PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846314

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1846314

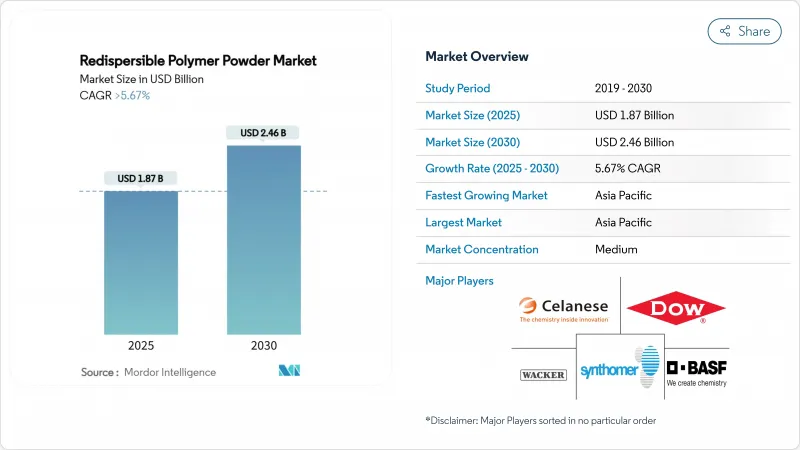

Redispersible Polymer Powder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Redispersible Polymer Powder Market size is estimated at USD 1.87 billion in 2025, and is expected to reach USD 2.46 billion by 2030, at a CAGR of greater than 5.67% during the forecast period (2025-2030).

A steady preference for high-performance dry-mortar additives is raising demand as policymakers push for durable and energy-efficient buildings. Expanding infrastructure spending across emerging economies adds a strong volume base, while renovation programs in Europe and North America redirect product innovation toward low-VOC and bio-based grades. Volatile vinyl acetate monomer prices after 2024 compressed margins, yet vertical integration by leading producers helped to stabilize supply. Technology upgrades in spray-drying, along with polymer powders tailored for 3D-printed concrete, are widening the practical scope of the redispersible polymer powder market.

Global Redispersible Polymer Powder Market Trends and Insights

Construction Boom in Emerging Economies

Infrastructure expansion in Asia-Pacific underpins long-term growth as China's carbon-neutrality roadmap and India's housing drive collectively deliver more than 60% of regional consumption. BASF allocated USD 10 billion to its Zhanjiang Verbund site, ensuring renewable-powered production of construction polymers. India's construction chemicals revenue touched INR 20,000 crore in 2025, and Master Builders Solutions set a turnover target of INR 500 crore by 2028. Saudi Arabia's NEOM project earmarked SAR 1.3 billion for robotics-enabled building, which highlights a preference for specialty binders capable of supporting automated assembly. Such multi-year public programs guarantee visibility for the redispersible polymer powder market far beyond routine housing cycles.

Rapid Shift to Ready-Mix Dry-Mortar Systems

Factory-produced mortars cut job-site labor and minimize mixing inconsistencies, accelerating the worldwide transition from traditional batching to standardized formulations. Early adoption in Germany and France has proven the pathway for universal quality standards, and similar policy moves emerge in large U.S. metropolitan areas. Wacker introduced its VINNAPAS eco range to deliver bio-balanced VAE powders designed for automated silos and pumps. Ready-mix growth improves dosing accuracy, allowing contractors to meet stricter tile adhesive shear strength requirements. As skilled labor shortages worsen, automated dosing becomes a cost-avoidance strategy that further enlarges the redispersible polymer powder market.

Volatility in Vinyl-Acetate Monomer and Ethylene Prices

Feedstock spikes since 2024 forced BASF and Celanese to raise prices for several acetate derivatives. Celanese responded with a 1.3 million-ton acetic-acid unit in Texas and a 70 kt VAE debottleneck in Nanjing to capture scale economies. Larger groups with backward integration hedge risks, yet small firms lacking long-term contracts face margin compression, amplifying consolidation inside the redispersible polymer powder industry.

Other drivers and restraints analyzed in the detailed report include:

- Renovation-Led Demand for High-Performance Tile Adhesives

- Government Energy-Efficient Building Codes

- Stricter VOC Limits on Protective Colloids

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

VAE controlled 47.18% of redispersible polymer powder market share in 2024 owing to its competitive cost and broad utility across tile adhesives, renders, and self-leveling compounds . Demand concentration allows economies of scale that underpin current price leadership. An uptick in premium construction jobs, however, is accelerating the adoption of VAE-VeoVa grades that grow at a 6.21% CAGR. Formulators prefer VAE-VeoVa for exterior insulation systems where alkaline resistance and flexibility are critical under climate stress. Acrylic powders sustain a niche in UV-exposed facades, whereas ethylene-vinyl-chloride blends serve industrial coatings that need chemical endurance.

Growth prospects hinge on producers' capacity to maintain steady spray-drying consistency. Wacker's renewable resource-based range targets carbon-footprint reductions without dampening shear strength. Celanese debuted Vinyl Acetate ECO-B with certified bio-content, catering to builders seeking verifiable sustainability claims. The redispersible polymer powder market thus shows dual momentum: volume security in VAE and margin growth in specialty subtypes.

The Redispersible Polymer Powder Market Report is Segmented by Type (Vinyl Acetate-Ethylene, Vinyl Acetate/Vinyl Ester of Versatic Acid, and More), Application (Plasters and Renders, Tile Adhesives, and More), End-User Industry (Residential, Commercial, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominates the redispersible polymer powder market, recording 45.28% of global volume in 2024 and sustaining the fastest 5.97% CAGR. Government stimulus for rail, highway, and affordable housing projects amplifies baseline usage, while Chinese carbon-neutral targets encourage eco-certified polymer grades. Producers that localize capacity, as Sika did with twin plants in China and Indonesia, secure customs and freight benefits while ensuring supply reliability. The result is a structural tilt in global demand toward the region.

North America and Europe preserve share through stringent energy-performance regulations and large renovation stock. The U.S. DOE grant pool of USD 240 million elevates state adoption of advanced codes and steers builders toward polymer solutions that cut thermal bridging. EU directives on embodied-carbon reporting accelerate adoption of bio-based VAE-VeoVa powders. Mature distribution networks in both regions enable just-in-time delivery of customized grades, which explains robust margins even though absolute growth trails Asia-Pacific.

South America and Middle-East and Africa add a growth flank as megacities overhaul transport corridors and climate-proof coastal infrastructure. Saudi Arabia's SAR 1.3 billion robotics-based NEOM agenda sets procurement protocols that favor high-durability binders. Brazil channels infrastructure stimulus toward sewer and road rehabilitation, spurring polymer demand in repair mortars. Local supply gaps invite joint ventures with global players that transfer technology while leveraging indigenous raw materials.

- Acquos

- ADA FINE CHEMICALS CO.,LTD

- Anhui Elite Industrial Co.,ltd

- Ashland

- BASF SE

- Bosson Union Tech(Beijing) Co.,Ltd

- Celanese Corporation

- Celotech Chemical Co., Ltd.

- DCC (Dairen Chemical Corporation)

- Dezhou Tengda Construction New Materials Co. , Ltd.

- Dow Inc.

- Hebei Derek Chemical Limited

- Hexion Inc.

- JSC Pigment

- Organik Kimya.

- Oscrete Construction Products

- Sakshi Chem Sciences Pvt. Ltd.

- SIDLEY CHEMICAL CO.,LTD.

- Synthomer plc

- Vinavil S.p.A.

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Construction Boom in Emerging Economies

- 4.2.2 Rapid Shift to Ready-Mix Dry-Mortar Systems

- 4.2.3 Renovation-Led Demand for High-Performance Tile Adhesives

- 4.2.4 Government Energy-Efficient Building Codes

- 4.2.5 3D-Printed Concrete Formulations Adopting Redispersible Polymer Binders

- 4.3 Market Restraints

- 4.3.1 Volatility Iin Vinyl-Acetate Monomer and Ethylene Prices

- 4.3.2 Technical Complexity in Achieving Consistent Spray-Dry Quality

- 4.3.3 Stricter VOC Limits on Protective Colloids

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Vinyl Acetate-Ethylene (VAE)

- 5.1.2 Vinyl Aceteate/Vinayl Ester of Versatic Acid (VAE-VeoVa)

- 5.1.3 Acrylic Powders

- 5.1.4 Other Types (Ethylene-Vinyl Chloride, Styrene-Butadiene, etc.)

- 5.2 By Application

- 5.2.1 Plasters and Renders

- 5.2.2 Tile Adhesives

- 5.2.3 Grouts

- 5.2.4 Mortar Additives

- 5.2.5 Other Applications (External Thermal Insulation Composite Systems (ETICS), etc.)

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial / Institutional

- 5.3.4 Infrastructure

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Analysis Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Acquos

- 6.4.2 ADA FINE CHEMICALS CO.,LTD

- 6.4.3 Anhui Elite Industrial Co.,ltd

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 Bosson Union Tech(Beijing) Co.,Ltd

- 6.4.7 Celanese Corporation

- 6.4.8 Celotech Chemical Co., Ltd.

- 6.4.9 DCC (Dairen Chemical Corporation)

- 6.4.10 Dezhou Tengda Construction New Materials Co. , Ltd.

- 6.4.11 Dow Inc.

- 6.4.12 Hebei Derek Chemical Limited

- 6.4.13 Hexion Inc.

- 6.4.14 JSC Pigment

- 6.4.15 Organik Kimya.

- 6.4.16 Oscrete Construction Products

- 6.4.17 Sakshi Chem Sciences Pvt. Ltd.

- 6.4.18 SIDLEY CHEMICAL CO.,LTD.

- 6.4.19 Synthomer plc

- 6.4.20 Vinavil S.p.A.

- 6.4.21 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment