PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846299

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846299

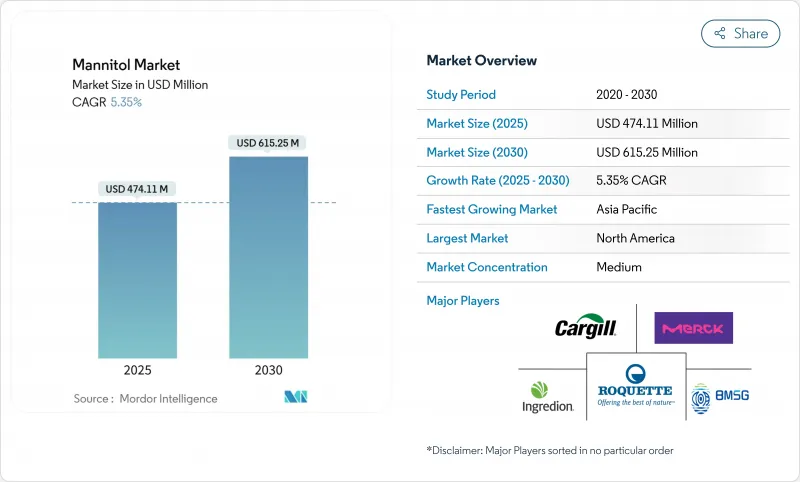

Mannitol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The global mannitol market has market size of USD 474.11 million in 2025 and is projected to reach USD 615.25 million by 2030, registering a compound annual growth rate (CAGR) of 5.35% during the forecast period.

This steady expansion reflects the increasing adoption of mannitol across pharmaceutical excipient applications and food industry sugar reduction initiatives, driven by regulatory pressures and evolving consumer preferences for healthier alternatives. Pharmaceutical formulators require stable, non-hygroscopic excipients, while food manufacturers demand low-calorie bulk sweeteners to align with global sugar-reduction mandates. This intersection presents a significant growth opportunity. Additionally, rapid regulatory developments, such as the European Medicines Agency's revised variations framework effective January 2025, are driving manufacturers to focus on ingredients with strong, multi-jurisdictional compliance records. Rising diabetes prevalence is further shifting consumer preferences toward sugar-free products, fueling demand. Strategic acquisitions by Roquette and Ingredion emphasize the competitive push to integrate scale, specialty-grade offerings, and regulatory expertise to serve both pharmaceutical and food industries effectively.

Global Mannitol Market Trends and Insights

Growing demand for low-calorie sweeteners in food and beverages

Leading corporations, such as PepsiCo, are driving the food industry's transition toward sugar reduction as a strategic business initiative. PepsiCo has set a target to ensure that 67% of its beverages deliver 100 calories or fewer from added sugars by 2025. This approach goes beyond regulatory compliance, positioning companies to gain a competitive edge. According to industry data, 96% of food and beverage businesses in Asia are prioritizing reformulation efforts to align with this trend. Mannitol, a multifunctional ingredient, offers manufacturers the ability to reduce caloric content while preserving product texture, addressing the dual objectives of taste retention and health-focused positioning. In Germany, the National Reduction and Innovation Strategy mandates a 20% reduction in sugar for breakfast cereals and a 15% reduction for soft drinks by 2025, creating regulatory momentum for the adoption of polyols. The alignment of consumer demand with regulatory pressures underscores the growing need for scalable solutions that can be implemented across diverse product categories and regulatory frameworks.

Rising diabetic population driving sugar-free product adoption

As healthcare systems face escalating treatment costs, the WHO's Global Diabetes Compact highlights the critical importance of dietary interventions to address the growing global diabetes crisis. This challenge is driving innovation in food formulation strategies, expanding beyond traditional diabetic-specific products to mainstream offerings, with sugar-free alternatives capturing a larger market share. Saudi Arabia and the UAE have implemented a 50% excise tax on sugar-sweetened beverages, a policy expected to significantly reduce childhood obesity rates by 2030. Mannitol, with its metabolic profile requiring minimal insulin response, is strategically positioned to benefit from increasing diabetes prevalence, particularly in developing markets undergoing rapid dietary transitions. The WHO's June 2024 warning about counterfeit diabetes medications further underscores the urgent need for reliable and accessible dietary management solutions.

Potential laxative effect at higher dosages limiting consumption

The physiological limitations of polyol consumption impose a natural cap on market growth, which cannot be addressed through technological advancements or marketing efforts. This inherently restricts mannitol's addressable market within food applications. The FDA, under 21 CFR 180.25, requires labeling warnings indicating that excessive consumption may cause laxative effects. This regulatory mandate reflects the scientific consensus on polyol tolerance thresholds. While individual tolerance levels vary, market strategies must consider the most sensitive consumers. The European Food Safety Authority is currently reassessing mannitol (E 421) as a sweetener, with a focus on these tolerance levels, which could lead to stricter usage regulations. Unlike other market challenges that can be mitigated through innovation or supply chain improvements, the laxative effect represents a biological constraint that directly impacts product formulation strategies and consumer acceptance across all applications.

Other drivers and restraints analyzed in the detailed report include:

- Increased use of mannitol as a bulking agent in pharmaceuticals

- Superior stability and non-hygroscopic nature favoring formulations

- Regulatory limitation on daily intake in food and beverage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Powder presently captures 63.79% of Mannitol market share in 2024, reflecting its compatibility with large-scale blending and automated feeding systems in both drug and food facilities. Powder forms allow continuous processing lines to meter excipients precisely, trimming downtime and validating batch uniformity under strict GMP audits. Granular mannitol enjoys the highest 6.46% CAGR as tablet makers adopt direct compression technologies that cut costly wet granulation steps. The Mannitol market size for granules is forecast to enlarge robustly alongside investment in oral-solid-dose capacity across India and China. Suppliers that offer consistent particle distribution for both forms gain leverage with multi-plant customers seeking single-specification procurement.

The pharmaceutical sector increasingly favors powder grades for dry-powder inhalers and lyophilized biologics, where flowability and low hygroscopicity are critical. In beverages, powder remains preferred because it dissolves rapidly, minimizing production cycles. Granules, however, support chewable tablets and sustained-release matrices thanks to improved compressibility. Regulatory scrutiny under revised EMA variations guidelines pushes manufacturers to validate each form separately, so dual-platform suppliers can unlock cross-selling gains. As a result, form flexibility will remain a competitive pivot inside the broader Mannitol market.

The Global Mannitol Market is Segmented by Form (Powder and Granules); Application (Food and Beverage, Pharmaceuticals, Industrial, and Others); and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributed 35.48% of 2024 revenue, anchored by sophisticated drug-delivery research and widespread availability of reduced-sugar snacks. FDA initiatives around excipient traceability may tighten approved-supplier lists, favoring incumbent producers with transparent chains. Canada and Mexico add incremental demand through cross-border pharmaceutical supply lines and joint labeling rules that recognize mannitol's safe history in foods. Asia-Pacific expands fastest at 6.24% CAGR through 2030, reflecting investments in excipient hubs and escalating consumption of sugar-free foods among swelling middle-class populations.. China's new additive code boosts confidence in local applications, while Southeast Asian governments adopt sugar levies that nudge formulators toward polyols. This region's combined pull from manufacturing and consumer sides underpins future Mannitol market gains.

Europe balances tight regulatory oversight with high purchasing power, sustaining premium prices for pharma-grade material. EFSA's ongoing re-evaluation of mannitol will shape future usage caps but also signals a commitment to science-based regulation that industry can plan around. National strategies such as Germany's sugar-reduction roadmap create stable demand in processed cereals and beverages. Eastern European contract-manufacturing clusters further augment regional volumes as they supply the broader European Economic Area.

South America and the Middle East and Africa trail in absolute size, yet offer upside tied to rising urbanization and evolving diet patterns. Brazil's large confectionery sector already uses mannitol in niche products, and Gulf Cooperation Council sugar taxes create early mover opportunities for local beverage bottlers. As regulatory frameworks converge with Codex Alimentarius, cross-regional trade in mannitol-containing goods should expand, enhancing visibility of the Mannitol market in emerging economies.

- Roquette Freres

- Cargill, Incorporated.

- Bright Moon Seaweed Group

- Ingredion Incorporated

- Merck KGaA

- SPI Pharma

- Rongde Seaweed Co.

- Shijiazhuang Huaxu Pharma

- Singsino Group

- Archer Daniels Midland

- ZuChem Inc.

- BASF SE

- Mitsubishi Shoji Foodtech

- Qingdao Xuyang Biochem

- Associated British Foods (ABF)

- Zhejiang Huakang Pharma

- B. Braun Medical

- Anhui BBCA Biochemical

- TCI America

- Spectrum Chemical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Low-Calorie Sweeteners in Food and Beverages

- 4.2.2 Rising Diabetic Population Driving Sugar-Free Product Adoption

- 4.2.3 Increased Use of Mannitol as a Bulking Agent in Pharmaceuticals

- 4.2.4 Superior Stability and Non-Hygroscopic Nature Flavorings Formulations

- 4.2.5 Surging Demand of Mannitol as an Excipient in Tablet and Capsule Manufacturing

- 4.2.6 Global Focus on Reducing Sugar Consumption Encouraging Polyol Use

- 4.3 Market Restraints

- 4.3.1 Potential Laxative Effect at Higher Dosages Limiting Consumption

- 4.3.2 Regulatory Limitation on Daily Intake in Food and Beverage

- 4.3.3 Volatility In Raw Material Supply

- 4.3.4 Unpleasant Aftertaste Reported in Certain Applications

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Granules

- 5.1.2 Powder

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.2 Pharmaceuticals

- 5.2.3 Industrial

- 5.2.4 Others

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Spain

- 5.3.2.6 Netherlands

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Indonesia

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Roquette Freres

- 6.4.2 Cargill, Incorporated.

- 6.4.3 Bright Moon Seaweed Group

- 6.4.4 Ingredion Incorporated

- 6.4.5 Merck KGaA

- 6.4.6 SPI Pharma

- 6.4.7 Rongde Seaweed Co.

- 6.4.8 Shijiazhuang Huaxu Pharma

- 6.4.9 Singsino Group

- 6.4.10 Archer Daniels Midland

- 6.4.11 ZuChem Inc.

- 6.4.12 BASF SE

- 6.4.13 Mitsubishi Shoji Foodtech

- 6.4.14 Qingdao Xuyang Biochem

- 6.4.15 Associated British Foods (ABF)

- 6.4.16 Zhejiang Huakang Pharma

- 6.4.17 B. Braun Medical

- 6.4.18 Anhui BBCA Biochemical

- 6.4.19 TCI America

- 6.4.20 Spectrum Chemical

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK