cost of ownership. Intensifying software innovation is tilting competitive advantage toward firms that control rendering engines and content ecosystems rather than only optical hardware, rewriting the basis of differentiation inside the volumetric display market.

Global Volumetric Display Market Trends and Insights

Adoption of 3D Anatomical Visualization in Minimally Invasive Surgeries

Hospitals integrate volumetric displays to overcome the spatial constraints of flat monitors. Systems such as RealView Imaging's Holoscope-i project interactive 3D/4D holograms that surgeons can inspect from any angle, lowering eye strain and shortening procedure times. Multi-institutional studies show surgical teams preferred holographic planning in 61% of cases over 2D images, reinforcing clinical momentum. As fluorescence-guided surgery merges with holographic output, the platform evolves from simple viewer to integrated surgical console. Purchasing patterns indicate the equipment will be standard in complex surgery suites by 2027, lifting annual hardware demand inside the volumetric display market.

Defense Demand for Glass-Free 360° Situational-Awareness Systems

Armed forces in the Middle East deploy volumetric displays inside command posts to let multiple officers share the same 3D battlespace view without headsets. Tests funded by the US Air Force Research Lab confirm quicker target recognition and mission-planning cycles compared with tiled 2D maps. Budget allocations for ISR upgrades now earmark glass-free 3D tables, signaling steady procurement through 2026. As OEMs certify mil-spec housing and sand-dust tolerance, defense orders form a reliable revenue stream for the volumetric display market.

Persistent Sub-HD Native Resolution Limiting Clinical Diagnostics

Most current volumetric systems fall below the pixel density clinicians need for micro-vascular inspection or pathology review. Lower lateral resolution becomes more pronounced on large collaborative tables, forcing radiologists to revert to CT workstations for fine detail. Research into color-aware holographic optimization is closing the gap, yet diagnostic-grade prototypes remain in labs. Until pixel pitches match digital microscopy thresholds, the volumetric display market must rely on surgical planning rather than diagnostics for medical revenue.

Other drivers and restraints analyzed in the detailed report include:

- Automotive HUD Evolution Toward In-Cabin 3D Instrument Clusters

- Media and Entertainment Pivot to Location-Based Holographic Attractions

- High Acquisition Cost versus Competing 3D Visualization Tools in SMEs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Swept-volume architectures capture 67.6% volumetric display market share in 2024 thanks to mature production tooling and field-proven reliability. Rotational persistence of vision enables bright images inside compact footprints, ideal for medical and defense consoles. Static-volume units, though smaller today, post the strongest 17.7% CAGR as holographic-laser-excited graphics eliminate moving parts, slashing maintenance cycles.

Recent demonstrations of color static-volume cubes show excellent environmental robustness, enticing laboratories that cannot tolerate mechanical vibration. As holographic materials scale, static-volume systems are forecast to erode swept-volume dominance, pushing the volumetric display market size for static architectures past USD 190 million by 2030. Vendors that master both paths hedge against future customer preference swings.

Optical hardware-projectors and laser engines-retains 37.1% share because brightness and color gamut still depend on photon efficiency. Yet rendering software and high-bandwidth GPUs accelerate at 16.6% CAGR, outpacing optics as buyers demand real-time 4K holograms. The volumetric display market size for compute subsystems is forecast to nearly double between 2025 and 2030 as processors with hologram-specific instruction sets reach commercial boards.

In response, hardware-centric firms form alliances with game-engine vendors to bundle SDKs, while pure-play software houses license IP blocks to projector manufacturers. The shift recasts value capture toward algorithms that compress interference patterns without visual artifacts, setting the next competitive battleground inside the volumetric display industry.

The Volumetric Display Market Report is Segmented by Display Type (Swept Volume Display, and Static Volume Display), Component (Projectors and Laser Modules, and More), Display Size (Below 360° Viewing Volume, and More), Application (Medical Imaging and Surgical Planning, and More), End-User Industry (Automotive and Transportation, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 33.2% share of the volumetric display market in 2024, anchored by Japanese, Chinese, and South-Korean conglomerates that combine semiconductor strength with large domestic entertainment spend. Japan's decision to embed holographic portraits in new banknotes signals mainstream acceptance, catalyzing local optics suppliers. South-Korea's telcos demonstrated live 5G hologram calls, drawing enterprise pilot projects. The region's dense supplier base keeps lead-times short, accelerating refresh cycles.

North America ranks second, propelled by US surgical-robot makers and defense labs that integrate volumetric consoles into C2 suites. Federal funding for advanced manufacturing testbeds exposes SMEs to the technology, expanding mid-market prospects. Canada's med-tech clusters in Ontario and British Columbia add clinical validation sites, reinforcing regional credibility.

Europe remains focused on automotive integration. German Tier-1s partner with optics specialists to engineer windshield-embedded holograms compliant with UN ECE glare rules. EU laser-safety norms slow deployments but ultimately raise baseline quality, building export appeal once certificates are issued.

The Middle East and Africa register the highest 17.2% CAGR through 2030 as defense ministries procure glass-free 360° tables for joint-ops centers. Sovereign funds in the Gulf finance entertainment complexes that feature holographic attractions, further boosting unit flow. Latin America shows nascent adoption, with Brazil's universities piloting volumetric labs for industrial design curricula, seeding future demand across the continent.

- Voxon Photonics

- Looking Glass Factory Inc.

- Coretec Group Inc.

- Seekway Technology Ltd.

- Burton Inc.

- Leia Inc.

- LightSpace Technologies

- HoloTech Studios

- SeeReal Technologies

- Sony Corporation

- Magic Leap Inc.

- Google LLC

- Microsoft Corporation

- RealView Imaging Ltd.

- WayRay AG

- zSpace Inc.

- Deepsky Corporation

- Alioscopy

- Holoxica Ltd.

- The 3rd Dimension Technologies

- VividQ

- ForwardX Robotics

- Shenzhen Giant Real Technology

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of 3D Anatomical Visualization in Minimally Invasive Surgeries (North America and Europe)

- 4.2.2 Defense Demand for Glass-Free 360° Situational Awareness Systems (Middle East)

- 4.2.3 Automotive HUD Evolution Toward In-Cabin 3D Instrument Clusters (Germany, Japan)

- 4.2.4 Media and Entertainment Pivot to Location-Based Holographic Attractions (Asia)

- 4.2.5 Falling Projection Cost per Lumen via Solid-State Lasers (Global)

- 4.2.6 Telecom 5G Rollout Enabling Real-time Volumetric Telepresence (US, South Korea)

- 4.3 Market Restraints

- 4.3.1 Persistent Sub-HD Native Resolution Limiting Clinical Diagnostics

- 4.3.2 High Acquisition Cost vs. Competing 3D Visualization Tools in SMEs

- 4.3.3 Limited Content Authoring Ecosystem Hindering Mass Adoption

- 4.3.4 Safety Regulations around High-Intensity Laser Sources (EU)

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Display Type

- 5.1.1 Swept Volume Display

- 5.1.2 Static Volume Display

- 5.2 By Component

- 5.2.1 Projectors and Laser Modules

- 5.2.2 Display Panels and Optical Elements

- 5.2.3 Rendering Software and GPU Hardware

- 5.2.4 Holographic Materials

- 5.2.5 Other Components

- 5.3 By Display Size

- 5.3.1 Below 360° Viewing Volume (Sub 24 inch cube)

- 5.3.2 360° Table-Top (24 inch-40 inch cube)

- 5.3.3 Large-Format (Above 40 inch cube)

- 5.4 By Application

- 5.4.1 Medical Imaging and Surgical Planning

- 5.4.2 Telepresence and Videoconferencing

- 5.4.3 Education and Training Simulations

- 5.4.4 Advertising and Digital Signage

- 5.4.5 Entertainment and Gaming

- 5.4.6 Engineering and Design Visualization

- 5.4.7 Defence and Security Command Centers

- 5.4.8 Other Applications

- 5.5 By End-user Industry

- 5.5.1 Healthcare Providers

- 5.5.2 Automotive and Transportation

- 5.5.3 Media, Sports and Entertainment Venues

- 5.5.4 Industrial and Manufacturing

- 5.5.5 Aerospace and Defence

- 5.5.6 Academic and Research Institutes

- 5.5.7 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 South America

- 5.6.3.1 Brazil

- 5.6.3.2 Rest of South America

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South-East Asia

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Gulf Cooperation Council Countries

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.3.1 Voxon Photonics

- 6.3.2 Looking Glass Factory Inc.

- 6.3.3 Coretec Group Inc.

- 6.3.4 Seekway Technology Ltd.

- 6.3.5 Burton Inc.

- 6.3.6 Leia Inc.

- 6.3.7 LightSpace Technologies

- 6.3.8 HoloTech Studios

- 6.3.9 SeeReal Technologies

- 6.3.10 Sony Corporation

- 6.3.11 Magic Leap Inc.

- 6.3.12 Google LLC

- 6.3.13 Microsoft Corporation

- 6.3.14 RealView Imaging Ltd.

- 6.3.15 WayRay AG

- 6.3.16 zSpace Inc.

- 6.3.17 Deepsky Corporation

- 6.3.18 Alioscopy

- 6.3.19 Holoxica Ltd.

- 6.3.20 The 3rd Dimension Technologies

- 6.3.21 VividQ

- 6.3.22 ForwardX Robotics

- 6.3.23 Shenzhen Giant Real Technology

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment