PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846274

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846274

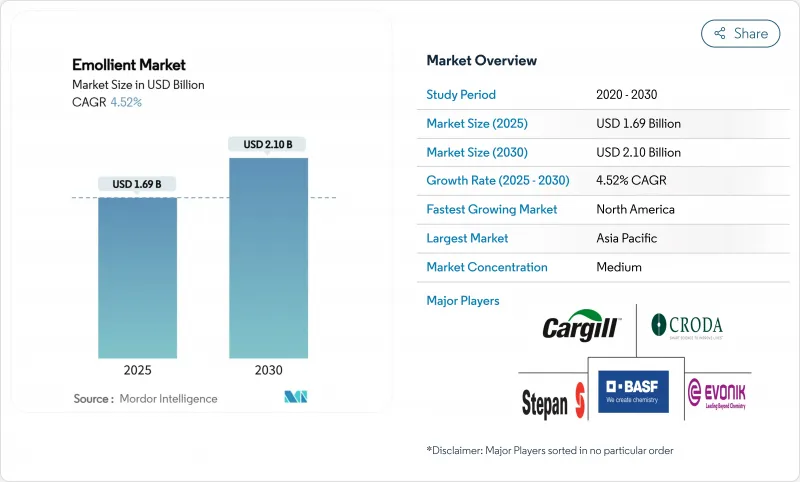

Emollient - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Emollient Market size is estimated at USD 1.69 billion in 2025, and is expected to reach USD 2.10 billion by 2030, at a CAGR of 4.52% during the forecast period (2025-2030).

The market growth is driven by consumer preferences for skin health and wellness products, particularly the demand for microbiome-friendly formulations that support skin barrier function. The increasing understanding of the skin microbiome's role in preventing dryness, irritation, and skin conditions has led manufacturers to develop products with prebiotic, probiotic, and postbiotic ingredients. The market is also expanding due to consumer demand for clean, sustainable, and ethically sourced ingredients, coupled with stricter regulatory requirements for product safety and efficacy. The emollients market continues to develop microbiome-focused solutions that address both consumer health needs and environmental considerations within the global cosmetics and personal care industry.

Global Emollient Market Trends and Insights

Skin-microbiome Friendly Formulations

The growing focus on microbiome-friendly skincare has transformed emollient development, expanding beyond basic moisturization to support the skin's bacterial ecosystem. Skincare products with a pH below 5 increase skin microbiome diversity while reducing harmful bacteria, creating new requirements for emollient manufacturers. Companies select ingredients that include prebiotics and postbiotics to promote beneficial bacteria while maintaining the skin barrier. Studies show that fermented ingredients, such as Lactobacillus plantarum-processed botanicals, improve skin hydration and elasticity, demonstrating the effectiveness of microbiome-focused formulations. Regulatory acceptance of microbiome health as a cosmetic benefit is increasing. For instance, in March 2024, the Netherlands government allocated EUR 200 million from its National Growth Fund to support research on microbiomes and their commercial applications. These developments support market growth while meeting regulatory requirements for safety and efficacy claims.

Technological Advancements in Emollient Formulations

Advanced nanocarrier systems deliver active ingredients to targeted skin layers while improving their stability and bioavailability. Temperature, pH, and multi-stimuli-responsive systems control ingredient release based on skin conditions, improving product effectiveness. These technological developments address poor skin penetration and ingredient stability issues in emollient formulations. Companies use digital technologies and AI algorithms to create personalized skincare solutions by analyzing skin characteristics and matching appropriate emollient combinations. The evolution of plant-based emollients demonstrates this technological progression in the global emollient market, as evidenced by Sonneborn, LLC's introduction of SonneNatural NXG in November 2023. This plant-based emollient for personal care products contains specialized occlusive agents that improve formula stability, reflecting the industry's transformation toward advanced, sustainable formulation technologies. The integration of these technological innovations enables manufacturers to develop more effective and targeted emollient solutions that meet diverse consumer requirements across various applications.

Complex and Evolving Regulatory Landscape

The implementation of comprehensive regulatory frameworks, including MoCRA in the United States and REACH compliance in Europe, is increasing compliance costs and operational complexity for emollient manufacturers. The Food and Drug Administration (FDA)'s new facility registration and product listing requirements, effective July 2024, mandate detailed ingredient disclosures and safety documentation, creating challenges for smaller manufacturers. European regulations have intensified requirements for nanomaterials and endocrine-disrupting substances, with extensive safety assessments extending product launch timelines. The variation in regulatory standards across major markets requires companies to maintain multiple formulation variants, which increases development costs. Recent inspections by the European Chemicals Agency found that 6.4% of cosmetics contained hazardous chemicals, leading to enhanced compliance requirements. Additionally, regulatory uncertainty regarding new ingredients, such as bio-fermented emollients, has limited manufacturer investment in innovative formulations.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Prevalence of Skin Illnesses

- Expansion Geriatric Population

- Price Sensitivity Among Consumers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Liquid oils dominate the market with a 58.42% share in 2024, driven by their formulation flexibility and consumer preference for lightweight, fast-absorbing textures. The segment's prominence stems from the technical advantages of liquid emollients in modern cosmetic formulations, particularly in terms of spread ability and sensory properties. Semi-solid butters maintain a stable position in specialized applications requiring intensive moisturization, while waxes and pastes serve protective and long-lasting formulations. The powder and beads segment, though smaller, shows the highest growth rate at 6.18% CAGR through 2030, supported by advances in encapsulation technology and consumer interest in new application methods.

Manufacturing advances in powder-based emollients are creating new market opportunities, especially in color cosmetics and multifunctional products where liquid forms have limitations. BASF and other manufacturers are developing specialized production facilities for emollient innovations, including powder formulations with enhanced stability and controlled release properties. The integration of sustainability requirements is promoting the development of biodegradable powder emollients that maintain performance while meeting environmental standards. Smart delivery systems using powder and bead technologies enable personalized skincare applications where users can adjust emollient intensity to their specific needs.

Plant-derived emollients hold a 45.37% market share in 2024, driven by consumer demand for natural ingredients and regulatory support for sustainable sourcing practices. The segment's strength stems from established supply chains and proven safety profiles that enable regulatory approval across global markets. Petrochemical sources remain significant in cost-sensitive applications, while animal-derived ingredients experience declining use due to ethical concerns and regulatory restrictions. Bio-fermented emollients exhibit the highest growth rate at 5.82% CAGR, supported by technological advancements enabling consistent quality and scalable production.

Bio-fermentation technology is transforming ingredient sourcing strategies in the market. This transformation is evident in recent industry developments. For instance, in March 2025, Symrise AG introduced Mindera, a 100% plant-based product protection platform that provides multi-functional, broad-spectrum activity for personal care formulations. Manufacturers are increasingly adopting upcycled ingredients to meet sustainability requirements while maintaining cost efficiency. The combination of fermentation technology with traditional botanical extraction creates hybrid sourcing methods that balance performance and environmental considerations. Regulatory frameworks continue to evolve, with safety assessment protocols adapting to evaluate these new bio-fermented materials.

The Emollient Market is Segmented by Form (Liquid Oils, Semi-Solid Butters, Waxes and Pastes, and More), by Source (Plant-Derived, Petro-Chemical, Animal-Derived, and More), by Product Type (Fatty Alcohols, Fatty Acid Esters, Natural Butters and Oils, Petrolatum and Mineral Oils, and More), by Application (Skin Care, Hair Care, Color Cosmetics, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commands 32.42% of the global emollients market in 2024. The region's middle-class population actively seeks skincare products, while rising disposable incomes in China, India, Japan, and Southeast Asia drive market expansion. Manufacturers benefit from robust production facilities and easy access to plant-based raw materials. Chinese consumers increasingly purchase premium skincare through digital platforms, while India's urban population demonstrates growing interest in personal care products. Japanese consumers demand innovative, high-performance emollient formulations, supporting the premium segment.

North America leads regional growth with a 4.85% CAGR through 2030. Companies actively invest in premium product development and facility upgrades to meet MoCRA regulations. United States manufacturers implement extensive product reformulations to comply with new standards. Canadian consumers actively choose natural ingredients, creating a strong market for sustainable emollients. Mexico serves as a strategic manufacturing hub, benefiting from its growing middle class and proximity to the United States markets.

European consumers actively demand premium and sustainable emollients, while strict regulations shape high-quality formulation standards. Manufacturers develop bio-based and circular economy emollients to meet sustainability requirements. REACH compliance drives companies to invest in safer alternatives to petrochemical ingredients. The Middle East and African markets show promise as urban populations embrace global beauty trends, though economic factors and distribution networks currently limit market expansion.

- BASF SE

- Cargill, Incorporated

- Croda International plc

- Stepan Company

- Evonik Industries AG

- The Lubrizol Corporation

- AAK AB

- Ashland Inc.

- Avril Group

- Clariant AG

- Eastman Chemical Company

- Sasol Limited

- Emery Oleochemicals

- Sophim Iberia S.L

- Symrise AG

- Dow Chemical Company

- Kao Corporation

- Matangi Industries

- Vantage Specialty Chemicals, Inc.

- Esteem Industries Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Skin-microbiome friendly formulations

- 4.1.2 Technological Advancements in Emollient Formulations

- 4.1.3 Increasing prevalence of skin illnesses

- 4.1.4 Expansion Geriatric Population

- 4.1.5 Surging demand for natural and organic products

- 4.1.6 Growing Popularity of Multi-Functional Skincare Products

- 4.2 Market Restraints

- 4.2.1 Complex and evolving regulatory landscape

- 4.2.2 Price sensitivity among consumers

- 4.2.3 Formulation Challenges and Compatibility Issues

- 4.2.4 Limited Penetration in Underdeveloped Markets

- 4.3 Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Liquid Oils

- 5.1.2 Semi-solid Butters

- 5.1.3 Waxes and Pastes

- 5.1.4 Powder and Beads

- 5.2 By Source

- 5.2.1 Plant-derived

- 5.2.2 Petro-chemical

- 5.2.3 Animal-derived

- 5.2.4 Bio-fermented

- 5.2.5 Upcycled Ingredients

- 5.3 By Product Type

- 5.3.1 Fatty Alcohols

- 5.3.2 Fatty Acid Esters

- 5.3.3 Natural Butters and Oils

- 5.3.4 Petrolatum and Mineral Oils

- 5.3.5 Silicones and Derivatives

- 5.4 By Application

- 5.4.1 Skin Care

- 5.4.2 Hair Care

- 5.4.3 Color Cosmetics

- 5.4.4 Pharmaceuticals/OTC Topicals

- 5.4.5 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Ranking Analysis

- 6.3 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.3.1 BASF SE

- 6.3.2 Cargill, Incorporated

- 6.3.3 Croda International plc

- 6.3.4 Stepan Company

- 6.3.5 Evonik Industries AG

- 6.3.6 The Lubrizol Corporation

- 6.3.7 AAK AB

- 6.3.8 Ashland Inc.

- 6.3.9 Avril Group

- 6.3.10 Clariant AG

- 6.3.11 Eastman Chemical Company

- 6.3.12 Sasol Limited

- 6.3.13 Emery Oleochemicals

- 6.3.14 Sophim Iberia S.L

- 6.3.15 Symrise AG

- 6.3.16 Dow Chemical Company

- 6.3.17 Kao Corporation

- 6.3.18 Matangi Industries

- 6.3.19 Vantage Specialty Chemicals, Inc.

- 6.3.20 Esteem Industries Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK