PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846255

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846255

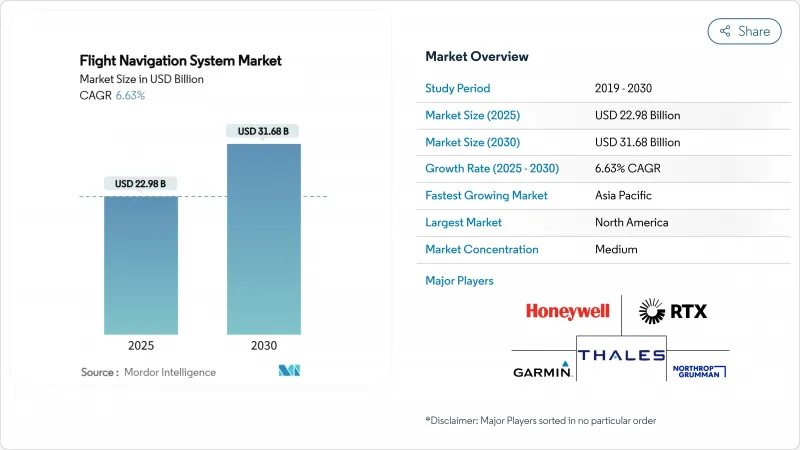

Flight Navigation System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The flight navigation system market is valued at USD 22.98 billion in 2025 and is projected to reach the market size of USD 31.68 billion by 2030, expanding at a 6.63% CAGR.

The current growth momentum reflects rising aircraft deliveries, mandatory NextGen and SESAR upgrades, and rapid adoption of AI-enabled sensor fusion across flight decks. Demand also benefits from expanding urban-air-mobility corridors, where centimeter-level positioning and low-latency data links are critical. Meanwhile, multi-layered redundancy architectures combining satellite-based augmentation, inertial sensors, and terrestrial aids lower fuel burn and increase airspace capacity. These advantages help offset mounting cybersecurity and spectrum-interference risks accompanying higher system complexity.

Global Flight Navigation System Market Trends and Insights

Satellite-Based Augmentation Systems Drive Infrastructure Transformation

EGNOS won a EUR 51 million (USD 60.01 million) extension through 2028, allowing European airports to support precision approaches without installing new ground beacons. Similar programs in Korea and sub-Saharan Africa mirror this success, pushing airlines to retire older receivers in favor of SBAS-ready hardware. Mandatory compatibility clauses within NextGen and SESAR accelerate equipment replacement cycles and promote global interoperability, which lowers pilot-training hours and flight-planning overheads. Airlines welcome lower ground-station maintenance costs because satellite signals deliver the required accuracy for Required Navigation Performance operations. These combined factors amplify upgrade demand across every fleet segment.

Commercial Fleet Expansion Fuels Navigation System Demand

Airbus and Boeing orderbooks returned to pre-pandemic levels in 2024, prompting OEMs like Thales to report EUR 6.4 billion (USD 7.54 billion) in avionics orders for flight management and navigation suites. Airlines prioritize continuous-descent and dynamic-routing software that cuts fuel burn and carbon penalties. Concurrently, more-electric aircraft architectures invite integrated computing platforms that consolidate navigation, communication, and flight-control tasks to save weight. Software-defined navigation unlocks over-the-air feature updates, protecting asset value across long service lives.

Cybersecurity Threats Expose Navigation Vulnerabilities

Confirmed GPS spoofing incidents rose sharply in 2024, disrupting commercial flights over conflict zones and compelling operators to fit multi-source positioning backups. Such redundancy raises costs and certification workloads. Manufacturers now embed quantum-grade inertial sensors to maintain accuracy during outages, while airlines invest in real-time monitoring to flag anomalous satellite data. Governments respond with spectrum-monitoring networks, but full deployment remains years away.

Other drivers and restraints analyzed in the detailed report include:

- Performance-Based Navigation Standards Reshape Operational Requirements

- UAV Navigation Reliability Drives Technology Innovation

- 5G Spectrum Interference Challenges Radar Altimeter Operations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radio links maintained 39.45% of 2024 revenue owing to entrenched VHF infrastructure and worldwide regulatory mandates. Yet hybrid GNSS-SBAS solutions are set to outpace all other technologies with an 8.95% CAGR, illustrating the industry swing toward precision approaches and oceanic coverage without ground aids. The flight navigation system market size for hybrid solutions is projected to grow faster than any other communication category, supported by satellite operators launching dedicated ADS-B constellations that feed real-time traffic data to crews.

Satellite communication gains relevance on polar and trans-oceanic tracks, while software-defined radios allow dynamic frequency selection to mitigate interference. The combination of space-based receivers and ground networks equips airlines with resilient links that underpin future four-dimensional trajectory management exercises. Thales' 100-satellite ADS-B program typifies this migration toward integrated surveillance and communications, reducing hardware counts and certification costs through common avionics modules.

Civil and commercial fleets controlled 41.25% of the flight navigation system market share in 2024, reinforced by replacing aging narrow-body aircraft and the rebound of passenger demand. Militaries drive the highest spending velocity with a 9.23% CAGR as nations pursue sovereign navigation capacity immune to foreign GNSS signals. These programs frequently bundle electronic-warfare filters, redundant inertial sensors, and AI-assisted mission planning in the same cockpit server to cut wiring and weight.

The Global Combat Air Programme's sixth-generation fighter concept demonstrates that sensor fusion and adaptive navigation will underpin future air superiority platforms. At the same time, eVTOL air-taxis, categorized under urban-air-mobility, begin to specify certified antennas and multi-frequency receivers designed for low-altitude corridors. This demand for diversity sustains backlog for platform-agnostic avionics suites that can be repackaged across fighters, freighters, and flying taxis with minimal requalification.

The Flight Navigation System Market Report is Segmented by Communication Technology (Radio, Satellite, Hybrid), Platform (Civil and Commercial Aviation, and More), Flight Instrument (Autopilot, Altimeter, Gyroscope, and More), System Type (Radars, Instrument Landing Systems, and More), Component (Hardware and Software), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America kept its leadership with a 35.65% share in 2024, underpinned by steady NextGen funding, strong business-jet production, and the FAA's proactive rulemaking on powered-lift aircraft. Area navigation route additions such as Q-143 and T-467 show that en-route efficiency upgrades persist even as passenger numbers rebound. The region's wide adoption of over-the-air software updates positions it as a proving ground for cloud-based navigation analytics that feed directly into dispatch-center algorithms.

Asia-Pacific is the fastest-growing arena at 8.12% CAGR to 2030. China and India dominate orderbooks for narrow-body jets, while regional governments allocate capital toward satellite-based augmentation and unmanned-traffic-management frameworks. Thales' new MRO facility in Delhi-NCR and its UTM roadmap agreement with Thai authorities illustrate a supplier pivot toward local engineering hubs that can cut time-to-certification for indigenous carriers. These moves accelerate the adoption of hybrid GNSS-SBAS receivers across new single-aisle fleets.

Europe registers solid gains as SESAR-driven PBN procedures proliferate and the European Union Aviation Safety Agency finalizes comprehensive VTOL regulations that set navigation performance baselines for urban air-mobility. The EGNOS service life extension to 2028 safeguards low-visibility operations for more than 400 airports, sustaining demand for SBAS-capable flight-management computers and precision approach displays. Sustainability priorities push airlines to adopt trajectory prediction tools that enable continuous-descent arrivals, reinforcing the role of predictive analytics within cockpit servers.

- Honeywell International Inc.

- Collins Aerospace (RTX Corporation)

- Thales Group

- Garmin Ltd.

- Northrop Grumman Corporation

- Safran SA

- L3Harris Technologies Inc.

- BAE Systems plc

- General Electric Company

- Universal Avionics Systems Corporation (Elbit Systems Ltd.)

- Leonardo S.p.A

- Moog Inc.

- Avidyne Corporation

- Saab AB

- The Boeing Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Satellite-based augmentation (SBAS) and NextGen/SESAR mandates

- 4.2.2 Rising global commercial aircraft fleet

- 4.2.3 Shift to performance-based navigation (PBN) standards

- 4.2.4 Growing demand for UAV and long-range UAS navigation reliability

- 4.2.5 Urban-air-mobility corridor integration needs

- 4.2.6 AI-driven sensor-fusion redundancy for zero-fail cockpits

- 4.3 Market Restraints

- 4.3.1 High upgrade and certification costs

- 4.3.2 Cyber-jamming and spoofing vulnerabilities

- 4.3.3 5G spectrum re-allocation crowding navigation bands

- 4.3.4 Rare-earth magnet shortages for MEMS gyros

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Communication Technology

- 5.1.1 Radio

- 5.1.2 Satellite

- 5.1.3 Hybrid (GNSS+SBAS)

- 5.2 By Platform

- 5.2.1 Civil and Commercial Aviation

- 5.2.2 Business and General Aviation

- 5.2.3 Military Aviation

- 5.2.4 UAV/eVTOL

- 5.3 By Flight Instrument

- 5.3.1 Autopilot

- 5.3.2 Altimeter

- 5.3.3 Gyroscope

- 5.3.4 Attitude Heading Reference System (AHRS)

- 5.3.5 Sensors (IMU, Air-data, etc.)

- 5.3.6 Magnetic Compass

- 5.4 By System Type

- 5.4.1 Radars

- 5.4.2 Instrument Landing Systems (ILS)

- 5.4.3 Inertial Navigation Systems (INS)

- 5.4.4 Collision Avoidance Systems (CAS)

- 5.4.5 GNSS/VOR-DME

- 5.4.6 Other Systems

- 5.5 By Component

- 5.5.1 Hardware

- 5.5.2 Software

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Honeywell International Inc.

- 6.4.2 Collins Aerospace (RTX Corporation)

- 6.4.3 Thales Group

- 6.4.4 Garmin Ltd.

- 6.4.5 Northrop Grumman Corporation

- 6.4.6 Safran SA

- 6.4.7 L3Harris Technologies Inc.

- 6.4.8 BAE Systems plc

- 6.4.9 General Electric Company

- 6.4.10 Universal Avionics Systems Corporation (Elbit Systems Ltd.)

- 6.4.11 Leonardo S.p.A

- 6.4.12 Moog Inc.

- 6.4.13 Avidyne Corporation

- 6.4.14 Saab AB

- 6.4.15 The Boeing Company

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment