PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846310

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846310

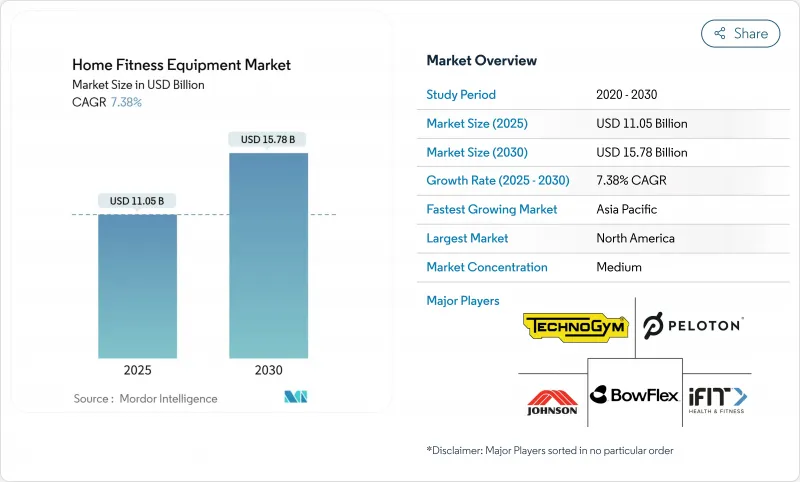

Home Fitness Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The home fitness equipment market is expected to reach USD 11.05 billion in 2025, and is projected to grow significantly, reaching USD 15.78 billion by 2030, with a strong CAGR of 7.38% over the forecast period (2025-2030).

This growth is driven by shifting consumer preferences toward convenience, privacy, and cost-effective long-term fitness solutions. Manufacturers are increasingly integrating artificial intelligence into connected devices, enabling enhanced user engagement and personalized coaching experiences. In high-density urban areas, limited living spaces are fueling demand for compact fitness equipment that accommodates smaller apartments without compromising on exercise variety. Additionally, global and national initiatives aimed at combating inactivity, obesity, and mental health challenges are positioning at-home workouts as an accessible and effective solution. The competitive landscape is evolving, with a transition from focusing solely on mechanical features to developing integrated ecosystems. These ecosystems combine equipment, digital content, and community-driven features, fostering customer retention through subscription-based models and enabling data-driven innovation in product development.

Global Home Fitness Equipment Market Trends and Insights

Increasing Obesity Rates and Health Concerns

The rising prevalence of obesity continues to drive sustained demand for accessible fitness solutions. According to Trust for America's Health, adult obesity in the United States has reached 41.9%, while youth obesity stands at 19.7% in 2023. Additionally, the White House's 2025 MAHA Report reveals that over 40% of American children are affected by chronic health conditions, primarily stemming from poor dietary habits and sedentary lifestyles. Notably, nearly 70% of children's caloric intake comes from ultra-processed foods, exacerbating the health crisis. This alarming trend has prompted increased consumer investment in home fitness equipment as a proactive approach to health management. Demographics with higher obesity rates, such as Black and Latino populations, are particularly driving this demand. Furthermore, the economic burden of obesity-related healthcare costs is pushing both individuals and institutions to prioritize fitness solutions. Home fitness equipment offers a practical alternative to traditional gyms by addressing key barriers such as transportation challenges, time constraints, and social anxiety. As a result, it has become a preferred choice for health-conscious consumers seeking sustainable and long-term lifestyle changes.

Rising Popularity of At-Home Workouts

The growing adoption of remote work and flexible schedules is driving a significant shift toward home-based fitness, reflecting evolving consumer lifestyle preferences. Sales of home fitness equipment are surging, highlighting a complementary relationship between home-based and commercial fitness rather than a substitutional one. This dual growth underscores the adaptability of consumers who balance gym memberships with home fitness solutions to meet diverse needs. Government initiatives further support this transition. The appeal of home fitness lies in its ability to offer time efficiency, cost savings compared to gym memberships, and personalized workout environments tailored to individual schedules and preferences. This structural shift is creating sustained demand for home fitness equipment that enables effective and convenient workout routines without reliance on external facilities or supervision. As a result, the home fitness segment is poised for continued growth, driven by consumer preferences for flexibility and the ongoing support of favorable policies.

Space Constraints in Homes

Urban housing constraints significantly impede the adoption of home fitness equipment, particularly in high-density markets where average living spaces are insufficient for accommodating such equipment. This challenge has driven manufacturers to innovate, focusing on compact, foldable designs and multi-functional equipment that integrates multiple exercise modalities into a single unit. For example, in the Japanese fitness market, strong consumer interest in health and wellness is evident. However, limited living space restricts the adoption of traditional fitness equipment, creating a growing demand for ultra-compact and space-efficient solutions. To address these needs, manufacturers are introducing vertical storage systems, wall-mounted equipment, and furniture-integrated designs that not only maintain functionality but also blend seamlessly with home interiors. Additionally, these spatial limitations have opened opportunities for rental and subscription-based models, enabling consumers in urban areas to access fitness equipment without committing to permanent space allocation. This trend is particularly relevant in cities where the high cost of space often outweighs the expense of the equipment itself, further emphasizing the need for innovative and flexible solutions in the home fitness market.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Smart and Connected Fitness Devices

- Government Campaigns Promoting Active Lifestyles

- Evolving Equipment-Free Workout Trends

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, treadmills command a leading market position with a 26.83% share, thanks to their adaptability for both walking and running. This versatility resonates with a wide range of fitness enthusiasts, spanning various age groups and demographics. Treadmills dominate the fitness landscape by offering cardiovascular workouts that closely replicate natural movement patterns. This accessibility caters to users of all fitness levels, including those with physical limitations. Furthermore, government health initiatives, like the Physical Activity Guidelines for Americans, underscore the importance of walking and running. These activities align with CDC recommendations, bolstering the treadmill's status as a favored home fitness choice. Modern treadmills are not just about walking or running; they've evolved. With features like incline variations, speed controls, and entertainment options, they significantly boost user engagement and workout efficiency.

Stationary cycles are on a rapid ascent, boasting a robust 7.83% CAGR projected through 2030. Their compact design and seamless integration with virtual cycling platforms offer users an immersive workout experience. This segment's surge is largely attributed to a growing consumer preference for low-impact cardiovascular exercises. Such exercises are especially beneficial for those with joint concerns or mobility limitations, ensuring effective calorie burning and cardiovascular advantages. The World Health Organization champions accessible physical activities, further validating the stationary cycle's role as a practical home fitness solution. Urban consumers, often grappling with space constraints, find cycles particularly appealing due to their space efficiency compared to treadmills. Additionally, cycles operate at lower noise levels, making them ideal for apartment living without the worry of disturbing neighbors.

In 2024, conventional fitness equipment commands a 68.15% market share, underscoring a consumer preference for straightforward, reliable workout solutions. These solutions deliver effective workouts without the intricacies of technology or the burden of ongoing subscription fees. The appeal of conventional equipment lies in its affordability, ease of use, and minimal maintenance. These attributes resonate with budget-conscious consumers and those who prioritize basic functionality over digital features. Additionally, government grant programs, like New Jersey's Local Recreation Improvement Grant, which subsidizes fitness equipment for public facilities, often lean towards conventional equipment. This preference is due to its lower acquisition costs and diminished operational expenses. Furthermore, the durability and longevity of conventional equipment attract consumers who seek enduring fitness solutions, free from worries about technological obsolescence or the need for software updates.

Meanwhile, the market for smart and connected fitness equipment is on a robust trajectory, projected to grow at a 9.58% CAGR through 2030. This surge is fueled by a rising consumer appetite for personalized fitness experiences, progress tracking, and interactive features that amplify workout motivation and efficacy. The segment's expansion is largely attributed to the infusion of Internet of Things technology. This integration metamorphoses basic exercise tools into holistic fitness platforms, offering real-time feedback, coaching, and community engagement. Institutional acknowledgment of the merits of connected fitness solutions is evident, as highlighted by the U.S. Olympic and Paralympic Committee's focus on technology-driven training and adaptive equipment. Smart equipment not only alleviates common consumer challenges-like maintaining workout motivation, ensuring proper form, and tracking progress-but also paves the way for manufacturers to tap into recurring revenue through subscription services and curated content libraries.

The Global Home Fitness Equipment Market Report Segments the Industry by Product Types (Treadmills, Elliptical Machines, Stationary Cycles, and More); by Category (Conventional, and More); by End User (Male and Female); by Distribution Channel (Offline Retail Stores and Online Retail Stores); and by Geography (North America, Europe, Asia-Pacific, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America commands a leading 41.67% market share, bolstered by its entrenched fitness culture, affluent populace, and proactive government health initiatives. The region's fitness momentum is further fueled by the President's Council on Sports, Fitness and Nutrition, extended until September 2025, spotlighting the National Youth Sports Strategy and the vital link between physical fitness and mental well-being. The "Physical Activity Guidelines for Americans" champion regular exercise, bolstering home fitness equipment uptake, and initiatives like "Move Your Way" offer community resources. North America's seasoned market, characterized by robust distribution networks, a comprehensive service framework, and stringent regulatory standards, fosters consumer trust, underpinning sustained market expansion.

Europe showcases consistent growth, buoyed by a tech-savvy consumer base and robust health initiatives. European buyers emphasize quality, durability, and design in fitness equipment, presenting a lucrative avenue for premium manufacturers. Concurrently, a regulatory spotlight on product safety and environmental sustainability shapes product development. Europe's varied national markets necessitate tailored distribution and marketing strategies. Government-backed programs, like New Jersey's Local Recreation Improvement Grant, bolster fitness equipment adoption in public venues and community hubs.

Asia-Pacific is set to outpace the globe with an 8.89% CAGR through 2030, fueled by swift urbanization, rising incomes, and proactive government health campaigns. These initiatives combat escalating obesity rates and promote fitness. The World Health Organization's Global Action Plan on Physical Activity (2018-2030) resonates across the region, with governments targeting a 10% reduction in physical inactivity by the end of 2025 and 15% by 2030. As the region witnesses a demographic shift towards health-conscious, affluent populations, there's a pronounced aspiration for fitness. Cultural inclinations for compact, space-saving equipment spur design innovations. With urbanization curtailing access to conventional exercise venues, government endorsements of active lifestyles pave the way for a surge in home fitness equipment adoption, transcending diverse economic landscapes.

- Peloton Interactive Inc.

- Icon Health and Fitness, Inc.

- Johnson Health Tech. Co., Ltd.

- BowFlex, Inc.

- Technogym S.p.A.

- Dyaco International Inc.

- Life Fitness LLC (Brunswick spin-off)

- TRUE Fitness Technology, Inc.

- Decathlon S.A.

- Tonal Systems Inc.

- Echelon Fitness Multimedia, LLC

- Coulter Ventures, LLC (Rogue Fitness)

- Concept2, Inc.

- Hydrow, Inc.

- Sunny Health and Fitness

- Tempo Interactive Inc.

- JTX Fitness

- Body-Solid, Inc.

- Impulse (Qingdao) Health Tech Co., Ltd.

- Adidas AG

- Core Health and Fitness, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Obesity Rates and Health Concerns

- 4.2.2 Rising Popularity of At-Home Workouts

- 4.2.3 Growth of Smart and Connected Fitness Devices

- 4.2.4 Government Campaigns Promoting Active Lifestyles

- 4.2.5 Surge in Demand for Compact, Portable, and Space-Saving Equipment

- 4.2.6 Influence of Fitness Influencers and Social Media

- 4.3 Market Restraints

- 4.3.1 Space Constraints in Homes

- 4.3.2 Competition from Commercial Fitness Centers

- 4.3.3 Evolving Equipment-Free Workout Trends

- 4.3.4 Risk of Injuries from Improper Equipment Use

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Types

- 5.1.1 Treadmills

- 5.1.2 Elliptical Machines

- 5.1.3 Stationary Cycles

- 5.1.4 Rowing Machines

- 5.1.5 Strength Training Equipment

- 5.1.6 Other Product Types

- 5.2 By Category

- 5.2.1 Conventional

- 5.2.2 Smart/Connected Equipment

- 5.3 By End User

- 5.3.1 Male

- 5.3.2 Female

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail Stores

- 5.4.2 Online Retaile Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Peloton Interactive Inc.

- 6.4.2 Icon Health and Fitness, Inc.

- 6.4.3 Johnson Health Tech. Co., Ltd.

- 6.4.4 BowFlex, Inc.

- 6.4.5 Technogym S.p.A.

- 6.4.6 Dyaco International Inc.

- 6.4.7 Life Fitness LLC (Brunswick spin-off)

- 6.4.8 TRUE Fitness Technology, Inc.

- 6.4.9 Decathlon S.A.

- 6.4.10 Tonal Systems Inc.

- 6.4.11 Echelon Fitness Multimedia, LLC

- 6.4.12 Coulter Ventures, LLC (Rogue Fitness)

- 6.4.13 Concept2, Inc.

- 6.4.14 Hydrow, Inc.

- 6.4.15 Sunny Health and Fitness

- 6.4.16 Tempo Interactive Inc.

- 6.4.17 JTX Fitness

- 6.4.18 Body-Solid, Inc.

- 6.4.19 Impulse (Qingdao) Health Tech Co., Ltd.

- 6.4.20 Adidas AG

- 6.4.21 Core Health and Fitness, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK