PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846304

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846304

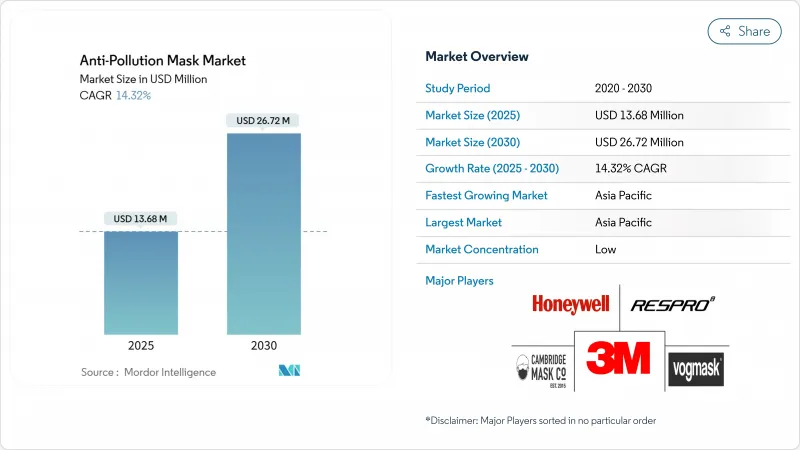

Anti-Pollution Mask - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The anti-pollution mask market is valued at USD 13.68 million in 2025 and is expected to reach USD 26.72 million by 2030, growing at a CAGR of 14.32% during the forecast period.

This growth is driven by stringent air quality regulations across major economies, particularly in the Asia-Pacific and North America regions. Cities worldwide are becoming increasingly hazardous to breathe in, with rising air pollutants like particulate matter (PM2.5 and PM10), vehicle emissions, industrial gases, dust, allergens, and seasonal smog taking center stage. Technological advancements are driving a surge in demand. Innovations like multi-layer filtration systems, nanofiber materials, rechargeable micro-ventilators, and sensor-equipped smart masks have enhanced both the efficacy and comfort of masks, drawing in health-conscious and tech-savvy consumers. Additionally, the widespread availability of masks in both offline retail outlets and online platforms has significantly boosted their global accessibility. Additionally, the COVID-19 pandemic has significantly influenced consumer behavior, leading to increased awareness about respiratory protection and air quality. The rising industrialization, urban air pollution levels, and growing health consciousness among consumers have further accelerated market expansion.

Global Anti-Pollution Mask Market Trends and Insights

Increasing Prevalence of Respiratory Diseases

With worsening air quality leading to a rise in both the prevalence and severity of respiratory diseases, individuals are increasingly turning to protective measures. Respiratory disease burden creates sustained demand for protective equipment as urbanization accelerates exposure risks. The Health Effects Institute's 2024 State of Global Air report documents 8.1 million deaths annually from air pollution, with 99% of the global population living in areas exceeding WHO PM2.5 . This epidemiological reality drives preventive healthcare adoption, particularly in Asia-Pacific, where rapid industrialization compounds traditional pollution sources. The correlation between air quality deterioration and respiratory morbidity establishes mask usage as a medical necessity rather than discretionary protection, fundamentally altering market dynamics from episodic to continuous demand patterns.

Growing Awareness of Health Risks from Air Pollution

Public consciousness regarding air pollution health impacts has reached a tipping point, transforming mask adoption from reactive to proactive behavior. Delhi's achievement of 209 'Good to Moderate' air quality days in 2024, the highest on record, paradoxically coincided with increased mask sales as residents became more attuned to daily AQI fluctuations . This phenomenon reflects sophisticated consumer behavior where improved air quality increases rather than decreases protective equipment usage, as awareness campaigns educate populations about sub-clinical exposure risks. The shift from crisis-driven to prevention-focused purchasing patterns creates more stable revenue streams for manufacturers while expanding addressable market segments beyond traditional high-pollution episodes. As awareness grows about the hidden and accumulating dangers of pollutants, individuals are turning to personal protective measures to shield themselves from harmful particles.

Poor Quality Masks and Ineffective Filtration

Quality control failures in pollution control equipment reduce consumer confidence and trigger regulatory oversight that limits market growth. Manufacturers face challenges in maintaining consistent product quality across their supply chains, leading to performance variations that erode market trust. The widespread distribution of low-quality masks during the COVID-19 pandemic generated consumer distrust due to insufficient protection, resulting in heightened examination of filtration performance claims. Many consumers experience respiratory issues despite using certified masks, while others discover counterfeit products in the market. This quality-related challenge increases compliance costs for established manufacturers while creating market entry barriers that potentially restrict innovation from smaller companies. Companies must now invest significantly in quality assurance systems, third-party testing, and certification processes to maintain market presence and regulatory compliance.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Mask Design

- Government and NGO Awareness Programs

- Environmental Concerns Related to Disposable Masks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposable masks hold a 53.73% market share in 2024, supported by established supply chains and widespread consumer adoption of single-use protective equipment. The disposable segment operates under clear regulatory frameworks, particularly NIOSH 42 CFR 84, which provides manufacturers with defined compliance standards from the National Institute for Occupational Safety and Health. These masks offer convenience through easy disposal after use, eliminating the need for cleaning and maintenance. Healthcare facilities, industrial workplaces, and public institutions prefer disposable masks for their consistent performance, reduced risk of cross-contamination, and simplified inventory management. The segment's growth is further driven by continuous improvements in material technology, enhanced filtration capabilities, and cost-effective manufacturing processes that maintain product quality while ensuring competitive pricing.

The reusable segment is growing at a CAGR of 14.82% through 2030, driven by sustainability regulations and lower total cost of ownership. This growth reflects changing consumer preferences toward sustainable products, as more consumers prioritize environmental responsibility in their purchasing decisions. The shift is particularly evident in developed markets where environmental awareness is high and regulatory support for sustainable alternatives is strong. Manufacturers of reusable products are using educational campaigns about environmental benefits to support premium pricing strategies. These campaigns emphasize reduced waste generation, lower carbon footprint, and long-term cost savings. The educational initiatives also highlight the durability and quality of reusable products, demonstrating their value proposition despite higher initial costs.

Particulate filters hold a 58.26% market share in 2024, as they effectively remove PM2.5 and PM10 particles in urban environments. These filters are designed to capture and remove microscopic particles from the air, including dust, pollen, smoke, and other airborne contaminants. Their high market share reflects their crucial role in addressing air quality concerns, particularly in densely populated urban areas where pollution levels are typically higher. The filters' effectiveness in trapping particles as small as 2.5 micrometers has made them essential components in various air filtration systems, from residential air purifiers to industrial air handling units.

The gas and odor filtration segments are growing at a CAGR of 14.95%, driven by increased awareness of volatile organic compounds and chemical pollutants beyond particulate matter. The integration of activated carbon technology demonstrates the segment's technical progress, particularly in enhancing absorption capacity and pollutant selectivity. These advancements allow manufacturers to target multiple pollutants simultaneously, including benzene, formaldehyde, and other harmful gases. The development of hybrid filtration systems combines activated carbon with other materials to improve overall efficiency and longevity. Manufacturers are now developing products offering comprehensive protection through multi-layer filtration mechanisms, specialized coating technologies, and enhanced surface area treatments. This evolution in filtration technology enables better removal of both visible and invisible contaminants while maintaining consistent performance throughout the filter's lifecycle.

The Anti-Pollution Mask Market Report Segments the Industry Into Product Type (Reusable, Disposable), Filter Type (Particulate, Gas and Odour, Combination), Material (Synthetic Fibers, Cotton, Activated Carbon, Non-Woven Fabric), Distribution Channel (Supermarkets/Hypermarkets, Drug Stores/Pharmacies, Online Retail Stores, Others), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounts for 34.55% of the market share in 2024 and is projected to grow at a CAGR of 15.56% through 2030. This growth stems from high pollution levels, large populations, and stricter regulations in the region. The area's established manufacturing base and access to raw materials create cost advantages that support both domestic use and exports. Manufacturing capabilities are particularly strong in countries like China, Vietnam, and Malaysia, which have developed extensive production networks and supply chains.

In China, air quality improvements have increased consumer awareness, leading to higher mask adoption. The country's urban areas continue to implement stringent air quality measures, while consumers maintain mask-wearing habits developed during periods of severe pollution. Japan and South Korea contribute to market expansion through technological advancements in premium products, which influence global standards. These countries focus on developing masks with enhanced filtration capabilities, smart features, and improved comfort. Their innovations include masks with replaceable filters, adjustable fits, and antimicrobial properties. The technological developments from these markets often set benchmarks for manufacturers worldwide, particularly in the premium segment.

North America and Europe are mature markets with significant growth rates, primarily due to regulatory compliance requirements and sustainability mandates. These regions have established infrastructure and stringent environmental regulations that drive the adoption of protective equipment. The implementation of advanced monitoring systems and regular updates to safety standards further support market growth. The Middle East and Africa demonstrate growth potential due to increasing urbanization and industrial development, which raises pollution exposure risks. These regions are experiencing rapid industrial expansion, infrastructure development, and population growth in urban centers, leading to heightened concerns about air quality and environmental protection. The establishment of new manufacturing facilities and energy production plants has intensified the focus on worker safety and environmental compliance.

- 3M

- Honeywell International Inc.

- Respro Ltd.

- Cambridge Mask Co.

- Vogmask (Ohlone Press LLC)

- RESPILON Ltd.

- AMD Medicom Inc.

- Makrite

- idMASK Co., Ltd.

- Dragerwerk AG & Co. KGaA

- Airinum AB

- Guangzhou Harley Commodity Co., Ltd.

- VENUS Safety & Health Pvt. Ltd.

- RZ Industries

- Moldex-Metric Inc.

- Aero Pro Co., Ltd

- Ansell Ltd.

- Shanghai Dasheng Health Products

- UVEX Safety Group

- Alpha Pro Tech Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Respiratory Diseases

- 4.2.2 Growing Awareness of Health Risks from Air Pollution

- 4.2.3 Technological Advancements in Mask Design

- 4.2.4 Government and NGO Awareness Programs

- 4.2.5 Heightened Awareness Due to COVID-19 Pandemic

- 4.2.6 Increased Demand for Reusable and Eco-Friendly Masks

- 4.3 Market Restraints

- 4.3.1 Poor Quality Masks and Ineffective Filtration

- 4.3.2 Volatile Demand Due to Health Crises and Seasonal Factors

- 4.3.3 Environmental Concerns Related to Disposable Masks

- 4.3.4 Regulatory Hurdles and Certification Requirements

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Reusable

- 5.1.2 Disposable

- 5.2 By Filter Type

- 5.2.1 Particulate

- 5.2.2 Gas and Odour

- 5.2.3 Combination

- 5.3 By Material

- 5.3.1 Synthetic Fibers

- 5.3.2 Cotton

- 5.3.3 Activated Carbon

- 5.3.4 Non-woven Fabric

- 5.4 By Distribution Channel

- 5.4.1 Supermarkets/Hypermarkets

- 5.4.2 Drug Stores/Pharmacies

- 5.4.3 Online Retail Stores

- 5.4.4 Other Distribution Channels

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Honeywell International Inc.

- 6.4.3 Respro Ltd.

- 6.4.4 Cambridge Mask Co.

- 6.4.5 Vogmask (Ohlone Press LLC)

- 6.4.6 RESPILON Ltd.

- 6.4.7 AMD Medicom Inc.

- 6.4.8 Makrite

- 6.4.9 idMASK Co., Ltd.

- 6.4.10 Dragerwerk AG & Co. KGaA

- 6.4.11 Airinum AB

- 6.4.12 Guangzhou Harley Commodity Co., Ltd.

- 6.4.13 VENUS Safety & Health Pvt. Ltd.

- 6.4.14 RZ Industries

- 6.4.15 Moldex-Metric Inc.

- 6.4.16 Aero Pro Co., Ltd

- 6.4.17 Ansell Ltd.

- 6.4.18 Shanghai Dasheng Health Products

- 6.4.19 UVEX Safety Group

- 6.4.20 Alpha Pro Tech Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK