PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846262

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846262

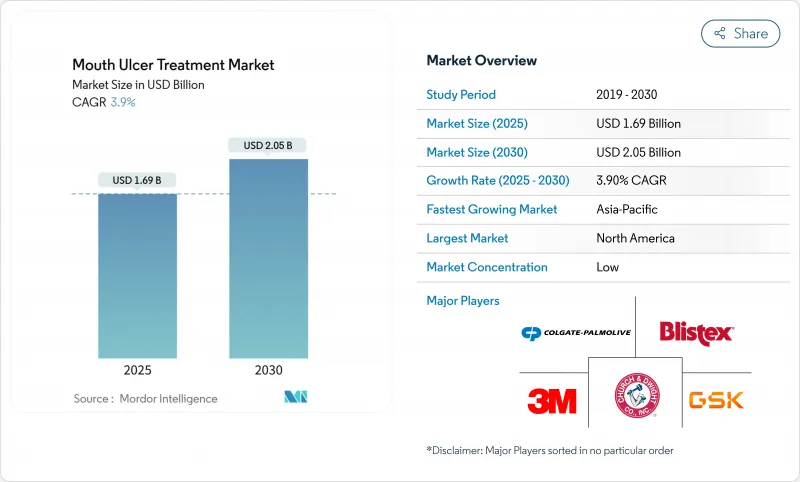

Mouth Ulcer Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The mouth ulcer treatment market generated USD 1.69 billion in 2025 and is forecast to reach USD 2.05 billion by 2030, advancing at a 3.89% CAGR.

Moderate expansion reflects a maturing landscape in which well-established corticosteroid and analgesic brands face new competition from AI-guided personalization, herbal actives, and muco-adhesive films. Demand is reinforced by growing autoimmune disease prevalence, wider e-commerce access to over-the-counter (OTC) remedies, and a steady pipeline of delivery-system innovations. Market participants also contend with cost pressure as generic erosion accelerates and subscription-commerce models reset consumer expectations. While premium formulations command higher unit revenues in North America and Western Europe, emerging economies focus on affordable sprays and gels that deliver rapid pain relief and minimal systemic exposure.

Global Mouth Ulcer Treatment Market Trends and Insights

Rise in Sugar-Free & Herbal OTC Gels

Consumers increasingly choose plant-derived and sugar-free gels, pushing manufacturers to invest in botanical actives such as eugenol and flavonoids that pair well with modern muco-adhesive bases. Clinical validation supports efficacy, addressing regulatory and prescriber scrutiny. Market leaders differentiate through transparent labeling, clinical dossiers, and convenient packaging aligned with tele-pharmacy growth.

Growing Prevalence of Autoimmune Disorders

Enhanced and aging demographics lift autoimmune disease incidence, increasing oral lichen planus and aphthous ulcer cases. Targeted small-molecule therapies, illustrated by tofacitinib success in erosive lichen planus, shift treatment from broad anti-inflammatory regimens to precision approaches. Cross-portfolio synergies emerge as systemic immunology pipelines adapt topical formulations for oral lesion

OTC Product Commoditization Keeps Prices Low

Patent expiries and biosimilar entry drop average selling prices by nearly 50%, limiting premium scope unless backed by clear clinical or convenience advantages. Manufacturers lengthen life-cycles through reformulations, but retailers use private-label parity to restrain shelf prices.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Proliferation Boosting Self-Medication

- Advances in Muco-Adhesive Drug-Delivery Films

- Safety Concerns Over Long-Term Corticosteroid Use

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Analgesics retained 38.78% of the mouth ulcer treatment market in 2024, benefiting from physician familiarity and broad OTC access. The segment's lead, however, is challenged as anesthetics log a 4.15% CAGR, reflecting patient preference for rapid numbness that supports daily function. Combination nanofiber platforms delivering acyclovir plus clobetasol demonstrate superior lesion resolution, underlining the role of co-formulations in the mouth ulcer treatment market.

In revenue terms, anesthetic expansion translates into a rising contribution to the mouth ulcer treatment market size, propelled by dentistry partnerships and digital triage apps that advise immediate symptomatic relief. Corticosteroid brands remain indispensable for immune-mediated ulcers despite safety debate, while antimicrobial agents occupy niche use against secondary infection.

The Mouth Ulcer Treatment Market Report Segments the Industry Into Drug Class (Antimicrobial, Antihistamine, Analgesics, Corticosteroids, Other Drug Classes), Formulation (Sprays, Mouthwash, Gels, Other Formulations), Indication (Aphthous Stomatitis, Oral Lichen Planus, Other Indications) and Geography (North America, Europe, Asia-Pacific, Middle East and Africa and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 38.89% of 2024 value through robust insurance coverage, specialist networks, and marketing scale. Retail pharmacies increasingly co-pack AI-guided consultation leaflets, reinforcing premium positioning. The United States posts the highest per-capita spend, while Canada's reimbursement reforms encourage expanded OTC usage.

Asia-Pacific registers the top 5.63% CAGR through 2030, driven by urbanization, oral health campaigns, and regulatory streamlining in China and India. Beijing's 2027 reform blueprint promises faster review cycles, likely accelerating innovative spray and film launches. Malaysia's National Oral Health Strategic Plan further underscores regional policy focus on mouth ulcer prevention and early treatment. Local manufacturing hubs reduce cost, supporting volume penetration.

Europe sustains steady growth as evidence-based guidelines promote clinically proven products. Cross-border e-pharmacy directives foster online share gains, although strict advertising codes cap direct-to-consumer promotional flexibility. Market access hinges on health-technology-assessment outcomes that reward real-world evidence for novel delivery systems.

- GlaxoSmithKline

- Colgate-Palmolive Company

- Sun Pharmaceuticals Industries

- Pfizer

- Blistex

- Church & Dwight

- Bristol-Myers Squibb

- Taro Pharmaceutical Industries Ltd.

- Bausch Health

- 3M

- Teva Pharmaceutical Industries

- Reckitt Benckiser Group

- Novartis

- Sanofi

- Prestige Consumer Healthcare

- EUSA Pharma

- Himalaya

- Dr. Reddy's Laboratories Ltd.

- Johnson & Johnson Consumer Health

- Procter & Gamble

- Dexcel Pharma

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in sugar-free & herbal OTC gels

- 4.2.2 Growing prevalence of autoimmune disorders

- 4.2.3 E-commerce proliferation boosting self-medication

- 4.2.4 Advances in muco-adhesive drug-delivery films (2025+)

- 4.2.5 AI-driven personalised oral-care regimens

- 4.2.6 Microbiome-targeted therapeutics pipeline

- 4.3 Market Restraints

- 4.3.1 OTC product commoditisation keeps prices low

- 4.3.2 Safety concerns over long-term corticosteroid use

- 4.3.3 Regulatory hurdles for novel biologic topicals

- 4.3.4 Under-diagnosis in low-income regions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Drug Class

- 5.1.1 Analgesics

- 5.1.2 Corticosteroids

- 5.1.3 Antimicrobials

- 5.1.4 Antihistamines

- 5.1.5 Anesthetics

- 5.1.6 Other Drug Classes

- 5.2 By Formulation

- 5.2.1 Ointments & Creams

- 5.2.2 Gels

- 5.2.3 Mouthwashes & Rinses

- 5.2.4 Sprays

- 5.2.5 Lozenges

- 5.2.6 Other Formulations

- 5.3 By Ulcer Type

- 5.3.1 Aphthous Stomatitis

- 5.3.2 Oral Lichen Planus

- 5.3.3 Others

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 GlaxoSmithKline plc

- 6.3.2 Colgate-Palmolive Company

- 6.3.3 Sun Pharmaceutical Industries Ltd.

- 6.3.4 Pfizer Inc.

- 6.3.5 Blistex Inc.

- 6.3.6 Church & Dwight Co., Inc.

- 6.3.7 Bristol-Myers Squibb Company

- 6.3.8 Taro Pharmaceutical Industries Ltd.

- 6.3.9 Bausch Health Companies Inc.

- 6.3.10 3M Company

- 6.3.11 Teva Pharmaceutical Industries Ltd.

- 6.3.12 Reckitt Benckiser Group plc

- 6.3.13 Novartis AG

- 6.3.14 Sanofi S.A.

- 6.3.15 Prestige Consumer Healthcare Inc.

- 6.3.16 EUSA Pharma

- 6.3.17 Himalaya Wellness Company

- 6.3.18 Dr. Reddy's Laboratories Ltd.

- 6.3.19 Johnson & Johnson Consumer Health

- 6.3.20 Procter & Gamble Company

- 6.3.21 Dexcel Pharma

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment