PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846306

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846306

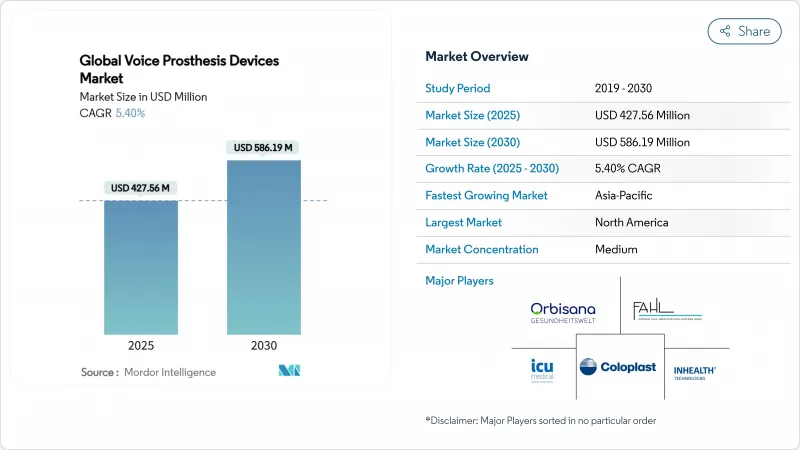

Global Voice Prosthesis Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The voice prosthesis devices market size is valued at USD 427.56 million in 2025 and is projected to reach USD 586.19 million by 2030, expanding at a 5.40% CAGR during the forecast period .

Steady progress in biofilm-resistant valve materials, broader reimbursement in high-income regions and a rising pool of laryngectomy survivors sustain this trajectory for the voice prosthesis devices market. North America keeps the largest revenue base, yet Asia-Pacific posts the quickest gains as domestic manufacturers introduce lower-priced products adapted to regional budgets. Regulatory convergence-most notably the 2026 alignment of the FDA's quality-system rule with ISO 13485-raises compliance costs but shortens multi-region registration cycles, enabling quicker launches. In parallel, the migration of ENT procedures to outpatient settings multiplies yearly replacement volumes while intensifying price sensitivity.

Global Voice Prosthesis Devices Market Trends and Insights

Rising Incidence of Laryngeal Cancer and Total Laryngectomies

Population-based data show 104 991 U.S. cases between 2000-2020, a figure expected to escalate as the population ages. Europe and Asia present similar upward trends, and forecasts point to a 50% rise in hypopharyngeal cancer by 2040. Because 70-75% of laryngectomy survivors become candidates for a prosthetic voice, incidence trends convert directly into demand, reinforcing the growth curve of the voice prosthesis devices market.

Technological Advances Extending Prosthesis Lifetime

Next-generation silicone blends, hydrophobic coatings and magnet-assisted closures double functional life from six to twelve months in early studies [ATOSMEDICAL.COM]. Custom 3-D-printed flanges reduce fit-related leakage, while antimicrobial surfaces slow fungal colonisation. These improvements lower replacement frequency and total cost of ownership, encouraging clinicians in developed regions to recommend indwelling models more readily and sustaining revenue momentum across the voice prosthesis devices market.

Outpatient ENT Surgery Growth

Ambulatory centres served 3.3 million Medicare fee-for-service beneficiaries in 2022, with USD 6.1 billion in spending.. ENT teams increasingly use modified retrograde insertion techniques that allow same-day discharge. Lower facility costs appeal to payers, while convenience attracts patients, pushing more replacements-and thus market revenue-into high-throughput outpatient channels of the voice prosthesis devices market.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Reimbursement Coverage in High-Income Countries

- High Replacement Cost and Limited Insurance in Emerging Markets

- Device-Related Complications (Leakage, Biofilm, Aspiration)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Indwelling valves represented 73.75% of voice prosthesis devices market share in 2024. The voice prosthesis devices market size tied to this segment is forecast to grow at 5.1% CAGR as upgraded materials push dwell time to a year in controlled cohorts. Indwelling systems demand professional replacement, fitting seamlessly into hospital and specialty-clinic workflows. Non-indwelling devices-posting a 6.05% CAGR-appeal to self-managing patients who value autonomy, especially in markets with robust tele-rehabilitation. Electrolarynx units and emerging 3-D-printed valves fill clinical gaps for anatomies unsuited to standard flanges, but their collective share remains below 5%.

Surgeon-reported primary-puncture success rates hover at 76.2%, climbing to 81.8% for secondary puncture though with higher complications [IJORL.COM]. U.S. insurers reimburse indwelling replacements at three- to six-month intervals, sustaining predictable order cycles. In resource-constrained regions, innovators market budget valves under USD 100, broadening access and buffering volume volatility. These trends collectively ensure indwelling leadership while fostering niche growth vectors, keeping the voice prosthesis devices market diversified yet stable.

The Voice Prosthesis Device Market Report is Segmented by Device Type (Indwelling, Non-Indwelling, Electrolarynx, Custom 3D-Printed), Valve Types (Provox, Blom-Singer, Activalve, Groningen, Aum, Specialty Custom), End User (Hospitals, Specialty Clinics, Ascs, Homecare), and Geography (North America, Europe, Asia-Pacific, South America, MEA). Market Forecasts are Provided in Value (USD).

Geography Analysis

North America's advanced reimbursement environment underpins predictable demand. Medicare's durable equipment rules authorise two indwelling replacements yearly when leakage or degradation is documented . The United States houses 13 dedicated laryngectomy centres that publish outcome data influential worldwide. Canada's provincially funded system provides comparable access, and Caribbean patients travel to Florida centres, incrementally enlarging the served population.

Asia-Pacific's acceleration stems from policy and production. India's Health Scheme, China's fast-track approvals and Japan's super-aged society all expand candidate numbers. Domestic manufacturing cuts landed cost by 40-60%, translating into higher annual replacement adherence. Early detection programs under Healthy China 2030 are set to lift operable tumour counts, further replenishing the user pool for the voice prosthesis devices market.

Europe's universal systems guarantee access yet negotiate aggressively on price. Germany's diagnosis-related group refinements add points for endoscopic replacements, improving hospital economics. France's assurance maladie reimburses devices at retail price, but austerity keeps physicians mindful of cost. The NHS includes valves on its High Cost Tariff Excluded list, sustaining volume while capping reimbursement. Logistics disruptions tied to Brexit have eased, and stock buffers now shield UK patients from shortage risk.

- Atos Medical (Coloplast A/S)

- InHealth Technologies (Freudenberg Medical)

- Hood Laboratories

- Kapitex Healthcare Ltd.

- Teleflex

- TRACOE medical

- Servona GmbH

- Andreas Fahl Medical Technology Sales

- Smiths Group

- Boston Medical Center

- Griffin Laboratories

- Soluvos Medical BV

- Beijing Tellyes Scientific Inc.

- Innaumation Medical Devices Pvt Ltd.

- Medtronic

- Johnson & Johnson (Acclarent)

- Nu-Vois Inc.

- La Maison Medicale

- Amplivox Ltd.

- Bruce Medical Supply Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of laryngeal cancer and total laryngectomies

- 4.2.2 Technological advances extending prosthesis lifetime

- 4.2.3 Expanding reimbursement coverage in high-income countries

- 4.2.4 Growing ENT-focused surgical volumes in outpatient settings

- 4.2.5 Adoption of low-cost indigenous prostheses in price-sensitive Asia

- 4.2.6 Additive-manufactured custom valves improving fit & comfort

- 4.3 Market Restraints

- 4.3.1 High replacement costs and limited insurance in emerging markets

- 4.3.2 Device-related complications (leakage, biofilm, aspiration)

- 4.3.3 Stringent sterilization/supply-chain regulations raising COGS

- 4.3.4 Shortage of trained TEP surgeons in low-resource regions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power - Suppliers

- 4.7.2 Bargaining Power - Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Segmentation

- 5.1 Device Type

- 5.1.1 Indwelling Tracheoesophageal Voice Prosthesis

- 5.1.2 Non-Indwelling Tracheoesophageal Voice Prosthesis

- 5.1.3 Electrolarynx / Artificial Larynx Devices

- 5.1.4 Custom 3-D Printed Voice Valves

- 5.2 Valve Types

- 5.2.1 Provox Series Valves

- 5.2.2 Blom-Singer Series Valves

- 5.2.3 ActiValve Magnetic Valves

- 5.2.4 Groningen Valve

- 5.2.5 Aum Voice Prosthesis

- 5.2.6 Specialty Custom Valves (Kapitex, Hood etc.)

- 5.3 End User

- 5.3.1 Hospitals

- 5.3.2 Specialty ENT Clinics

- 5.3.3 Ambulatory Surgery Centers

- 5.3.4 Homecare & Direct-to-Patient Channels

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Atos Medical (Coloplast A/S)

- 6.3.2 InHealth Technologies (Freudenberg Medical)

- 6.3.3 Hood Laboratories

- 6.3.4 Kapitex Healthcare Ltd.

- 6.3.5 Teleflex Incorporated

- 6.3.6 TRACOE medical GmbH

- 6.3.7 Servona GmbH

- 6.3.8 Andreas Fahl Medizintechnik-Vertrieb GmbH

- 6.3.9 Smiths Medical (ICU Medical)

- 6.3.10 Boston Medical Products Inc.

- 6.3.11 Griffin Laboratories

- 6.3.12 Soluvos Medical BV

- 6.3.13 Beijing Tellyes Scientific Inc.

- 6.3.14 Innaumation Medical Devices Pvt Ltd.

- 6.3.15 Medtronic plc

- 6.3.16 Johnson & Johnson (Acclarent)

- 6.3.17 Nu-Vois Inc.

- 6.3.18 La Maison Medicale

- 6.3.19 Amplivox Ltd.

- 6.3.20 Bruce Medical Supply Corp.

7 Market Opportunities & Future Outlook