PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846250

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846250

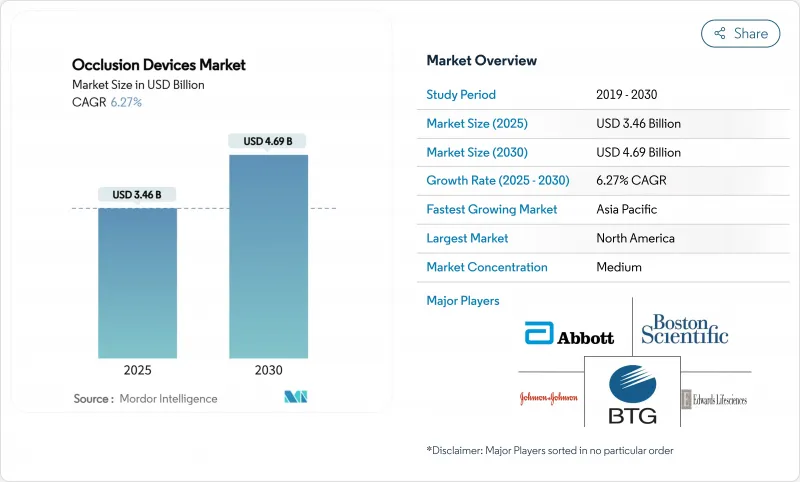

Occlusion Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Occlusion Devices Market size is estimated at USD 3.46 billion in 2025, and is expected to reach USD 4.69 billion by 2030, at a CAGR of 6.27% during the forecast period (2025-2030).

Across the forecast horizon, rising demand for minimally invasive neurovascular and peripheral interventions, steady migration of complex procedures into outpatient settings, and regulatory clarity for AI-enabled devices collectively underpin expansion. Persistent pressure on providers to shorten length-of-stay, together with broader insurance coverage for stroke and aneurysm care, reinforces purchasing of next-generation occlusion systems. Material innovation centred on bio-resorbable polymers opens new commercial white spaces, while supply-chain stress around high-grade alloys and the need for specialist training temper growth in some low-resource regions. Portfolio breadth, clinical-evidence leadership, and rapid integration of AI and robotic assistance remain the core competitive levers in the occlusion devices market.

Global Occlusion Devices Market Trends and Insights

Growing Preference for Minimally Invasive Occlusive Procedures

Regulators cleared several next-generation systems in 2024 that improve deliverability and reduce complication rates, illustrating confidence in less-invasive approaches. Comparative studies show hospital stay reductions of 1.5-2 days and 15-20% total episode cost savings when occlusion devices replace open surgery. These clinical and economic benefits encourage provider adoption, especially in reimbursement-sensitive environments. Ambulatory centers report double-digit volume increases as minimally invasive protocols become routine, reinforcing demand for devices that support same-day discharge. With stroke and peripheral arterial disease incidence rising among ageing populations, minimally invasive occlusion solutions remain central to future treatment algorithms.

Shift Toward Ambulatory Endovascular Care Models

Updated 2025 CMS payment rules now reimburse a broader list of endovascular procedures in outpatient settings. This shift lets ASCs invest in premium occlusion platforms while maintaining cost advantages over hospitals. Data from multisite registries indicate equivalent safety profiles and 25-30% lower total costs for ASC procedures. Payers gain from reduced facility fees, prompting insurers to authorise more cases outside hospitals. Manufacturers respond with compact consoles and single-use kits engineered for smaller procedure rooms. As the outpatient share of endovascular volumes climbs, demand concentrates on devices that balance portability, ease of use, and robust clinical performance.

High Capital Costs in Resource-Limited Settings

Healthcare providers in emerging economies struggle to fund premium occlusion systems amid competing spending priorities. Currency volatility and EU MDR-related compliance costs that suppliers pass through to buyers raise acquisition prices by 15-25%. Financing innovations such as leasing and shared-service models partly ease barriers, yet uptake lags in rural hospitals where stroke burden is high. Without consistent device access, these regions risk poorer outcomes and widening care disparities.

Other drivers and restraints analyzed in the detailed report include:

- Integration of AI-Guided Imaging & Robotic Assistance

- Broader Insurance Coverage for Stroke Interventions

- Training Demands for Neuro-Occlusion Techniques

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Removal devices secured 42.68% of the occlusion devices market in 2024 owing to their indispensable role in emergency stroke care where rapid vessel recanalisation dictates outcomes. Robust clinical guidelines and favourable reimbursement sustain steady demand, while iterative design advances such as enhanced clot-engagement stent retrievers sharpen clinical performance. Emerging miniaturised coil retrievers broaden treatable anatomy, reinforcing segment resilience. Concurrently, Embolization devices post an 8.01% CAGR to 2030, propelled by growth in oncology and preventive aneurysm workflows. Providers increasingly prefer combination therapy kits that package embolic agents with delivery catheters, improving procedural efficiency. Support devices grow in tandem, supplying micro-catheters, guidewires, and ancillary tools that enable precise deployment across complex vasculature.

Clinicians report expanding utilisation of removal devices in distal stroke territories once considered unreachable, thanks to ultra-trackable stent retrievers. Manufacturers integrate radiopaque markers and kink-resistant shaft designs that maintain tactile feedback while improving deliverability. Embolization innovators focus on bio-active coils and liquid embolics that achieve definitive occlusion with lower re-canalisation rates. As oncologic and trauma indications broaden, the balance of revenue slowly tilts toward embolization, yet emergency neurovascular applications safeguard the primacy of removal systems within the occlusion devices market.

Nitinol, with 43.93% 2024 share, remains the backbone of high-performance occlusion devices because shape-memory and super-elastic characteristics match tortuous cerebrovascular anatomy. Suppliers refine alloy purity and surface treatments to mitigate nickel ion release and enhance endothelialisation. Platinum continues serving cases requiring high radiopacity for fine anatomical visualisation. In contrast, bio-resorbable polymers record an 11.39% CAGR, mirroring clinician appetite for temporary scaffolds that avoid long-term imaging artefacts and permit future interventions. Early clinical programs demonstrate predictable degradation profiles and favourable inflammatory responses, although manufacturing yields and sterilisation protocols still add cost premiums.

Device makers explore hybrid constructions, embedding radiopaque fibres into polymer matrices to marry visibility with resorption. Regulatory bodies require stringent in-vivo degradation data, delaying market entry for some concepts. Yet once scale efficiencies materialise, bio-resorbables promise to expand indications where permanent implants pose lifetime risk management challenges. The competition between metallic durability and polymer convenience is likely to shape materials R&D budgets throughout the forecast period.

The Occlusion Devices Market Report is Segmented by Product (Occlusion Removal Devices, Embolization Devices, Support Devices), Material (Nitinol, Platinum, and More), Application (Peripheral Vascular Disease, and More), Disease Pathology (Ischemic Stroke, and More), End User (Hospitals, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 43.04% of 2024 revenue, buoyed by Medicare reimbursement certainty, dense stroke-centre networks, and a mature innovation ecosystem spanning academic hospitals and industry partners. Continued FDA policy clarity around AI and bio-resorbables sustains a favourable launch environment for novel occlusion solutions. Canada's single-payer system channels incremental funding to stroke prevention, while Mexico's public-private hospital expansion gradually adds procedure capacity. Talent concentration and strong payer-provider alignment preserve North America's leadership despite intensifying cost-containment pressures.

Asia-Pacific posts the fastest regional CAGR at 12.58% through 2030, underpinned by rapid hospital construction, insurance expansion, and mounting cerebrovascular disease prevalence among ageing citizens. China's Volume-Based Procurement framework compresses price points, yet sheer procedural volume and provincial stroke-centre rollouts offset margin pressure. Japan leads research into high-precision micro-catheters and advanced alloy compositions, although demographic headwinds moderate long-term procedure growth. India, with improving neuro-interventional training pipeline and rising middle-class insurance coverage, delivers high-double-digit unit growth despite infrastructure gaps. South Korea and Australia provide stable demand anchored in high-acuity tertiary facilities and active clinical-trial participation.

Europe maintains steady, mid-single-digit growth driven by robust universal healthcare systems, continent-wide stroke care protocols, and pan-EU regulatory harmonisation that expedites multi-market launches. Germany's engineering strengths support local manufacturing clusters, while the United Kingdom, navigating post-Brexit adjustments, remains influential in guideline development and outcomes research. Southern European markets benefit from EU Cohesion Funds funnelling capital into hospital modernisation, whereas Eastern Europe offers long-term upside as reimbursement frameworks mature. Collaborative initiatives between the European Medicines Agency and FDA accelerate evidence sharing, shortening time-to-market for cross-Atlantic product launches.

- Medtronic

- Boston Scientific

- Abbott Laboratories

- Stryker

- Terumo

- Penumbra

- Merit Medical Systems

- Edward Lifesciences

- Johnson & Johnson

- BTG International

- Cook Group

- W. L. Gore & Associates

- MicroVention (Terumo)

- Kaneka Corp.

- Acandis

- Phenox

- Cardinal Health

- Balt Extrusion

- Asahi Intecc

- B. Braun

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Preference for Minimally Invasive Occlusive Procedures

- 4.2.2 Shift Toward Ambulatory Endovascular Care Models

- 4.2.3 Integration of AI-Guided Imaging & Robotic Assistance

- 4.2.4 Broader Insurance Coverage for Stroke Interventions

- 4.2.5 Rising Neuro-Oncology Demand Linked to SRS & Trans-Radial Techniques

- 4.2.6 Civilian Adoption of Military Hemorrhage Control Devices

- 4.3 Market Restraints

- 4.3.1 High Capital Costs in Resource-Limited Settings

- 4.3.2 Training Demands for Neuro-Occlusion Techniques

- 4.3.3 Material Safety Concerns in Flow-Diversion

- 4.3.4 Vulnerable Supply Chains for High-Grade Alloys

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Occlusion Removal Devices

- 5.1.1.1 Coil Retrievers

- 5.1.1.2 Stent Retrievers

- 5.1.1.3 Other Removal Devices

- 5.1.2 Embolization Devices

- 5.1.3 Support Devices

- 5.1.1 Occlusion Removal Devices

- 5.2 By Material

- 5.2.1 Nitinol

- 5.2.2 Platinum

- 5.2.3 Bio-resorbable Polymers

- 5.3 By Application

- 5.3.1 Peripheral Vascular Disease

- 5.3.2 Neurology

- 5.3.3 Oncology

- 5.3.4 Urology

- 5.3.5 Other Applications

- 5.4 By Disease Pathology

- 5.4.1 Ischemic Stroke

- 5.4.2 Cerebral Aneurysm

- 5.4.3 Peripheral Arterial Occlusion

- 5.4.4 Tumor Embolization

- 5.5 By End User

- 5.5.1 Hospitals

- 5.5.2 Ambulatory Surgical Centers

- 5.5.3 Specialty Clinics

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Medtronic

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Abbott Laboratories

- 6.3.4 Stryker Corporation

- 6.3.5 Terumo Corporation

- 6.3.6 Penumbra Inc.

- 6.3.7 Merit Medical Systems

- 6.3.8 Edwards Lifesciences

- 6.3.9 Johnson & Johnson

- 6.3.10 BTG International Ltd

- 6.3.11 Cook Medical

- 6.3.12 W. L. Gore & Associates

- 6.3.13 MicroVention (Terumo)

- 6.3.14 Kaneka Corp.

- 6.3.15 Acandis GmbH

- 6.3.16 Phenox GmbH

- 6.3.17 Cardinal Health

- 6.3.18 Balt Extrusion

- 6.3.19 Asahi Intecc

- 6.3.20 B. Braun Melsungen

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment