PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846251

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846251

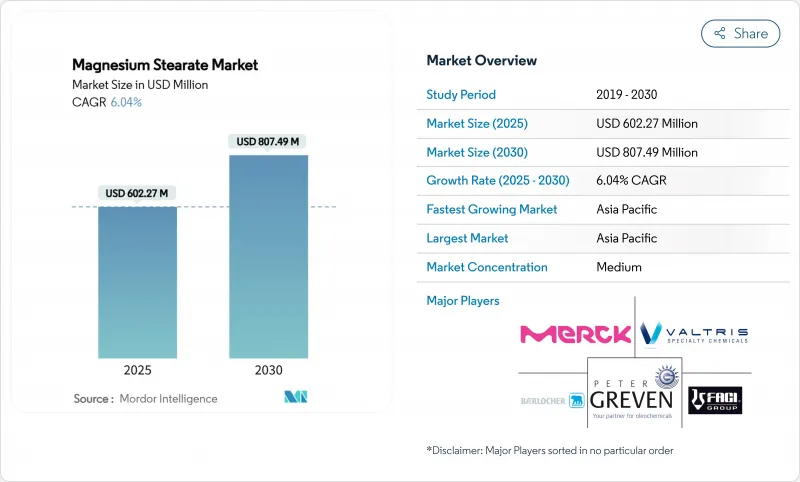

Magnesium Stearate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Magnesium Stearate Market size is estimated at USD 602.27 Million in 2025, and is expected to reach USD 807.49 Million by 2030, at a CAGR of 6.04% during the forecast period (2025-2030).

Current growth momentum mirrors the compound's entrenched role in pharmaceutical compression, personal care binding, anti-caking food systems, and polymer heat stabilization. Heightened investment in continuous oral-solid-dose manufacturing, especially across North America and Europe, keeps demand buoyant as equipment makers specify excipients that sustain lubrication under high-throughput conditions. Clean-label imperatives have simultaneously pushed suppliers to introduce plant-based or palm-free grades, adding premium-priced alternatives without displacing core volumes. Asia-Pacific's expanding generic production and rising per-capita medicine intake anchor bulk consumption, while the advent of electric-vehicle wire harnesses opens a small yet strategically significant outlet for stearate-stabilized PVC. Competitive intensity revolves around analytical consistency, fatty-acid-chain verification, and traceability programs that reassure quality-focused buyers.

Global Magnesium Stearate Market Trends and Insights

Accelerated Shift to Continuous-manufacturing Lines in Solid-dose Pharma

Large producers such as Pfizer and Eli Lilly now run commercial continuous-manufacturing assets that blend, compress, and coat tablets in integrated skids, eliminating stoppages that once masked excipient variability. Magnesium stearate market participants able to guarantee narrow particle-size distributions and stable fatty-acid ratios secure preferred-supplier status because any deviation escalates the risk of lubrication overshoot that damages tensile strength. Regulators back the switch by shortening approval review times for continuous plants, further entrenching high-specification excipient demand. Continuous processing magnifies every input's contribution to critical-quality attributes, encouraging tier-one buyers to pare their vendor lists to firms with robust in-line analytical tools.

Emergence of Vegan / Palm-free Grades Targeting Clean-label Nutraceuticals

Consumers scrutinize excipient origins as closely as active ingredients, prompting nutraceutical formulators to abandon animal-derived or palm-based stearates where feasible. Suppliers such as Biogrund commercialized CompactCel LUB, a vegetable-sourced grade that matches traditional lubrication yet aligns with vegan labeling and Roundtable on Sustainable Palm Oil commitments . While functional equivalence lowers reformulation hurdles, manufacturers still validate flow, compressibility, and dissolution in pilot runs, sustaining testing revenues for analytical houses. Retailers amplify momentum by mandating excipient transparency for store-brand supplements, nudging even cost-sensitive private-labelers toward certified vegan inputs.

Stringent Palm-oil Traceability Regulations Increasing Input Costs

The European Union's deforestation regulation and parallel the United States Customs audits oblige stearate producers to document every tonne of palm-derived stearic acid. Compliance entails satellite monitoring, isotopic fingerprinting, and blockchain recordkeeping, driving procurement overheads that smaller mills struggle to absorb. Analytical mandates from bodies like the Malaysian Palm Oil Board have raised testing frequency, adding laboratory capital expense and elongating lead times . Larger multinationals, however, recoup costs by marketing certified-sustainable excipients at premiums to personal-care brands prioritizing ethical sourcing.

Other drivers and restraints analyzed in the detailed report include:

- Rising Intake of Oral-Solid-Dosage Forms in Low-income Economies

- Rapid Expansion of Cosmetic Pressed-powder Lines

- Adoption of Sodium Stearyl Fumarate as a High-performance Clean-label Alternative

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, pharmaceutical applications accounted for 44.18% of the Magnesium Stearate market revenue, underscoring decades of regulatory acceptance and cost-efficient performance. Tablets, capsules, and granules integrate the excipient at concentrations usually below 2%, yet cumulative volumes remain high due to sheer output of oral-solid doses. Because reformulating legacy products demands new bioequivalence dossiers, brand and generic manufacturers retain existing stearate grades, insulating this segment from short-term substitution risk. Meanwhile, the personal care business, anchored by pressed-powder and dry shampoo launches, shows the fastest trajectory at a 6.45% CAGR. This growth adds premium-priced, cosmetic-grade volumes, albeit from a smaller base.

Food and beverage formulators employ the powder as an anti-caking and flow agent in icing sugar, baking mixes, and powdered drink bases. Even at low inclusion rates, dependable moisture control renders magnesium stearate indispensable where conveyor throughput and consumer pour-ability intersect. Plastics processors have carved a niche in heat-stabilized Polyvinyl Chloride (PVC), particularly for electric-vehicle wiring that experiences higher under-hood temperatures. Although representing a modest slice, this outlet diversifies revenue streams and lowers reliance on pharmaceutical cycles. Collectively, these patterns safeguard the broader magnesium stearate market against demand shocks in any single vertical.

The Report Covers Magnesium Stearate Market Companies and is Segmented by End-User Industry (Pharmaceutical, Food & Beverage, Personal Care, Plastics, and Other End-User Industries) and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Size and Forecasts for Magnesium Stearate Market are Provided in Revenue (USD Million) for all the Above Segments.

Geography Analysis

Asia-Pacific led with 41.65% revenue in 2024 and is on track for a 6.32% CAGR through 2030, making it the linchpin of the magnesium stearate market. China's magnesium-metal capacity surged 24.5% in 2024, surpassing 1.02 Million tonnes and cushioning regional raw-material supply. Concurrently, India's contract-development and manufacturing organizations ramped tablet output for exports to Africa and Latin America, further lifting lubricant demand. Southeast Asian nations benefit as both consumption and secondary processing hubs, with Vietnam and Indonesia offering cost-advantaged blending services that feed neighboring Association of Southeast Asian Nations (ASEAN) markets.

North America remains a technology pacesetter, hosting several Food and Drug Administration (FDA)-approved continuous-manufacturing plants that set stringent excipient specification benchmarks. Buyers insist on full United States Pharmacopeia (USP), European Pharmacopoeia (EP), and Japanese Pharmacopoeia (JP) monograph compliance, compelling vendors to maintain harmonized documentation packs. Clean-label advocacy is more pronounced in the United States, where natural-product retailers blacklist animal-derived stearates, nudging suppliers toward certified vegan lines. Europe mirrors these quality demands and intensifies sustainability scrutiny, compelling palm-supply chain audits and life-cycle assessments before purchasing decisions.

South America, the Middle East, and Africa collectively contribute a smaller but rising parcel of global uptake. Brazil's Agencia Nacional de Vigilancia Sanitaria (ANVISA) fast-track for generic approvals fuels tablet output, while Saudi Arabian and South African public tenders prioritize local sourcing where feasible. However, fragmented local production capacity often lacks advanced analytical instruments, creating opportunity for multinational suppliers offering turnkey quality services. Despite lower volume, these geographies offer risk diversification and long-run upside as healthcare spend per capita climbs.

- Baerlocher GmbH

- FACI Corporate S.p.A.

- Huzhou City Linghu Xinwang Chemical Co., Ltd

- IRRH Specialty Chemicals

- James M. Brown Ltd.

- Kemipex

- Kirsch Pharma GmbH

- Merck KGaA

- MLA Group of Industries

- NB Entrepreneurs

- Nimbasia

- Peter Greven GmbH & Co. KG

- Roquette Freres

- Struktol Company of America, LLC

- Thermo Fisher Scientific Inc.

- Valtris Specialty Chemicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Shift to Continuous-manufacturing Lines in Solid-dose Pharma

- 4.2.2 Emergence of Vegan/palm-free Grades Targeting Clean-label Nutraceuticals

- 4.2.3 Rising Intake of Oral Solid Dosage Forms in Low-income Economies

- 4.2.4 Polyvinyl Chloride (PVC) Heat-stabilization Demand in Electric-vehicle Wire Harnesses

- 4.2.5 Rapid Expansion of Cosmetic Pressed-powder Lines

- 4.3 Market Restraints

- 4.3.1 Stringent Palm-oil Traceability Regulations Increasing Input Costs

- 4.3.2 Adoption of Sodium Stearyl Fumarate as a High-performance Clean-label Alternative

- 4.3.3 Quality-variance Risk From Micro-scale Suppliers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By End-User Industry

- 5.1.1 Pharmaceutical

- 5.1.2 Food & Beverage

- 5.1.3 Personal Care

- 5.1.4 Plastics

- 5.1.5 Other End-iser Industries (Paints & Coatings, etc.)

- 5.2 By Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 Japan

- 5.2.1.3 India

- 5.2.1.4 South Korea

- 5.2.1.5 ASEAN Countries

- 5.2.1.6 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Spain

- 5.2.3.6 Russia

- 5.2.3.7 NORDIC Countries

- 5.2.3.8 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Baerlocher GmbH

- 6.4.2 FACI Corporate S.p.A.

- 6.4.3 Huzhou City Linghu Xinwang Chemical Co., Ltd

- 6.4.4 IRRH Specialty Chemicals

- 6.4.5 James M. Brown Ltd.

- 6.4.6 Kemipex

- 6.4.7 Kirsch Pharma GmbH

- 6.4.8 Merck KGaA

- 6.4.9 MLA Group of Industries

- 6.4.10 NB Entrepreneurs

- 6.4.11 Nimbasia

- 6.4.12 Peter Greven GmbH & Co. KG

- 6.4.13 Roquette Freres

- 6.4.14 Struktol Company of America, LLC

- 6.4.15 Thermo Fisher Scientific Inc.

- 6.4.16 Valtris Specialty Chemicals

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Microencapsulation Technology Enhancing Magnesium Stearate's Performance