PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846254

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846254

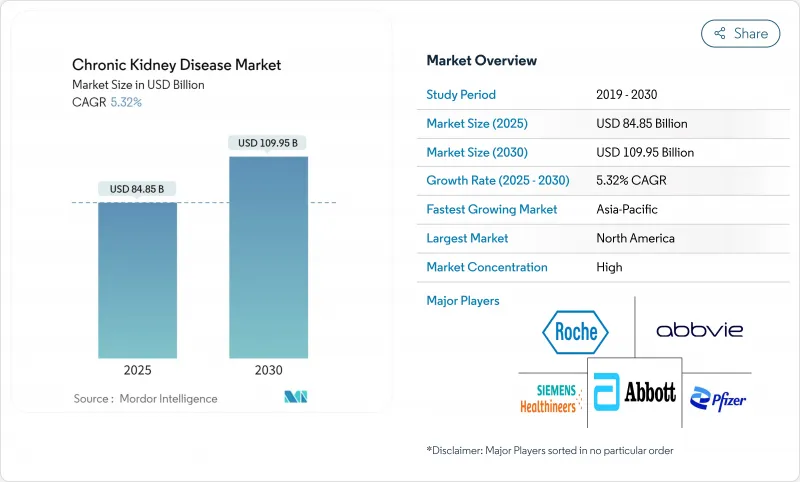

Chronic Kidney Disease - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The chronic kidney disease market stands at USD 84.85 billion in 2025 and is on track to reach USD 109.95 billion by 2030, advancing at a 5.32% CAGR.

This expansion reflects the convergence of rising diabetes and hypertension prevalence, demographic aging, and expanding value-based payment models that reward early intervention. Demand remains resilient because diabetes and hypertension together cause about 70% of chronic kidney disease cases, creating a large, stable treatment base. Continuous FDA approvals of precision drugs such as atrasentan and iptacopan are accelerating therapeutic uptake. Hospitals still perform most care coordination, yet dialysis centers and home-based modalities are scaling quickly as technology makes decentralized treatment feasible. Competitive pressure is intensifying, especially in diagnostics, where AI-powered risk tools and point-of-care biomarker tests shorten detection times and support preventive care adoption.

Global Chronic Kidney Disease Market Trends and Insights

Rising Prevalence of Diabetes & Hypertension

Diabetes affects 537 million adults and hypertension another 1.28 billion, creating a vast at-risk pool for kidney damage. AstraZeneca modelling indicates up to 16.5% of populations in eight major countries may develop chronic kidney disease by 2032, with advanced-stage cases rising 59.3%. FDA expansion of semaglutide in 2025 demonstrated a 24% drop in kidney failure risk, linking endocrine and renal markets. These patterns elevate demand for preventive drugs, integrated care, and long-term monitoring. Medicare already spends USD 8.8 billion yearly on dialysis, underlining cost pressure for early action. As comorbid patients age into Medicare, the chronic kidney disease market is primed for solutions that delay progression and avoid costly renal replacement therapy.

Aging Population Escalating CKD Incidence

Kidney function declines about 1% yearly after age 40. In nations with rapid aging, such as Japan, diagnosis rates have surged, stressing capacity. Baby boomers entering their 70s and 80s present growing demand for dialysis and transplant services. Developing regions face the same demographic curve, but often lack infrastructure, prompting interest in home-based dialysis. Elderly patients require multidisciplinary management, raising demand for coordinated hospital, primary care, and specialized services. This demographic driver ensures steady volume growth well beyond the forecast horizon.

High Cost of Dialysis & Treatment

Annual dialysis outlays can exceed USD 90,000 per patient, limiting access in lower-income economies and straining public budgets. Medicare already allocates USD 8.8 billion to dialysis each year . Many emerging markets lack broad insurance, so patients forgo or delay therapy, capping unit growth. Cost barriers spur exploration of bundled payments and portable devices, yet upfront investments remain challenging for under-resourced systems.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Early Diagnostics

- Value-Based Kidney-Care Payment Incentives

- Generic Erosion in Mature Drug Classes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Treatment products generated 75.25% revenue in 2024, illustrating their central role across disease stages. The chronic kidney disease market size for treatment reached USD 63.9 billion and is projected to expand alongside new precision drugs and next-generation dialysis. FDA clearance of atrasentan for IgA nephropathy and iptacopan for complement 3 glomerulopathy underscores a shift to targeted therapy that can carry premium pricing . Dialysis technology is also evolving toward portable and wearable systems, reducing facility dependence and widening patient choice. Treatment manufacturers now bundle digital adherence tools to prove outcome gains in value-based contracts.

Diagnosis products hold a smaller slice yet post the fastest CAGR at 6.87%. Early detection kits, imaging advances, and AI-based risk models support this upswing. Rapid biomarker panels enable clinicians to stage disease well before serum creatinine rises, opening an expanding preventive market. Blood tests still account for most diagnostic revenue, but urine biomarker panels and imaging upgrades gain share as clinicians adopt multi-modal assessment pathways. Continuous monitoring devices could soon allow real-time eGFR tracking, fostering subscription revenue models for device makers.

The Chronic Kidney Disease Market Report is Segmented by Product Type (Diagnosis, Treatment), End User (Hospitals, Dialysis Centers, Homecare Settings, Other End Users), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 42.61% revenue in 2024, underpinned by broad insurance coverage and early uptake of novel drugs and devices. The United States anchors this lead; its duopoly dialysis structure imparts economies of scale but invites antitrust review. Canada follows with universal coverage, while Mexico's recent CKD screening campaigns expand diagnosis volumes.

Asia-Pacific is the fastest-growing region at 7.15% CAGR. China invests heavily in chronic disease clinics and domestic generic production that cuts therapy costs. India's manufacturing base drives affordable SGLT2 inhibitors, widening access across low-income states. Japan, with the world's oldest population, continues to deploy advanced home hemodialysis systems and invests in wearable artificial kidney trials. South Korea and Australia reinforce regional momentum through proactive tele-nephrology programs.

Europe, the Middle East & Africa, and South America offer moderate growth. Europe benefits from universal payer systems but seeks cost-savings via generics and home therapies. Gulf Cooperation Council states invest in transplant centers to offset regional dialysis demand. Africa faces strained infrastructure yet gains from public-private partnerships introducing low-cost peritoneal dialysis. South America, led by Brazil, incrementally raises CKD awareness and funds screening in primary care.

________________________________________

- Abbott Laboratories

- Abbvie

- Amgen

- AstraZeneca

- Baxter

- Bayer

- Beckton Dickinson

- Boehringer Ingelheim

- Bristol-Myers Squibb

- DaVita

- Roche

- Fresenius

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novo Nordisk

- Pfizer

- ProKidney

- Reata Pharmaceuticals

- Siemens Healthineers

- Sysmex

- Teva Pharmaceutical Industries

- Akebia Therapeutics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Diabetes & Hypertension

- 4.2.2 Aging Population Escalating Ckd Incidence

- 4.2.3 Technological Advances In Early Diagnostics

- 4.2.4 Value-Based Kidney-Care Payment Incentives

- 4.2.5 Ai-Driven Risk Stratification Tools

- 4.2.6 Growth Of Low-Carbon/Home Dialysis Devices

- 4.3 Market Restraints

- 4.3.1 High Cost Of Dialysis & Treatment

- 4.3.2 Generic Erosion In Mature Drug Classes

- 4.3.3 Drug Safety & Adverse-Effect Concerns

- 4.3.4 ESG-Linked Supply-Chain Cost Pressures

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Diagnosis

- 5.1.1.1 Blood Tests

- 5.1.1.2 Urine Tests

- 5.1.1.3 Imaging Tests

- 5.1.1.4 Point-of-Care Kidney Tests

- 5.1.1.5 Other Diagnosis Products

- 5.1.2 Treatment

- 5.1.2.1 Drug Class

- 5.1.2.1.1 ACE Inhibitors

- 5.1.2.1.2 Angiotensin-II Receptor Blockers

- 5.1.2.1.3 Diuretics

- 5.1.2.1.4 SGLT2 Inhibitors

- 5.1.2.1.5 Mineralocorticoid Receptor Antagonists

- 5.1.2.1.6 Erythropoiesis Stimulating Agents

- 5.1.2.1.7 Phosphate Binders

- 5.1.2.1.8 HIF-PH Inhibitors (Vadadustat etc.)

- 5.1.2.1.9 Other Drug Classes

- 5.1.2.2 Dialysis

- 5.1.2.2.1 Hemodialysis

- 5.1.2.2.2 Peritoneal Dialysis

- 5.1.2.2.3 Home Dialysis Systems

- 5.1.2.2.4 Wearable & Portable Dialysis

- 5.1.2.3 Other Treatment Products

- 5.1.1 Diagnosis

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Dialysis Centers

- 5.2.3 Homecare Settings

- 5.2.4 Other End Users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East & Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East & Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 AbbVie

- 6.3.3 Amgen

- 6.3.4 AstraZeneca

- 6.3.5 Baxter International

- 6.3.6 Bayer AG

- 6.3.7 Beckman Coulter

- 6.3.8 Boehringer Ingelheim

- 6.3.9 Bristol-Myers Squibb

- 6.3.10 DaVita

- 6.3.11 F. Hoffmann-La Roche

- 6.3.12 Fresenius Medical Care

- 6.3.13 GlaxoSmithKline

- 6.3.14 Johnson & Johnson

- 6.3.15 Merck & Co.

- 6.3.16 Novo Nordisk

- 6.3.17 Pfizer

- 6.3.18 ProKidney

- 6.3.19 Reata Pharmaceuticals

- 6.3.20 Siemens Healthineers

- 6.3.21 Sysmex

- 6.3.22 Teva Pharmaceutical Industries

- 6.3.23 Akebia Therapeutics

7 Market Opportunities & Future Outlook

- 7.1 White-space & unmet-need assessment