PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846296

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846296

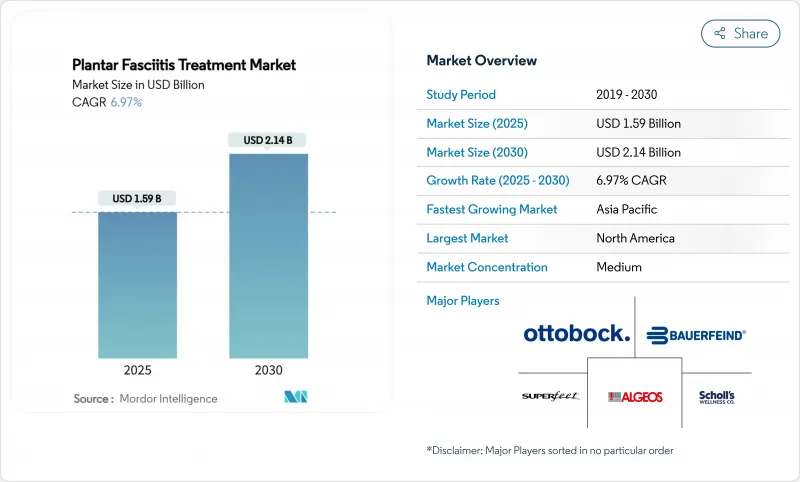

Plantar Fasciitis Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The plantar fasciitis treatment market is valued at USD 1.59 billion in 2025 and is forecast to reach USD 2.14 billion in 2030, advancing at a 6.97% CAGR.

Orthotic devices remain the backbone of care, but technology-enabled modalities such as extracorporeal shock-wave therapy (ESWT), AI-guided pressure-sensing insoles and ultrasonic fasciotomy are lifting the therapeutic ceiling. Demand growth aligns with the sharp rise in obesity and an aging global population-both proven risk amplifiers for plantar fascia degeneration. Reimbursement progress for outpatient embolization codes in North America, rising sports participation rates in Asia-Pacific and clinician preference for custom biomechanics correction are widening commercial opportunities. Meanwhile, fragmented competitive dynamics create room for consolidation, illustrated by Zimmer Biomet's USD 5 billion purchase of Paragon 28, a specialist in foot and ankle products.

Global Plantar Fasciitis Treatment Market Trends and Insights

Rising Prevalence of Plantar Fasciitis Fueled by Obesity & Aging Population

Elevated BMI magnifies risk: adults with BMI >= 30 are five times more likely to develop plantar fasciitis than normal-weight peers. Prevalence peaks between ages 45-64, a cohort that is expanding quickly in most developed economies. Gender disparity is notable; women report plantar heel pain 2.5 times more often than men, prompting vendors to design gender-specific orthotics. Health systems now promote early orthotic use because 25% of untreated acute cases progress to daily chronic pain that requires costlier intervention.

Adoption of Custom-Made Orthotic Insoles & Night Splints

Three-dimensional printing with variable stiffness lets clinicians redistribute plantar pressure precisely along patient-specific arch geometry. Trials show custom insoles outperform prefabricated versions on pain relief and recurrence rates, giving payers a clear cost-avoidance argument. Image-generative AI adds cosmetic customization that improves adherence, particularly among younger, fashion-conscious users. Night splints, once sidelined for discomfort, are returning as part of combination protocols that couple nocturnal stretching with daytime insole correction to maximize the healing window.

High Cost & Patchy Insurance Coverage for Advanced Therapies

Despite FDA clearance, many private insurers still label ESWT and ultrasonic ablation as investigational and refuse reimbursement anthem.com. Patients either absorb full procedural costs or revert to repetitive conservative therapy, delaying definitive care and inflating long-run expenditures. Emerging economies face even steeper barriers where out-of-pocket spending already tops 50% of total health expenditure.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Uptake of Minimally-Invasive ESWT & Ultrasound-Guided Procedures

- AI-Enabled Pressure-Sensing Insoles Enabling Tele-Rehab Compliance

- Counterfeit / Low-Grade Orthotics Undermining Clinical Outcomes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Orthotic devices contributed USD 0.59 billion and held 36.73% plantar fasciitis market share in 2024, underscoring the primacy of biomechanical realignment at the base of the care pyramid. The segment benefits from continuous material innovation-carbon-fiber composites, shape-memory polymers and breathable lattices-delivering lighter, more durable insoles without sacrificing corrective strength. Smart-insole variants are layering electronics atop traditional shells, turning static supports into data generators that inform tele-rehab pathways. Prefabricated inserts anchor entry-level demand, though custom CAD-CAM models grab higher margins and show lower 12-month recurrence.

The shockwave sub-segment is forecast to grow at 10.03% CAGR, fastest within the plantar fasciitis treatment market, aided by portable generators that allow outpatient delivery. Focused ESWT platforms now incorporate ultrasound imaging for real-time targeting, enhancing efficacy and curbing session counts. Regulatory clearances in Japan and Australia are drawing new device makers and regional distributors. Surgical interventions-endoscopic and ultrasonic fasciotomy-remain niche but vital for the 5-10% who fail conservative care. Regenerative therapies, including PRP and stem cells, sit at the innovative frontier yet await robust evidence and reimbursement traction.

Plantar Fasciitis Treatment Market Report is Segmented by Treatment Type (Pharmacological Treatment [NSAIDs and More], Orthotic Devices [Prefabricated Insoles and More], Shockwave Therapy [Focused Shockwave and More], and More), Indication (Acute, Chrnoic and More), End User (Hospitals, Ambulatory Surgical Center, and More), and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 39.54% of 2024 revenue. Mature insurance frameworks cover baseline orthotics and physical therapy, while recent code updates broaden access to outpatient embolization, anchoring the region's technology adoption curve. The U.S. Food and Drug Administration's 2025 approvals of pressure-mapped smart insoles and ultrasonic fasciotomy suites validate the innovation pipeline. Academic-industry collaborations feed continuous evidence generation, accelerating guideline acceptance across podiatry and orthopedics.

Asia-Pacific is set to log a 9.06% CAGR, the fastest in the plantar fasciitis treatment market. China's Healthy China 2030 plan is scaling podiatry clinics inside tertiary hospitals, while India's Ayushman Bharat insurance expansion improves affordability for outpatient therapies. Rapid urbanization increases sedentary office work and weekend sports participation, both driving plantar heel pain incidence. Device makers adapt with mid-tier ESWT units and subscription-priced 3D-printed insoles to match varied purchasing power.

Europe posts steady growth underpinned by universal healthcare and CE-mark streamlining for novel devices. Germany and the Nordic countries lead ESWT utilization per capita thanks to early payer adoption. Southern Europe reports rising use of electro-acupuncture protocols in chronic cases, blending traditional modalities with Western evidence standards. Regulatory harmonization across the EU eases cross-border supply for orthotic brands, while sports-medicine clinics tied to football clubs drive research into preventive footwear.

Latin America and the Middle East & Africa remain emerging opportunities. Brazil's private insurance sector reimburses ESWT selectively, and medical tourism in Mexico offers bundled shock-wave packages to U.S. self-pay patients. Gulf Cooperation Council states invest in sports infrastructures ahead of global events, raising awareness of foot-ankle care and spurring demand for specialist clinics. However, podiatry workforce shortages and counterfeit orthotic inflows temper uptake until stronger regulatory enforcement materializes.

- Shapecrunch Technology

- Ottobock

- Algeo

- Bauerfeind

- Scholl's Wellness Co.

- Superfeet Worldwide Inc.

- GlaxoSmithKline

- Sanofi

- Pfizer

- Hanger Clinic

- Zimmer Biomet

- Enovis

- Breg

- SIGVARIS Group

- FootBalance System Ltd.

- SoftWave Medical Inc.

- Bioventus

- Smiths Group

- Arthrex

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence Of Plantar Fasciitis Fueled By Obesity & Aging Population

- 4.2.2 Adoption Of Custom-Made Orthotic Insoles & Night Splints

- 4.2.3 Rapid Uptake Of Minimally-Invasive ESWT & Ultrasound-Guided Procedures

- 4.2.4 AI-Enabled Pressure-Sensing Insoles Enabling Tele-Rehab Compliance

- 4.2.5 New Outpatient Reimbursement Codes For Embolization & Ultrasonic Fasciotomy

- 4.2.6 Sports-Biomechanics Data Analytics Driving Preventive Plantar Products

- 4.3 Market Restraints

- 4.3.1 High Cost & Patchy Insurance Coverage For Advanced Therapies

- 4.3.2 Counterfeit / Low-Grade Orthotics Undermining Clinical Outcomes

- 4.3.3 Shortage Of Certified Podiatrists In Emerging Economies

- 4.3.4 Limited Long-Term Evidence For Regenerative Injectables (PRP, Stem Cells)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technology Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value-USD)

- 5.1 By Treatment Type

- 5.1.1 Pharmacological Treatment

- 5.1.1.1 NSAIDs

- 5.1.1.2 Corticosteroid Injections

- 5.1.1.3 Other Pharmaceuticals (botulinum toxin, analgesics)

- 5.1.2 Orthotic Devices

- 5.1.2.1 Prefabricated Insoles

- 5.1.2.2 Custom-made Insoles

- 5.1.2.3 Night Splints & Foot Braces

- 5.1.3 Shockwave Therapy

- 5.1.3.1 Extracorporeal Shockwave Therapy (ESWT)

- 5.1.3.2 Focused Shockwave

- 5.1.3.3 Radial Shockwave

- 5.1.4 Surgery

- 5.1.4.1 Endoscopic Plantar Fasciotomy

- 5.1.4.2 Open Plantar Fasciotomy

- 5.1.4.3 Ultrasonic Fasciotomy

- 5.1.5 Regenerative & Novel Interventions

- 5.1.5.1 Platelet Rich Plasma (PRP) Injections

- 5.1.5.2 Stem-cell & Growth-factor Therapies

- 5.1.5.3 Transcatheter Arterial Embolization

- 5.1.6 Other Treatment Types

- 5.1.1 Pharmacological Treatment

- 5.2 By indication

- 5.2.1 Acute

- 5.2.2 Chronic

- 5.2.3 Refractory and Others

- 5.3 By End User

- 5.3.1 Hospitals

- 5.3.2 Ambulatory Surgical Centers

- 5.3.3 Specialty Foot Clinics & Podiatry Centers

- 5.3.4 Home-care / Direct-to-Consumer

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Shapecrunch Technology Pvt Ltd

- 6.3.2 Ottobock

- 6.3.3 Algeo Limited

- 6.3.4 Bauerfeind AG

- 6.3.5 Scholl's Wellness Co.

- 6.3.6 Superfeet Worldwide Inc.

- 6.3.7 GlaxoSmithKline plc

- 6.3.8 Sanofi

- 6.3.9 Pfizer Inc.

- 6.3.10 Hanger Clinic

- 6.3.11 Zimmer Biomet Holdings Inc.

- 6.3.12 Enovis

- 6.3.13 Breg Inc.

- 6.3.14 SIGVARIS Group

- 6.3.15 FootBalance System Ltd.

- 6.3.16 SoftWave Medical Inc.

- 6.3.17 Bioventus LLC

- 6.3.18 Smith & Nephew plc

- 6.3.19 Arthrex Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment