PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846246

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846246

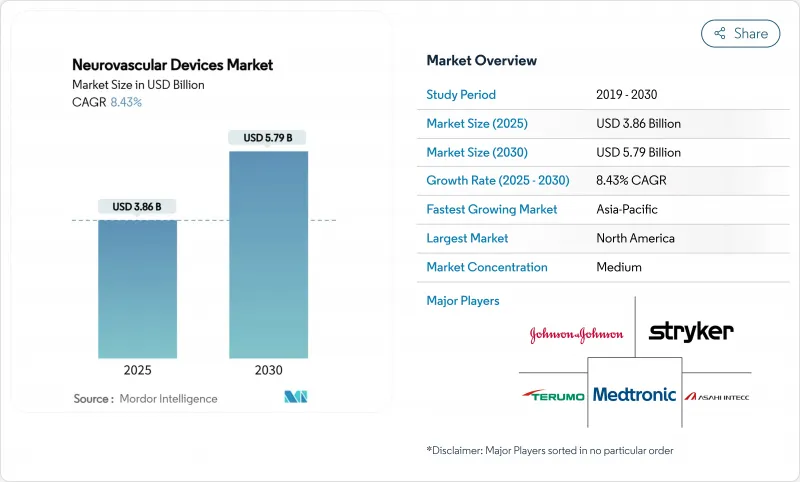

Neurovascular Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Neurovascular Devices Market size is estimated at USD 3.86 billion in 2025, and is expected to reach USD 5.79 billion by 2030, at a CAGR of 8.43% during the forecast period (2025-2030).

Sustained demand for minimally-invasive stroke interventions, reimbursement tailwinds in North America, and the diffusion of advanced imaging platforms are reinforcing the growth trajectory of the neurovascular devices market. North America continues to lead procedure volumes as hospitals standardize mechanical thrombectomy for large-vessel occlusions, while Asia-Pacific propels incremental growth through infrastructure build-outs that narrow treatment-access gaps. Device suppliers amplify competitive intensity by launching aspiration catheters with higher recanalization rates, flow diverters with faster occlusion profiles, and robotic navigation systems that lower radiation exposure. At the same time, expanded public and private payer coverage-most recently Medicare's broader carotid stenting policy-removes cost barriers that previously dampened adoption.

Global Neurovascular Devices Market Trends and Insights

Escalating Global Stroke Incidence and Associated Socio-economic Burden

Worldwide, stroke-related productivity losses cost USD 45.5 billion annually, incentivizing payers to reimburse early interventions that trim long-term care spending. Mortality rates in emerging economies remain 40-60% higher than in developed nations, reflecting infrastructure gaps that the neurovascular devices market can address. Asia-Pacific's demographic shift toward older cohorts is projected to lift regional stroke incidence another 30% by 2030, accelerating device uptake. Health systems now quantify the return on investment of neurovascular programs by weighing shorter rehabilitation timelines against societal productivity gains.

Rapid Innovation in Minimally-Invasive Neuro-interventional Technologies

Next-generation aspiration catheters such as the SOFIA family deliver 85% recanalization versus the 65% benchmarks of earlier designs, providing a clinical edge that speeds adoption. Flow diverters like Pipeline Vantage achieve 95% aneurysm occlusion at 12 months while cutting average procedure times by 25%. Early evidence from robotic-assisted thrombectomy shows a 20% reduction in radiation exposure, supporting hospitals' safety initiatives. AI-enhanced imaging platforms now deliver real-time vessel analysis that reduces complications by up to 20%. These performance gains lock in premium pricing, reinforcing the revenue potential of the neurovascular devices market.

Stringent and Lengthy Regulatory Approval Processes Across Key Markets

Average US 510(k) clearance time stretched to 201 days in 2024, more than doubling the statutory target and delaying commercial launches. PMA approvals now exceed 12 months, and the EU Medical Device Regulation forces manufacturers to prepare separate clinical datasets costing up to USD 5 million per category. Smaller innovators struggle to fund dual-region submissions, damping pipeline diversity. Protracted approval cycles erode first-mover advantage, discouraging investors who weigh time-value of capital. The resulting lag constrains revenue realization within the neurovascular devices market.

Other drivers and restraints analyzed in the detailed report include:

- Hospital Adoption of Biplane Angio Suites Boosting Procedure Volumes

- Increasing Research and Development Investments

- High Procedure and Capital Equipment Costs Limiting Adoption in Budget-Constrained Hospitals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Aneurysm coiling and embolization devices captured 38.51% of the neurovascular devices market share in 2024 thanks to proven efficacy across diverse aneurysm morphologies. Hydrogel and bioactive coils now deliver 92% five-year occlusion versus the 85% benchmark of bare platinum variants, keeping the segment firmly entrenched in hospital protocols. Over the forecast horizon, continuous material and delivery improvements help sustain unit demand.

Neurothrombectomy devices are growing fastest at a 10.86% CAGR, catalyzed by guideline expansions that allow treatment up to 24 hours after onset. Aspiration-first techniques and larger-bore catheters extend eligibility to patients with large core infarcts, broadening the neurovascular devices market. Cerebral balloon angioplasty and stenting systems post steady gains from refinements in balloon compliance and closed-cell stent design. Support devices such as micro-catheters and guidewires maintain consistent pull-through revenues as each thrombectomy consumes multiple disposables. Niche categories-liquid embolics, occlusion balloons, and next-gen flow diverters-offer incremental growth where conventional tools meet anatomical limits.

The Neurovascular Devices Market Report is Segmented by Product (Aneurysm Coiling & Embolization Devices, Cerebral Balloon Angioplasty & Stenting Systems, Neurothrombectomy Devices, and More), Target Disease (Ischemic Stroke, Cerebral Aneurysm, and More), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 36.71% of global revenue in 2024, buoyed by Medicare coverage expansion for carotid stenting and 65% penetration of biplane angiography among US hospitals. Canadian provinces allocated new stroke-infrastructure budgets that equipped tertiary centers with thrombectomy suites, while Mexican private hospitals invested in aspiration systems to service medical tourists.

Asia-Pacific is forecast to post the strongest 11.21% CAGR, propelled by China's 2.77 million ischemic stroke cases, Japan's rapidly aging population, and India's growing middle class. Nevertheless, device penetration varies: Japan approaches Western adoption levels, whereas emerging ASEAN markets prioritize foundational capacity such as perfusion CT scanners. Local manufacturing incentives in China encourage partnerships that counterbalance import tariffs and regulatory delays, supporting long-term growth for the neurovascular devices market.

Europe maintains steady demand across Germany, the United Kingdom, and France, where evidence-based purchasing committees favor devices with robust cost-effectiveness dossiers. Middle East & Africa show nascent uptake concentrated in Gulf Cooperation Council states, while South America progresses gradually as Brazil deploys stroke networks and Argentina capitalizes on domestic device production. Regional momentum hinges on infrastructure maturity, payer policy, and economic development, necessitating localized commercial models.

- Medtronic

- Stryker

- Penumbra

- CERENOVUS (Johnson & Johnson)

- Terumo Corporation (MicroVention)

- Asahi Intecc Co., Ltd.

- MicroPort

- Integer Holdings

- Imperative Care Inc.

- Shape Memory Medical

- Balt Group

- Acandis

- Rapid Medical Ltd.

- Kaneka

- Trandomed 3D Inc.

- Evasc Neurovascular

- Wallaby Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating Global Stroke Incidence and Associated Socio-economic Burden

- 4.2.2 Rapid Innovation in Minimally Invasive Neuro-interventional Technologies

- 4.2.3 Hospital Adoption of Biplane Angio Suites Boosting Procedure Volumes

- 4.2.4 Increasing Research and Development Investments

- 4.2.5 Expanding Reimbursement Coverage for Endovascular Stroke Care in Major Healthcare Systems

- 4.2.6 Expansion of Healthcare Infrastructure in Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Stringent and Lengthy Regulatory Approval Processes Across Key Markets

- 4.3.2 High Procedure and Capital Equipment Costs Limiting Adoption in Budget-Constrained Hospitals

- 4.3.3 Persistent Shortage of Trained Neuro-interventionalists-Especially in Low- and Middle-Income Regions

- 4.3.4 Procedural Complications: Risks, Awareness Gaps, and Diagnostic Delays

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Aneurysm Coiling & Embolization Devices

- 5.1.2 Cerebral Balloon Angioplasty & Stenting Systems

- 5.1.3 Neurothrombectomy Devices

- 5.1.4 Support Devices (Micro-catheters, Guidewires, Sheaths)

- 5.1.5 Other Devices (Liquid Embolics, Occlusion Balloons)

- 5.2 By Target Disease

- 5.2.1 Ischemic Stroke

- 5.2.2 Cerebral Aneurysm

- 5.2.3 Arteriovenous Malformations & Fistulas

- 5.2.4 Intracerebral Hemorrhage

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Neurology & Stroke Centers

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Stryker Corporation

- 6.3.3 Penumbra Inc.

- 6.3.4 CERENOVUS (Johnson & Johnson)

- 6.3.5 Terumo Corporation (MicroVention)

- 6.3.6 Asahi Intecc Co., Ltd.

- 6.3.7 MicroPort Scientific Corporation

- 6.3.8 Integer Holdings Corporation

- 6.3.9 Imperative Care Inc.

- 6.3.10 Shape Memory Medical Inc.

- 6.3.11 Balt Group

- 6.3.12 Acandis GmbH

- 6.3.13 Rapid Medical Ltd.

- 6.3.14 Kaneka Corporation

- 6.3.15 Trandomed 3D Inc.

- 6.3.16 Evasc Neurovascular

- 6.3.17 Wallaby Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment