PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846267

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846267

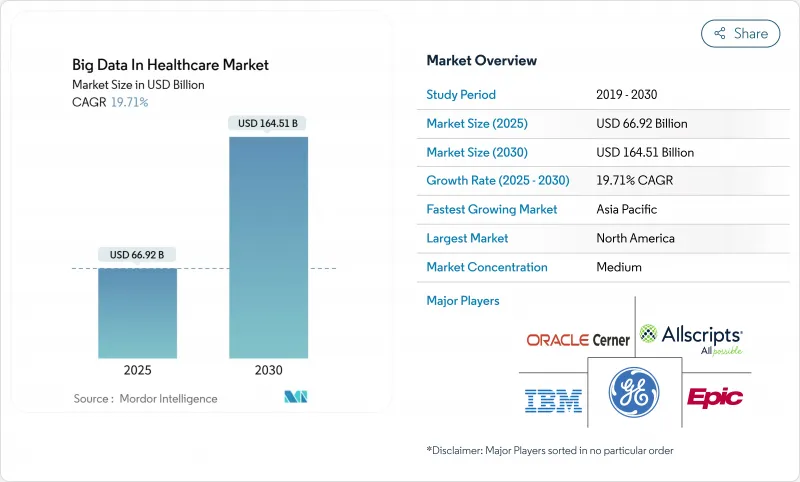

Big Data In Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Big Data In Healthcare Market size is estimated at USD 66.92 billion in 2025, and is expected to reach USD 164.51 billion by 2030, at a CAGR of 19.71% during the forecast period (2025-2030).

Growth is propelled by providers' move toward data-driven care delivery, the rise of real-time analytics, and policy initiatives that favor interoperable data exchange. Value-based care agreements are accelerating demand for advanced analytics that prove measurable outcomes to payers, while the European Health Data Space shows how regulation can unlock secondary data use across an entire region. Multi-omics integration is pushing precision medicine into everyday practice, with AI models now processing genomic and clinical data from 57 million National Health Service patient records. North America leads adoption thanks to FHIR-based interoperability infrastructure, yet Asia-Pacific is growing fastest as large public-private digitization programs scale across China and India. Services dominate spending because most healthcare organizations lack internal expertise for complex deployments, and cloud migration outpaces on-premise upgrades as AI workloads intensify.

Global Big Data In Healthcare Market Trends and Insights

Increase in Demand for Analytics Solutions for Population Health Management

Population health strategies increasingly combine social determinants with clinical data to predict risk and allocate resources. Providers deploying advanced analytics have lowered readmission rates and demonstrated material cost savings, aligning with the Centers for Medicare & Medicaid Services target that all fee-for-service beneficiaries join value-based arrangements by 2030. Real-world evidence platforms merge claims, electronic health records, and genomic profiles to create individualized risk scores that guide early interventions. Uptake is widespread across integrated delivery networks in the United States, while European payers use similar tools to meet EHDS objectives.

Rising Need for Business Intelligence to Optimise Health Administration & Strategy

Hospitals face tight margins and growing administrative complexity. Modern business intelligence suites integrate revenue-cycle metrics with operational and clinical indicators to highlight performance gaps in real time. AI-based denial management modules automate claim edits and have shortened average payment windows for large US systems, freeing cash for patient care investments. Rolling forecasts and scenario modeling help executives navigate shifting reimbursement rates, workforce constraints, and supply chain disruptions. Multi-facility systems benefit the most because enterprise dashboards surface best practices that can be standardized across locations.

Security Concerns Related to Sensitive Patient Medical Data

More than 31 million Americans were affected by healthcare breaches in 2024. Proposed 2025 HIPAA security updates mandate rigorous asset inventories and incident response plans, adding complexity to analytics rollouts. Homomorphic encryption allows computation on encrypted data but introduces latency and integration hurdles that slow projects. Cross-institution research collaborations struggle to reconcile data-sharing benefits with legal exposure, leading some partners to narrow the scope of joint analytics initiatives.

Other drivers and restraints analyzed in the detailed report include:

- Mandates for Value-Based Care Reimbursement

- Expanding Adoption of Real-Time Remote-Patient-Monitoring Data Streams

- High Cost of Implementation and Deployment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The services segment held 56.77% of Big Data in Healthcare market share in 2024 and is forecast to grow at 22.18% CAGR as organizations outsource consulting, integration, and managed operations. Many health systems lack internal skill sets in data governance and security, so they contract specialized vendors to design cloud architectures, map data flows, and ensure regulatory compliance. The services segment also benefits from multi-year managed analytics contracts that bundle platform maintenance with performance optimization.

Despite software's smaller share, platform vendors collaborate with services partners to accelerate deployments, improving time to value for providers. Growth in services underscores the Big Data in Healthcare market need for multidisciplinary teams that combine clinical insight with data science and cybersecurity. Providers negotiate outcome-based service level agreements that align consulting fees with readmission reductions or revenue-cycle improvements. As advanced use cases emerge, such as federated learning across multiple hospitals, demand for specialized algorithm-curation services is rising.

On-premise deployments accounted for 61.89% of the Big Data in Healthcare market size in 2024 because many institutions retained physical control over protected health information. However, cloud deployments are projected to grow at 24.72% CAGR through 2030 as hyperscalers invest in healthcare-specific security tooling and compliance attestations. Providers increasingly migrate AI and high-performance computing workloads to cloud clusters where elastic scaling supports computationally intensive genomics and imaging analyses.

Cloud uptake also reflects the shift to subscription models that convert capital outlays into operating expenses, a feature attractive to budget-constrained hospitals. Microsoft and NVIDIA collaborate to offer turnkey AI stacks optimized for healthcare, encouraging health systems to offload model training to secure data centers microsoft.com. Hybrid models persist in cardiology and radiology departments where large imaging archives still reside on local picture archiving systems, yet data-tiering policies push older studies to cheaper cloud object storage.

The Big Data in Healthcare Market Report is Segmented by Component (Software, Services), Deployment (On-Premise, Cloud), Analytics Type (Descriptive Analytics, Predictive Analytics, Prescriptive Analytics), Application (Financial Analytics, and More), End User (Healthcare Providers, and More), and Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest regional market with 45.84% share in 2024, supported by mature EHR adoption and federal interoperability policies. The 2024 Draft Federal FHIR Action Plan aims to standardize implementation guides across agencies, encouraging seamless data flow among providers, payers, and public health bodies. US health systems engage cloud vendors to modernize analytics while balancing HIPAA obligations. Canada advances national health data integration through its Infoway initiatives, and Mexico invests in digital epidemiology to manage chronic disease burdens.

Europe follows closely, energized by the European Health Data Space that is expected to save the bloc EUR 11 (USD 12.9) billion over ten years by enabling secure secondary data use. Germany's Hospital Future Act allocates EUR 4 (USD 4.7) billion to modernize hospital IT systems, including analytics readiness. The United Kingdom scales its NHS Federated Data Platform to unify datasets across trusts. France, Italy, and Spain implement national electronic health record expansion, emphasizing AI readiness. By 2028 the EHDS will create cross-border data-sharing pathways that accelerate research and population health programs.

Asia-Pacific is the fastest growing big data in healthcare market region, projected at a 20.57% CAGR through 2030. China integrates provincial health information exchanges into a national backbone that supports predictive modeling for public health emergencies. India's Ayushman Bharat Digital Mission establishes a unique health identifier that links patient data across public and private facilities. Japan pilots AI-driven eldercare monitoring as it contends with a rapidly aging population. Australia publishes My Health Record APIs to encourage third-party analytics innovations, and South Korea funds cloud-based genomic analysis under its Bio-Vision 2030 roadmap. Diverse demographics and disease profiles create demand for flexible analytics frameworks that can scale from megacities to remote islands.

- Allscripts

- Dell

- Epic Systems

- GE Healthcare

- SAS Institute

- IBM

- Innovaccer

- Oracle

- Optum

- Exl Service

- Health Fidelity

- Apixio Inc.

- Flatiron Health

- Amazon Web Services Inc.

- Koninklijke Philips

- Siemens Healthineers

- Health Catalyst

- Palantir Technologies Inc.

- MedeAnalytics

- Truven Health Analytics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in Demand for Analytics Solutions for Population Health Management

- 4.2.2 Rising Need for Business Intelligence to Optimise Health Administration & Strategy

- 4.2.3 Mandates for Value-Based Care Reimbursement

- 4.2.4 Expanding Adoption of Real-Time Remote-Patient-Monitoring Data Streams

- 4.2.5 Integration of Multi-Omics Datasets into Clinical Decision Support

- 4.2.6 Emergence of Hospital-At-Home Models Generating Rich Home-Based Data

- 4.3 Market Restraints

- 4.3.1 Security Concerns Related to Sensitive Patient Medical Data

- 4.3.2 High Cost of Implementation and Deployment

- 4.3.3 Fragmented Data Standards Hindering Interoperability

- 4.3.4 Limited AI Explainability Raising Clinical-Liability Risk

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Component

- 5.1.1 Software

- 5.1.2 Services

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Analytics Type

- 5.3.1 Descriptive Analytics

- 5.3.2 Predictive Analytics

- 5.3.3 Prescriptive Analytics

- 5.4 By Application

- 5.4.1 Financial Analytics

- 5.4.2 Clinical Data Analytics

- 5.4.3 Operational Analytics

- 5.4.4 Population Health Analytics

- 5.5 By End User

- 5.5.1 Healthcare Providers

- 5.5.2 Healthcare Payers

- 5.5.3 Pharma & Biotechnology Companies

- 5.5.4 Other End Users

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East & Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East & Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Allscripts Healthcare Solutions Inc.

- 6.3.2 Dell Technologies Inc.

- 6.3.3 Epic Systems Corporation

- 6.3.4 GE HealthCare

- 6.3.5 SAS Institute Inc.

- 6.3.6 International Business Machines Corporation (IBM)

- 6.3.7 Innovaccer Inc.

- 6.3.8 Oracle Corporation

- 6.3.9 Optum Inc.

- 6.3.10 ExlService Holdings Inc.

- 6.3.11 Health Fidelity Inc.

- 6.3.12 Apixio Inc.

- 6.3.13 Flatiron Health

- 6.3.14 Amazon Web Services Inc.

- 6.3.15 Philips Healthcare

- 6.3.16 Siemens Healthineers AG

- 6.3.17 Health Catalyst Inc.

- 6.3.18 Palantir Technologies Inc.

- 6.3.19 MedeAnalytics Inc.

- 6.3.20 Truven Health Analytics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment