PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846308

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846308

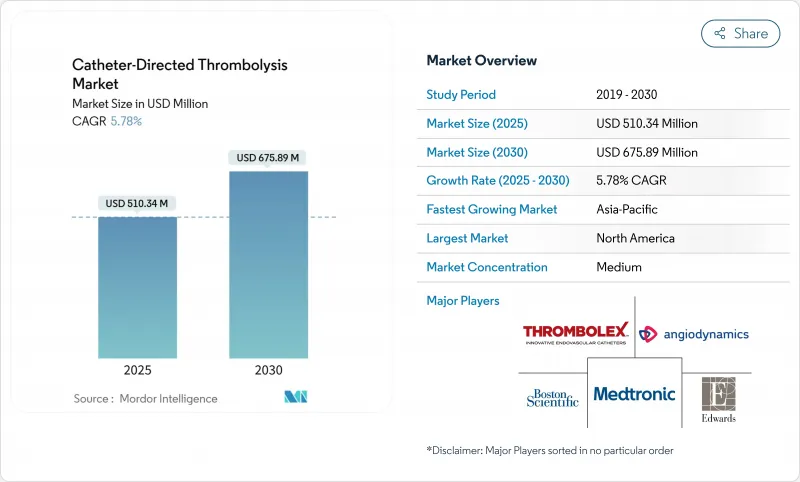

Catheter-Directed Thrombolysis - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The catheter-directed thrombolysis market stood at USD 510.34 million in 2025 and is projected to reach USD 675.89 million by 2030, advancing at a 5.78% CAGR.

The catheter-directed thrombolysis market is shifting from an experimental niche to a mainstream interventional option as mounting clinical evidence and broader reimbursement coverage encourage targeted thrombus dissolution over systemic lysis. Clinical urgency linked to venous thromboembolism (VTE) and peripheral artery disease (PAD), coupled with payer incentives that reward faster recovery and shorter intensive-care stays, keeps demand resilient. Vendors are widening portfolios to integrate ultrasound energy, aspiration modules, and AI-guided navigation, although procedure growth is tempered by interventional radiology (IR) workforce shortages and the ascent of mechanical thrombectomy-only systems. Capacity constraints outside tier-1 centers limit throughput, but technology convergence, outpatient migration, and favorable payment updates anchor a steady, mid-single-digit expansion path for the catheter-directed thrombolysis market.

Global Catheter-Directed Thrombolysis Market Trends and Insights

Rising Global Incidence of VTE & PAD

Escalating VTE prevalence-now the third-leading vascular killer worldwide-intensifies demand for catheter interventions that can remove clot burden without systemic bleeding risks. The aging demographic in developed markets and the lingering pro-thrombotic sequelae of COVID-19 amplify case volumes. Hospital audits place VTE incidence between 0.53% and 19.8% among acute stroke admissions, underscoring sizable procedural headroom. Because PAD often coexists with VTE, cross-indication use bolsters procedure growth, anchoring a recurring revenue base for the catheter-directed thrombolysis market.

Rapid Adoption of Pharmacomechanical CDT Systems

Pharmacomechanical platforms held 55.71% of 2024 catheter-directed thrombolysis market share by combining mechanical fragmentation with localized drug delivery, thereby lowering lytic dose and bleeding risk. Ultrasound-assisted catheters enhance penetration of thrombolytics, while aspiration channels evacuate debris in one pass, trimming procedure times. The technology serves as a bridge while purely mechanical thrombectomy devices finalize pivotal trials, sustaining mid-term momentum for the catheter-directed thrombolysis market.

Limited Interventional Radiology Capacity Outside Tier-1 Centers

Only 58.5% of independent IR residency seats were filled in 2024 in the United States, revealing a pipeline gap that directly constrains procedure volume. Comparable shortages in France kept mechanical thrombectomy output at 7,500 cases against theoretical capacity of 20,500, a proxy for CDT bottlenecks. In rural hospitals and emerging markets, lack of specialists forces referrals or delayed therapy, dampening uptake across the catheter-directed thrombolysis market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Hospital Demand for Day-Case Minimally Invasive PE Care

- AI-Guided Vascular Imaging Improving Procedural Success

- Growing Competition From Mechanical Thrombectomy-Only Devices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pulmonary embolism accounted for 41.45% of 2024 catheter-directed thrombolysis market size, reflecting its life-threatening nature and the preference for targeted clot lysis when systemic options are contraindicated. High-risk cases treated with catheter regimes showed 43% mortality versus 57% with veno-arterial ECMO alone across 34 European centers. Growing clinical endorsement keeps procedure demand steady even as mechanical systems vie for share.

Deep vein thrombosis (DVT) is the fastest-growing application segment, expanding at 6.26% CAGR through 2030 as outpatient protocols and refined risk stratification prompt earlier intervention. Expanded reimbursement for lower-extremity DVT procedures, coupled with rising obesity and cancer prevalence, widens the patient base. Lower acuity allows ambulatory settings to capture incremental volume, aiding geographic penetration of the catheter-directed thrombolysis market.

The Catheter-Directed Thrombolysis Market Report Segments the Industry Into Application (Deep Vein Thrombosis, Pulmonary Embolism, Stroke, Other Applications), End-User (Hospitals, Ambulatory Surgical Centers), and Geography (North America, Europe, Asia Pacific, Middle East and Africa, South America). Get Five Years of Historical Data Alongside Five-Year Market Forecasts.

Geography Analysis

North America held 42.37% of 2024 catheter-directed thrombolysis market size, anchored by broad insurance coverage, mature IR networks, and constant clinical trial activity. CMS doubled payments for cardiovascular CT and lifted ASC cardiac reimbursements, structurally rewarding adoption. Yet, workforce shortages limit penetration into suburban and rural centers, prompting tele-mentoring initiatives and hub-and-spoke referral models to maximise installed capacity.

Europe represents a mature but cost-pressured territory. France's mechanical thrombectomy plateau illustrates system bottlenecks that also hamper CDT. Regulatory tightening under the Medical Device Regulation raises compliance costs but ultimately favors well-capitalized manufacturers. CE-mark clearances for devices such as Penumbra's CAVT platform confirm steady pipeline flow, though budget scrutiny could cap premium pricing across the catheter-directed thrombolysis market.

Asia-Pacific is the fastest-growing region at a 7.48% CAGR, fueled by infrastructure upgrades and rising VTE awareness in China, Japan, and India. Inari Medical's distribution alliances and Penumbra's acknowledgment of geopolitical headwinds signal both opportunity and complexity. Value-engineered systems and modular pricing tiers are gaining traction as hospitals balance innovation with affordability. Expanding private insurance coverage in India and universal health reforms in China position the region as a pivotal demand driver for the catheter-directed thrombolysis market.

- AngioDynamics

- BD (Becton Dickinson)

- Boston Scientific

- Edward Lifesciences

- Inari Medical

- Medtronic

- Penumbra

- Teleflex

- iVascular

- Thrombolex

- UN & UP LLC

- EkoSonic (BTG/Boston Scientific)

- Shockwave Medical

- Johnson & Johnson (Cordis)

- Abbott Laboratories

- Terumo Corp.

- Merit Medical Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Incidence Of VTE & PAD

- 4.2.2 Rapid Adoption Of Pharmacomechanical CDT Systems

- 4.2.3 Surge In Hospital Demand For "Day-Case" Minimally-Invasive Pe Care

- 4.2.4 Ai-Guided Vascular Imaging Improving Procedural Success

- 4.2.5 Value-Based Reimbursement Models Favouring Reduced ICU Stay

- 4.2.6 Next-Gen Catheter Coatings Lowering Re-Intervention Rates

- 4.3 Market Restraints

- 4.3.1 High Upfront Device & Drug Costs In Low-Income Settings

- 4.3.2 Limited Interventional Radiology Capacity Outside Tier-1 Centers

- 4.3.3 Bleeding-Risk Concerns For Elderly With Polypharmacy

- 4.3.4 Growing Competition From Mechanical Thrombectomy-Only Devices

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Reimbursement Scenario

5 Market Size & Growth Forecasts

- 5.1 By Application

- 5.1.1 Deep Vein Thrombosis

- 5.1.2 Pulmonary Embolism

- 5.1.3 Ischemic Stroke

- 5.1.4 Other Applications

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centers

- 5.3 By Thrombolytic Technique

- 5.3.1 Catheter-Directed Thrombolysis (CDT)

- 5.3.2 Pharmacomechanical CDT

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East & Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East & Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, Recent Developments)

- 6.3.1 AngioDynamics

- 6.3.2 BD (Becton Dickinson)

- 6.3.3 Boston Scientific Corp.

- 6.3.4 Edwards Lifesciences

- 6.3.5 Inari Medical

- 6.3.6 Medtronic

- 6.3.7 Penumbra

- 6.3.8 Teleflex

- 6.3.9 iVascular SLU

- 6.3.10 Thrombolex

- 6.3.11 UN & UP LLC

- 6.3.12 EkoSonic (BTG/Boston Scientific)

- 6.3.13 Shockwave Medical

- 6.3.14 Johnson & Johnson (Cordis)

- 6.3.15 Abbott

- 6.3.16 Terumo Corp.

- 6.3.17 Merit Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment