PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846244

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846244

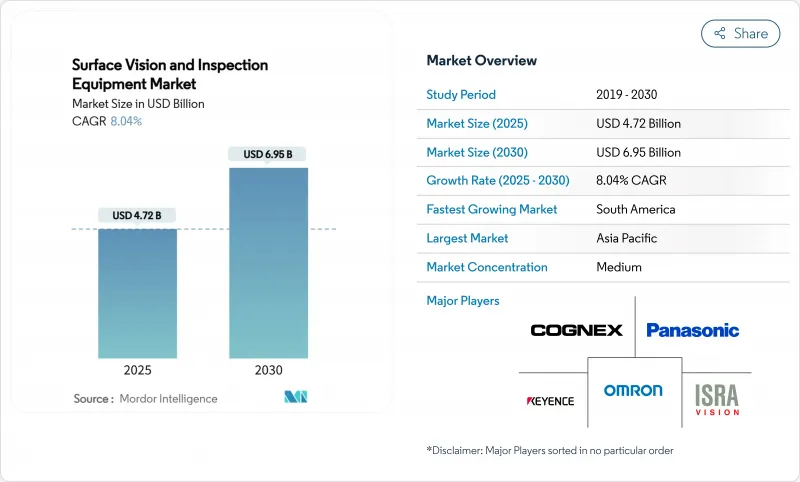

Surface Vision & Inspection Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The surface vision and inspection equipment market size recorded USD 4.72 billion in revenue in 2025 and is forecast to advance to USD 6.95 billion by 2030, reflecting an 8.04% CAGR over the period.

Accelerating adoption of hyperspectral imaging, real-time artificial intelligence (AI) inference at the edge, and pay-per-inspection service models are widening access to advanced visual quality assurance. Demand spikes in automotive battery lines, solar cell production, and semiconductor front-end fabrication reinforce the strategic value of near-zero-defect manufacturing. In tandem, the escalation of connected Industry 4.0 architectures is prompting corporations to place cybersecurity and data governance at the center of vision-system roadmaps. Mid-sized manufacturers are responding by favoring portable, low-capex scanners and pay-as-you-use software subscriptions that shorten investment payback cycles.

Global Surface Vision & Inspection Equipment Market Trends and Insights

Increasing need for higher manufacturing throughput at lower cost

Vision-enabled automation is enabling processors to compress inspection cycles from minutes to seconds while sustaining >=99% detection accuracy, as evidenced by cutting-tool systems running four-second cycles assemblymag.com. Electronics factories operating as "dark" facilities in China validate the 24/7 production model and capture energy savings of 15-20%. Cost-down pressures therefore reinforce the case for the surface vision and inspection equipment market across discrete and process manufacturing.

Rising demand for zero-defect quality in precision industries

Advanced semiconductor nodes, electric-vehicle battery packs, and implantable medical devices tolerate no latent defects. For example, Onto Innovation reported Q1 2025 revenue growth tied to DRAM and gate-all-around geometries, underscoring inspection's link to wafer yield. Battery cell producers are similarly adopting round-the-clock visual analytics to prevent downstream safety failures. Consequently, the surface vision and inspection equipment market captures rising capital allocations in high-reliability segments.

Scarcity of skilled vision engineers and integration complexity

Only 19.5% of South Korean SMEs report smart-factory uptake, citing limited technical capability as the top hurdle. Cognex is countering the talent gap by channeling 17% of revenue into R&D to simplify setup through low-code interfaces. Yet the human-capital constraint continues to temper the near-term expansion rate of the surface vision and inspection equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Industry 4.0 and smart-factory automation

- Emergence of hyperspectral imaging for sub-surface defect detection

- High upfront cost of high-resolution 3D systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cameras represented 44% of 2024 revenue, cementing their status as the foundational element of any inspection stack. Progress in sensor resolution, frame rate, and ultraviolet sensitivity is expanding the attainable defect envelope in semiconductor back-end and micro-LED lines. Lighting and optics integrate tightly with those cameras to expose fine scratches on polished metals and detect voids in transparent substrates. The segment's scale anchors the surface vision and inspection equipment market and secures volume pricing on complementary optics and frame grabbers.

AI-enabled vision platforms, while a smaller base, are forecast to post a 9.4% CAGR to 2030. Embedding convolutional neural networks directly into smart cameras reduces latencies that previously mandated host-based inference. Cognex's April 2024 launch of an integrated 3D-with-AI device illustrates how suppliers now collapse multiple sub-systems into a single housing. This convergence is set to reshape the cost stack and expand addressable use cases across the surface vision and inspection equipment market.

2D vision keeps a 63% foothold thanks to barcode decoding, presence checks, and label verification that rarely require depth data. These legacy tasks continue to secure incremental refresh revenue as line speeds accelerate. At the same time, AI-enabled configurations are scaling quickly at an 8.8% CAGR, delivering robustness to variable lighting, shape deformation, and overlapping features that confound rule-based scripts. The surface vision and inspection equipment market size for AI-enabled systems is projected to reach USD 2.1 billion by 2030, supported by declining inference-engine costs.

3D imaging remains a niche for applications like gearbox housing measurement or aerospace fastener depth validation, but the blend of structured light and neural inference is starting to blur historical boundaries. Suppliers that merge 2D, 3D, and spectral content within unified software suites stand to capture cross-selling premiums in the surface vision and inspection equipment industry.

The Surface Vision and Inspection Equipment Market Report is Segmented by Component (Camera, Lighting Equipment, and More), System Type (2D Vision Systems, 3D Vision Systems, AI-Enabled Vision Systems), Deployment Mode (In-line/On-line Inspection, Off-Line Inspection, and More), Application Industry (Automotive, Electrical and Electronics, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific captured 39% of global revenue in 2024, powered by large-scale electronics and auto supply chains in China, Japan, and South Korea. Chinese machine-vision vendors benefited from >=30% sales growth in 2024 as state policies reinforced "smart manufacturing" imperatives. South Korea's robot density of 1,012 units per 10,000 workers illustrates the region's appetite for automation hardware that embeds intelligent optics.

Europe and North America retain robust demand lines anchored in aerospace, semiconductor front-end, and regulated medical-device sectors that justify premium pricing. The surface vision and inspection equipment market size for North America is forecast to approach USD 1.8 billion by 2030 as electrification and printed-electronics projects proliferate. Manufacturers also value proximity to high-service vendors to navigate integration complexity.

South America is the fastest-growing territory with an 8.4% CAGR, underpinned by Brazil's modernization agenda and Argentina's push into automotive and agricultural-equipment exports. Battery and solar investments in Chile and Brazil offer fresh landing zones for vision suppliers. Although Middle East & Africa remains an emerging prospect, rising pharmaceutical production in Saudi Arabia and UAE is laying foundations for future uptake.

- Omron Corporation

- Cognex Corporation

- Keyence Corporation

- Isra Vision AG

- Teledyne DALSA

- Panasonic Corporation

- AMETEK Surface Vision

- Basler AG

- Stemmer Imaging AG

- Matrox Imaging Ltd.

- Edmund Optics Inc.

- Sick AG

- Sony Semiconductor Solutions

- Datalogic S.p.A.

- Shenzhen Sipotek Technology Co., Ltd.

- Daitron Inc.

- Opto Engineering Srl

- FlexFilm Ltd.

- Comvis AG

- Omnitron Sensors

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing need for higher manufacturing throughput at lower cost

- 4.2.2 Rising demand for zero-defect quality in precision industries

- 4.2.3 Adoption of Industry 4.0 and smart-factory automation

- 4.2.4 Emergence of hyperspectral imaging for sub-surface defect detection

- 4.2.5 Pay-per-inspection service models lowering SME capex barriers

- 4.2.6 ESG-driven mandatory inspection in battery and solar lines to cut waste

- 4.3 Market Restraints

- 4.3.1 Scarcity of skilled vision engineers and integration complexity

- 4.3.2 High upfront cost of high-resolution 3D systems

- 4.3.3 Cyber-security risks in connected inspection networks

- 4.3.4 Rapid product-mix changes outpacing algorithm update cycles

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Camera

- 5.1.2 Lighting Equipment

- 5.1.3 Optics

- 5.1.4 Frame Grabbers and Processors

- 5.1.5 Software

- 5.1.6 Other Components

- 5.2 By System Type

- 5.2.1 2D Vision Systems

- 5.2.2 3D Vision Systems

- 5.2.3 AI-enabled Vision Systems

- 5.3 By Deployment Mode

- 5.3.1 In-line / On-line Inspection

- 5.3.2 Off-line Inspection

- 5.3.3 Portable / Hand-held Systems

- 5.4 By Application Industry

- 5.4.1 Automotive

- 5.4.2 Electrical and Electronics

- 5.4.3 Semiconductor and PCB

- 5.4.4 Medical and Pharmaceuticals

- 5.4.5 Food and Beverage and Packaging

- 5.4.6 Metals and Paper

- 5.4.7 Postal and Logistics

- 5.4.8 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Australia

- 5.5.4.7 New Zealand

- 5.5.4.8 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 GCC

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Israel

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Omron Corporation

- 6.4.2 Cognex Corporation

- 6.4.3 Keyence Corporation

- 6.4.4 Isra Vision AG

- 6.4.5 Teledyne DALSA

- 6.4.6 Panasonic Corporation

- 6.4.7 AMETEK Surface Vision

- 6.4.8 Basler AG

- 6.4.9 Stemmer Imaging AG

- 6.4.10 Matrox Imaging Ltd.

- 6.4.11 Edmund Optics Inc.

- 6.4.12 Sick AG

- 6.4.13 Sony Semiconductor Solutions

- 6.4.14 Datalogic S.p.A.

- 6.4.15 Shenzhen Sipotek Technology Co., Ltd.

- 6.4.16 Daitron Inc.

- 6.4.17 Opto Engineering Srl

- 6.4.18 FlexFilm Ltd.

- 6.4.19 Comvis AG

- 6.4.20 Omnitron Sensors

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment