PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846311

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846311

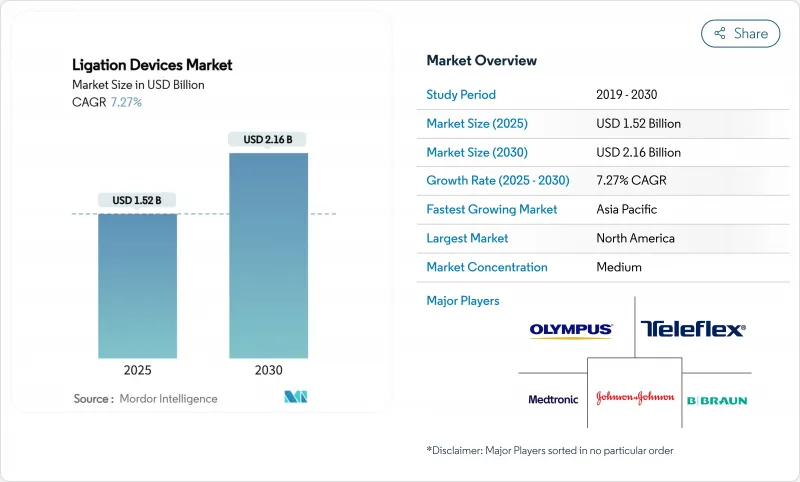

Ligation Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Ligation Devices Market size is estimated at USD 1.52 billion in 2025, and is expected to reach USD 2.16 billion by 2030, at a CAGR of 7.27% during the forecast period (2025-2030).

This momentum stems from rapid uptake of minimally invasive surgery, rising cardiovascular and urological caseloads, and continuous improvements in energy-based vessel-sealing systems that shorten seal time while boosting burst-pressure strength. Intensifying hospital emphasis on reduced length of stay, alongside payer incentives that reward lower peri-operative complication rates, further strengthens purchasing appetite for premium sealing platforms. Competitive differentiation now revolves around AI-enabled energy modulation, ergonomic hand instruments, and eco-friendly clip materials that address both surgical performance and sustainability mandates.

Global Ligation Devices Market Trends and Insights

Rising Prevalence of CV & Urologic Diseases

Cardiologists and urologists are increasingly turning to advanced vessel-sealing platforms that can secure arteries up to 7 mm while lowering intra-operative blood loss compared with sutures. Urology has moved beyond excisional methods; systems such as UroLift use mechanical tissue lifting to relieve benign prostatic hyperplasia, sustaining sexual function and driving surgeon preference. An aging global population intensifies procedure volume, and value-based payment programs reward technology that trims transfusion rates and shortens ICU stays. These factors lock in long-term demand for premium sealing solutions able to manage fragile, calcified or inflamed vessels with minimal thermal spread.

Growth in Minimally Invasive Procedures

Ambulatory centers are posting 5.7% annual growth in case counts, benefiting from 25-50% cost savings over hospital outpatient units. Concurrently, robotic platforms add precise vessel-sealing hardware; FDA clearance for Intuitive's curved sealer now allows confined-space work on da Vinci systems. Smaller incisions speed discharge and promote quicker return to work, encouraging payers to endorse laparoscopic and robotic approaches. Surgeons, in turn, demand sealing instruments that fit through 5-mm ports yet maintain burst pressures above 360 mmHg. These dynamics place the ligation devices market at the center of the minimally invasive ecosystem.

High Cost of Advanced Ligation Systems

Capital-intensive generators and disposable handpieces often exceed equipment budgets in smaller hospitals, prompting value committees to demand rigorous cost-effectiveness data before granting conversion. Bundled-payment contracts further squeeze margins, discouraging purchase of technology that lacks demonstrable return within the episode-of-care window. In lower-income economies, public tenders rate price over performance, delaying penetration of AI-directed sealing units and dampening near-term revenue for the ligation devices market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Bariatric & Aesthetic Surgeries

- Rapid Tech Advances in Vessel-Sealing Energy Devices

- Regulatory / Reimbursement Hurdles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Accessories generated 63.88% of the ligation devices market size in 2024 as single-use clips, bands and cartridges drove repeat purchasing. Infection-control policies and elimination of reprocessing overhead keep this category essential to hospital supply chains. Hand-held instruments, however, are on track for a 9.07% CAGR through 2030, underpinned by smarter energy delivery and lighter ergonomics that reduce surgeon fatigue.

Second-generation clip appliers fashioned from magnesium alloys appear artifact-free on MRI and fully absorb within 12 months while maintaining tensile strength. Band ligators now incorporate torque-limiting triggers for consistent ring placement in endoscopic variceal ligation. Meanwhile, AI-ready generators sense tissue type in real time and calibrate voltage ranges, an advance that keeps hand-held sales brisk in the ligation devices market.

Minimally invasive surgery accounted for 71.61% of the ligation devices market in 2024. Surgeons favor small-port approaches that shorten recovery times and permit same-day discharge. Robotic cases are set for a 12.24% CAGR as da Vinci 5 adds haptic feedback and new curved sealers capable of sub-millimeter thermal margins.

Laparoscopic teams continue to upgrade visualization platforms, with infrared overlays unveiling otherwise hidden vasculature for safer sealing. Endoscopic use of magnetic compression devices accelerates pouch-to-limb anastomosis without staples, opening new frontiers in scarless revision bariatrics. Open surgery remains vital for trauma and oncology, sustaining baseline demand for high-throughput clip cartridges within the ligation devices market.

The Ligation Devices Market Report is Segmented by Product Type (Hand-Held Instruments, Accessories), Procedure (Minimally Invasive Surgery, Open Surgery), Application (Gastrointestinal & Abdominal, Cardiovascular, and More), End User (Hospitals, Ambulatory Surgical Centres, and More), and Geography (North America, Europe, Asia-Pacific, Middle East & Africa, South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 41.81% of the ligation devices market size in 2024 on the strength of high disposable-income patients and robust reimbursement. Large GPO contracts favor bundled clip-and-generator deals, further entrenching incumbent brands.

Asia-Pacific posts the fastest 8.58% CAGR to 2030 as China streamlines hospital licensing and India expands insurance coverage. Domestic manufacturers such as EziSurg introduce competitively priced sealers tailored to local budgets. Japan's super-aged society underpins steady robotic-assisted adoption, while South-Korean tender reforms open private-sector routes for premium generators.

Europe maintains disciplined technology rotation, with clinicians prioritizing CE-marked sealers that carry peer-reviewed data on thermal spread. Sustainability directives push hospitals toward absorbable polymer clips. Latin America and the Middle East & Africa remain price-sensitive yet invest in high-volume bariatric centers, slowly broadening the addressable ligation devices market.

- Johnson & Johnson

- Medtronic

- Teleflex

- Olympus

- Applied Medical Resources

- CONMED Corp.

- The Cooper Companies

- B. Braun

- Boston Scientific

- Intuitive Surgical

- AngioDynamics

- Kangji Medical

- Grena

- Welfare Medical

- Progressive Medical

- LiVac Medical

- GI Windows

- Mellon Medical

- LaproSurge

- Smiths Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of CV & Urologic Diseases

- 4.2.2 Growth in Minimally Invasive Procedures

- 4.2.3 Surge In Bariatric & Aesthetic Surgeries

- 4.2.4 Rapid Tech Advances in Vessel-Sealing Energy Devices

- 4.2.5 Magnet-Assisted Anastomosis Adoption

- 4.2.6 Shift to Absorbable Polymer Clips

- 4.3 Market Restraints

- 4.3.1 High Cost of Advanced Ligation Systems

- 4.3.2 Regulatory / Reimbursement Hurdles

- 4.3.3 Emergence of Suture-Less Bio-Adhesive Sealants

- 4.3.4 Sustainability Push Vs Single-Use Clips

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product Type

- 5.1.1 Hand-held Instruments

- 5.1.1.1 Ligating clip appliers

- 5.1.1.2 Endoscopic band ligators

- 5.1.1.3 Vessel-sealing generators

- 5.1.2 Accessories

- 5.1.1 Hand-held Instruments

- 5.2 By Procedure

- 5.2.1 Minimally Invasive Surgery

- 5.2.1.1 Laparoscopic

- 5.2.1.2 Endoscopic

- 5.2.1.3 Robotic-assisted

- 5.2.2 Open Surgery

- 5.2.1 Minimally Invasive Surgery

- 5.3 By Application

- 5.3.1 Gastrointestinal & Abdominal

- 5.3.2 Cardiovascular

- 5.3.3 Gynecology

- 5.3.4 Urology

- 5.3.5 Bariatric / Metabolic

- 5.3.6 Others

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Ambulatory Surgical Centres

- 5.4.3 Specialty Clinics

- 5.4.4 Academic & Research Institutes

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 Johnson & Johnson

- 6.3.2 Medtronic

- 6.3.3 Teleflex Inc.

- 6.3.4 Olympus Corporation

- 6.3.5 Applied Medical

- 6.3.6 CONMED Corp.

- 6.3.7 CooperSurgical Inc.

- 6.3.8 B. Braun Melsungen AG

- 6.3.9 Boston Scientific

- 6.3.10 Intuitive Surgical

- 6.3.11 AngioDynamics

- 6.3.12 Kangji Medical

- 6.3.13 Grena Ltd.

- 6.3.14 Welfare Medical

- 6.3.15 Progressive Medical

- 6.3.16 LiVac Medical

- 6.3.17 GI Windows

- 6.3.18 Mellon Medical

- 6.3.19 LaproSurge

- 6.3.20 Smiths Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment