PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846266

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846266

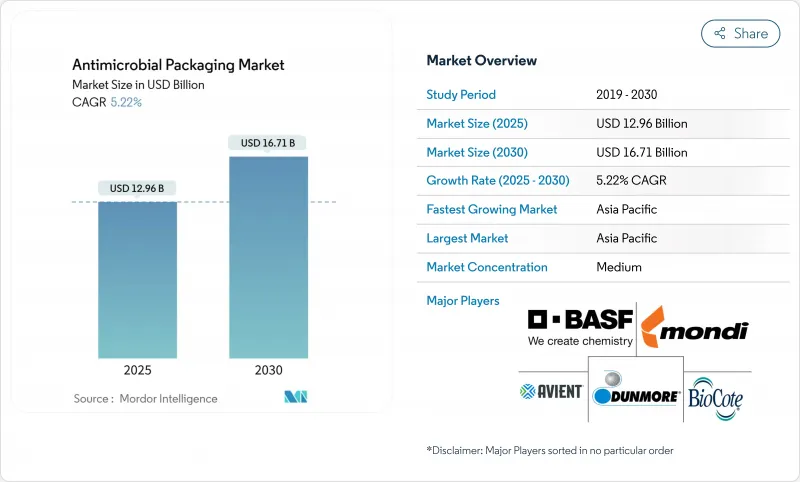

Antimicrobial Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Current data indicate the antimicrobial packaging market is valued at USD 12.96 billion in 2025 and is forecast to reach USD 16.71 billion by 2030, expanding at a 5.22% CAGR.

Demand is propelled by stricter food-contact regulations, the phase-out of PFAS substances, and corporate sustainability mandates that elevate antimicrobial functionality to a mainstream packaging requirement. Regulatory momentum has sparked a pivot toward bio-based antimicrobial agents that balance microbial efficacy with environmental credentials. Asia-Pacific remains the fulcrum of growth, driven by evolving sanitation laws, a booming e-grocery sector, and rapid cold-chain upgrades. Parallel advances in controlled-release nano-silver films, natural compound integration, and smart-sensor pairing are reshaping competitive innovation priorities. As a result, the antimicrobial packaging market continues to diversify across materials, technologies, and end-use sectors.

Global Antimicrobial Packaging Market Trends and Insights

Stringent Post-COVID Food-Safety Regulations

The global reset of food-contact oversight is amplifying uptake of antimicrobial solutions. The United States Human Foods Program now reassesses legacy PFAS notifications, creating an opening for safer antimicrobial alternatives. European agencies simultaneously flag persistent pathogens such as Listeria monocytogenes, compelling processors to adopt packaging that adds an extra microbial barrier. These converging mandates accelerate investment in naturally-derived agents that fulfil both safety and "clean-label" expectations. For suppliers able to document efficacy and recyclability, regulatory tightening translates into clear growth runway within the antimicrobial packaging market.

Acceleration of E-Grocery Cold-Chain Investments

Explosive demand for online groceries places unprecedented stress on temperature-controlled logistics. In Asia-Pacific, thousands of micro-fulfilment warehouses now require packaging that maintains quality over extended last-mile journeys. When refrigeration falters, antimicrobial layers serve as a critical secondary safeguard, reducing spoilage claims. Emerging smart packs pair time-temperature indicators with embedded antimicrobials, giving platforms data-driven control over freshness. As same-day delivery windows shrink, retailers increasingly make antimicrobial functionality a procurement prerequisite, particularly for high-risk perishables. This e-commerce momentum solidifies near-term gains for the antimicrobial packaging market.

EU Biocide Regulation (BPR) Hurdles for Nano-Metals

Europe's Biocidal Products Regulation requires exhaustive dossiers before nano-silver or nano-copper can enter food-contact channels. With no nano-metal yet authorised for direct food or feed applications, innovators face multi-year toxicology programs. Wide-ranging data demands inflate time-to-market, prompting some firms to pivot toward plant-based actives that clear regulatory pathways more swiftly. The deterrent effect narrows near-term growth for metallic solutions inside the antimicrobial packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Breakthroughs in Controlled-Release Nano-Silver Films

- Inclusion of Antimicrobial Features in ESG Scorecards

- Price Volatility in Silver and Copper Feedstocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastics currently anchor the antimicrobial packaging market size, capturing 60.32% revenue share in 2024 due to scalable extrusion lines and robust barrier performance. Yet policy targets that mandate full recyclability by 2030 propel biopolymers to an 8.32% CAGR, the fastest among materials. Poly-lactic acid and polyhydroxyalkanoate blends enhanced with chitosan or essential oils now match microbial kill rates seen in petrochemical films while supporting compostable end-of-life routes.

Investment is accelerating in closed-loop collection schemes that recover biopolymer offcuts without sacrificing antimicrobial potency. Research also evidences that paper fibres coated with phenolic-rich polysaccharides retain recyclability and deliver broad-spectrum bacterial inhibition. These advances ensure biopolymers will continue eroding plastic share, reshaping supplier portfolios throughout the antimicrobial packaging market.

Organic acids command 45.63% of 2024 revenue owing to regulatory familiarity and cost efficiency. However, bacteriocins and enzymes accelerate at 7.53% CAGR, mirroring consumer migration to recognizable, label-friendly additives. Synergistic systems marry bacteriocins with nano-silver, doubling kill efficiency while curbing metal dosage.

Essential oils protected within cyclodextrin cages provide controlled vapor release that suppresses spoilage organisms in high-moisture produce. As biocide scrutiny intensifies, plant-derived agents gain strategic heft, positioning natural actives as pivotal to future differentiation in the antimicrobial packaging market.

Antimicrobial Packaging Market is Segmented by Material (Plastics, Biopolymers, and More), Antimicrobial Agent Type (Organic Acids, Bacteriocins and Enzymes, and More), Technology (Active Surface Coating, and More), Pack Type (Pouches and Bags, Films and Wraps, and More), End-User Industry (Food and Beverages, Healthcare and Medical Devices, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific tops the global leaderboard, holding 41.22% revenue in 2024 and registering the highest 8.96% CAGR to 2030. China's Food Safety Law amendments and India's FSSAI hygiene codes mandate microbiological safeguards that funnel capital toward advanced packs. Japanese converters add smart indicators and controlled-release antimicrobials to premium seafood exports, elevating unit margins. Regional government initiatives to counter antimicrobial resistance further incentivise adoption, reinforcing Asia-Pacific's pull on the antimicrobial packaging market.

Europe follows, its trajectory shaped by the EU Packaging and Packaging Waste Regulation that forces recyclability and recycled-content compliance. Germany and France spearhead R&D into bio-based actives, whereas Mediterranean exporters deploy antimicrobial cartons to secure shelf life during cross-border produce shipments. While the BPR slows nano-metal roll-outs, it simultaneously accelerates botanical innovation, keeping Europe central to technology leadership.

North America sustains steady gains anchored by FDA oversight and robust healthcare demand. The United States channels grant funding toward PFAS alternatives, indirectly uplifting antimicrobial packaging market size for natural actives. Canadian institutes pilot cellulose-based films infused with enzyme cocktails, targeting seafood supply chains. Mexico, leveraging near-shoring trends, scales antimicrobial pouch production for both domestic brands and US retailers.

- Amcor Plc

- Mondi Group

- Sealed Air Corporation

- BASF SE

- Avient Corporation

- BioCote Limited

- Sciessent LLC

- Microban International

- Covestro AG

- Takex Labo Co., Ltd.

- Dunmore Corporation

- Sonoco Products Company

- Constantia Flexibles

- Toppan Printing Co., Ltd.

- Toyochem Co., Ltd.

- Nissen Chemitec Corporation

- Parx Materials N.V.

- Tekni-Plex Inc.

- Plastipak Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent post-COVID food-safety regulations

- 4.2.2 Acceleration of e-grocery cold-chain investments

- 4.2.3 Breakthroughs in controlled-release nano-silver films

- 4.2.4 Inclusion of antimicrobial features in ESG scorecards

- 4.2.5 Shift to reusable medical-device trays in hospitals

- 4.2.6 Adoption of edible, antimicrobial coatings for fresh-produce export

- 4.3 Market Restraints

- 4.3.1 EU biocide regulation (BPR) hurdles for nano-metals

- 4.3.2 Price volatility in silver and copper feedstocks

- 4.3.3 Consumer push-back on synthetic preservatives in packaging

- 4.3.4 Scale-up challenges for bio-based antimicrobial polymers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastics

- 5.1.2 Biopolymers

- 5.1.3 Paper and Paperboard

- 5.1.4 Glass

- 5.1.5 Metals

- 5.2 By Antimicrobial Agent Type

- 5.2.1 Organic Acids

- 5.2.2 Bacteriocins and Enzymes

- 5.2.3 Silver and Copper Nanoparticles

- 5.2.4 Essential Oils and Plant Extracts

- 5.3 By Technology

- 5.3.1 Active Surface Coating

- 5.3.2 Controlled-Release Systems

- 5.4 By Pack Type

- 5.4.1 Pouches and Bags

- 5.4.2 Films and Wraps

- 5.4.3 Trays and Lids

- 5.4.4 Carton Packages

- 5.5 By End-user Industry

- 5.5.1 Food and Beverages

- 5.5.1.1 Meat, Poultry and Seafood

- 5.5.1.2 Bakery and Confectionery

- 5.5.1.3 Fruits and Vegetables

- 5.5.2 Healthcare and Medical Devices

- 5.5.3 Personal Care and Cosmetics

- 5.5.4 Animal Feed and Pet Food

- 5.5.5 Other End-User Industry

- 5.5.1 Food and Beverages

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor Plc

- 6.4.2 Mondi Group

- 6.4.3 Sealed Air Corporation

- 6.4.4 BASF SE

- 6.4.5 Avient Corporation

- 6.4.6 BioCote Limited

- 6.4.7 Sciessent LLC

- 6.4.8 Microban International

- 6.4.9 Covestro AG

- 6.4.10 Takex Labo Co., Ltd.

- 6.4.11 Dunmore Corporation

- 6.4.12 Sonoco Products Company

- 6.4.13 Constantia Flexibles

- 6.4.14 Toppan Printing Co., Ltd.

- 6.4.15 Toyochem Co., Ltd.

- 6.4.16 Nissen Chemitec Corporation

- 6.4.17 Parx Materials N.V.

- 6.4.18 Tekni-Plex Inc.

- 6.4.19 Plastipak Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment