PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846289

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846289

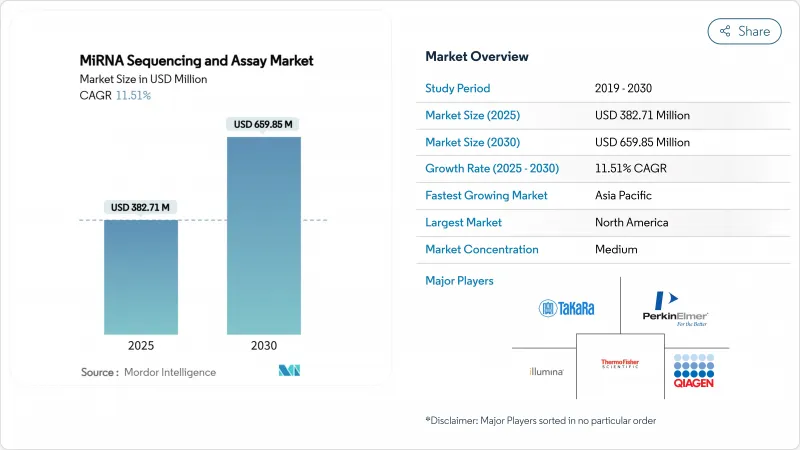

MiRNA Sequencing And Assay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The miRNA sequencing and assay market size stands at USD 382.71 million in 2025 and is forecast to reach USD 659.85 million by 2030, rising at an 11.51% CAGR.

Declining sequencing costs, regulatory clarity in laboratory-developed tests, and rapid uptake of liquid biopsy diagnostics steer this expansion. North America retains the largest regional footprint, while Asia-Pacific posts the quickest gains as Chinese genomics infrastructure scales. Accuracy gains such as Oxford Nanopore's 98.8% median precision for direct RNA fragments shorten clinical validation cycles and attract hospital laboratories. Pharmaceutical companies integrate miRNA panels into drug discovery workflows, and artificial-intelligence bioinformatics tools cut data-analysis time from days to hours. Corporate acquisitions underline an intensifying competitive climate as incumbents and new entrants race to lower per-sample prices and broaden multiomics offerings.

Global MiRNA Sequencing And Assay Market Trends and Insights

Dominance of Next-Generation Sequencing in Molecular Diagnostics

Next-generation sequencing now delivers clinical-grade precision in miRNA analysis. Oxford Nanopore's direct RNA workflow reports 98.8% median accuracy for 50-nucleotide fragments, removing amplification biases and meeting hospital quality thresholds. The FDA's 2024 clearance of Illumina's TruSight Oncology Comprehensive test established a precedent for NGS companion diagnostics. Validation studies show multi-cancer miRNA panels surpass 90% sensitivity across nine tumor types while keeping specificity above 99%. Automated sample prep and real-time analytics shrink result delivery from weeks to hours, encouraging routine adoption in oncology clinics.

Expanding Public and Private Funding for Genomics Research

An NIH-NSF initiative dedicates USD 15.4 million to RNA technology projects, including nanopore enhancements. Novartis strengthened its therapeutic portfolio by acquiring Regulus Therapeutics, underscoring industry commitment to miRNA-based drugs. Academic-industry consortia combine institutional expertise with commercial capacity, fostering sustained research programs. Similar capital flows appear in Europe's Horizon initiatives and in Asia-Pacific where governments back domestic platforms to lessen Western dependence.

High Capital Expenditure for Sequencing Platforms and Ancillary Equipment

Top-tier instruments cost hundreds of thousands of dollars, plus service contracts and consumables, limiting uptake in resource-constrained settings. FDA quality-system rules add compliance overhead. Sequencing-as-a-service models offer relief yet introduce concerns over data latency and security, causing some hospitals to defer adoption.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Decline in Sequencing Costs and Turnaround Time

- Rising Cancer Incidence Driving Demand for Liquid-Biopsy Biomarkers

- Shortage of Skilled Bioinformatics Workforce

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sequencing consumables generated 46.43% of the miRNA sequencing and assay market in 2024, underlining the recurring nature of reagents sales. The consumable contribution to miRNA sequencing and assay market size is expected to stay high through 2030 as manufacturers bundle kits with instruments to lock in loyalty. Bioinformatics services grow the fastest at a 13.54% CAGR because many laboratories prefer outsourcing complex analytics to specialized vendors. This outsourcing trend benefits cloud-native providers that guarantee scalable storage and standardized pipelines. Automation-ready reagent formulations also cut technician time and bolster reproducibility.

Consumables' dominance rests on constant demand for flow cells and library kits each sequencing run consumes. At the same time, service providers differentiate on turnaround and compliance documentation, carving out profitable niches even as instrument prices fall. The movement toward software subscriptions complements physical reagent sales and helps vendors smooth revenue swings tied to hardware replacement cycles.

Sequencing-by-synthesis delivered 62.54% of miRNA sequencing and assay market share in 2024 thanks to mature chemistries and broad informatics support. The method remains entrenched in clinical laboratories that value well-validated workflows. Nanopore platforms expand at a 13.89% CAGR by enabling direct RNA reads that bypass reverse transcription, preserving native modifications important for functional studies.

Nanopore units appeal to users seeking rapid results and lower capital thresholds, especially in decentralized settings. Their real-time streaming also fits emergency disease surveillance. SBS vendors respond with higher throughput models and bundled informatics to defend market position. Hybrid facilities now deploy both modalities to balance cost, speed, and read-length requirements across research and diagnostic tasks.

The MiRNA Sequencing and Assay Market Report is Segmented by Product (Sequencing Consumables, and More), Technology (Sequencing by Synthesis, and More), Application (Oncology Diagnostics/Liquid Biopsy, and More), End User (Clinical Laboratories, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 42.43% of 2024 revenue to the miRNA sequencing and assay market, anchored by the NIH-NSF USD 15.4 million RNA initiative and an FDA roadmap that shortens diagnostic approvals. Reimbursement pathways for molecular assays and strong venture capital flows encourage hospital adoption. Major acquisitions such as Novartis-Regulus further concentrate expertise and capital in the region.

Asia-Pacific advances at a 12.54% CAGR to 2030, propelled by Chinese capacity expansion and policies that subsidize domestic platforms like MGI's DNBSEQ, which targets a USD 10 genome. Regional agricultural and veterinary genomics projects provide additional demand, while local start-ups offer lower-cost sequencing services for small clinics. India and Japan invest heavily in personalized-medicine trials, reinforcing sustained consumable and bioinformatics growth.

Europe shows steady gains amid IVDR implementation, which imposes new evidence requirements before clinical rollout. Collaborative public-private consortia smooth compliance costs for smaller innovators. Governments widen precision-medicine funding and support cross-border clinical trials using miRNA-based stratification. Despite regulatory hurdles, the continent retains a strong pharmaceutical footprint that continually seeds new biomarker initiatives.

- Illumina

- Thermo Fisher Scientific

- QIAGEN

- PerkinElmer

- Takara Bio

- New England Biolabs

- Norgen Biotek

- TriLink Biotechnologies

- Lexogen GmbH

- Oxford Nanopore Technologies

- Agilent Technologies

- BGI / MGI Tech

- Pacific Biosciences

- NanoString Technologies

- MedGenome

- SomaGenics

- CD Genomics

- Illumina (BlueBee Bioinformatics)

- Guardant Health

- Eurofins

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Dominance of Next-Generation Sequencing in Molecular Diagnostics

- 4.2.2 Expanding Public and Private Funding for Genomics Research

- 4.2.3 Rapid Decline in Sequencing Costs and Turnaround Time

- 4.2.4 Rising Cancer Incidence Driving Demand for Liquid Biopsy Biomarkers

- 4.2.5 Emerging Agricultural and Veterinary Genomic Applications

- 4.2.6 Adoption of Artificial Intelligence for Automated MiRNA Data Interpretation

- 4.3 Market Restraints

- 4.3.1 High Capital Expenditure for Sequencing Platforms and Ancillary Equipment

- 4.3.2 Shortage of Skilled Bioinformatics Workforce

- 4.3.3 Fragmented Regulatory and Reimbursement Landscape for MiRNA Tests

- 4.3.4 Stringent Data-Privacy and Cross-Border Genomic Data Restrictions

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Sequencing Consumables

- 5.1.2 Library Preparation Kits

- 5.1.3 Sequencing Platforms / Instruments

- 5.1.4 Bioinformatics Pipelines & Services

- 5.2 By Technology

- 5.2.1 Sequencing by Synthesis (SBS)

- 5.2.2 Ion Semiconductor

- 5.2.3 SOLiD

- 5.2.4 Nanopore Sequencing

- 5.2.5 Single-Molecule Real-Time (SMRT)

- 5.3 By Application

- 5.3.1 Oncology Diagnostics / Liquid Biopsy

- 5.3.2 Drug Discovery & Transcriptome Research

- 5.3.3 Other Applications

- 5.4 By End User

- 5.4.1 Clinical Laboratories

- 5.4.2 Academic & Research Institutes

- 5.4.3 Biotech / Pharma Companies

- 5.4.4 Contract Research Organizations

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 Illumina Inc.

- 6.3.2 Thermo Fisher Scientific

- 6.3.3 QIAGEN N.V.

- 6.3.4 PerkinElmer Inc.

- 6.3.5 Takara Bio Inc.

- 6.3.6 New England Biolabs

- 6.3.7 Norgen Biotek

- 6.3.8 TriLink Biotechnologies

- 6.3.9 Lexogen GmbH

- 6.3.10 Oxford Nanopore Technologies

- 6.3.11 Agilent Technologies

- 6.3.12 BGI / MGI Tech

- 6.3.13 Pacific Biosciences

- 6.3.14 NanoString Technologies

- 6.3.15 MedGenome

- 6.3.16 SomaGenics

- 6.3.17 CD Genomics

- 6.3.18 Illumina (BlueBee Bioinformatics)

- 6.3.19 Guardant Health

- 6.3.20 Eurofins Genomics

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment