PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846270

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846270

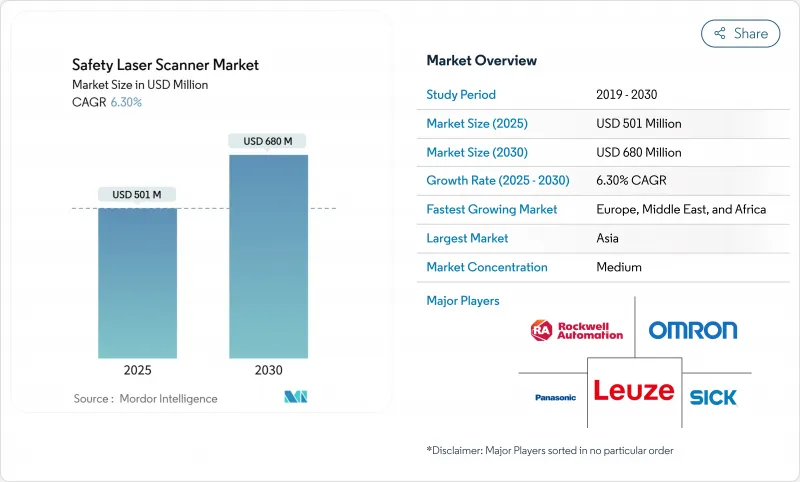

Safety Laser Scanner - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The safety laser scanner market is valued at USD 501 million in 2025 and is forecast to expand to USD 680 million by 2030, advancing at a 6.3% CAGR.

Europe anchors demand with a 35% revenue contribution, while Asia-Pacific is set to post the fastest 7.5% CAGR, buoyed by Chinese electronics automation and "dark-warehouse" projects in Japan-and-r15-08-(industrial-mobile-robots)-implementation). Strong momentum comes from automated guided vehicles (AGVs) and autonomous mobile robots (AMRs), enforcement of ISO 13849-1 and IEC 61496, and a shift toward predictive, data-rich safety systems that integrate with Industry 4.0 architectures. Competitive intensity is moderate: leading vendors differentiate through 275-degree fields of view, safeHDDM(R) filtering, and on-board analytics, while new entrants push cost-efficient 3D ultrasonic or vision-based alternatives. Region-specific regulations, such as Brazil's NR-12 and Australia's IECEx mandates, raise entry barriers but also open opportunities for specialist housings and explosion-proof designs.

Global Safety Laser Scanner Market Trends and Insights

Rapid Adoption of AMRs in European Intralogistics Hubs

European warehouses now field AMR fleets exceeding 1,000 daily missions, such as ifm electronic GmbH's MiR100 deployment covering 30 km of routes. ISO 3691-4 obliges dynamic protective-field changes, which stationary guarding cannot meet. Consequently, mobile safety laser scanners with multi-zone switching and Ethernet/IP interfaces become essential enablers, rather than mere compliance devices, for material-handling automation.

ISO 13849-1 & IEC 61496 Enforcement at German Automotive OEMs

German carmakers now demand SIL3-validated scanners packaged with full EN ISO 12100:2024 risk-assessment files. New criteria include cybersecurity design and AI-based predictive hazard identification. Vendors that offer adaptive, self-diagnosing scanners secure preferred-supplier status, although upfront validation costs increase system pricing.

High SIL2/PLd Certification Costs for Brazilian & Argentine Tier-2 Suppliers

Brazil's NR-12 requires Portuguese documentation and on-site engineer validation, adding up to 20% of a scanner's purchase price. Smaller suppliers delay adoption, slowing regional growth yet opening consultancy niches for vendors with local compliance teams.

Other drivers and restraints analyzed in the detailed report include:

- Retrofitting Legacy Machinery in US SMEs for OSHA 1910.212 Compliance

- Collaborative-Robot Boom in Chinese Electronics Assembly

- Dust-Induced False Trips in Australian Mining Sites

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Stationary units retained 57.1% of the safety laser scanner market in 2024, supported by proven uptime on fixed presses and conveyors. Mobile variants, however, are tracking an 8.5% CAGR to 2030 as AMRs proliferate in warehouses. The safety laser scanner market size for mobile solutions is projected to reach USD 270 million by 2030, underpinned by compact battery-efficient designs and ISO 3691-4 compliance. Pilz's PSENscan, for instance, ships with up to 70 configurable fields, letting AMRs recalibrate protection in milliseconds. Stationary models still dominate high-precision automotive body-in-white lines where repeatable guard shapes outweigh flexibility.

Protective-field preference is shifting. Five-meter scanners captured 42% of 2024 revenue because they balance coverage and latency, whereas seven-meter models, equipped with optimized optics, will log a 7.2% CAGR. Meanwhile, 3D scanning remains a premium niche for complex welding cells, while cost-driven buyers stick with robust 2D units.

Conveyor and packaging applications drew 33% of 2024 revenue, but stricter personnel-safety rules elevate area protection & access control to the fastest 7.5% CAGR. Multi-zone scanners now ring robot welding bays and palletisers, replacing mechanical fences that impede line flexibility. SICK's microScan3 permits three separate safety fields running in parallel, a critical feature for dense packaging floors. The safety laser scanner market share for area protection is set to climb to 37% by 2030 as insurers demand certification evidence.

AGVs and AMRs form the second-largest bucket, yet they will soon eclipse conveyors because intralogistics automation receives the bulk of capital budgets, especially from e-commerce operators. Scanner OEMs embed diagnostic gateways so that fleet-management software can pull health data and schedule predictive maintenance, keeping uptime above 99%.

Global Safety Laser Scanners Market is Segmented Into Type(Stationary Safety Laser Scanners, Mobile Safety Laser Scanners, and More), Application(automotive, Food and Beverage, and More), End-User Industry (Automotive, Healthcare, and Pharmaceutical), and Geography (North America, Europe, Asia Pacific, and More ). The Market Sizes and Forecasts are Provided in Terms of Value in USD

Geography Analysis

Europe controlled 35% of 2024 revenue, leveraging strict CE machinery directives and a dense integrator network. German OEMs issue tightened procurement specs that elevate scanner functional safety, whereas Nordic robots shift to camera-based systems, creating price pressure yet also accelerating image-processing add-ons. Regional grant programs targeting carbon-neutral production further incentivize automation, indirectly lifting scanner sales.

Asia-Pacific is on course for a 7.5% CAGR. China's electronics plants require integrated Speed-and-Separation Monitoring for cobots, and Japan's logistics firms pursue lights-out operations. Meanwhile, skilled-labour shortages in Taiwan and Korea spur turnkey safety packages bundled with remote diagnostics. India's automotive Tier-1 suppliers begin piloting Ethernet/IP scanners to future-proof greenfield lines, yet import duties still curb rapid expansion.

North America benefits from OSHA endorsement of laser guarding and clearer NRTL certification pathways. Retrofit projects in metal-forming SMEs and new EV battery plants fuel demand. However, widespread reliance on legacy CAN networks slows the shift to data-rich Ethernet models. South America struggles with NR-12 cost burdens that push smaller outfits toward cheaper mechanical guards, though multinational OEMs maintain purchases to meet corporate safety KPIs. Africa remains nascent; mining enclaves adopt scanner-protected robotic drilling rigs but volumes stay low.

- SICK AG

- OMRON Corporation

- Keyence Corporation

- Leuze Electronic GmbH

- Panasonic Industrial Sensors

- Banner Engineering

- Hans Turck GmbH

- Hokuyo Automatic Co., Ltd.

- IDEC Corporation

- Pilz GmbH and Co. KG

- Datalogic SpA

- Rockwell Automation Inc.

- Arcus Automation Pvt Ltd.

- FARO Technologies, Inc.

- Hexagon AB

- Trimble Inc.

- Pepperl+Fuchs SE

- ABB Ltd.

- Blickfeld GmbH

- Slamcore Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of AMRs in European Intralogistics Hubs

- 4.2.2 ISO 13849-1 and IEC 61496 Enforcement at German Automotive OEMs

- 4.2.3 Retrofitting Legacy Machinery in US SMEs for OSHA 1910.212 Compliance

- 4.2.4 Collaborative-Robot Boom in Chinese Electronics Assembly

- 4.2.5 Dark Warehouses in Japanese 3PL Driving 270° Mobile Scanner Demand

- 4.3 Market Restraints

- 4.3.1 High SIL2/PLd Certification Costs for Brazilian and Argentine Tier-2 Suppliers

- 4.3.2 Dust-Induced False Trips in Australian Mining Sites

- 4.3.3 Price Erosion from Vision-based Safety Cameras in Nordic Robotics

- 4.3.4 Skilled-Labour Gap for Scanner Integration in Middle-East SMEs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Stationary Safety Laser Scanners

- 5.1.2 Mobile Safety Laser Scanners

- 5.1.3 Protective-Field Range (3 m, 5 m, 7 m)

- 5.1.4 Scanning Dimension (2D, 3D)

- 5.1.5 Connectivity (Ethernet, CAN, IO-Link)

- 5.2 By Application

- 5.2.1 AGVs and AMRs

- 5.2.2 Robotic Cells

- 5.2.3 Conveyor and Packaging Lines

- 5.2.4 Area Protection and Access Control

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverage

- 5.3.3 Healthcare and Pharmaceuticals

- 5.3.4 Consumer Goods and Electronics

- 5.3.5 Logistics and Warehousing

- 5.3.6 Metals and Heavy Machinery

- 5.3.7 Oil and Gas

- 5.4 By Connectivity

- 5.4.1 Ethernet

- 5.4.2 CAN

- 5.4.3 IO-Link

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 SICK AG

- 6.4.2 OMRON Corporation

- 6.4.3 Keyence Corporation

- 6.4.4 Leuze Electronic GmbH

- 6.4.5 Panasonic Industrial Sensors

- 6.4.6 Banner Engineering

- 6.4.7 Hans Turck GmbH

- 6.4.8 Hokuyo Automatic Co., Ltd.

- 6.4.9 IDEC Corporation

- 6.4.10 Pilz GmbH and Co. KG

- 6.4.11 Datalogic SpA

- 6.4.12 Rockwell Automation Inc.

- 6.4.13 Arcus Automation Pvt Ltd.

- 6.4.14 FARO Technologies, Inc.

- 6.4.15 Hexagon AB

- 6.4.16 Trimble Inc.

- 6.4.17 Pepperl+Fuchs SE

- 6.4.18 ABB Ltd.

- 6.4.19 Blickfeld GmbH

- 6.4.20 Slamcore Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment