PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846283

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846283

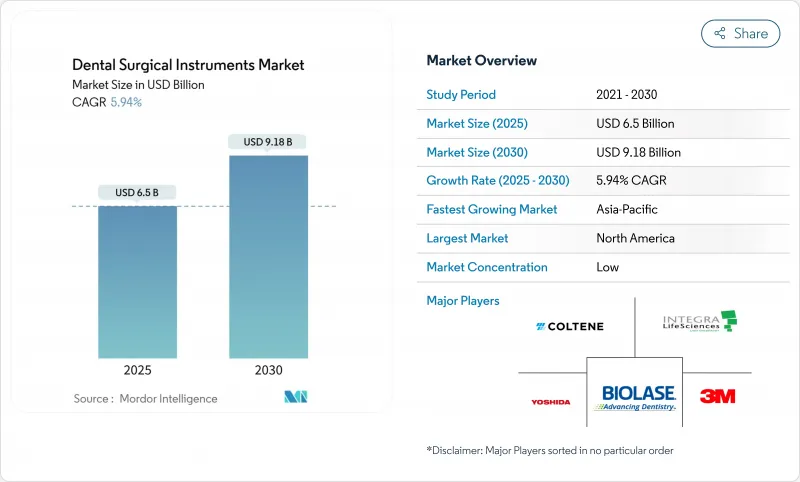

Dental Surgical Instruments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global dental surgical instruments market is valued at USD 6.50 billion in 2024 and is projected to reach USD 9.18 billion by 2030, registering a 5.94% CAGR over 2025-2030.

Growing volumes of implantology, rapid uptake of AI-guided robotics, and rising cross-border demand for complex oral surgeries are the primary forces expanding the dental surgical instruments market. Handheld tools retain a central role, yet laser-based and piezoelectric systems are accelerating because they shorten healing time, preserve tissue, and improve patient comfort. North America continues to lead the dental surgical instruments market thanks to early adoption of digital workflows and supportive reimbursement, while Asia-Pacific is the fastest-growing region as tourism clusters and private investments enhance capacity. Intensifying consolidation among dental support organizations is reshaping procurement, and purpose-built geriatric programs are steering product design toward minimally invasive kits.

Global Dental Surgical Instruments Market Trends and Insights

Adoption of Piezoelectric-Assisted Osteotomy

Selective micro-vibrations allow piezoelectric devices to cut mineralized tissue while sparing adjacent nerves and vessels, reducing postoperative pain and swelling for third-molar extractions and implant site preparation. Growing clinical evidence of a lower nerve-injury rate is prompting specialty practices to replace conventional rotary drills. Training centers in the United States and Germany now include piezosurgery modules in residency curricula, accelerating competency among young clinicians. Suppliers are refining tip designs for hard-to-access mandibular regions, and distributors report double-digit unit growth in 2024. As reimbursement parity with rotary systems improves, the driver sustains a positive medium-term lift on the dental surgical instruments market.

AI-Guided Robotic Dental Surgery Uptake

Robotics platforms integrate pre-operative cone-beam CT data with real-time navigation, enabling sub-millimeter implant placement accuracy and eliminating disposable surgical guides. Clinical trials in 2025 demonstrated mean trueness deviations of 1.2 mm compared with 2.0 mm for manual techniques, translating to fewer intra-operative adjustments. Early adopters report reduced chair time and predictable flapless protocols that appeal to patients. Capital cost remains high, yet leasing models and service contracts are lowering entry barriers. Regulatory approvals in Canada and Japan broaden the addressable base, feeding long-term momentum across the dental surgical instruments market.

High Cost of Dental Surgical Instruments

Premium diode lasers sell for USD 50,000-70,000 and piezoelectric surgery units for USD 5,000-15,000, exceeding the capital budgets of rural clinics. Service contracts and mandatory calibration add 15-20% to annual ownership costs. Community colleges in North Carolina secured USD 3.57 million to train assistants on advanced devices, underscoring the sizable investment required before revenue materializes. Smaller practices defer purchases, directly suppressing uptake in price-sensitive segments of the dental surgical instruments market.

Other drivers and restraints analyzed in the detailed report include:

- Tourism-Led Demand for Complex Implant Surgeries

- Geriatric Oral-Health Programs Boosting Minimally-Invasive Kits

- Poor Reimbursement Policies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Handheld instruments retained 39.67% of dental surgical instruments market share in 2024, reflecting their central role in routine scaling, extraction, and restorative work. Stainless-steel explorers, needle holders, and bone files continue to set purchasing baselines, and incremental refinements in handle knurling and balance sustain loyalty among clinicians. Despite dominance, the product mix is nudging toward micro-surgical variants that allow finer gestures in confined operative fields. Dental lasers, although representing a smaller installed base, are the fastest-growing line with a 6.98% CAGR forecast through 2030. Orthodontic offices and periodontists favor erbium and diode systems that ablate soft tissue with minimal collateral damage, shortening chair time and driving positive word-of-mouth. The dental surgical instruments market size for laser systems is projected to expand steadily as unit prices decline and manufacturers bundle training with purchase agreements.

Powered handpieces and surgical motors are in steady demand for implant bed preparation and endodontic shaping. Brushless micro-motors and integrated LED illumination improve torque stability and visualization, further differentiating premium models. Electrosurgical units cater to coagulation in oro-facial oncology, whereas ultrasonic scalers remain cornerstones of periodontal maintenance. Although elective cosmetic cases fell during pandemic lockdowns, powered instrumentation rebounded swiftly as patient flow normalized. Vendors leveraging modular battery packs and autoclavable casings are expected to capture share, keeping the dental surgical instruments market on a technology-driven upgrade path.

The Dental Surgical Devices Market Report is Segmented by Product (Handheld Instruments, Lasers, Consumables, and Other Products), Application (Restorative Dentistry, Orthodontics, Endodontics, and Other Applications), and Geography (North America, Europe, Asia-Pacific, Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 41.23% of the dental surgical instruments market in 2024. Early reimbursement for robotic implant placement and widespread incorporation of cone-beam CT underwrite sustained equipment refresh cycles. The American Dental Association notes that 67% of U.S. practices now offer in-house 3-D imaging, a rate that pushes demand for compatible surgical guides and precision burs. Federal payment parity across service sites, finalized by the Centers for Medicare & Medicaid Services in 2024, strengthens hospital purchasing confidence for advanced oral-surgery sets.

Asia-Pacific shows the strongest momentum with a 7.34% CAGR to 2030. Thailand and Turkey attract inbound patients seeking full-arch implant rehabilitation at prices 60% lower than in Western Europe, necessitating robust inventories of implant drills, torque drivers, and graft syringes. China increases local manufacturing output through tax breaks on Class III medical devices, enhancing supply chain resilience. India's Production-Linked Incentive scheme earmarks subsidies for mid-size med-tech firms, lifting domestic output of ultrasonic scalers and obturation systems. Japan advances robotics integration by pairing indigenous haptic controllers with imported navigation software, further diversifying regional product demand.

Europe continues to exhibit steady uptake driven by national prevention programs targeting periodontal disease. Germany champions laser adoption via reimbursement codes for minimally invasive frenectomies, while the United Kingdom's NHS deploys mobile dental vans equipped with portable surgical sets to reach underserved communities. Central and Eastern Europe benefit from EU structural funds that modernize university clinics and foster cross-border training exchanges. In the Middle East and Africa, Gulf Cooperation Council states allocate oil revenues to build specialized implant centers, whereas South American markets such as Brazil witness a surge in esthetic demand linked to rising disposable income. Collectively, these dynamics anchor long-run expansion opportunities across the dental surgical instruments market.

- Danaher Corporation (KaVo, Nobel Biocare)

- Dentsply Sirona

- Henry Schein Inc. (Hu-Friedy)

- 3M

- Straumann Group

- Osstem Implant Co., Ltd.

- Coltene Holding

- B. Braun Melsungen AG (Aesculap)

- Acteon Group

- Brasseler USA

- BIOLASE Inc.

- Carl Zeiss

- A-dec

- NSK Nakanishi Inc.

- W&H Group

- Planmeca

- Dentium Co., Ltd.

- Zimvie

- Yoshida Dental Mfg. Co., Ltd.

- Medesy Srl

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of piezoelectric-assisted osteotomy

- 4.2.2 AI-guided robotic micro-surgery uptake in North America implant centres

- 4.2.3 Tourism-led demand for complex implant surgeries in Turkey & GCC drives kit sales

- 4.2.4 Geriatric oral-health programs boosting minimally-invasive kits in Japan & Nordics

- 4.2.5 Bulk procurement by fast-growing DSO chains in U.S. & Canada

- 4.2.6 Clear-aligner IPR boom driving precision burs demand in South America

- 4.3 Market Restraints

- 4.3.1 Reimbursement gap for advanced electrosurgical devices in Caribbeans & Africa

- 4.3.2 Limited stainless-steel metallurgy capacity in Nordics inflates costs

- 4.3.3 EU MDR certification delays for new laser handpieces

- 4.3.4 Counterfeit handhelds influx from Asia impacting Oceania

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type (Value)

- 5.1.1 Handheld Instruments

- 5.1.2 Handpieces & Motors

- 5.1.3 Electrosurgical & Cautery Systems

- 5.1.4 Ultrasonic Instruments & Scalers

- 5.1.5 Powered Surgical Instruments

- 5.1.6 Dental Lasers

- 5.1.7 Sutures & Hemostats

- 5.2 By Application (Value)

- 5.2.1 Implantology

- 5.2.2 Endodontic Surgery

- 5.2.3 Periodontal Surgery

- 5.2.4 Orthodontic & Cosmetic Surgery

- 5.2.5 Oral & Maxillofacial Surgery

- 5.2.6 Restorative / Prosthodontic Surgery

- 5.3 By End User (Value)

- 5.3.1 Hospitals

- 5.3.2 Dental Clinics

- 5.3.3 Others

- 5.4 By Geography (Value)

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Danaher Corporation (KaVo, Nobel Biocare)

- 6.4.2 Dentsply Sirona Inc.

- 6.4.3 Henry Schein Inc. (Hu-Friedy)

- 6.4.4 3M Company

- 6.4.5 Institut Straumann AG

- 6.4.6 Osstem Implant Co., Ltd.

- 6.4.7 COLTENE Holding AG

- 6.4.8 B. Braun Melsungen AG (Aesculap)

- 6.4.9 ACTEON Group

- 6.4.10 Brasseler USA

- 6.4.11 BIOLASE Inc.

- 6.4.12 Carl Zeiss Meditec AG

- 6.4.13 A-dec Inc.

- 6.4.14 NSK Nakanishi Inc.

- 6.4.15 W&H Group

- 6.4.16 Planmeca Oy

- 6.4.17 Dentium Co., Ltd.

- 6.4.18 Zimvie

- 6.4.19 Yoshida Dental Mfg. Co., Ltd.

- 6.4.20 Medesy Srl

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment