PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910649

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910649

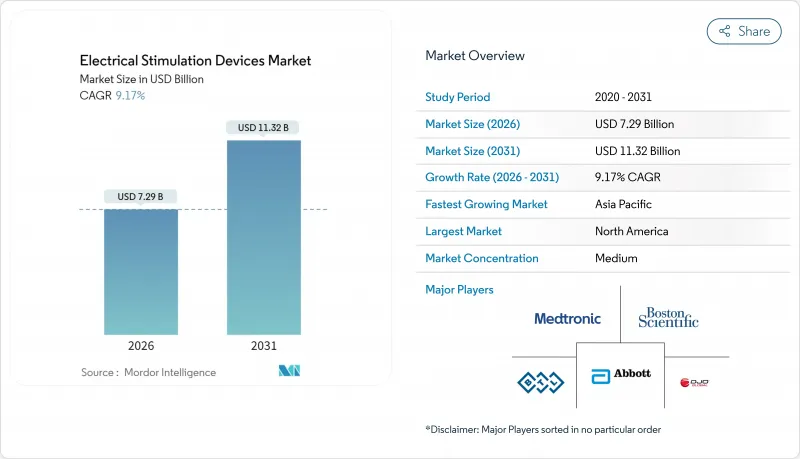

Electrical Stimulation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The electrical stimulation devices market was valued at USD 6.68 billion in 2025 and estimated to grow from USD 7.29 billion in 2026 to reach USD 11.32 billion by 2031, at a CAGR of 9.17% during the forecast period (2026-2031).

The combination of artificial intelligence and bioelectronics is pushing the electrical stimulation devices market toward proactive, highly personalized neurological care that targets root causes rather than symptoms. Spinal cord stimulation devices, which already account for 51.34% of revenue, continue to anchor growth, while deep brain stimulation devices outpace all other categories at a 10.12% CAGR. Hospitals remain the principal clinical setting with a 48.21% share, yet stronger adoption of wearable systems is propelling home-care uptake at a 10.29% CAGR. Regionally, North America holds 42.98% of revenue, supported by favorable reimbursement and streamlined approvals, whereas Asia-Pacific expands fastest at a 10.04% CAGR as regulatory modernization accelerates device launches. Competitive intensity is climbing as industry leaders deploy vertical integration and AI-enabled closed-loop innovations to secure differentiation.

Global Electrical Stimulation Devices Market Trends and Insights

Rising Prevalence of Chronic Pain & Musculoskeletal Disorders

Around 50 million Americans live with chronic pain, generating an annual economic burden of USD 635 billion that encourages payers to prioritize cost-effective, non-opioid therapies. Aging populations intensify demand because global musculoskeletal disorders are expected to rise 25% by 2030. Electrical stimulation devices reduce lifetime treatment costs and avoid addiction risks, positioning the electrical stimulation devices market as a first-line intervention in multidisciplinary pain programs. Peripheral nerve stimulation delivers net annual savings of USD 30,221 per patient and cumulative savings of USD 93,685 over three years, reinforcing its economic appeal. Health systems increasingly integrate bioelectronic therapy with standard protocols to shift pain management from symptom suppression to neural pathway modulation.

Increasing Neurological Disorder Incidence

More than 1 billion people worldwide suffer from neurological disorders, and 1.2 million European patients with Parkinson's disease qualify for deep brain stimulation. Roughly 30% of individuals with major depressive disorder exhibit drug-resistant symptoms, widening the addressable opportunity for transcranial magnetic stimulation and vagus nerve stimulation. Stroke rehabilitation demand is rising as 795,000 Americans experience strokes annually. The FDA approval of Medtronic's BrainSense Adaptive deep brain stimulation in February 2025 signals stronger regulatory support for precision neuromodulation . Vagus nerve stimulation paired with structured rehab produces sustained functional gains for at least one year, validating long-term value and boosting market adoption prospects .

Stringent Multi-Country Regulatory Hurdles

The European Union's Medical Device Regulation raised compliance expenditures above EUR 50 million for large OEMs and proportionately more for smaller firms, delaying product launches by 18-24 months. China's National Medical Products Administration processed 12,213 device applications in 2023, a 25.4% rise that stretched staff and extended reviews. Proposed reforms abolish country-of-origin approvals yet add joint-liability rules, complicating market entry. Japan's Pharmaceuticals and Medical Devices Agency applies advanced-therapy oversight to certain neuromodulation devices, increasing clinical evidence demands. Divergent data requirements between the FDA and EMA keep harmonization incomplete, pressuring device developers to run parallel regulatory tracks that shorten effective patent life.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Neuromodulation & Device Miniaturization

- Favourable Reimbursement & Streamlined FDA Approvals

- Cyber-Security Risks in Connected Implants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Spinal cord stimulation retained 50.82% of revenue in 2025, underpinned by established reimbursement and extensive clinical evidence. Deep brain stimulation, though smaller, grows fastest at a 9.88% CAGR through 2031 as adaptive systems like BrainSense secure global approvals. Sacral nerve stimulation continues steady growth for incontinence therapy, while vagus nerve stimulation broadens beyond epilepsy into depression and stroke recovery. Smaller categories such as transcutaneous electrical nerve stimulation and functional electrical stimulation secure share gains through home-care adoption. Invasive brain-computer interface trials under way in China showcase the next frontier for hybrid neurostimulation platforms.

Continued integration of evoked compound action potential monitoring in SCS devices delivers sustained pain relief with 92% one-year patient satisfaction. Peripheral nerve stimulation validates short-duration protocols yielding durable shoulder-pain improvements. Each innovation increases competitive pressure as manufacturers race to embed adaptive control and cloud analytics while controlling bill of materials costs.

Pain management contributed 65.72% of revenue in 2025, reflecting urgent demand for opioid-free alternatives. Incontinence and pelvic health, however, grow a faster 10.06% CAGR to 2031 on the back of stronger clinical evidence and unmet need in urology. Electrical stimulation of the major pelvic ganglion shows restorative control of bladder reflexes, widening the addressable patient pool. AI-based closed-loop systems optimize therapy for movement disorders and treatment-resistant depression, boosting efficacy versus static protocols.

Emerging gastrointestinal and metabolic uses, from gastroparesis relief to weight-control support, widen the scope of the electrical stimulation devices market by tapping previously underserved conditions.

The Electrical Stimulation Devices Market Report is Segmented by Device Type (Deep Brain Stimulation, Spinal Cord Stimulation, and More), Application (Pain Management, Musculoskeletal Disorders, and More), End-User (Hospitals, Ascs, Home-Care, Others), Product Portability (Implantable, External), and Geography (North America, Europe, and More). Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America delivered 42.45% of 2025 revenue due to comprehensive reimbursement, established clinical expertise, and the FDA's Breakthrough Devices Program that expedites commercialization. Recent HCPCS code additions for auricular vagus nerve stimulation bolster stable cash flows, and the opioid crisis keeps non-pharmacological pain management on policy agendas. Concentrated R&D hubs around Boston, Minneapolis, and the San Francisco Bay Area accelerate iterative product cycles by linking OEMs, academic hospitals, and venture capital.

Asia-Pacific records the quickest advance with a 9.81% CAGR through 2031. China's National Medical Products Administration processed 12,213 device filings in 2023, and draft legislation abolishing country-of-origin proof can shorten foreign registration. Government-backed investment in high-end manufacturing clusters, along with an aging population, fuels demand for advanced neuromodulation. Japan's rigorous but transparent Pharmaceuticals and Medical Devices Agency keeps device quality high, which encourages early adoption in tertiary centers. Ongoing BCI trials in Shanghai highlight regional aspirations to leapfrog established platforms with next-generation interfaces.

Europe sustains measured growth. The Medical Device Regulation increases compliance complexity yet raises patient confidence. Germany expands repetitive transcranial magnetic stimulation adoption for psychiatric care, supported by solid national insurance. France and Italy leverage value-based procurement to integrate spinal cord stimulation into chronic pain pathways. Eastern European markets widen access with EU funding for stroke rehabilitation that includes functional electrical stimulation modules. Latin America, the Middle East, and Africa open new opportunities as Brazil and Saudi Arabia streamline device approvals, and Chile positions itself as a deep brain stimulation research site linked to global clinical networks.

- Medtronic

- Boston Scientific

- Abbott Laboratories

- DJO Global

- BTL

- Nevro

- NeuroMetrix

- Zynex Medical

- Cogentix Medical

- BioMedical Life Systems

- LivaNova

- Cochlear

- Sonova

- Stimwave Technologies

- Bioness (a Bioventus Co.)

- Synapse Biomedical

- Soterix Medical

- OMRON

- NeuroPace

- Second Sight Medical Products

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising prevalence of chronic pain & musculoskeletal disorders

- 4.2.2 Increasing neurological disorder incidence

- 4.2.3 Technological advances in neuromodulation & device miniaturisation

- 4.2.4 Favourable reimbursement & streamlined FDA approvals

- 4.2.5 AI-driven closed-loop stimulation algorithms

- 4.2.6 Home-based wearable electro-rehab systems

- 4.3 Market Restraints

- 4.3.1 Stringent multi-country regulatory hurdles

- 4.3.2 Wide availability of pharmacologic & RF-ablation alternatives

- 4.3.3 High capital & procedure costs

- 4.3.4 Cyber-security risks in connected implants

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Device Type

- 5.1.1 Deep Brain Stimulation Devices

- 5.1.2 Spinal Cord Stimulation Devices

- 5.1.3 Sacral Nerve Stimulation Devices

- 5.1.4 Vagus Nerve Stimulation Devices

- 5.1.5 Other Electrical Stimulation Devices

- 5.2 By Application

- 5.2.1 Pain Management

- 5.2.2 Musculoskeletal Disorder Management

- 5.2.3 Neurological & Movement Disorder Management

- 5.2.4 Incontinence & Pelvic Health

- 5.2.5 Metabolism & G-I-T Regulation

- 5.2.6 Others

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centres

- 5.3.3 Home-Care Settings

- 5.3.4 Others

- 5.4 By Product Portability

- 5.4.1 Implantable Devices

- 5.4.2 External Devices

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Medtronic plc

- 6.3.2 Boston Scientific Corporation

- 6.3.3 Abbott Laboratories

- 6.3.4 DJO Global Inc.

- 6.3.5 BTL Industries

- 6.3.6 Nevro Corp.

- 6.3.7 NeuroMetrix Inc.

- 6.3.8 Zynex Medical

- 6.3.9 Cogentix Medical

- 6.3.10 BioMedical Life Systems

- 6.3.11 LivaNova PLC

- 6.3.12 Cochlear Ltd.

- 6.3.13 Sonova Holding AG

- 6.3.14 Stimwave Technologies

- 6.3.15 Bioness (a Bioventus Co.)

- 6.3.16 Synapse Biomedical

- 6.3.17 Soterix Medical

- 6.3.18 OMRON Corporation

- 6.3.19 NeuroPace Inc.

- 6.3.20 Second Sight Medical Products

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment