PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846263

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846263

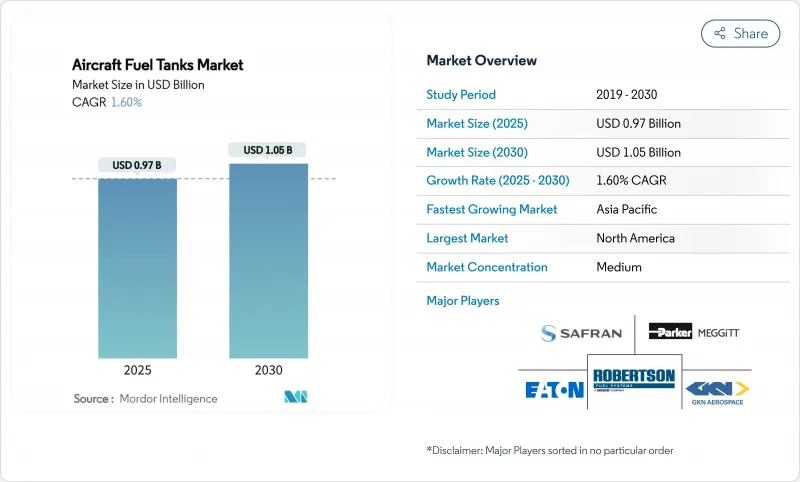

Aircraft Fuel Tanks - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The aircraft fuel tanks market stands at USD 0.97 billion in 2025 and is forecasted to reach a market size of USD 1.05 billion by 2030, translating into a restrained 1.6% CAGR.

The modest topline masks latent disruption as OEMs balance incremental upgrades to kerosene-based systems with sizeable R&D outlays for hydrogen storage. Robust replacement demand-underpinned by Boeing's projection for nearly 44,000 new deliveries through 2043-anchors baseline production volumes, even as cryogenic concepts mature for mid-2030s entry-into-service. Parallel defense recapitalization initiatives, such as the US KC-Y bridge tanker and the Next Generation Air-refueling System, inject premium revenue streams into a market historically led by commercial programs. Composite material penetration keeps margins attractive; carbon-fiber solutions account for 41.34% of 2024 material revenues, reflecting the unrelenting OEM focus on weight reduction.

Global Aircraft Fuel Tanks Market Trends and Insights

Commercial Aircraft Production Up-Cycle

Airlines are replacing older narrow-bodies with high-utilization single-aisle jets, sustaining baseline fuel-tank demand even during macroeconomic uncertainty. The Airbus A321XLR's 12,900-liter rear-center tank extends range to 4,700 nm, proving that creative fuel storage unlocks new, thinner routes. Record backlog visibility-often exceeding 10 years-allows tank suppliers to forward-plan capacity. OEMs now target 90-day cabin-to-wing modification cycles, down from 120 days on early programs, broadening line-fit throughput. Sustained single-aisle mix shifts favor technologies that ease center-of-gravity management as airlines standardize high-density seating. While supply-chain fragility tempers near-term output, the driver's net positive effect remains sizable over the medium term.

Defense Fleet Modernization Programs

Three-phase tanker recapitalization in the United States involves completing KC-46A deliveries by 2029, procuring 140-160 KC-Y units, and fielding the stealth NGAS platform around 2040. The KC-46A alone has transferred over 200 million lb of fuel in global operations, highlighting the mission-critical role of advanced tank technology. Asia-Pacific outlays, accounting for 42% of global arms imports, widen the addressable military fleet base. Europe's eight-unit Multinational MRTT Fleet provides a cooperative model that other regions may replicate for cost-effective aerial refueling capacity. Premium pricing of stealth-compatible tanks offsets the narrower unit volumes typical of defense programs, ensuring a robust revenue contribution through the long term.

Volatile Aerospace Raw-Material Prices and Supply Chain Risk

Titanium sponge sourcing remains exposed, with the United States importing over 90% from geopolitically sensitive suppliers. Russia's conflict with Ukraine and China's capacity build-up undermine price stability, driving a 6.8% global titanium CAGR through 2027. Counterfeit alloy incidents have prompted intensified incoming inspection protocols at Airbus and Boeing lines, heightening cost and schedule pressure. Backlogs now embed longer lead times for forgings and castings, forcing OEMs to dual-source critical tank components. Diversification campaigns and near-shoring initiatives require multi-year capital commitments, diluting margin upside for first-tier suppliers.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Lightweight CFRP and Hybrid Tanks

- Rising Retrofit Demand for Auxiliary/Long-Range Kits

- Stringent Certification and Fire-Safety Testing Requirements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

External tanks record the fastest 4.11% CAGR as militaries prioritize drop-tanks, conformal systems, and buddy-pod refuelers that can be jettisoned or detached when tactical needs shift. Internal systems still dominate 59.77% of 2024 revenue, underscoring their space-efficiency and center-of-gravity advantages in commercial service. Eaton's 1,360-gal jettisonable units showcase compliance with JP-4, JP-5, and JP-8 while offering structural provisions for supersonic carriage. The emergence of conformable shapes supports blended-wing-body demonstrators that lack traditional wing boxes. Advancements in self-sealing technology protect against incendiary rounds, while integrated fuel-quantity gauging achieves sub-0.25% accuracy through digital probes.

Growth pivots to emerging hybrid fighter missions demanding stealth and ferry range, compelling designers to blend internal bays with low-observable external pods. Bladder-based auxiliary kits reinforce aftermarket momentum, letting airlines field range-extension packages without structural re-certification. Active-health-monitoring sensors feed prognostic algorithms that schedule maintenance windows before leaks propagate. Thus, even as the aircraft fuel tank market size remains, internal systems and external tank innovation deliver a disproportionate share of incremental revenue.

Carbon-fiber composites captured 41.34% of 2024 revenue, driven by weight savings of 15-35 kg per short-haul aircraft, translating into multi-million-dollar lifetime fuel burn reductions. Hybrid cryogenic structures clock a 5.6% CAGR as hydrogen roadmaps crystallize around mid-2030s entry-into-service. Linerless Type V tanks promise 40% additional weight savings but face micro-crack propagation issues under high-cycle pressure loads. Metallic alloys such as aluminum-lithium retain relevance where proven fracture toughness is paramount, especially in wing integral tanks for wide-bodies. Polymer-based bladders continue to service retrofit demand thanks to installation speed and lower capital requirements.

Automated Fiber Placement couples ultrasonic welding to create liquid-tight seams, a prerequisite for cryogenic LH2. Hybrid configurations mesh titanium liners with carbon overwraps, allowing linerless concepts to mature. Embedded fiber-optic sensors track strain and temperature in real time, enabling predictive maintenance business models. Consequently, while composites dominate value today, the aircraft fuel tanks market share of hybrid and smart-material solutions will continue to climb.

The Aircraft Fuel Tanks Market Report is Segmented by Type (Internal and External), Material (Metallic Alloys, Carbon-Fiber Composites, Polymer/Elastomer Bladders, and More), Platform (Commercial Aircraft, Military Aircraft, and More), End Use (OEM, Aftermarket/Retrofit), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35.34% of 2024 revenue on the back of Boeing's high-volume B737 and B787 lines, plus the US Air Force's tanker recapitalization roadmap. The KC-46A program, despite schedule slips, validates advanced inert-ing and boom-refueling tanks capable of 1,200 gallons-per-minute offload rates. Washington's policy focuses on reshoring titanium and aluminum value chains and aims to defuse geopolitical risk from Russia and China. The Biden administration's 2025 Inflation Reduction Act credits hydrogen-aircraft demonstrators, catalyzing early LH2 tank R&D funding

Asia-Pacific posts the highest 5.28% CAGR as China seeks to double its commercial fleet by 2043, demanding more than 8,000 single-aisle aircraft that will ship with integral carbon-fiber tanks. COMAC C919 deliveries reached 10 aircraft by end-2024, stimulating home-grown subsystem ecosystems. India's 8.3% annual passenger growth underpins high-seat-count narrow-body orders, while its Make-in-India scheme lures fuel-system joint ventures such as Safran-HAL for LEAP engine parts. Defense spending, accounting for 42% of global imports, demands multirole tankers and conformal solutions on revamped fighter fleets.

Europe's share edges forward on steady Airbus output and collaborative defense projects like the eight-unit MRTT fleet delivered out of the Netherlands. EASA's RefuelEU mandate requires 2% SAF blending in 2025, scaling to 70% by 2050, compelling tank upgrade paths for fuel-property variability. Regional R&D clusters in Sweden and France invest heavily in cryogenic demonstrators, exemplified by GKN's 5,000 m2 expansion in Trollhattan that integrates AFP cells and digital twins. Brexit-driven customs frictions dampen UK suppliers' competitiveness, yet targeted investments by Spirit AeroSystems shore up critical-structure capacity. Overall, geographical demand shifts make Asia-Pacific the volume growth leader while North America remains the technology bellwether.

- Safran SA

- Meggitt PLC (Parker-Hannifin Corporation)

- Eaton Corporation plc

- Robertson Fuel Systems LLC

- Aero Tec Laboratories Ltd.

- GKN Aerospace (Melrose plc)

- Elbit Systems Ltd.

- Marshall Group

- Applied Aerospace Structures Corporation

- Collins Aerospace (RTX Corporation)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Commercial aircraft production up-cycle

- 4.2.2 Defense fleet modernization programs

- 4.2.3 Adoption of lightweight CFRP and hybrid tanks

- 4.2.4 Rising retrofit demand for auxiliary/long-range kits

- 4.2.5 Mandatory inert-gas inerting systems

- 4.2.6 Emergence of cryogenic LH2 tanks for zero-emission aircraft

- 4.3 Market Restraints

- 4.3.1 Volatile aerospace raw-material prices and supply chain risk

- 4.3.2 Stringent certification and fire-safety testing requirements

- 4.3.3 High R&D and tooling CAPEX for composite tanks

- 4.3.4 Sub-100-seat electric aircraft reducing future tank demand

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Internal (Integral, Bladder, Self-sealing)

- 5.1.2 External (Drop, Conformal, Buddy-Pods)

- 5.2 By Material

- 5.2.1 Metallic Alloys (Al-Li, Ti)

- 5.2.2 Carbon-Fiber Composites

- 5.2.3 Polymer/Elastomer Bladders

- 5.2.4 Hybrid and Next-Gen Cryogenic

- 5.3 By Platform

- 5.3.1 Commercial Aircraft

- 5.3.2 Military Aircraft

- 5.3.3 General Aviation Aircraft and Business Jets

- 5.4 By End Use

- 5.4.1 OEM

- 5.4.2 Aftermarket/Retrofit

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 France

- 5.5.2.3 Germany

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Safran SA

- 6.4.2 Meggitt PLC (Parker-Hannifin Corporation)

- 6.4.3 Eaton Corporation plc

- 6.4.4 Robertson Fuel Systems LLC

- 6.4.5 Aero Tec Laboratories Ltd.

- 6.4.6 GKN Aerospace (Melrose plc)

- 6.4.7 Elbit Systems Ltd.

- 6.4.8 Marshall Group

- 6.4.9 Applied Aerospace Structures Corporation

- 6.4.10 Collins Aerospace (RTX Corporation)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment