PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846252

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846252

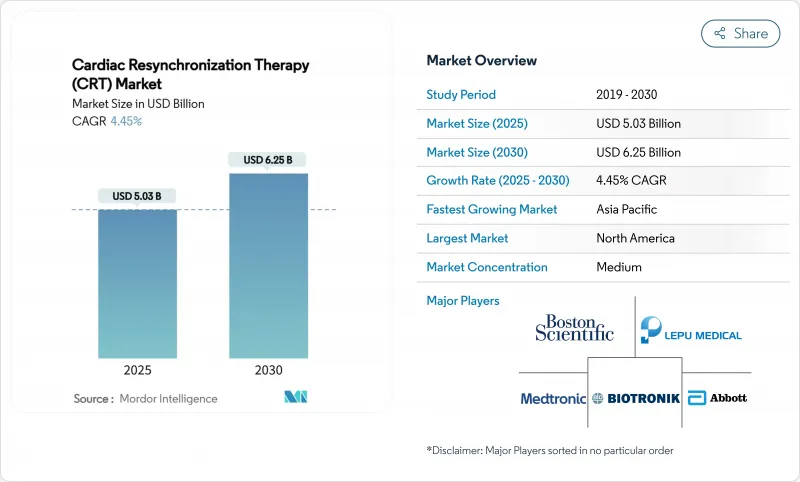

Cardiac Resynchronization Therapy (CRT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The cardiac resynchronization therapy market is valued at USD 5.03 billion in 2025 and is projected to reach USD 6.25 billion by 2030, advancing at a 4.45% CAGR.

Demand is pivoting from pure procedure volume to value-based care, where AI-driven patient stratification, leadless systems, and modular upgrades determine purchasing decisions. Aging populations, a persistent heart-failure burden, and faster approvals for minimally invasive hardware sustain unit growth, while His-bundle and left-bundle branch area pacing are reshaping clinical guidelines. North America's supportive reimbursement, Asia-Pacific's capacity expansion, and Europe's emphasis on outcome-based procurement together keep the cardiac resynchronization therapy market on a steady global uptrend. Manufacturers are mitigating raw-material risks by dual-sourcing rare-earth magnets and by adding fabless semiconductor partnerships, securing supply resilience and protecting margins.

Global Cardiac Resynchronization Therapy (CRT) Market Trends and Insights

Rising Burden of Heart Failure & Other Cardiac Disorders

Cardiovascular disease now causes 20.5 million deaths each year, and more than 80% occur in low- and middle-income countries. The widening prevalence of reduced ejection-fraction heart failure enlarges the cardiac resynchronization therapy market by continually adding eligible candidates. Asia-Pacific cities show increasing heart-failure incidence among adults in their 40s, triggered by urban diets and limited exercise. CRT lowers heart-failure-related admissions by 30-40%, making it a first-line device therapy in international guidelines. Enhanced echocardiography and AI-enabled biomarker screening uncover latent conduction delays, expanding the treatable cohort and underpinning sustained device demand.

Rapidly Expanding Geriatric Population and Sedentary Lifestyles

Every region is ageing, yet Asia-Pacific adds the largest absolute number of elders annually. Concomitant sedentary behaviour in younger demographics intensifies lifetime cardiovascular risk. Governments in China and India are scaling public insurance that covers CRT because long-term modelling shows a 40% drop in five-year management costs when CRT replaces repeated hospitalizations . The cardiac resynchronization therapy market thereby gains both volume and policy support, especially as outpatient implant pathways shorten stay lengths and free capacity for older complex cases.

Stringent Multi-Region Regulatory Requirements and Lengthy Approval Cycles

The United States FDA demands 12-18 months for novel CRT clearances, while Europe's MDR adds post-market surveillance costs exceeding USD 10 million for a global filing . These investments deter start-ups and delay diffusion of cost-saving innovations. Variations in battery longevity mandates or lead insulation test protocols force region-specific SKUs, ballooning inventory complexity. Consequently, first launches concentrate in high-margin territories, slowing cardiac resynchronization therapy market expansion into lower-income countries.

Other drivers and restraints analyzed in the detailed report include:

- Break-through Product Innovations

- Favourable Reimbursement & Heart-Failure Mandates in OECD Nations

- AI-Driven CRT Optimisation & Predictive Analytics Platforms

- Commercialisation of Leadless & Modular CRT Systems in Emerging Markets

- High Procedure/Device Cost & Limited Implanter Skill Base

- Supply-Chain Vulnerability for Rare-Earth Magnets and Semiconductor ICs

- Rising Clinical Scrutiny of Non-Responder Rates Spurring Conduction-System Pacing Substitutes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CRT-Defibrillators generated 71.67% of 2024 global revenue, reflecting their dual role in halting arrhythmic death and resynchronising ventricles. Their comprehensive protection cements physician preference for high-risk heart-failure patients. Nevertheless, CRT-Pacemakers are rising at a 5.13% CAGR as guidelines broaden to milder ejection-fraction impairment. Leadless CRT-P devices shorten theatre time and cut infection risk, giving ambulatory centres a safer outpatient path. AI-driven optimisation firmware bundled into both categories is enlarging perceived clinical value and justifying price premiums. CRT-D adoption may plateau past 2028 as comorbidity profiles shift toward lower arrhythmia risk, prompting device-selection algorithms to propose pacemakers instead.

In monetary terms, the CRT-Pacemaker sub-segment is forecast to add USD 460 million by 2030, capturing users unsuitable for ICD shocks yet benefiting from ventricular resynchronisation. Advanced single-chamber CRT-P systems tailored to atrioventricular node ablation recipients highlight personalised therapy. Remote-monitoring connectivity features, once premium, are now standard, equalising differentiation and pushing the cardiac resynchronization therapy market toward service-based competition. Vendor strategies increasingly pair devices with subscription analytics, converting episodic hardware sales into annuity revenue.

Hospitals & Cardiac Centers held 70.39% of global procedures in 2024 because complex implants still need advanced imaging, anaesthesia, and intensive monitoring. They dominate upgrades and generator replacements, which account for one-third of annual volume. However, the 5.65% CAGR in Ambulatory Surgical Centers shows payer appetite for lower facility fees. Simplified CRT-P implants with conscious sedation allow same-day discharge, freeing inpatient beds for acuity-heavy cases. Hospitals respond by setting up on-site outpatient wings to retain referrals.

Home & Remote Monitoring Settings form a nascent but strategic channel. Cloud dashboards alert clinicians to threshold changes, enabling drug titration or firmware tweaks without clinic visits. Over time, remote adjustments could cut in-person follow-ups by 40%, easing workforce constraints while solidifying vendor-provider relationships. Research & Academic Institutes, though small in volume, shape future practice through first-in-human trials of conduction-system pacing, influencing longer-term product roadmaps and indirectly steering the cardiac resynchronization therapy industry toward physiologic pacing norms.

The Cardiac Resynchronization Therapy Report is Segmented by Device Type (CRT-Defibrillators, CRT-Pacemakers), End User (Hospitals & Cardiac Centres, and More), Application (Intraventricular Dyssynchrony, and More), Technology (Conventional Bi-Ventricular Pacing, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 45.35% of 2024 revenue because public and private payers reimburse CRT without volume caps, and more than 1,500 implants centres operate across the United States. Medicare covers device and implantation fees, ensuring broad access for seniors, while Veterans Affairs facilities adopt new algorithms rapidly through centralised procurements. Canadian provinces fund CRT under single-payer plans, though device selection committees negotiate aggressive discounts. Mexico's growing middle class uses private hospitals where leadless CRT-P launches at a 15% price premium, yet faces no waiting lists.

Europe delivered steady growth under mature conditions. Germany leads procedure counts, aided by DRG incentives that reward shorter stays when remote monitoring replaces in-person checks. The United Kingdom's NHS centralised tendering lowers per-unit costs but guarantees high vendor volumes. France pilots bundled payments linking hospital bonuses to six-month readmission rates, nudging adoption of predictive-analytics platforms. Eastern European nations are upgrading catheter labs with EU cohesion funds, expanding the reachable cardiac resynchronization therapy market.

Asia-Pacific posts the fastest trajectory, 6.25% CAGR through 2030. China's device tenders specify domestic content thresholds, encouraging multinationals to co-manufacture with local firms. India's Ayushman Bharat scheme reimburses CRT-P at tier-II city hospitals, enlarging rural reach. Japan adopts physiologic pacing early thanks to experienced electrophysiologists and an ageing demographic profile. South Korea's national insurance approves AI-optimised CRT adjustments, speeding market penetration of software modules. Vietnam, Indonesia, and the Philippines witness double-digit growth from rising per-capita incomes and government insurance expansions that include high-value cardiac implants.

The Middle East & Africa region records moderate uptake. Gulf Cooperation Council states import premium CRT-D models for tertiary centres in Riyadh, Abu Dhabi, and Doha. South Africa's private insurers cover CRT selectively, while public hospitals rely on donor programmes. Supply-chain constraints and limited implanter availability cap volume growth elsewhere on the continent. South America sees Brazil leading adoption as ANVISA accelerates approvals for locally-assembled pulse generators, while Argentina's import-licence delays lengthen waiting lists.

- Abbott Laboratories

- Medtronic

- Boston Scientific

- BIOTRONIK

- MicroPort

- Lepu Medical

- MEDICO

- Integer Holdings

- OSYPKA MEDICAL GmbH

- Shree Pacetronix

- LivaNova

- Koninklijke Philips

- EBR Systems

- MicroTransponder Inc.

- Biotronik's Acutus JV

- Sorin Group (now part of LivaNova)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Burden Of Heart Failure & Other Cardiac Disorders

- 4.2.2 Rapidly Expanding Geriatric Population And Sedentary Lifestyles

- 4.2.3 Break-Through Product Innovations

- 4.2.4 Favourable Reimbursement & HF Disease-Management Mandates In Oecd Nations

- 4.2.5 AI-Driven CRT Optimisation & Predictive Analytics Platforms

- 4.2.6 Commercialisation Of Leadless & Modular CRT Systems In Emerging Markets

- 4.3 Market Restraints

- 4.3.1 Stringent Multi-Region Regulatory Requirements And Lengthy Approval Cycles

- 4.3.2 High Procedure/Device Cost & Limited Implanter Skill Base

- 4.3.3 Supply-Chain Vulnerability For Rare-Earth Magnets And Semiconductor Ics

- 4.3.4 Rising Clinical Scrutiny Of Non-Responder Rates Spurring CSP Substitutes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Device Type

- 5.1.1 CRT-Defibrillators (CRT-D)

- 5.1.1.1 Transvenous CRT-D

- 5.1.1.2 Sub-cutaneous CRT-D (S-ICD)

- 5.1.2 CRT-Pacemakers (CRT-P)

- 5.1.2.1 Single-chamber CRT-P

- 5.1.2.2 Dual/Biventricular CRT-P

- 5.1.1 CRT-Defibrillators (CRT-D)

- 5.2 By End User

- 5.2.1 Hospitals & Cardiac Centres

- 5.2.2 Ambulatory Surgical Centres

- 5.2.3 Home & Remote Monitoring Settings

- 5.2.4 Research & Academic Institutes

- 5.3 By Application

- 5.3.1 Intraventricular Dyssynchrony

- 5.3.2 Interventricular Dyssynchrony

- 5.3.3 Atrioventricular Dyssynchrony

- 5.4 By Technology

- 5.4.1 Conventional Bi-ventricular Pacing

- 5.4.2 His-Bundle Pacing (HBP)

- 5.4.3 Left Bundle Branch Area Pacing (LBBAP)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 Medtronic plc

- 6.3.3 Boston Scientific Corporation

- 6.3.4 BIOTRONIK SE & Co. KG

- 6.3.5 MicroPort Scientific Corporation

- 6.3.6 Lepu Medical Technology Co., Ltd.

- 6.3.7 MEDICO S.p.A.

- 6.3.8 Integer Holdings Corporation

- 6.3.9 OSYPKA MEDICAL GmbH

- 6.3.10 Shree Pacetronix Ltd.

- 6.3.11 LivaNova PLC

- 6.3.12 Koninklijke Philips N.V.

- 6.3.13 EBR Systems Inc.

- 6.3.14 MicroTransponder Inc.

- 6.3.15 Biotronik's Acutus JV

- 6.3.16 Sorin Group (now part of LivaNova)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment