PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846279

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846279

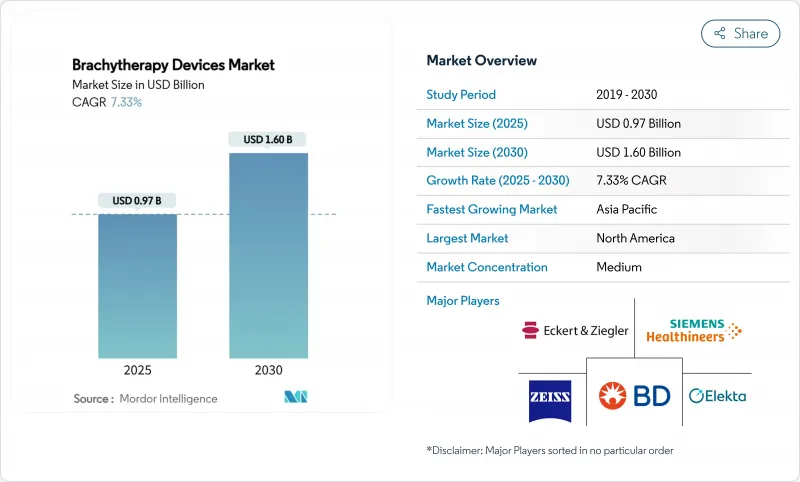

Brachytherapy Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Global brachytherapy devices market size stands at USD 0.97 billion in 2025 and is projected to reach USD 1.60 billion by 2030, reflecting a 7.33% CAGR over the forecast period.

Intensifying cancer incidence, favorable reimbursement for outpatient high-dose-rate (HDR) procedures, and rapid adoption of electronic systems anchor the demand outlook. Government and payer programs that accelerate radiotherapy access, especially in Asia-Pacific and Latin America, further support uptake. Parallel advances in artificial intelligence (AI) for treatment planning and electronic after-loading technologies shorten procedure times, expand deployment to community settings, and safeguard the isotope supply chain. Emerging nano-scale radionuclide carriers could unlock organ-sparing salvage options, broadening the therapeutic window and lengthening device replacement cycles for the Global brachytherapy devices market.

Global Brachytherapy Devices Market Trends and Insights

Growing Burden of Cancer Incidence

Persistent growth in global cancer diagnoses underpins a structural need for precise, localized radiation. The American Cancer Society projects 2,041,910 new U.S. cases in 2025, with prostate, breast, and gynecologic cancers forming the core clinical settings for brachytherapy. As aging populations swell, oncologists value brachytherapy's high conformality and organ preservation advantages. Clinical data in hepatocellular carcinoma cite 98.5% overall response rates using high-dose-rate protocols, signaling opportunity for disease-site expansion. Together, epidemiology and outcome evidence reinforce long-run demand in the Global brachytherapy devices market.

Rising Government & Payer Initiatives to Expand Radiotherapy Access

Policy makers view radiotherapy equity as public-health priority. India's National Cancer Grid is closing a national shortfall of 53 brachytherapy units through indigenous HDR platforms, such as the 'Karknidon' remote after-loader, lowering acquisition costs. In the United States, Medicare's Transitional Coverage for Emerging Technologies (TCET) pathway accelerates breakthrough device coverage decisions, potentially welcoming five brachytherapy candidates each year. These moves broaden patient pools and de-risk innovation for the Global brachytherapy devices market.

Shortage of Trained Brachy-Oncologists & Medical Physicists

Fifteen percent of U.S. medical physicists signal retirement intentions within 10 years, while cancer incidence climbs 2% annually, magnifying staffing gaps. Residency directors cite limited caseloads as barriers to braid practical exposure, curtailing future competencies. Australian and New Zealand trainees echo concerns over shrinking seed-implant volumes, foreshadowing skills attrition. While simulation workshops raise proficiency, the talent pipeline remains a rate-limiter for the Global brachytherapy devices market.

Other drivers and restraints analyzed in the detailed report include:

- Technological Shift Toward HDR & Electronic Brachytherapy Systems

- Reimbursement Tail-Winds for Outpatient HDR Procedures

- Uneven Isotope Supply Chain & Export Controls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

High-dose-rate systems secured 55.51% share of the Global brachytherapy devices market in 2024, reflecting their capacity to condense treatment into few fractions and fit modern outpatient economics. Peer-reviewed data at ASTRO 2024 confirmed dose escalation benefits without overall-survival trade-offs across HDR and low-dose-rate (LDR) arms. The segment's leadership remains anchored in prostate and gynecologic workflows, yet lung, liver, and head-and-neck indications show acceptance, sustaining hardware refresh cycles in the Global brachytherapy devices market.

Pulsed-dose-rate (PDR) technology is projected to record 9.25% CAGR through 2030, blending LDR radiobiology with HDR infrastructure to expand case mix flexibility. AI-enabled planning equalizes quality between modalities, flattening the learning curve for new adopters. LDR retains relevance in permanent seed implants where single-session convenience aligns with patient preference. Technique diversification ensures clinicians match dose kinetics to tumor biology, reinforcing clinical confidence and mitigating modality substitution risk.

Seeds captured 43.53% share of the Global brachytherapy devices market in 2024, bolstered by decades of urology familiarity and streamlined inventory models. Yet electronic brachytherapy (eBx) systems-free of radioactive source handling-are on track for a 15.15% CAGR through 2030. The Global brachytherapy devices market size for eBx is projected to climb as unshielded-room operation invites smaller hospitals and ambulatory centers into the modality, especially for skin and breast protocols.

Applicators and after-loaders represent the mechanical backbone of HDR and PDR workflows, sustaining steady replacement demand as caseloads and dose-rate innovations evolve. Treatment-planning software, increasingly bundled in subscription models, embeds reinforcement learning scripts that cut plan iterations from hours to minutes, driving stickiness for integrated vendors and elevating switching costs across the Global brachytherapy devices market.

The Brachytherapy Devices Market Report is Segmented by Technique (High Dose Rate (HDR) Brachytherapy Devices, and More), Product Type (Seeds, Applicators & Afterloaders, and More), Application (Gynecologic Cancer, Prostate Cancer, Breast Cancer, and More), End User (Hospitals, Ambulatory Surgical Centers, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 45.32% share in 2024 as mature reimbursement, early AI adoption, and a dense cancer-care network sustain procedure volumes. Federal programs such as TCET speed market access for breakthrough brachytherapy devices, while a looming 15% physicist retirement rate challenges workforce capacity. Partnerships like Varian-Ballad Health illustrate efforts to bridge rural access gaps via long-term equipment and service contracts. Vendor service revenues from these deals underpin regional resilience for the Global brachytherapy devices market.

Europe delivers steady growth through evidence-based adoption and cross-border research collaborations. Germany, France, and the United Kingdom pioneer MRI-guided adaptive brachytherapy, while CE-marked innovations such as AngioDynamics' AlphaVac F18 85 gain rapid uptake, reinforcing regulatory predictability. EU-backed training exchanges with Asia bolster best-practice dissemination and support consistent utilization across the continent. The Global brachytherapy devices market benefits from Europe's early-phase clinical trial density, informing global purchasing decisions.

Asia-Pacific will chart the highest 9.61% CAGR through 2030 as oncology infrastructure scales. India records nearly 1 million new cancer cases annually and addresses a 53-unit brachytherapy gap through indigenous HDR platforms. Japan hosts 129 Ir-192 remote after-loaders and reports 48% of centers employing 3D planning, underscoring advanced practice penetration. China's provincial equipment procurement programs and central reimbursement reforms are expanding patient access, but physics staffing remains constrained. Regional collaboration via the Federation of Asian Organizations for Radiation Oncology aims to elevate treatment quality, sustaining momentum for the Global brachytherapy devices market.

- Accuray

- Argon Medical Devices

- Beckton Dickinson

- Carl Zeiss

- CIVCO Medical solutions

- Eckert & Ziegler

- Elekta

- iCAD Inc.

- IsoRay

- Siemens Healthineers

- Theragenics

- ViewRay Inc.

- Panacea Medical Technologies

- C4 Imaging LLC

- Mevion Medical Systems

- Source Production & Equipment Co.

- IBt Bebig Belgium

- Advanced Oncology Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden Of Cancer Incidence

- 4.2.2 Rising Government & Payer Initiatives To Expand Radiotherapy Access

- 4.2.3 Technological Shift Toward HDR & Electronic Brachytherapy Systems

- 4.2.4 Reimbursement Tail-Winds For Outpatient HDR Procedures

- 4.2.5 AI-Driven Treatment-Planning Improving Workflow Efficiency

- 4.2.6 Nano-Scale Radionuclide Carriers Enabling Organ-Sparing Salvage Therapy

- 4.3 Market Restraints

- 4.3.1 Shortage Of Trained Brachy-Oncologists & Medical Physicists

- 4.3.2 Uneven Isotope Supply Chain (Ir-192, I-125) & Export Controls

- 4.3.3 Declining Utilization Amid Competition From SBRT & Robotic Surgery

- 4.3.4 Regulatory Uncertainty Around Electronic Brachytherapy Devices (Class III)

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Technique

- 5.1.1 High Dose Rate (HDR) Brachytherapy Devices

- 5.1.2 Low Dose Rate (LDR) Brachytherapy Devices

- 5.1.3 Pulsed Dose Rate (PDR) Brachytherapy Devices

- 5.2 By Product Type

- 5.2.1 Seeds

- 5.2.2 Applicators & Afterloaders

- 5.2.3 Electronic Brachytherapy Systems

- 5.2.4 Software & Treatment-Planning Solutions

- 5.3 By Application

- 5.3.1 Prostate Cancer

- 5.3.2 Gynecologic Cancer

- 5.3.3 Breast Cancer

- 5.3.4 Skin Cancer

- 5.3.5 Head & Neck Cancer

- 5.3.6 Others

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Oncology Centers & Specialty Clinics

- 5.4.3 Ambulatory Surgical Centers

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Accuray Inc.

- 6.3.2 Argon Medical Devices Inc.

- 6.3.3 Becton, Dickinson and Company

- 6.3.4 Carl Zeiss Meditec AG

- 6.3.5 CIVCO Medical Solutions

- 6.3.6 Eckert & Ziegler BEBIG

- 6.3.7 Elekta AB

- 6.3.8 iCAD Inc.

- 6.3.9 Isoray Inc.

- 6.3.10 Siemens Healthineers AG

- 6.3.11 Theragenics Corporation

- 6.3.12 ViewRay Inc.

- 6.3.13 Panacea Medical Technologies

- 6.3.14 C4 Imaging LLC

- 6.3.15 Mevion Medical Systems

- 6.3.16 Source Production & Equipment Co.

- 6.3.17 IBt Bebig Belgium

- 6.3.18 Advanced Oncology Solutions

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment